4 days ago

18 days ago

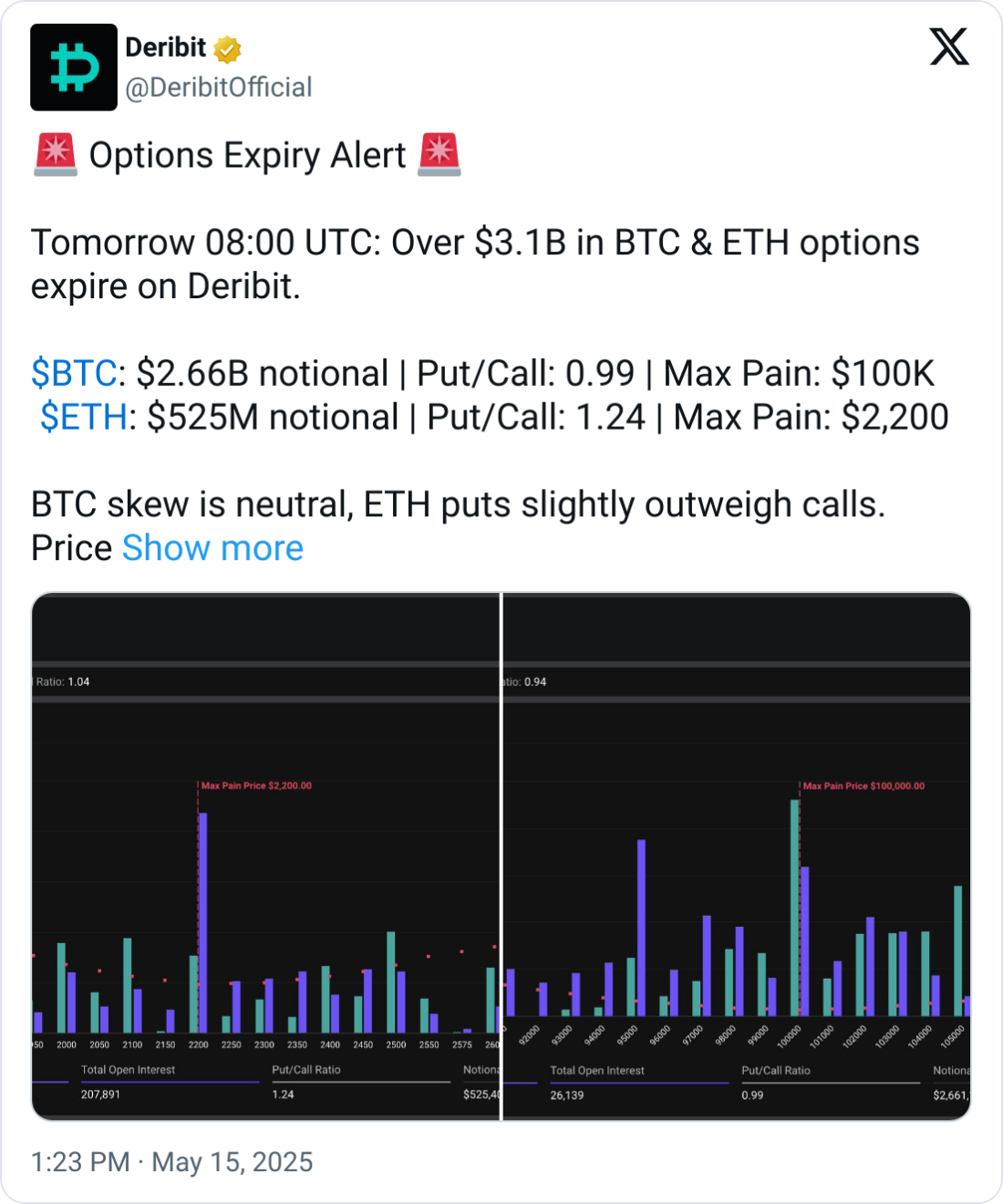

🚨 Bitcoin & Ethereum Alert! 🚨

🔥 $3.2B worth of BTC & ETH options are expiring today! Market volatility is expected to spike as traders react.

