14 days ago

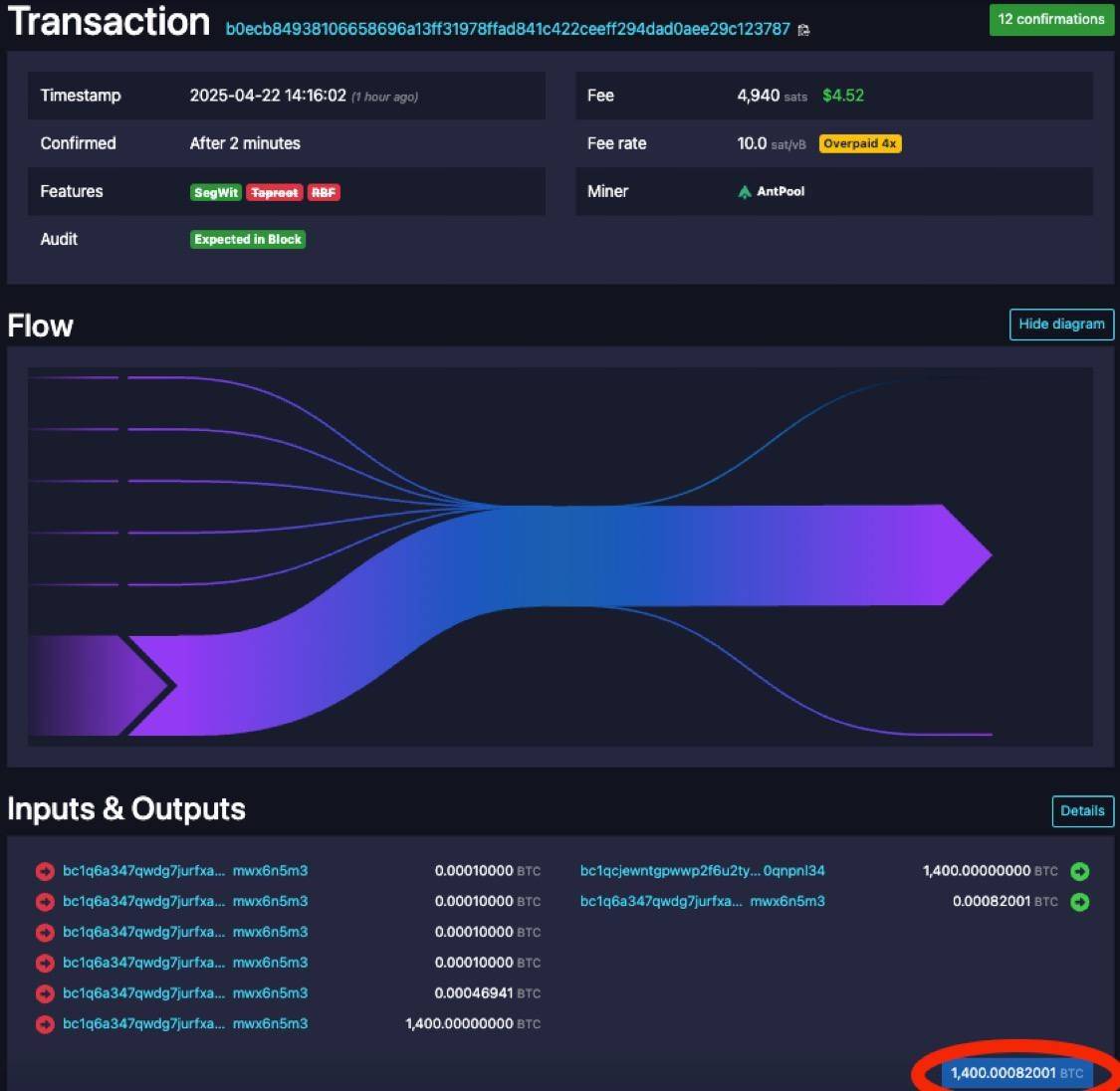

🚨 Today, a Bitcoiner moved 1,400 BTC ($128M) for just $4.52 in fees.

