1 month ago

🚀 Bitcoin ETF Chart Pack Alert – Just dropped today on Bloomberg.

The momentum continues: Bitcoin ETFs have pulled in nearly $4 billion over 8 consecutive days of inflows. 🚨

Here’s a look at how the cumulative flows have evolved over time – the adoption train isn’t slowing down. ⏳📈

#bitcoin #ETF #CryptoInvesting #MarketUpdate #Bloomberg

The momentum continues: Bitcoin ETFs have pulled in nearly $4 billion over 8 consecutive days of inflows. 🚨

Here’s a look at how the cumulative flows have evolved over time – the adoption train isn’t slowing down. ⏳📈

#bitcoin #ETF #CryptoInvesting #MarketUpdate #Bloomberg

1 month ago

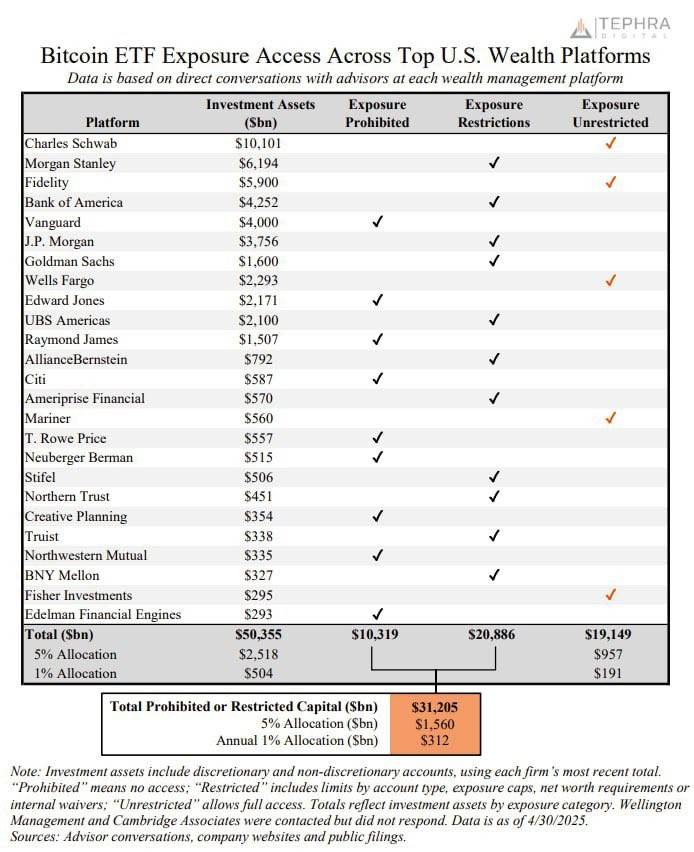

🚨 Breaking the Chains: Over $31 trillion in U.S. wealth platform capital is still RESTRICTED or PROHIBITED from accessing #BitcoinETFs .

Structural constraints are holding back inflows — but they’re also creating MAJOR opportunities.

This won’t last forever. The floodgates will open.

Data sourced directly from conversations with advisors at each platform. #crypto #bitcoin #Investing #ETF

Structural constraints are holding back inflows — but they’re also creating MAJOR opportunities.

This won’t last forever. The floodgates will open.

Data sourced directly from conversations with advisors at each platform. #crypto #bitcoin #Investing #ETF

1 month ago

🚨 History in the making! 🚨

Arizona State just went full crypto mode — first U.S. state to launch a Strategic Bitcoin Reserve 💸🔥

They’re doubling down on the future, pledging up to 10% of $31.5 billion in State Assets Funds to invest in Bitcoin. That’s not just bold — that’s revolutionary. 🧠✨

The message is clear: Bitcoin isn’t the future anymore… it’s the present. 🚀

#bitcoin #BTC #Arizona #cryptonews #StateReserve #Investing #FutureMoney #Web3 #FinanceTwitter 😎💼

Arizona State just went full crypto mode — first U.S. state to launch a Strategic Bitcoin Reserve 💸🔥

They’re doubling down on the future, pledging up to 10% of $31.5 billion in State Assets Funds to invest in Bitcoin. That’s not just bold — that’s revolutionary. 🧠✨

The message is clear: Bitcoin isn’t the future anymore… it’s the present. 🚀

#bitcoin #BTC #Arizona #cryptonews #StateReserve #Investing #FutureMoney #Web3 #FinanceTwitter 😎💼

1 month ago

🚨 Big news for crypto in the U.S.!

