6 days ago

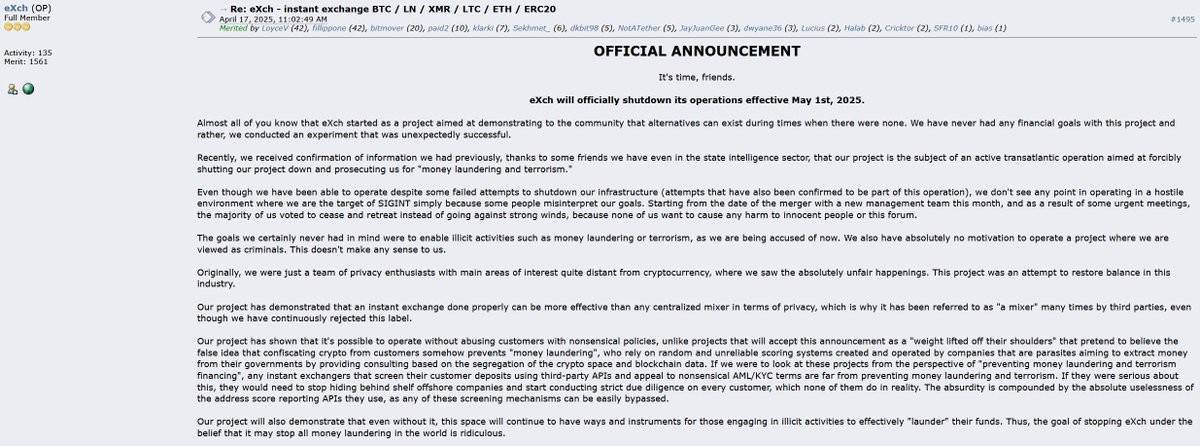

NEW: Crypto exchange eXch announces its shutdown due to an alleged "transatlantic operation" targeting them with accusations of enabling money laundering and terrorism.

The company is launching a 50 BTC open-source fund to support privacy-focused FOSS projects.

The company is launching a 50 BTC open-source fund to support privacy-focused FOSS projects.

10 days ago

DWF Labs has announced a notable $25 million investment in World Liberty Financial (WLFI), a decentralized finance protocol with ties to the Trump family. This investment is seen as a significant step into the U.S. market for DWF Labs, which plans to open an office in New York City to foster relationships with regulators and financial institutions. The investment, which highlights DWF's confidence in the U.S. as a growing region for institutional crypto adoption, comes amidst existing political controversies surrounding WLFI.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

1 month ago

Telegram has surpassed 1 billion monthly active users, making it the second-largest messaging app in the world.

Monthly Active Users: Over 1 billion

Daily App Opens per User: 21 times

Average Daily Usage Time: 41 minutes

Revenue (2024): $547 million profit

Monthly Active Users: Over 1 billion

Daily App Opens per User: 21 times

Average Daily Usage Time: 41 minutes

Revenue (2024): $547 million profit

1 month ago

🚨🚨🚨 New Cryptojacking Malware MassJacker Targets Cryptocurrency Transactions

A new type of crypto-jacking malware known as MassJacker is targeting users who download pirated software. The malware hijacks #cryptocurrency transactions by replacing stored addresses. The malware originates from the website pesktop[dot]com, where unsuspecting users may inadvertently infect their devices. Once installed, MassJacker swaps out crypto addresses stored on the clipboard application for those controlled by the attacker.

CyberArk reports that 778,531 unique wallets are linked to the theft, with only 423 holding crypto assets, totaling approximately $336,700 as of August. Notably, one wallet contained over 600 Solana (SOL) worth around $87,000 and had a history of holding NFTs like Gorilla Reborn and Susanoo. An analysis revealed 1,184 transactions since March 11, 2022, and the wallet's owner engaged in decentralized finance activities in November 2024, swapping tokens such as Jupiter (JUP), Uniswap (UNI), USDC, and Raydium (RAY).