Bankers hate this trick. 😏 #bitcoin

Bankers hate this trick. 😏 #bitcoin

15 days ago

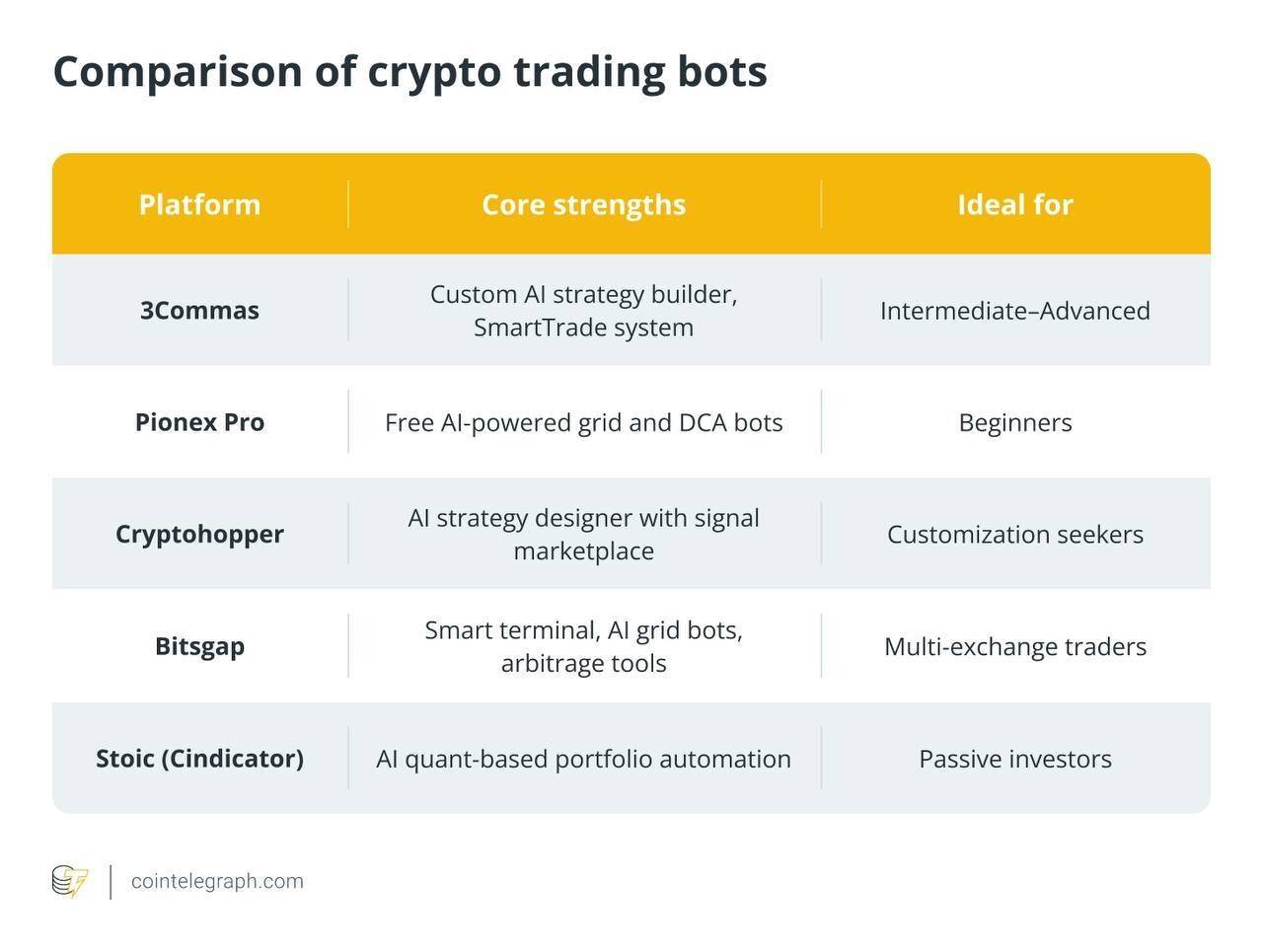

🚀⚡️INSIGHT: AI bots are *reshaping* the game in crypto trading — automating strategies, managing risks, and grinding 24/7 with zero sleep. 🤖💹

Here’s a quick breakdown of some popular crypto trading bots making waves:

1. 3Commas – Smart trading terminal with powerful automation tools. Great for beginners & pros alike.