📉 Max Pain Prices:

- Bitcoin: $100K

- Ethereum: $2,200

💰 Bitcoin briefly surpassed $100K but is facing resistance near $105K. Could we see a correction or further upside? 🤔

📊 Investors are adjusting strategies—taking profits, shifting to defensive positions, and eyeing key strike prices.

🚀 Altcoins are mixed: DOGE, LINK & AVAX trending lower, while BNB & SUI see gains.

Stay tuned—this could be a pivotal moment for the crypto market! 💎🔥

#bitcoin #ethereum #cryptonews #MarketTrends #BTC #ETH

🔥 $3.2B worth of BTC & ETH options are expiring today! Market volatility is expected to spike as traders react.

📉 Max Pain Prices:

- Bitcoin: $100K

- Ethereum: $2,200

💰 Bitcoin briefly surpassed $100K but is facing resistance near $105K. Could we see a correction or further upside? 🤔

📊 Investors are adjusting strategies—taking profits, shifting to defensive positions, and eyeing key strike prices.

🚀 Altcoins are mixed: DOGE, LINK & AVAX trending lower, while BNB & SUI see gains.

Stay tuned—this could be a pivotal moment for the crypto market! 💎🔥

#bitcoin #ethereum #cryptonews #MarketTrends #BTC #ETH

30 days ago

The real Bitcoin Founder is suited in jail for life!

This is Paul Le Roux, the man who holds $64B in BTC

I researched all the interviews and leaked data

Here is the truth about BTC founder and what can be his next move🧵👇🏻

2/➫ Let's talk about Paul Le Roux

❍ Not just some coder - this guy was a genius who built encryption software, ran a global criminal empire, and might just be Satoshi Nakamoto

❍ Sounds wild? Let's dive into the facts👇

3/➫ A major clue appeared during the Kleiman v. Wright lawsuit

❍ Craig Wright oddly linked Le Roux’s Wikipedia page in an unredacted footnote labeled "Document 187."

❍ This unusual mention sparked immediate speculation that Wright knew something crucial about Le Roux's identity

4/➫ Following this revelation, an anonymous user leaked Le Roux’s Congo Republic ID card on 4chan

❍ It displays his full name as “Paul Soloci Calder Le Roux.”

❍ This middle name "Solotshi" closely mirrors "Satoshi," suggesting a deliberate hint

5/➫ The anonymous 4chan poster claimed Le Roux invented Bitcoin specifically for money laundering

❍ According to them, Bitcoin was the project of an "evil genius," designed to serve his criminal empire

❍ They noted his arrest in 2012 abruptly ended his Satoshi identity

6/➫ Le Roux’s technical expertise also aligns perfectly with Satoshi’s known skills

❍ He created E4M ("Encryption for the Masses"), an influential open-source encryption program

❍ A derivative called TrueCrypt was released later, though Le Roux denies involvement

7/➫ Further bolstering this connection is Le

This is Paul Le Roux, the man who holds $64B in BTC

I researched all the interviews and leaked data

Here is the truth about BTC founder and what can be his next move🧵👇🏻

2/➫ Let's talk about Paul Le Roux

❍ Not just some coder - this guy was a genius who built encryption software, ran a global criminal empire, and might just be Satoshi Nakamoto

❍ Sounds wild? Let's dive into the facts👇

3/➫ A major clue appeared during the Kleiman v. Wright lawsuit

❍ Craig Wright oddly linked Le Roux’s Wikipedia page in an unredacted footnote labeled "Document 187."

❍ This unusual mention sparked immediate speculation that Wright knew something crucial about Le Roux's identity

4/➫ Following this revelation, an anonymous user leaked Le Roux’s Congo Republic ID card on 4chan

❍ It displays his full name as “Paul Soloci Calder Le Roux.”