Cryptocurrency malware has been around since Coinhive released the first cryptojacking script in 2017. In February 2025, Kaspersky Labs found malware in app-making kits for Android and iOS that could scan images for crypto seed phrases. In October 2024, Checkmarx discovered crypto-stealing malware in the Python Package Index. Other malware has also targeted macOS devices.

#MassJacker #crypto #cryptocurrency #malware #Jupiter #Uniswap #USDC #nft #Cryptojacking #hacked

A new type of crypto-jacking malware known as MassJacker is targeting users who download pirated software. The malware hijacks #cryptocurrency transactions by replacing stored addresses. The malware originates from the website pesktop[dot]com, where unsuspecting users may inadvertently infect their devices. Once installed, MassJacker swaps out crypto addresses stored on the clipboard application for those controlled by the attacker.

CyberArk reports that 778,531 unique wallets are linked to the theft, with only 423 holding crypto assets, totaling approximately $336,700 as of August. Notably, one wallet contained over 600 Solana (SOL) worth around $87,000 and had a history of holding NFTs like Gorilla Reborn and Susanoo. An analysis revealed 1,184 transactions since March 11, 2022, and the wallet's owner engaged in decentralized finance activities in November 2024, swapping tokens such as Jupiter (JUP), Uniswap (UNI), USDC, and Raydium (RAY).

Cryptocurrency malware has been around since Coinhive released the first cryptojacking script in 2017. In February 2025, Kaspersky Labs found malware in app-making kits for Android and iOS that could scan images for crypto seed phrases. In October 2024, Checkmarx discovered crypto-stealing malware in the Python Package Index. Other malware has also targeted macOS devices.

#MassJacker #crypto #cryptocurrency #malware #Jupiter #Uniswap #USDC #nft #Cryptojacking #hacked

1 month ago

How North Korean hackers stole $1.5 billion in crypto

Hackers thought to be working for the North Korean regime have successfully cashed out hundreds of millions of dollars of their record-breaking $1.5 billion crypto heist.

The criminals, known as the Lazarus Group, swiped a huge haul of digital tokens in an audacious and remarkable hack on the crypto exchange ByBit last month.

Since then, they have been in a cat-and-mouse game with the company and legions of crypto fans trying to stop them from turning the coins into usable cash.

The Lazarus Group is accused of a litany of huge hacks, allegedly to make money for the hermit nation’s weapons program.

#Lazarus #Lazarusgroup #HACK #crypto #BYBIT #BybitHack

Hackers thought to be working for the North Korean regime have successfully cashed out hundreds of millions of dollars of their record-breaking $1.5 billion crypto heist.

The criminals, known as the Lazarus Group, swiped a huge haul of digital tokens in an audacious and remarkable hack on the crypto exchange ByBit last month.

Since then, they have been in a cat-and-mouse game with the company and legions of crypto fans trying to stop them from turning the coins into usable cash.

The Lazarus Group is accused of a litany of huge hacks, allegedly to make money for the hermit nation’s weapons program.