A stablecoin regulation bill is headed to the Senate floor before Memorial Day — a major step toward clearer oversight of digital assets. What happens next could shape the future of finance.

Source - https://subscriber.politic...

#CryptoRegulation #stablecoin #USPolitics #Blockchain

A stablecoin regulation bill is headed to the Senate floor before Memorial Day — a major step toward clearer oversight of digital assets. What happens next could shape the future of finance.

Source - https://subscriber.politic...

#CryptoRegulation #stablecoin #USPolitics #Blockchain

1 month ago

📢 Big Update for #stablecoins : The U.S. SEC has officially closed its investigation into PayPal’s stablecoin, PYUSD, without taking any enforcement action.

In a recent filing, PayPal revealed the SEC issued a document subpoena in Nov 2023 and concluded the probe in Feb 2025. While this is positive news, PayPal also warned of potential future compliance costs from evolving regulations — and risks if PYUSD is ever tied to illicit activity or litigation.

For now, this closure could help ease institutional concerns around stablecoin adoption. 🚀

#cryptonews #PayPal #PYUSD #SEC #Regulation #fintech #DigitalCurrency

In a recent filing, PayPal revealed the SEC issued a document subpoena in Nov 2023 and concluded the probe in Feb 2025. While this is positive news, PayPal also warned of potential future compliance costs from evolving regulations — and risks if PYUSD is ever tied to illicit activity or litigation.

For now, this closure could help ease institutional concerns around stablecoin adoption. 🚀

#cryptonews #PayPal #PYUSD #SEC #Regulation #fintech #DigitalCurrency

1 month ago

🔍 Big developments in crypto policy!

The UK Treasury has announced plans to collaborate with the United States to boost innovation in the cryptocurrency sector.

In a statement released on April 30, UK Finance Minister Rachel Reeves outlined the “Change Plan ”—a regulatory initiative aimed at creating new rules for crypto asset providers like Bitcoin and Ethereum. The goal? Strengthen investor confidence and fuel industry growth.

Reeves recently met with US Treasury Secretary Scott Bessent in Washington to discuss cross-border cooperation on digital asset regulation. They’re working closely through the UK-US Financial Regulatory Working Group, including exploring ideas from SEC Commissioner Hester Peirce.

This follows recent pro-crypto moves by the UK government, like revising the Financial Services and Markets Act 2000 in January to ease restrictions on staking services—marking a clear shift toward fostering innovation.

💡 The message is clear: the UK wants to be "the best place for innovation in the world ."

#cryptonews #DigitalAssets #Regulation #bitcoin #ethereum #UKPolicy #USFinance #BlockchainInnovation #RachelReeves #CryptoRegulation

The UK Treasury has announced plans to collaborate with the United States to boost innovation in the cryptocurrency sector.

In a statement released on April 30, UK Finance Minister Rachel Reeves outlined the “Change Plan ”—a regulatory initiative aimed at creating new rules for crypto asset providers like Bitcoin and Ethereum. The goal? Strengthen investor confidence and fuel industry growth.

Reeves recently met with US Treasury Secretary Scott Bessent in Washington to discuss cross-border cooperation on digital asset regulation. They’re working closely through the UK-US Financial Regulatory Working Group, including exploring ideas from SEC Commissioner Hester Peirce.

This follows recent pro-crypto moves by the UK government, like revising the Financial Services and Markets Act 2000 in January to ease restrictions on staking services—marking a clear shift toward fostering innovation.

💡 The message is clear: the UK wants to be "the best place for innovation in the world ."

#cryptonews #DigitalAssets #Regulation #bitcoin #ethereum #UKPolicy #USFinance #BlockchainInnovation #RachelReeves #CryptoRegulation

1 month ago

🔐 BREAKING: U.S. Court Rules OFAC’s Sanctions on Tornado Cash Were Illegal

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

1 month ago

(E)

World Liberty Financial USD (USD1) Now $2.1B

Token tracker: https://bscscan.com/token/...