2. Pionex – Built-in bots with zero subscription fees. Grid trading made easy.

3. Cryptohopper – Cloud-based, feature-rich, and perfect for strategy customization.

4. Shrimpy – Portfolio management meets auto-trading. Ideal for long-term investors.

5. Bitsgap – Combines trading, arbitrage, and bots in one dashboard.

💡These bots are not just tools—they're like your personal AI co-pilot in the volatile crypto markets.

👇Which one have you tried (or want to try)? Let's talk bots. #crypto #AIBots #CryptoTrading #defi #Automation

Here’s a quick breakdown of some popular crypto trading bots making waves:

1. 3Commas – Smart trading terminal with powerful automation tools. Great for beginners & pros alike.

2. Pionex – Built-in bots with zero subscription fees. Grid trading made easy.

3. Cryptohopper – Cloud-based, feature-rich, and perfect for strategy customization.

4. Shrimpy – Portfolio management meets auto-trading. Ideal for long-term investors.

5. Bitsgap – Combines trading, arbitrage, and bots in one dashboard.

💡These bots are not just tools—they're like your personal AI co-pilot in the volatile crypto markets.

👇Which one have you tried (or want to try)? Let's talk bots. #crypto #AIBots #CryptoTrading #defi #Automation

16 days ago

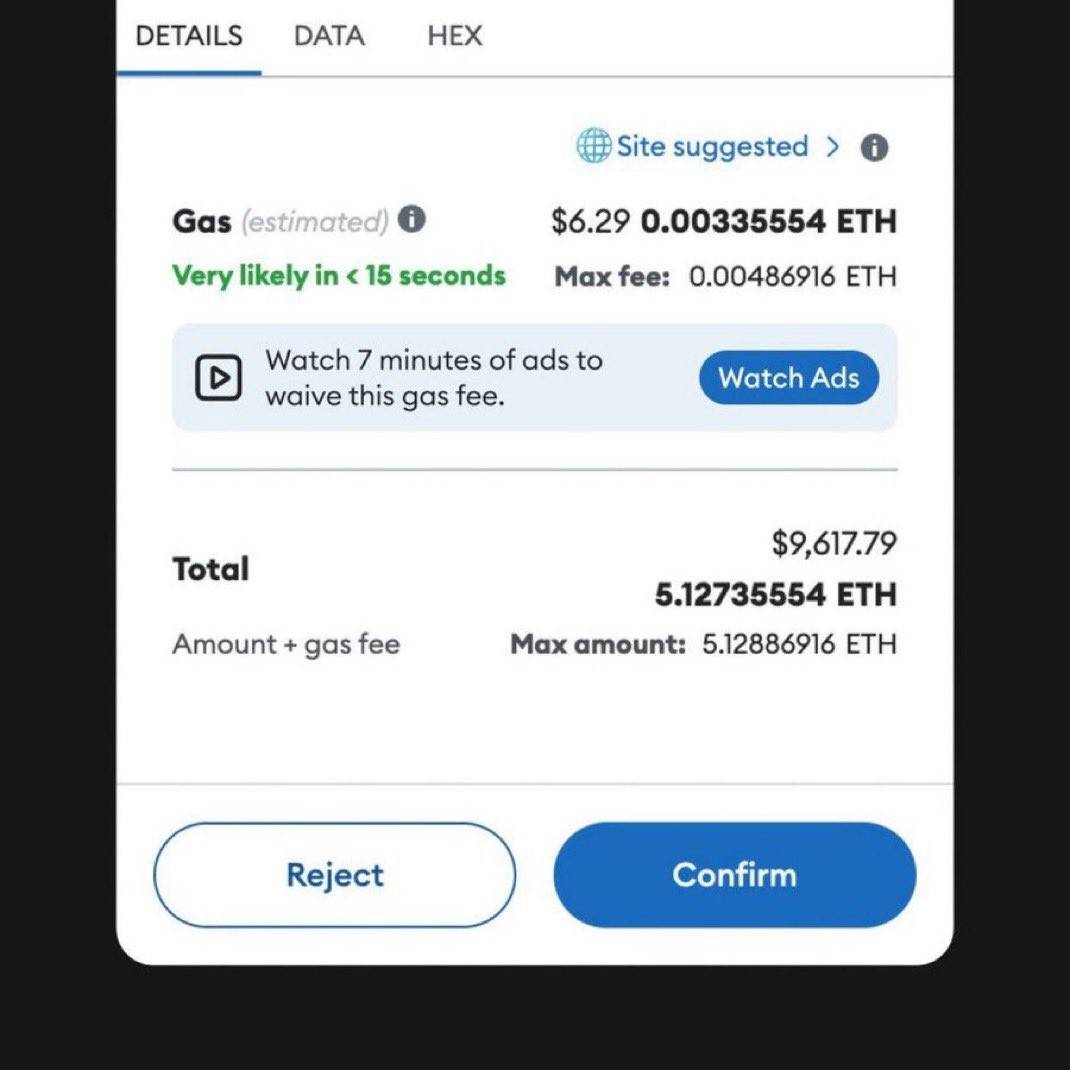

🚨Ethereum Gas Fees Drop ⛽

#ethereum 's gas fees have reached a notably low level, with the cost of revoking a single token authorization approximately $0.01. This presents an opportunity for users to utilize tools like RevokeCash and Rabby to cancel any uncertain or potentially unsafe authorizations. Even when processing hundreds of authorizations in bulk, the cost remains just a few dollars, effectively mitigating potential high-risk exposures.

#ethereum 's gas fees have reached a notably low level, with the cost of revoking a single token authorization approximately $0.01. This presents an opportunity for users to utilize tools like RevokeCash and Rabby to cancel any uncertain or potentially unsafe authorizations. Even when processing hundreds of authorizations in bulk, the cost remains just a few dollars, effectively mitigating potential high-risk exposures.

