13 days ago

🚀 Big News from DefiLlama! 🚀

DefiLlama announces a game-changing update: Protocol pages now track Incentives and Earnings! 📊💰

Here's the scoop:

🔹 Earnings = Revenue - Incentives

🔹 Discover if a protocol is cashing in more revenue than it’s shelling out in incentives!

Stay informed, make smart moves, and optimize your DeFi strategy with this new insight. Dive into the numbers and see where your favorite protocols stand! 📈🔍

#DeFiLlama #DeFiData #CryptoEarnings #SmartInvesting

DefiLlama announces a game-changing update: Protocol pages now track Incentives and Earnings! 📊💰

Here's the scoop:

🔹 Earnings = Revenue - Incentives

🔹 Discover if a protocol is cashing in more revenue than it’s shelling out in incentives!

Stay informed, make smart moves, and optimize your DeFi strategy with this new insight. Dive into the numbers and see where your favorite protocols stand! 📈🔍

#DeFiLlama #DeFiData #CryptoEarnings #SmartInvesting

13 days ago

🎯 DefiLlama Just Got Even Better!

Finally, a smarter way to track your favorite DeFi metrics! The new dashboard navigation is chef's kiss 🔥

What's New:

• Fresh dropdown menu at the top 📊

• 18 different protocol metrics to explore 📈

• 11 chain metrics to analyze 🔗

Pro tip: Play around with different rankings to uncover hidden gems in the DeFi space 💎

This is the upgrade we've all been waiting for! Who else is loving the new interface? 🙋♂️

#defi #DeFiLlama #CryptoTools #Web3 $BTC $ETH

Finally, a smarter way to track your favorite DeFi metrics! The new dashboard navigation is chef's kiss 🔥

What's New:

• Fresh dropdown menu at the top 📊

• 18 different protocol metrics to explore 📈

• 11 chain metrics to analyze 🔗

Pro tip: Play around with different rankings to uncover hidden gems in the DeFi space 💎

This is the upgrade we've all been waiting for! Who else is loving the new interface? 🙋♂️

#defi #DeFiLlama #CryptoTools #Web3 $BTC $ETH

18 days ago

The market value of stablecoins has experienced a slight increase over the past week.

According to data from DefiLlama, the total market capitalization of #stablecoins across the network is currently $246.365 billion.

In the past week, this represents a growth of 1.02%. The market share of USDT has remained almost unchanged, holding steady at 62.25%.

According to data from DefiLlama, the total market capitalization of #stablecoins across the network is currently $246.365 billion.

In the past week, this represents a growth of 1.02%. The market share of USDT has remained almost unchanged, holding steady at 62.25%.

2 months ago

According to DefiLlama, the total market capitalization of stablecoins has reached $233.54 billion, reflecting a 0.99% growth in the past week. USDT continues to lead the pack, commanding a dominant share of 61.88% in the #stablecoin market.

3 months ago

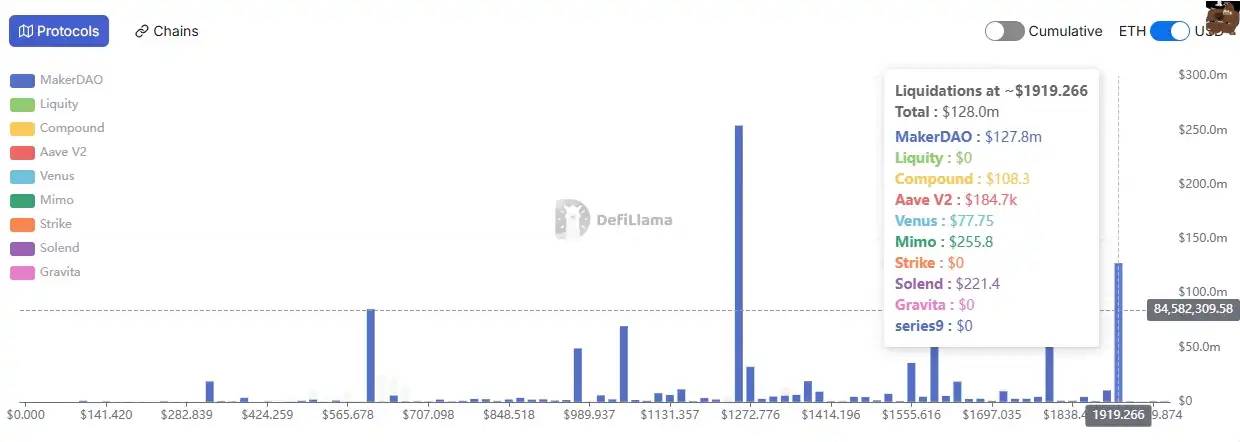

Ethereum Faces $1.28 Billion in Potential On-Chain Liquidation at $1,919

Data from #DeFiLlama shows that Ethereum is at risk of an on-chain liquidation totaling $128 million if its price hits $1,919.266. The bulk of this liquidation, approximately $127.8 million, is linked to the MakerDAO protocol.

#ethereum

Data from #DeFiLlama shows that Ethereum is at risk of an on-chain liquidation totaling $128 million if its price hits $1,919.266. The bulk of this liquidation, approximately $127.8 million, is linked to the MakerDAO protocol.

#ethereum

3 months ago

Berachain, Arbitrum, And Solana Lead In Weekly Net Inflows

Recent data released by DeFiLlama indicates that Berachain, Arbitrum, and Solana have recorded the highest net inflows over the past week. Aptos ranks fourth, followed by the Ethereum mainnet in fifth place.

#DeFiLlama #Berachain #arbitrum #solana #Aptos #ethereum

Recent data released by DeFiLlama indicates that Berachain, Arbitrum, and Solana have recorded the highest net inflows over the past week. Aptos ranks fourth, followed by the Ethereum mainnet in fifth place.

#DeFiLlama #Berachain #arbitrum #solana #Aptos #ethereum

3 months ago

Explore the power of DefiLlama chain dashboards to analyze diverse metrics in tandem.

Get a holistic view of chain performance and understand the dynamic relationships between key indicators.

Check out Berachain view, where DefiLlama integrated TVL, Volume, and App Revenue for in-depth analysis. 📊

https://defillama.com/chai...

#defi #Blockchain #DataAnalysis #Berachain #TVL #Volume #Analytics

Get a holistic view of chain performance and understand the dynamic relationships between key indicators.

Check out Berachain view, where DefiLlama integrated TVL, Volume, and App Revenue for in-depth analysis. 📊

https://defillama.com/chai...

#defi #Blockchain #DataAnalysis #Berachain #TVL #Volume #Analytics

3 months ago

Exciting news for Solana users!

📢 DeFiLlama is now tracking Jupiter Exchange's staked SOL pools on the Yield Dashboard! 📈 Track your JUP staked SOL and stay updated on the latest yield opportunities.

Check it out now! 👇

https://defillama.com/prot...

#DeFiLlama #JupiterExchange #solana #defi #YieldFarming

📢 DeFiLlama is now tracking Jupiter Exchange's staked SOL pools on the Yield Dashboard! 📈 Track your JUP staked SOL and stay updated on the latest yield opportunities.

Check it out now! 👇

https://defillama.com/prot...

#DeFiLlama #JupiterExchange #solana #defi #YieldFarming

Sponsored by

Administrator

11 months ago