Token tracker: https://bscscan.com/token/...

1 month ago

🚀 Breaking: Trump-Backed Stablecoin USD1 Hits $1.02B Market Cap Across Ethereum & BNB Chain!

The stablecoin USD1 from World Liberty Financial (WLFI), the crypto project tied to the Trump family, has now surpassed $1.02 billion in total market value — with over $1B+ on BNB Chain alone!

On-chain data reveals three rapid minting events recently on BNB Chain, injecting hundreds of millions of USD1 into the network. Paired with existing supply on Ethereum, the token’s footprint is rapidly expanding.

Analysts suggest this surge could be part of a larger strategy to boost USD1’s adoption across DeFi protocols, cross-chain liquidity pools, and major trading platforms.

Is USD1 positioning itself as a major player in the stablecoin ecosystem? Time will tell — but the momentum is undeniable. 💸

#crypto #stablecoin #USD1 #BNBChain #ethereum #TrumpCoin #defi #Blockchain #Web3 #WLFI

The stablecoin USD1 from World Liberty Financial (WLFI), the crypto project tied to the Trump family, has now surpassed $1.02 billion in total market value — with over $1B+ on BNB Chain alone!

On-chain data reveals three rapid minting events recently on BNB Chain, injecting hundreds of millions of USD1 into the network. Paired with existing supply on Ethereum, the token’s footprint is rapidly expanding.

Analysts suggest this surge could be part of a larger strategy to boost USD1’s adoption across DeFi protocols, cross-chain liquidity pools, and major trading platforms.

Is USD1 positioning itself as a major player in the stablecoin ecosystem? Time will tell — but the momentum is undeniable. 💸

#crypto #stablecoin #USD1 #BNBChain #ethereum #TrumpCoin #defi #Blockchain #Web3 #WLFI

1 month ago

David Marcus, former PayPal President and current CEO of Lightspark, announced the launch of Spark, a new Bitcoin Layer-2 solution compatible with the Lightning Network.

Unveiled at Lightspark’s first partner summit, Lightspark Sync, Spark enables non-custodial use of Bitcoin and stablecoins, enhancing transaction speed and cost-efficiency.

The platform builds on Lightspark’s Universal Money Address (UMA) standard, introducing features like tipping, subscriptions, and invoicing over Lightning, while also integrating with legacy banking systems for broader accessibility.

Marcus aims to position Bitcoin as a global settlement layer, addressing Lightning’s complexity and reliability issues to make it enterprise-grade for institutions and banks.

Unveiled at Lightspark’s first partner summit, Lightspark Sync, Spark enables non-custodial use of Bitcoin and stablecoins, enhancing transaction speed and cost-efficiency.

The platform builds on Lightspark’s Universal Money Address (UMA) standard, introducing features like tipping, subscriptions, and invoicing over Lightning, while also integrating with legacy banking systems for broader accessibility.

Marcus aims to position Bitcoin as a global settlement layer, addressing Lightning’s complexity and reliability issues to make it enterprise-grade for institutions and banks.

1 month ago

BREAKING: #Tether Treasury just minted 2 billion #USDT in two transactions on the Ethereum network (via WhaleAlert).

According to CEO Paolo Ardoino, the newly minted USDT is a replenishment of inventory, part of routine operations.

Notably, this is an authorized but unissued transaction — meaning these tokens will be held as reserve inventory for future issuance requests & chain swaps.

https://etherscan.io/tx/0x...

https://etherscan.io/tx/0x...

Stay tuned for more updates. #stablecoin #cryptonews #Blockchain

According to CEO Paolo Ardoino, the newly minted USDT is a replenishment of inventory, part of routine operations.

Notably, this is an authorized but unissued transaction — meaning these tokens will be held as reserve inventory for future issuance requests & chain swaps.

https://etherscan.io/tx/0x...

https://etherscan.io/tx/0x...