#Lazarus #Lazarusgroup #HACK #crypto #BYBIT #BybitHack

2 months ago

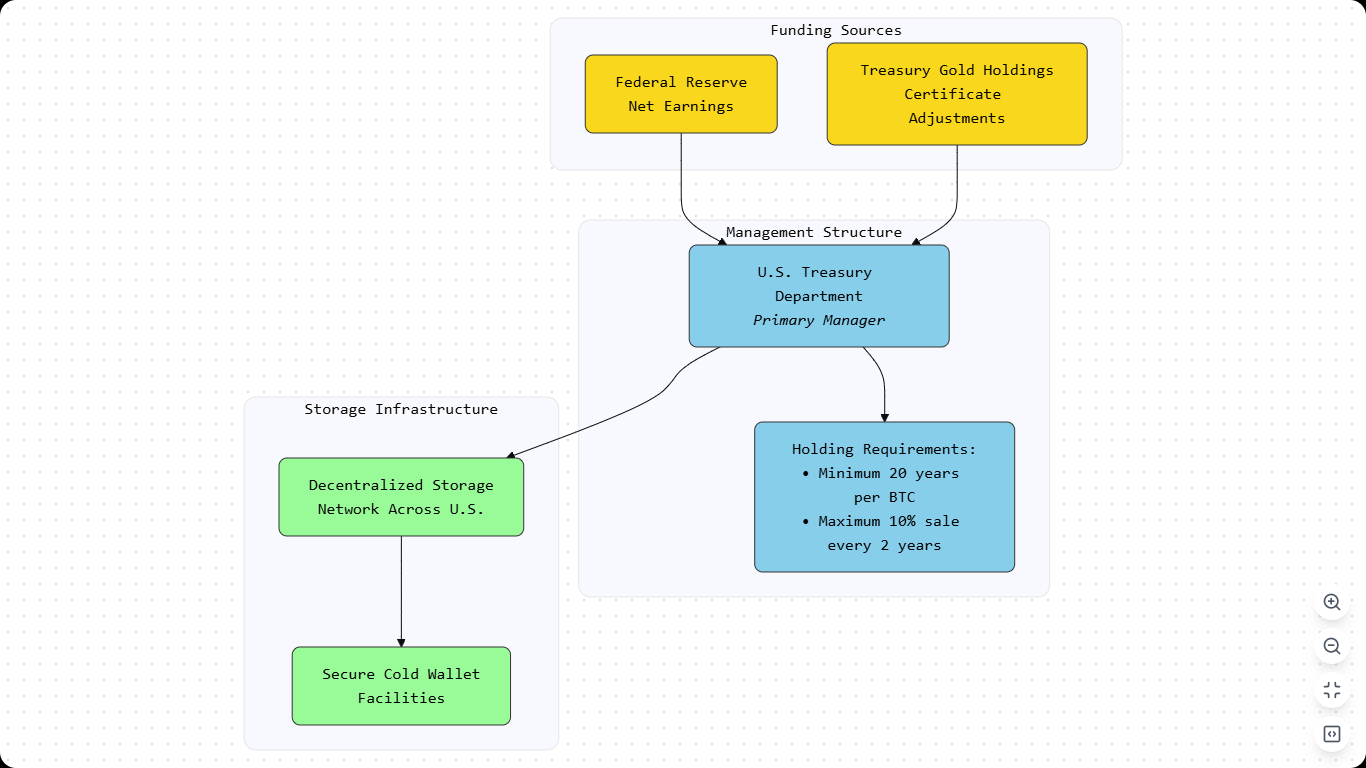

The USA government to purchase 1 million bitcoins over five years that would be transferred to a “decentralized network” of storage facilities.