❍ This middle name "Solotshi" closely mirrors "Satoshi," suggesting a deliberate hint

5/➫ The anonymous 4chan poster claimed Le Roux invented Bitcoin specifically for money laundering

❍ According to them, Bitcoin was the project of an "evil genius," designed to serve his criminal empire

❍ They noted his arrest in 2012 abruptly ended his Satoshi identity

6/➫ Le Roux’s technical expertise also aligns perfectly with Satoshi’s known skills

❍ He created E4M ("Encryption for the Masses"), an influential open-source encryption program

❍ A derivative called TrueCrypt was released later, though Le Roux denies involvement

7/➫ Further bolstering this connection is Le

1 month ago

🚨 Breaking: UK Gov Unveils Draft Crypto Rules!

The UK government has released proposed regulations targeting the crypto sector, including new rules for operating trading exchanges and issuing stablecoins.

This marks a major step toward bringing clarity and oversight to the industry. What do you think—good news for crypto adoption or more red tape? 💬

#CryptoRegulation #UKCrypto #stablecoins #DigitalAssets #Blockchain

The UK government has released proposed regulations targeting the crypto sector, including new rules for operating trading exchanges and issuing stablecoins.

This marks a major step toward bringing clarity and oversight to the industry. What do you think—good news for crypto adoption or more red tape? 💬

#CryptoRegulation #UKCrypto #stablecoins #DigitalAssets #Blockchain

1 month ago

🚨 RUMORS 🚨

Pokémon is reportedly looking to launch its own cryptocurrency on the SUI blockchain, with NFTs integrated

Pokémon is reportedly looking to launch its own cryptocurrency on the SUI blockchain, with NFTs integrated

3 months ago

🚨 NEW: Bitnomial to launch its first ever regulated $XRP futures in the US on Mar. 20 and dropped its lawsuit against the SEC.

#SEC #xrp #Bitnominal #btnl

#SEC #xrp #Bitnominal #btnl

3 months ago

🚨 Clynton Marks Detained in Connection with South African Bitcoin Ponzi Scheme (MTI)

Clynton Marks, the alleged mastermind behind the South African Bitcoin Ponzi scheme Mirror Trading International (MTI), has been detained following his failure to provide satisfactory answers to liquidators regarding Bitcoin withdrawals from his MTI account. Marks claimed, "I am doing my best to respond to all questions, but my memory is insufficient to recall all the transactions. Additionally, I am unable to contact the individuals who managed the account on my behalf." Previously, Marks had entrusted investment and withdrawal operations to two associates, Don Nkomo and Andrew Caw. In 2022, Marks, along with MTI CEO Johann Steynberg and others, was ordered to repay $291 million to defrauded investors.

### Background on MTI's Downfall

MTI, once promoted as a lucrative Bitcoin and forex trading platform, promised investors monthly returns of 10%. However, it was later exposed as a fraudulent Ponzi scheme. In 2023, the Western Cape High Court declared MTI an illegal operation, invalidating all agreements with investors. Despite appeals, the ruling remains in effect. Steynberg, arrested in Brazil, is currently facing extradition, while the U.S. Commodity Futures Trading Commission (CFTC) is pursuing a $1.73 billion claim against the scheme.

South African liquidators, in coordination with international authorities, are working to recover assets, including approximately 29,421 Bitcoins, to compensate affected investors.

#CryptoFraud #bitcoin #cryptocurrency

Clynton Marks, the alleged mastermind behind the South African Bitcoin Ponzi scheme Mirror Trading International (MTI), has been detained following his failure to provide satisfactory answers to liquidators regarding Bitcoin withdrawals from his MTI account. Marks claimed, "I am doing my best to respond to all questions, but my memory is insufficient to recall all the transactions. Additionally, I am unable to contact the individuals who managed the account on my behalf." Previously, Marks had entrusted investment and withdrawal operations to two associates, Don Nkomo and Andrew Caw. In 2022, Marks, along with MTI CEO Johann Steynberg and others, was ordered to repay $291 million to defrauded investors.