Stay tuned for more updates. #stablecoin #cryptonews #Blockchain

1 month ago

🚨 $5.8 TRILLION Fidelity just dropped a 🔥 statement:

#bitcoin supply is shrinking thanks to heavy public company buying! 🏦📉

“We anticipate this accelerating.” — Fidelity 💬

Buckle up. The squeeze is real. 🚀

#BTC #cryptonews #BitcoinSupplyShock #BULLISH

#bitcoin supply is shrinking thanks to heavy public company buying! 🏦📉

“We anticipate this accelerating.” — Fidelity 💬

Buckle up. The squeeze is real. 🚀

#BTC #cryptonews #BitcoinSupplyShock #BULLISH

1 month ago

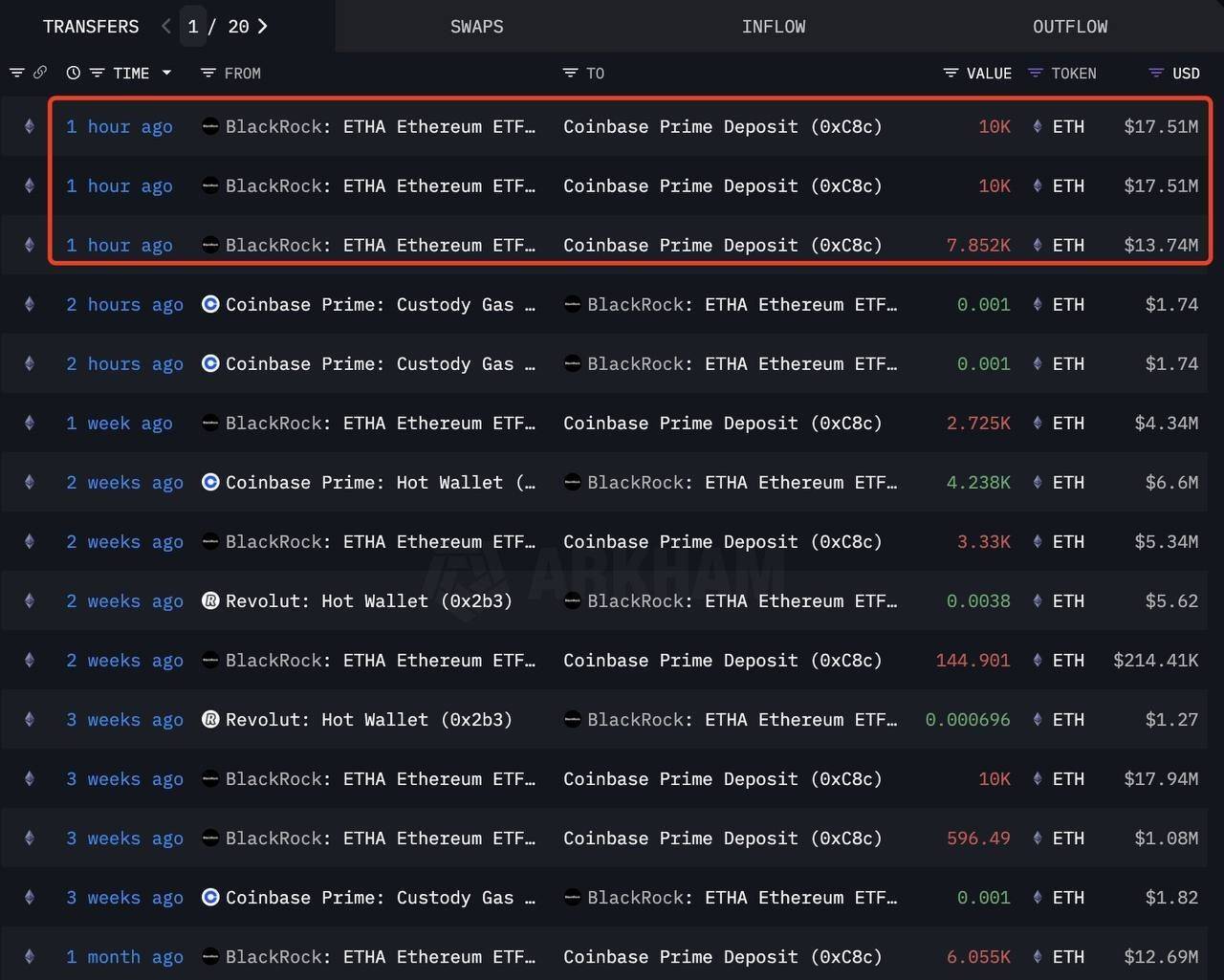

⚡️ NEW: BlackRock deposited 27,852 $ETH (worth $48.75M) to Coinbase Prime just one hour ago.

