6 hours ago

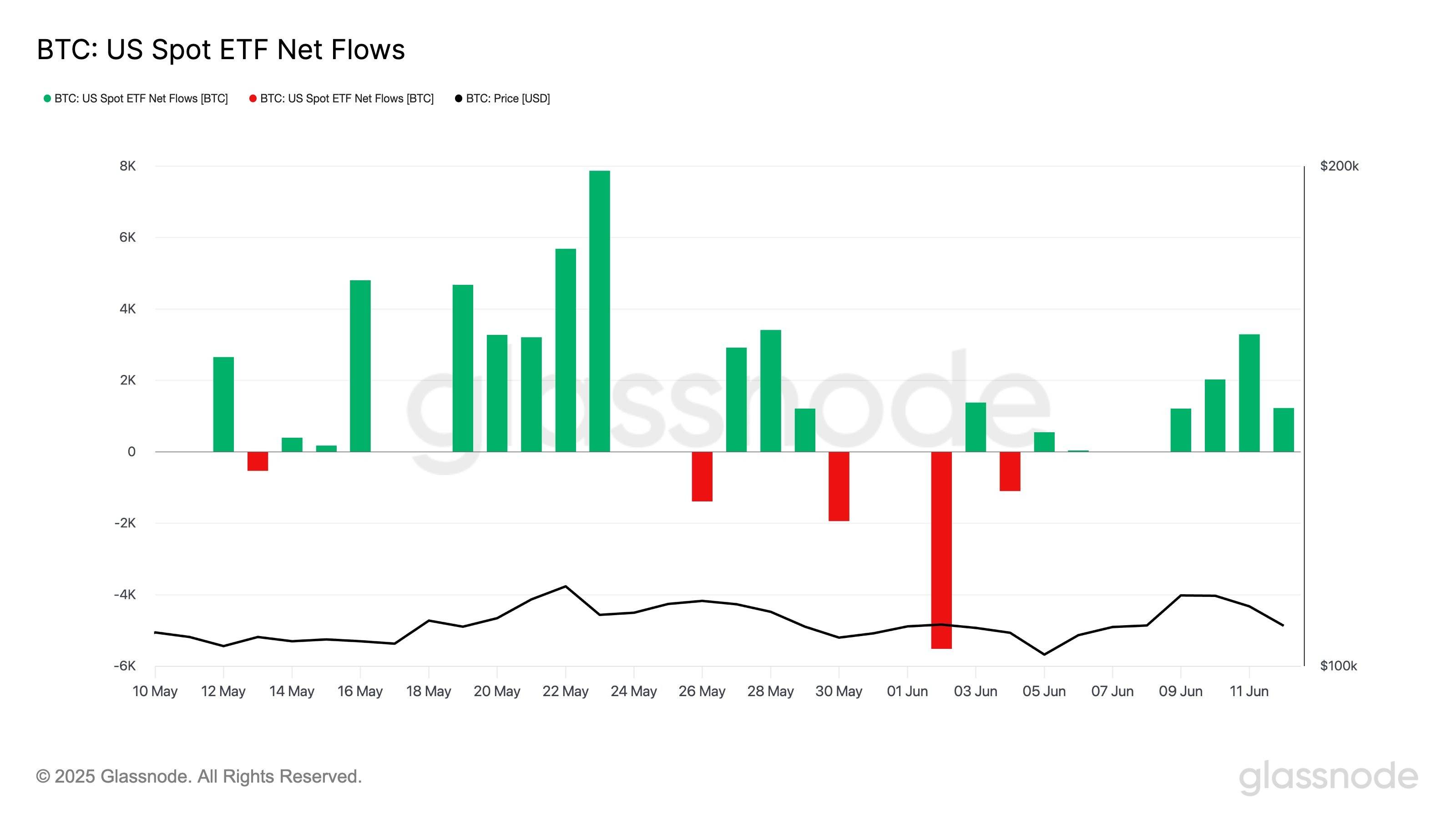

📉 #BTC ETF momentum slows down.

Total inflows this week hit 7.8K BTC — slightly above average, but still far from the May peak of 7.9K BTC inflow recorded on May 23rd.

Market activity cools, but eyes stay on the long-term trend. What’s your take? #bitcoin #CryptoMarkets

Total inflows this week hit 7.8K BTC — slightly above average, but still far from the May peak of 7.9K BTC inflow recorded on May 23rd.

Market activity cools, but eyes stay on the long-term trend. What’s your take? #bitcoin #CryptoMarkets

4 days ago

🔍 BREAKING: BlackRock has purchased 267,214 ETH — over $673 million — in just the past month.

This kind of institutional movement could be a MAJOR catalyst for Ethereum and the broader crypto market. What’s your take? 🚀

#ethereum #ETH #blackrock #cryptonews #InstitutionalAdoption #Web3 #defi #bitcoin #Blockchain

This kind of institutional movement could be a MAJOR catalyst for Ethereum and the broader crypto market. What’s your take? 🚀

#ethereum #ETH #blackrock #cryptonews #InstitutionalAdoption #Web3 #defi #bitcoin #Blockchain

4 days ago

🚨 RUMOR 🚨

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and crypto in the United States!