#bitcoin #USA #decentralizednetwork #purchase

#bitcoin #USA #decentralizednetwork #purchase

2 months ago

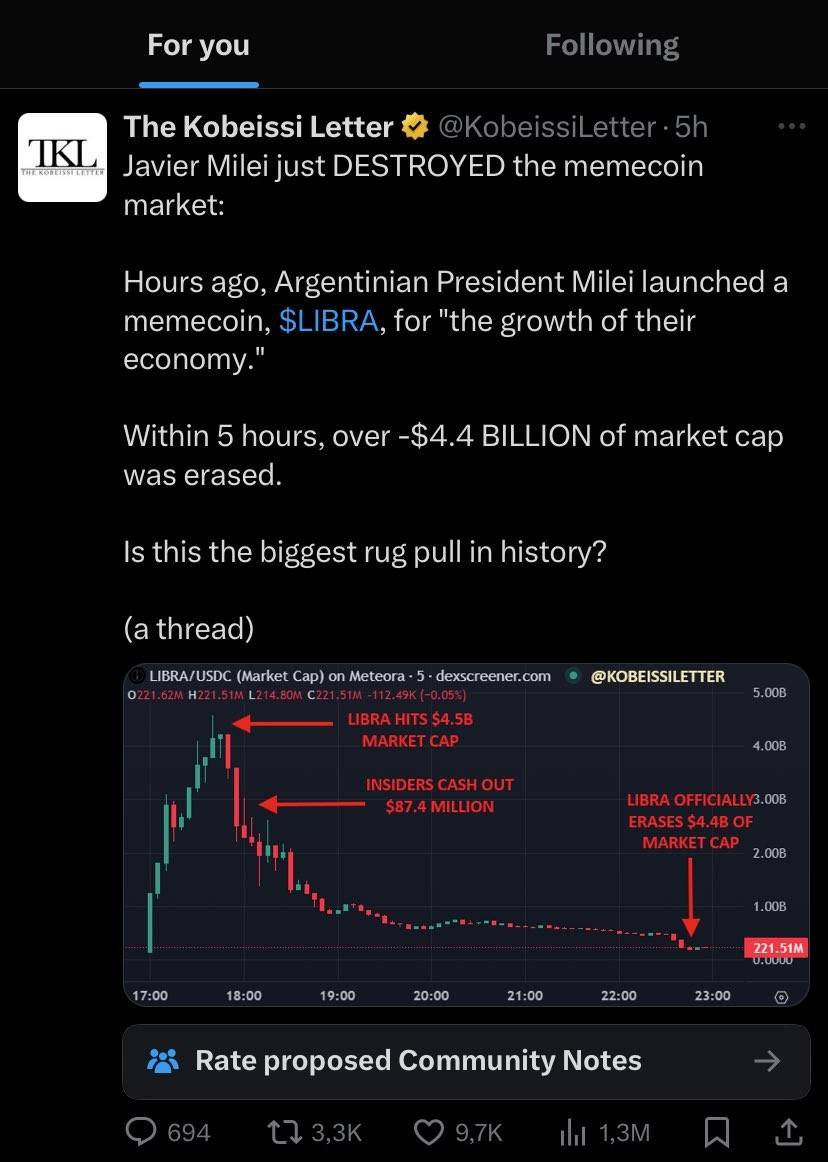

Is This The Biggest Crypto Scam Ever?

In this gripping tale, Martín, a young Argentine, stakes his $5,000 life savings on $LIBRA, a memecoin hyped by President Javier Milei as a lifeline amid crippling inflation.

As $LIBRA’s value rockets to $60,000, hope surges—until a ruthless crash wipes out $4.4 billion in hours, leaving Martín and thousands destitute. Insider Hayden Davis admits to pocketing $110 million, exposing a scam of manipulated markets and broken trust.

From Buenos Aires’ dark apartments to global crypto fallout, this video uncovers a wild saga of greed, desperation, and a nation’s betrayed dreams—where presidential promises turn to dust in the Wild West of memecoins.

#crypto #cryptoscam #Scam #cryptocurrency

In this gripping tale, Martín, a young Argentine, stakes his $5,000 life savings on $LIBRA, a memecoin hyped by President Javier Milei as a lifeline amid crippling inflation.

As $LIBRA’s value rockets to $60,000, hope surges—until a ruthless crash wipes out $4.4 billion in hours, leaving Martín and thousands destitute. Insider Hayden Davis admits to pocketing $110 million, exposing a scam of manipulated markets and broken trust.

From Buenos Aires’ dark apartments to global crypto fallout, this video uncovers a wild saga of greed, desperation, and a nation’s betrayed dreams—where presidential promises turn to dust in the Wild West of memecoins.

#crypto #cryptoscam #Scam #cryptocurrency

2 months ago

Amouranth, a popular streamer, was reportedly robbed at gunpoint, with the attackers demanding #cryptocurrency .

On March 2nd, streamer Amouranth (Kaitlyn Siragusa) reported a violent home invasion in Houston where attackers demanded Bitcoin.

Amouranth shared on X (formerly Twitter) that she was pulled out of bed at gunpoint and instructed to make a crypto payment. She tweeted about the incident while it was happening, explaining that calling emergency services would have been too dangerous.

Quote from Amouranth: "I'm being too robbed at gunpoint...They wanted crypto is what they were yelling they pulled me out of bed." She also stated, "Was at gun point they gave me phone and said log in with gun to my head and I tweeted because calling would be a death sentence."

#crypto #cryptorobbery #robbed #bitcoin

On March 2nd, streamer Amouranth (Kaitlyn Siragusa) reported a violent home invasion in Houston where attackers demanded Bitcoin.