#blackrock

#blackrock

1 month ago

🚨 BREAKING: THE SEC MET WITH EL SALVADOR THIS WEEK TO DISCUSS CREATING A SANDBOX FOR #bitcoin AND CRYPTO INNOVATION 💥

A NEW ERA BEGINS. MASSIVE. 🔥

Global crypto adoption is heating up — are you paying attention? 🌍🧠

#cryptonews #BitcoinAdoption #ElSalvador #BlockchainRevolution

A NEW ERA BEGINS. MASSIVE. 🔥

Global crypto adoption is heating up — are you paying attention? 🌍🧠

#cryptonews #BitcoinAdoption #ElSalvador #BlockchainRevolution

1 month ago

🐋 NEW: A whale sold all 630,339 $TRUMP tokens ($5.48M) at $8.70 just hours before the Trump dinner news, making a ~$483K profit.

Had he waited, his profit could’ve exceeded $4.5 million.

#whalealert

Had he waited, his profit could’ve exceeded $4.5 million.

#whalealert

1 month ago

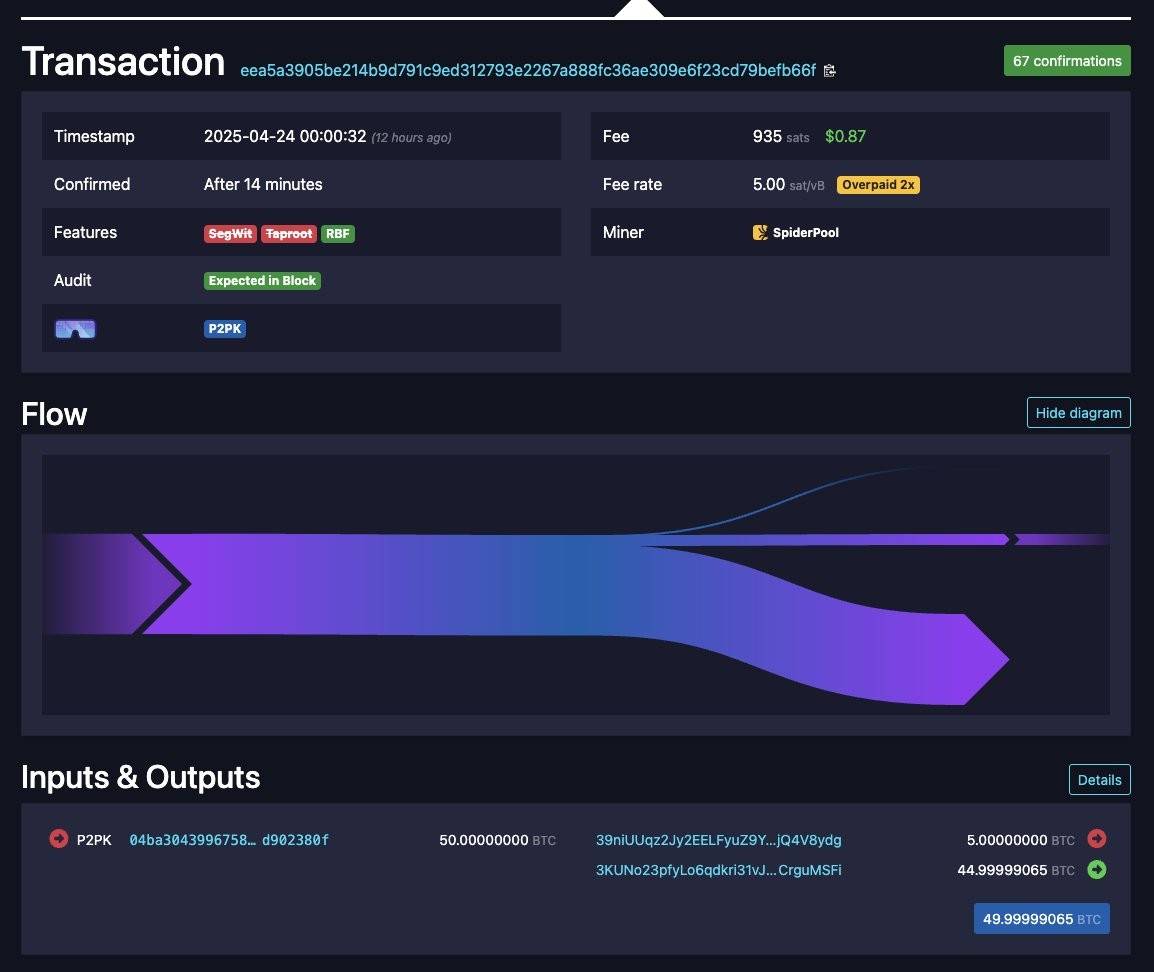

🚨 SOMEONE JUST MOVED 50 BITCOIN THEY MINED 15 YEARS AGO… WHEN BTC WAS UNDER $0.10 😱

They held through everything — crashes, FUD, bans, hype, and history.

Now it’s worth OVER $5 MILLION 💰💰💰

Absolute LEGEND 👑

#bitcoin #HODL #CryptoHistory #BTC

They held through everything — crashes, FUD, bans, hype, and history.

Now it’s worth OVER $5 MILLION 💰💰💰

Absolute LEGEND 👑

#bitcoin #HODL #CryptoHistory #BTC

1 month ago

Riot Platforms has secured a $100 million credit facility from Coinbase Credit, a subsidiary of Coinbase Global, Inc. The credit facility, Riot's first bitcoin-backed facility, will provide the company with non-dilutive funding at an attractive financing cost.

Key Points:

Purpose: Riot intends to use the proceeds from the credit facility for strategic initiatives and general corporate purposes.

Terms: The loan has a variable annual interest rate of at least 7.75%, calculated as the greater of 3.25% or the federal funds rate upper bound, plus 4.5%. It will mature 364 days after the effective date, with a possible one-year extension subject to Coinbase's consent.