### Background on MTI's Downfall

MTI, once promoted as a lucrative Bitcoin and forex trading platform, promised investors monthly returns of 10%. However, it was later exposed as a fraudulent Ponzi scheme. In 2023, the Western Cape High Court declared MTI an illegal operation, invalidating all agreements with investors. Despite appeals, the ruling remains in effect. Steynberg, arrested in Brazil, is currently facing extradition, while the U.S. Commodity Futures Trading Commission (CFTC) is pursuing a $1.73 billion claim against the scheme.

South African liquidators, in coordination with international authorities, are working to recover assets, including approximately 29,421 Bitcoins, to compensate affected investors.

#CryptoFraud #bitcoin #cryptocurrency

3 months ago

JUST IN:

Kraken's IPO Plans Resume as SEC Drops Unregistered Broker Case

Kraken's plans for an initial public offering (IPO) are moving forward after the U.S. Securities and Exchange Commission (SEC) dropped a lawsuit against the cryptocurrency exchange that accused it of operating as an unregistered broker.

This lawsuit had previously stalled Kraken's IPO ambitions, which had faced numerous challenges, including regulatory scrutiny and adverse market conditions since 2023.

Following the SEC's decision, which included no admission of wrongdoing and no penalties, Kraken's leadership is optimistic about entering public markets as soon as early 2026.

Kraken's IPO Plans Resume as SEC Drops Unregistered Broker Case

Kraken's plans for an initial public offering (IPO) are moving forward after the U.S. Securities and Exchange Commission (SEC) dropped a lawsuit against the cryptocurrency exchange that accused it of operating as an unregistered broker.

This lawsuit had previously stalled Kraken's IPO ambitions, which had faced numerous challenges, including regulatory scrutiny and adverse market conditions since 2023.

Following the SEC's decision, which included no admission of wrongdoing and no penalties, Kraken's leadership is optimistic about entering public markets as soon as early 2026.

3 months ago

(E)

0x Protocol

The 0x Protocol is a decentralized exchange (DEX) infrastructure that enables the peer-to-peer trading of cryptocurrencies and tokens on the Ethereum blockchain and other Ethereum-compatible networks.

Developed by 0x Labs, 0x Protocol uses smart contracts to execute trades, offering a low-cost and secure alternative to traditional centralized exchanges.

How does 0x protocol work?

- Order creation: A user creates an order specifying the token they want to trade, the amount, and their price requirements.

- Order relay: The order is shared off-chain via relayers or directly with a counterparty.

- Order matching: A relayer matches the order with a suitable counterparty or provides an order book for users to select from.

- On-chain settlement: Once both parties agree on the trade, the order is executed on-chain using the 0x smart contracts, ensuring security and transparency.

Use cases of #0xprotocol

- Decentralized Exchanges (DEXs): Enables the creation of DEX platforms with custom features and order books.

- DeFi applications: Integrated into lending, borrowing, and other DeFi platforms to facilitate token swaps.

- NFT marketplaces: Supports ERC-721 tokens, enabling decentralized trading of non-fungible assets.

0x token (ZRX)

- Governance: ZRX holders vote on protocol upgrades and governance decisions, contributing to 0x’s decentralized development.

- Staking: ZRX can be staked to earn rewards, particularly from trading fees generated on the network.

- Utility: Used to pay fees for services provided by relayers within the 0x ecosystem.

#cryptolearn

The 0x Protocol is a decentralized exchange (DEX) infrastructure that enables the peer-to-peer trading of cryptocurrencies and tokens on the Ethereum blockchain and other Ethereum-compatible networks.

Developed by 0x Labs, 0x Protocol uses smart contracts to execute trades, offering a low-cost and secure alternative to traditional centralized exchanges.