Amouranth shared on X (formerly Twitter) that she was pulled out of bed at gunpoint and instructed to make a crypto payment. She tweeted about the incident while it was happening, explaining that calling emergency services would have been too dangerous.

Quote from Amouranth: "I'm being too robbed at gunpoint...They wanted crypto is what they were yelling they pulled me out of bed." She also stated, "Was at gun point they gave me phone and said log in with gun to my head and I tweeted because calling would be a death sentence."

#crypto #cryptorobbery #robbed #bitcoin

2 months ago

2 months ago

Argentina's President Milei deceives thousands of his supporters in a memecoin pump-and-dump scheme scam of $4.4 Billion.

The funnier is that he posted later that he had nothing to do with the project

The funnier is that he posted later that he had nothing to do with the project

5 months ago

👍👍👍👍👍👍

📻 RADIOGRAM - Music = Profit! 🎧💰

- By listening to music, for every minute you receive 1⚡️ impulse, which can be exchanged for a project token! 🎁🎁

- Complete daily tasks, move up the leaderboard and earn even more! 🎉🎉

- Thousands of radio stations, 20 genres, 26 countries!.There's something for everyone!🌍✨

-We are preparing many interesting features, updates and surprises for you! 🤫👍👍

- LISTEN TO RADIOGRAM, enjoy your favorite tracks🎧 and earn money at the same time!💰

💥💥💥💥💥💥💥💥 https://bit.ly/3D1qbCD

📻 RADIOGRAM - Music = Profit! 🎧💰

- By listening to music, for every minute you receive 1⚡️ impulse, which can be exchanged for a project token! 🎁🎁

- Complete daily tasks, move up the leaderboard and earn even more! 🎉🎉

- Thousands of radio stations, 20 genres, 26 countries!.There's something for everyone!🌍✨

-We are preparing many interesting features, updates and surprises for you! 🤫👍👍

- LISTEN TO RADIOGRAM, enjoy your favorite tracks🎧 and earn money at the same time!💰

💥💥💥💥💥💥💥💥 https://bit.ly/3D1qbCD

Telegram: Contact @RadiogrammBot

First “Listen & Earn” Telegram App. Earn Impulse by listening to music. 🎧💰

https://bit.ly/3D1qbCD

9 months ago

(E)

### Bitcoin and Cryptocurrencies:

- **The Ethereum restaking protocol EigenLayer** has lost $5 billion in total value locked (TVL) within a few weeks (Journal du Coin).

- **Bitcoin exchanges** have seen significant inflows into ETFs, totaling $2 billion over nine consecutive days (Journal du Coin).

### Regulation and Security:

- The **European Securities and Markets Authority (ESMA)** has made progress in developing the digital euro, an initiative that could transform financial transactions in Europe (Une-Blockchain).

- **Hong Kong** plans to implement a licensing system for stablecoin issuers, thereby strengthening regulation in this sector (Journal du Coin).

### Technological Developments:

- **Ubisoft** has chosen Aleph.im to manage the dynamic NFTs for its new Web 3 game, further integrating blockchain into the gaming industry (Journal du Coin).

### Adoption and Usage:

- Various **blockchain adoption initiatives** continue to emerge, such as the acceptance of cryptocurrencies for purchasing real estate and luxury services in Dubai (Krypto Channel).

These developments indicate a growing adoption and significant movements in the blockchain and cryptocurrency space, affecting both asset prices and regulatory and technological infrastructure.

- **The Ethereum restaking protocol EigenLayer** has lost $5 billion in total value locked (TVL) within a few weeks (Journal du Coin).

- **Bitcoin exchanges** have seen significant inflows into ETFs, totaling $2 billion over nine consecutive days (Journal du Coin).

### Regulation and Security:

- The **European Securities and Markets Authority (ESMA)** has made progress in developing the digital euro, an initiative that could transform financial transactions in Europe (Une-Blockchain).

- **Hong Kong** plans to implement a licensing system for stablecoin issuers, thereby strengthening regulation in this sector (Journal du Coin).

### Technological Developments:

- **Ubisoft** has chosen Aleph.im to manage the dynamic NFTs for its new Web 3 game, further integrating blockchain into the gaming industry (Journal du Coin).