19 days ago

💸🔗 Ethereum: Where Gas Fees Burn More Than My Ex's Texts! 😂

Exploring the wild world of Ethereum like:

👉 Bought an NFT.

👉 Paid more gas than the artwork’s worth.

👉 Now I just stare at my MetaMask like it owes me a refund. 😅

But hey, smart contracts are smarter than my last 3 decisions combined! 🤖📜

Decentralized? Yes. Confusing? Also yes.

Still HODLing like it’s a Marvel post-credit scene. 🚀🌕

#EthereumVibes #CryptoLaughs #GasFeeGotMeLike #BlockchainHumor #Web3Life #HODLAndPray

Exploring the wild world of Ethereum like:

👉 Bought an NFT.

👉 Paid more gas than the artwork’s worth.

👉 Now I just stare at my MetaMask like it owes me a refund. 😅

But hey, smart contracts are smarter than my last 3 decisions combined! 🤖📜

Decentralized? Yes. Confusing? Also yes.

Still HODLing like it’s a Marvel post-credit scene. 🚀🌕

#EthereumVibes #CryptoLaughs #GasFeeGotMeLike #BlockchainHumor #Web3Life #HODLAndPray

2 months ago

Four.meme is a specialized platform on the BNB Smart Chain that serves as the first dedicated meme token launchpad dappbay.bnbchain.org.

This innovative platform provides creators with a streamlined environment to bring their meme-based cryptocurrency projects to life

Why Choose Four.meme? 🎯

📉 Lowest fees in the industry

✨ Streamlined token creation process

🚀 Maximum community traction

💡 Your canvas for crypto creativity

Partnership with PancakeSwap and Binance web3 wallet

This innovative platform provides creators with a streamlined environment to bring their meme-based cryptocurrency projects to life

Why Choose Four.meme? 🎯

📉 Lowest fees in the industry

✨ Streamlined token creation process

🚀 Maximum community traction

💡 Your canvas for crypto creativity

Partnership with PancakeSwap and Binance web3 wallet

2 months ago

(E)

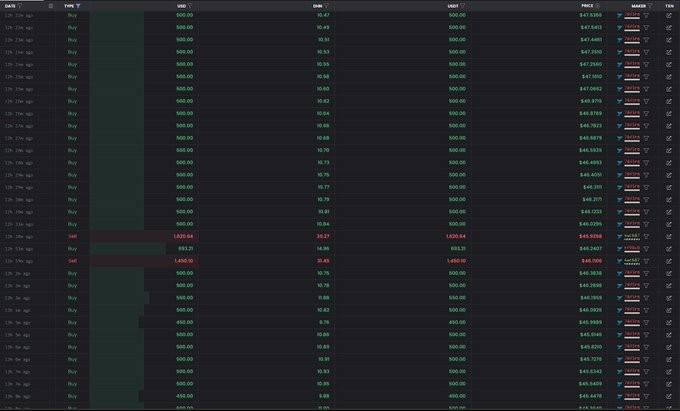

I was looking through the transactions of Dohrnii_io in the dex screener and found something off, like their team is buying through bots as if to showcase if it is kinda bullish or to create a fake demand.