How does 0x protocol work?

- Order creation: A user creates an order specifying the token they want to trade, the amount, and their price requirements.

- Order relay: The order is shared off-chain via relayers or directly with a counterparty.

- Order matching: A relayer matches the order with a suitable counterparty or provides an order book for users to select from.

- On-chain settlement: Once both parties agree on the trade, the order is executed on-chain using the 0x smart contracts, ensuring security and transparency.

Use cases of #0xprotocol

- Decentralized Exchanges (DEXs): Enables the creation of DEX platforms with custom features and order books.

- DeFi applications: Integrated into lending, borrowing, and other DeFi platforms to facilitate token swaps.

- NFT marketplaces: Supports ERC-721 tokens, enabling decentralized trading of non-fungible assets.

0x token (ZRX)

- Governance: ZRX holders vote on protocol upgrades and governance decisions, contributing to 0x’s decentralized development.

- Staking: ZRX can be staked to earn rewards, particularly from trading fees generated on the network.

- Utility: Used to pay fees for services provided by relayers within the 0x ecosystem.

#cryptolearn

3 months ago

Swiss National Bank Rejects #bitcoin Reserves Proposal

According to CoinDesk, Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of incorporating bitcoin into Switzerland's central bank reserves. Schlegel highlighted concerns over the cryptocurrency's volatility, liquidity, and security as primary reasons for this decision. In an interview with the Tamedia group, he emphasized that the instability of #cryptocurrencies makes them unsuitable for preserving long-term value.

Schlegel further explained that the central bank's reserves must remain highly liquid to be readily available for monetary policy interventions. He also pointed out the inherent security risks associated with software-based assets, noting that software can be prone to bugs and vulnerabilities. These remarks come amid a broader discussion in Switzerland regarding the potential inclusion of Bitcoin in the SNB's reserves.

A recent initiative, spearheaded by entrepreneur Yves Bennaim, is advocating for a constitutional amendment that would require the SNB to hold bitcoin alongside gold in its reserves. This initiative, launched in December, aims to gather 100,000 signatures within 18 months to prompt a nationwide vote on the matter. While the proposal does not specify the exact bitcoin allocations, it suggests that the reserves should be built from the bank's earnings.

Despite the increasing acceptance of cryptocurrencies in Switzerland, with several Swiss banks offering cryptocurrency-related services, Schlegel remains skeptical.

According to CoinDesk, Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of incorporating bitcoin into Switzerland's central bank reserves. Schlegel highlighted concerns over the cryptocurrency's volatility, liquidity, and security as primary reasons for this decision. In an interview with the Tamedia group, he emphasized that the instability of #cryptocurrencies makes them unsuitable for preserving long-term value.

Schlegel further explained that the central bank's reserves must remain highly liquid to be readily available for monetary policy interventions. He also pointed out the inherent security risks associated with software-based assets, noting that software can be prone to bugs and vulnerabilities. These remarks come amid a broader discussion in Switzerland regarding the potential inclusion of Bitcoin in the SNB's reserves.

A recent initiative, spearheaded by entrepreneur Yves Bennaim, is advocating for a constitutional amendment that would require the SNB to hold bitcoin alongside gold in its reserves. This initiative, launched in December, aims to gather 100,000 signatures within 18 months to prompt a nationwide vote on the matter. While the proposal does not specify the exact bitcoin allocations, it suggests that the reserves should be built from the bank's earnings.

Despite the increasing acceptance of cryptocurrencies in Switzerland, with several Swiss banks offering cryptocurrency-related services, Schlegel remains skeptical.

4 months ago

BREAKING: International law firms are reportedly preparing "massive lawsuits" against Argentinian President Milei after his memecoin launch, $LIBRA.

The launch led to the loss of $4.4 billion of market cap in 7 hours.

#cryptoscam

The launch led to the loss of $4.4 billion of market cap in 7 hours.

#cryptoscam

Sponsored by

Administrator

11 months ago