Collateral: The loan is secured by a portion of Riot's total bitcoin holdings. As of April 2025, Riot held 19,223 BTC, valued at approximately $1.8 billion.

Strategic Importance: The credit facility is a key part of Riot's efforts to diversify funding sources, support operations, and pursue strategic growth initiatives, with a focus on long-term stockholder value creation.

Market Reaction: Following the announcement, shares of Riot Platforms (RIOT) rose more than 8% on April 23, amid a broad rally for Bitcoin miners and the overall stock market.

Key Points:

Purpose: Riot intends to use the proceeds from the credit facility for strategic initiatives and general corporate purposes.

Terms: The loan has a variable annual interest rate of at least 7.75%, calculated as the greater of 3.25% or the federal funds rate upper bound, plus 4.5%. It will mature 364 days after the effective date, with a possible one-year extension subject to Coinbase's consent.

Collateral: The loan is secured by a portion of Riot's total bitcoin holdings. As of April 2025, Riot held 19,223 BTC, valued at approximately $1.8 billion.

Strategic Importance: The credit facility is a key part of Riot's efforts to diversify funding sources, support operations, and pursue strategic growth initiatives, with a focus on long-term stockholder value creation.

Market Reaction: Following the announcement, shares of Riot Platforms (RIOT) rose more than 8% on April 23, amid a broad rally for Bitcoin miners and the overall stock market.

1 month ago

🇷🇺 LATEST: Russia is planning to launch a #cryptocurrency exchange that will be jointly operated by its central bank and finance ministry, specifically for qualified investors.

1 month ago

⚡️ TODAY: Twenty One Capital CEO Jack Mallers claims he wants to “encourage the world to adopt #Bitcoin” in a sense it hasn’t yet.

Sponsored by

Administrator

11 months ago