It surged from $0.0014 to $52, and you can see they’re trying to artificially maintain the price by making a $500 buys, imposing high fees, and keeping the trading volume near zero. Someone also placed a limited buy order at $250K to intimidate sellers.

Have a look at the dex screener and share your thoughts.

https://dexscreener.com/et...

https://www.coingecko.com/...

#ScamAlert #cryptoscam #Scam #crypto

It surged from $0.0014 to $52, and you can see they’re trying to artificially maintain the price by making a $500 buys, imposing high fees, and keeping the trading volume near zero. Someone also placed a limited buy order at $250K to intimidate sellers.

Have a look at the dex screener and share your thoughts.

https://dexscreener.com/et...

https://www.coingecko.com/...

#ScamAlert #cryptoscam #Scam #crypto

2 months ago

(E)

0x Protocol

The 0x Protocol is a decentralized exchange (DEX) infrastructure that enables the peer-to-peer trading of cryptocurrencies and tokens on the Ethereum blockchain and other Ethereum-compatible networks.

Developed by 0x Labs, 0x Protocol uses smart contracts to execute trades, offering a low-cost and secure alternative to traditional centralized exchanges.

How does 0x protocol work?

- Order creation: A user creates an order specifying the token they want to trade, the amount, and their price requirements.

- Order relay: The order is shared off-chain via relayers or directly with a counterparty.

- Order matching: A relayer matches the order with a suitable counterparty or provides an order book for users to select from.

- On-chain settlement: Once both parties agree on the trade, the order is executed on-chain using the 0x smart contracts, ensuring security and transparency.

Use cases of #0xprotocol

- Decentralized Exchanges (DEXs): Enables the creation of DEX platforms with custom features and order books.

- DeFi applications: Integrated into lending, borrowing, and other DeFi platforms to facilitate token swaps.

- NFT marketplaces: Supports ERC-721 tokens, enabling decentralized trading of non-fungible assets.

0x token (ZRX)

- Governance: ZRX holders vote on protocol upgrades and governance decisions, contributing to 0x’s decentralized development.

- Staking: ZRX can be staked to earn rewards, particularly from trading fees generated on the network.

- Utility: Used to pay fees for services provided by relayers within the 0x ecosystem.

#cryptolearn

The 0x Protocol is a decentralized exchange (DEX) infrastructure that enables the peer-to-peer trading of cryptocurrencies and tokens on the Ethereum blockchain and other Ethereum-compatible networks.

Developed by 0x Labs, 0x Protocol uses smart contracts to execute trades, offering a low-cost and secure alternative to traditional centralized exchanges.

How does 0x protocol work?

- Order creation: A user creates an order specifying the token they want to trade, the amount, and their price requirements.

- Order relay: The order is shared off-chain via relayers or directly with a counterparty.

- Order matching: A relayer matches the order with a suitable counterparty or provides an order book for users to select from.

- On-chain settlement: Once both parties agree on the trade, the order is executed on-chain using the 0x smart contracts, ensuring security and transparency.

Use cases of #0xprotocol

- Decentralized Exchanges (DEXs): Enables the creation of DEX platforms with custom features and order books.

- DeFi applications: Integrated into lending, borrowing, and other DeFi platforms to facilitate token swaps.

- NFT marketplaces: Supports ERC-721 tokens, enabling decentralized trading of non-fungible assets.

0x token (ZRX)

- Governance: ZRX holders vote on protocol upgrades and governance decisions, contributing to 0x’s decentralized development.

- Staking: ZRX can be staked to earn rewards, particularly from trading fees generated on the network.

- Utility: Used to pay fees for services provided by relayers within the 0x ecosystem.

#cryptolearn

2 months ago

2 months ago

Jupiter is live on Rage Trade 🐱

Integrated with Jupiter Exchange!