### Adoption and Usage:

- Various **blockchain adoption initiatives** continue to emerge, such as the acceptance of cryptocurrencies for purchasing real estate and luxury services in Dubai (Krypto Channel).

These developments indicate a growing adoption and significant movements in the blockchain and cryptocurrency space, affecting both asset prices and regulatory and technological infrastructure.

Subscribe to Unlock

For 1$ / Monthly

10 months ago

The future of Bitcoin is a topic of significant debate and speculation among investors, economists, and technology experts. Several factors could influence the trajectory of Bitcoin and other cryptocurrencies in the coming years:

### 1. **Regulation**

Regulation is a critical factor that will shape the future of Bitcoin. Governments worldwide are grappling with how to regulate cryptocurrencies, balancing the need to prevent illegal activities and protect consumers while fostering innovation. Stricter regulations could impact Bitcoin's value and usage, while a favorable regulatory environment could spur growth.

### 2. **Adoption**

The adoption of Bitcoin as a legitimate form of payment and store of value is essential for its long-term success. More businesses and institutions accepting Bitcoin and integrating it into their financial systems could drive widespread acceptance. Conversely, if adoption stalls, it might limit Bitcoin's potential growth.

### 3. **Technological Developments**

Advancements in blockchain technology, scalability solutions like the Lightning Network, and improvements in transaction speed and cost are crucial for Bitcoin's future. Innovations that make Bitcoin more efficient and user-friendly could enhance its appeal and usability.

### 4. **Market Dynamics**

The cryptocurrency market is highly volatile and influenced by factors such as investor sentiment, macroeconomic trends, and technological developments. Market dynamics, including competition from other cryptocurrencies and traditional financial products, will play a signific

### 1. **Regulation**

Regulation is a critical factor that will shape the future of Bitcoin. Governments worldwide are grappling with how to regulate cryptocurrencies, balancing the need to prevent illegal activities and protect consumers while fostering innovation. Stricter regulations could impact Bitcoin's value and usage, while a favorable regulatory environment could spur growth.

### 2. **Adoption**

The adoption of Bitcoin as a legitimate form of payment and store of value is essential for its long-term success. More businesses and institutions accepting Bitcoin and integrating it into their financial systems could drive widespread acceptance. Conversely, if adoption stalls, it might limit Bitcoin's potential growth.

### 3. **Technological Developments**

Advancements in blockchain technology, scalability solutions like the Lightning Network, and improvements in transaction speed and cost are crucial for Bitcoin's future. Innovations that make Bitcoin more efficient and user-friendly could enhance its appeal and usability.

### 4. **Market Dynamics**

The cryptocurrency market is highly volatile and influenced by factors such as investor sentiment, macroeconomic trends, and technological developments. Market dynamics, including competition from other cryptocurrencies and traditional financial products, will play a signific

10 months ago

Bitcoin bottom signal? German gov’t runs out of BTC to sell

Bitcoin’s

price could be on track to begin the reaccumulation phase as the German government is down to its last few thousand BTC

The German government’s Bitcoin wallet has decreased to just 3,856 BTC, only three weeks after it began selling.

As a result, the additional $222 million in selling pressure has pushed BTC’s price below $60,000 over the past week. However, signs of a potential bottom are beginning to emerge.

In its latest transactions on July 12, the wallet transferred 800 BTC to the Kraken exchange, 500 BTC to wallet “bc1q,” and another 1,000 BTC to wallet “139p.

Bitcoin’s

price could be on track to begin the reaccumulation phase as the German government is down to its last few thousand BTC

The German government’s Bitcoin wallet has decreased to just 3,856 BTC, only three weeks after it began selling.

As a result, the additional $222 million in selling pressure has pushed BTC’s price below $60,000 over the past week. However, signs of a potential bottom are beginning to emerge.

In its latest transactions on July 12, the wallet transferred 800 BTC to the Kraken exchange, 500 BTC to wallet “bc1q,” and another 1,000 BTC to wallet “139p.

Sponsored by

Administrator

10 months ago