You can now experience Jupiter's deep SOL liquidity + low fees + multi-collateral trading straight from our UI

Try now: https://app.rage.trade

#JupiterExchange #RageTrade #solana

Integrated with Jupiter Exchange!

You can now experience Jupiter's deep SOL liquidity + low fees + multi-collateral trading straight from our UI

Try now: https://app.rage.trade

#JupiterExchange #RageTrade #solana

3 months ago

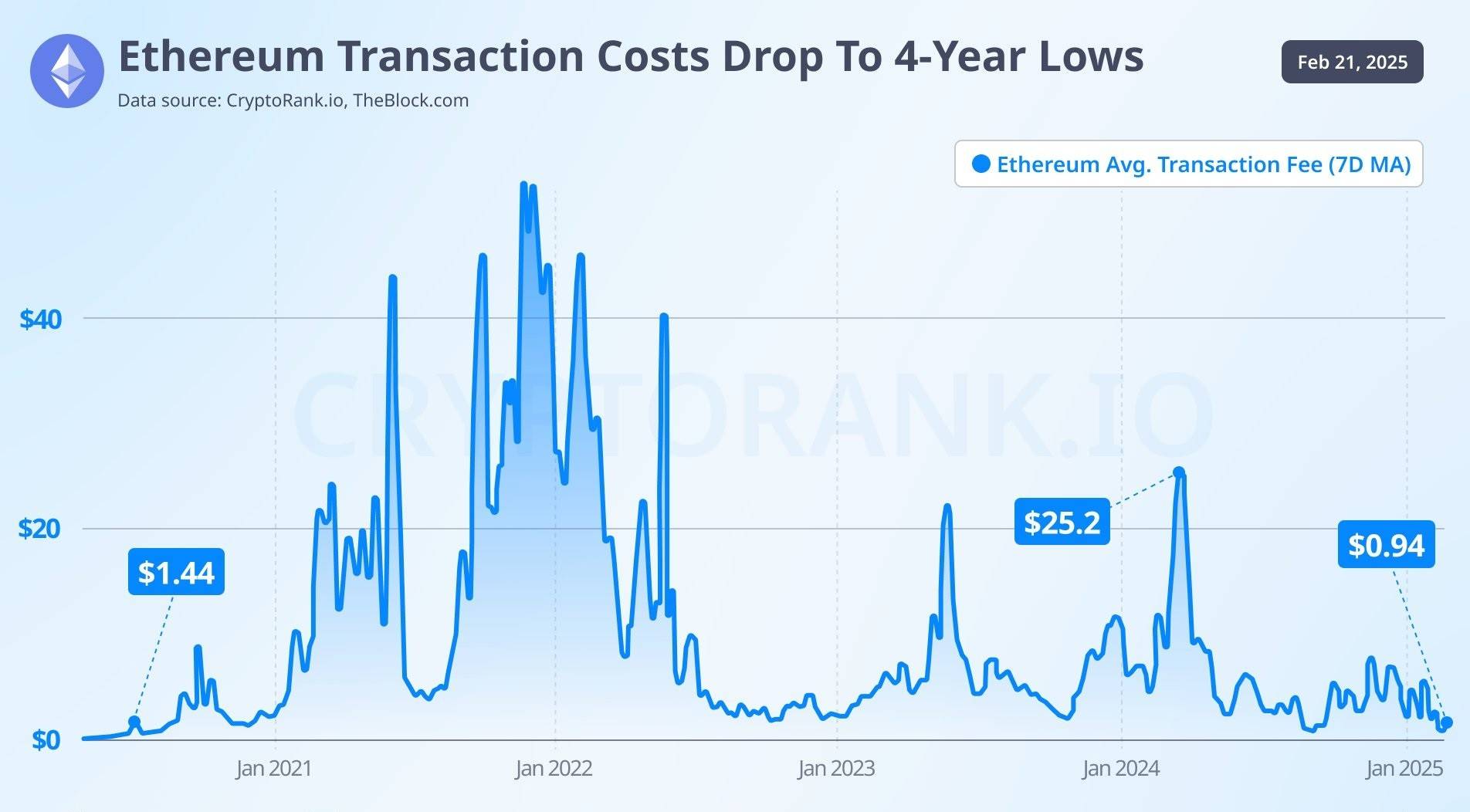

Ethereum Transaction Costs Drop To 4-Year Lows

The 7-day moving average of transaction fees on the

#ethereum network dropped to $0.94 on February 20, reaching its lowest level in more than four years.

Additionally, the median gas price fell to historical lows last seen in 2020, hitting 1.39 Gwei yesterday.

The 7-day moving average of transaction fees on the

#ethereum network dropped to $0.94 on February 20, reaching its lowest level in more than four years.

Additionally, the median gas price fell to historical lows last seen in 2020, hitting 1.39 Gwei yesterday.

3 months ago

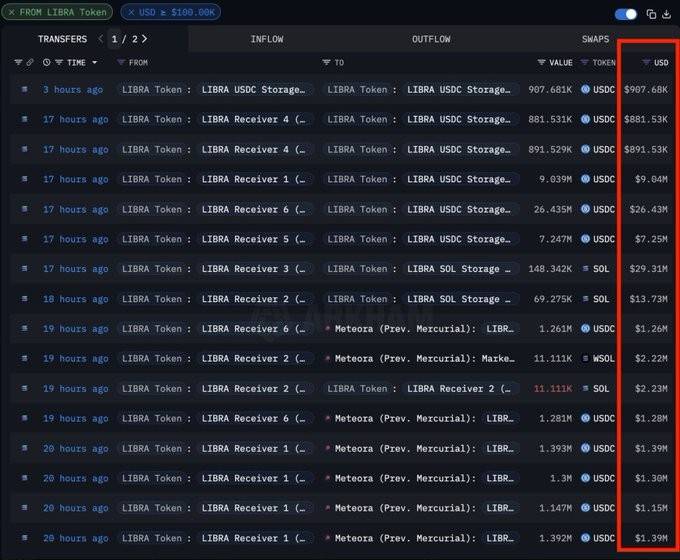

BREAKING: Insider wallets connected to Argentina's $LIBRA coin launch extracted $106.2M over the last 18 hours, per Arkham Intelligence.

These accounts now hold $57.6M USDC and $48.6M SOL.

The developer ALONE claimed $20M in trading fees.

Insiders cashed-in over +$126M of profit.

https://bitrr.io/thread/71...

These accounts now hold $57.6M USDC and $48.6M SOL.

The developer ALONE claimed $20M in trading fees.

Insiders cashed-in over +$126M of profit.

https://bitrr.io/thread/71...

3 months ago

(E)

🚀 Exciting news! Onyxcoin $XCN is now available for exchange on http://Godex.io 🌐 Swap your XCN securely, anonymously, and without any registration or hidden fees. Start trading today 📈

#crypto #cryptocurrency

#crypto #cryptocurrency

10 months ago

today’s crypto news:

Crypto Exchange Bankruptcy Protection:

When a crypto exchange goes bankrupt, it must cover legal fees and debts during bankruptcy proceedings. As a result, your crypto holdings may not be entirely safe in such situations1.

Q2 2024 Trends:

The second quarter of 2024 saw significant activity in meme coins, Real World Assets (RWA), and Artificial Intelligence (AI) within the crypto market2.

BlockDAG’s Impact:

BlockDAG, with its impressive $60 million presale and technological advancements, has been making waves in the crypto market. Meanwhile, AVAX faced a downturn, and Kaspa showed growth prospects3.

Remember to stay informed and make informed decisions in the ever-evolving crypto landscape! 🚀🌟

Crypto Exchange Bankruptcy Protection:

When a crypto exchange goes bankrupt, it must cover legal fees and debts during bankruptcy proceedings. As a result, your crypto holdings may not be entirely safe in such situations1.

Q2 2024 Trends:

The second quarter of 2024 saw significant activity in meme coins, Real World Assets (RWA), and Artificial Intelligence (AI) within the crypto market2.

BlockDAG’s Impact:

BlockDAG, with its impressive $60 million presale and technological advancements, has been making waves in the crypto market. Meanwhile, AVAX faced a downturn, and Kaspa showed growth prospects3.

Remember to stay informed and make informed decisions in the ever-evolving crypto landscape! 🚀🌟

Sponsored by

Administrator

10 months ago