If implemented, this could be a MASSIVE boost for the crypto market and a game-changer for investors. 🚀

#bitcoin #cryptonews #Trump #TaxPlan #BitcoinBoom #CryptoTwitter

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and crypto in the United States!

If implemented, this could be a MASSIVE boost for the crypto market and a game-changer for investors. 🚀

#bitcoin #cryptonews #Trump #TaxPlan #BitcoinBoom #CryptoTwitter

5 days ago

Tether's Market Valuation Could Surpass Major Corporations

#Tether CEO Paolo Ardoino shared on the X platform that if Tether were to go public, its market valuation would reach $515 billion. This would position Tether as the 19th largest company globally, surpassing giants like Costco and Coca-Cola. Ardoino noted that while these figures are impressive, they might be slightly pessimistic considering Tether's growing reserves in Bitcoin and gold. Despite this, Tether aims to remain humble and is enthusiastic about the company's next phase of development. The company is focused on creating a significant hedging tool amid social instability, which results in a negative equity risk premium (ERP).

#Tether CEO Paolo Ardoino shared on the X platform that if Tether were to go public, its market valuation would reach $515 billion. This would position Tether as the 19th largest company globally, surpassing giants like Costco and Coca-Cola. Ardoino noted that while these figures are impressive, they might be slightly pessimistic considering Tether's growing reserves in Bitcoin and gold. Despite this, Tether aims to remain humble and is enthusiastic about the company's next phase of development. The company is focused on creating a significant hedging tool amid social instability, which results in a negative equity risk premium (ERP).

7 days ago

🚨 BREAKING NEWS 🚨

🇯🇵 #Metaplanet just announced plans to raise $5.4 BILLION to buy even MORE #bitcoin — aiming to hold 210,000 BTC by 2027 !

This kind of institutional demand is about to create a MAJOR supply shock in the market 🔥

Are we ready for what’s next? #BTC #cryptonews #BitcoinDominance

🇯🇵 #Metaplanet just announced plans to raise $5.4 BILLION to buy even MORE #bitcoin — aiming to hold 210,000 BTC by 2027 !

This kind of institutional demand is about to create a MAJOR supply shock in the market 🔥

Are we ready for what’s next? #BTC #cryptonews #BitcoinDominance

11 days ago

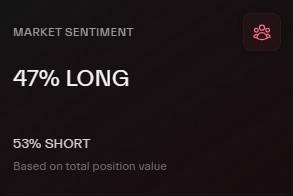

📊 Crypto Market Sentiment Update

🔍 Taking the pulse of the market:

47% LONG

53% SHORT

Based on total position value.

Bull vs bear battle continues — where do you stand?

#MarketSentiment #crypto #trading #MarketAnalysis

🔍 Taking the pulse of the market:

47% LONG

53% SHORT

Based on total position value.

Bull vs bear battle continues — where do you stand?

#MarketSentiment #crypto #trading #MarketAnalysis

11 days ago

Hong Kong company Reitar Logtech will buy $1.5b of #bitcoin

Reitar Logtech — is a leading Asian developer and operator of logistics facilities, working at the intersection of real estate, technology and automation.

Market capitalization = $250m+. Specialization: intelligent warehouses, cold storage and logistics infrastructure in China and ASEAN countries.

Reitar Logtech — is a leading Asian developer and operator of logistics facilities, working at the intersection of real estate, technology and automation.

Market capitalization = $250m+. Specialization: intelligent warehouses, cold storage and logistics infrastructure in China and ASEAN countries.

12 days ago

Understand this:

- binance and all centralized exchanges want a bear market. They make a lot of money in bear markets as people buy dips to death, and they get to liquidate every long in their order book. This is also where they accumulate their holdings and create dominance.

- MicroStrategy, BlackRock, and the Strategic Reserve and Treasury companies and sovereign nations don't want a bear market. Their value proposition is Store of Value.

This is what is going on right now.

The cycle has changed. The participants have changed. The US

CMEGroup, NasdaqExchange, regulated by the CFTC, will push back on binance, Bybit_Official, okx, and all unregulated leverage platforms from creating the bear markets we have seen in the past. The creation of artificial volatility by unlicensed offshore market makers will be regulated out of mainstream crypto.

This means the bear markets will shrink in spread. The super cycle begins because the participants have changed.

Over the next year we will share this experience together. I will report on all pertinent regulation, events, alpha, and significant geo political news as we navigate this new dynamic.

- binance and all centralized exchanges want a bear market. They make a lot of money in bear markets as people buy dips to death, and they get to liquidate every long in their order book. This is also where they accumulate their holdings and create dominance.

- MicroStrategy, BlackRock, and the Strategic Reserve and Treasury companies and sovereign nations don't want a bear market. Their value proposition is Store of Value.

This is what is going on right now.

The cycle has changed. The participants have changed. The US

CMEGroup, NasdaqExchange, regulated by the CFTC, will push back on binance, Bybit_Official, okx, and all unregulated leverage platforms from creating the bear markets we have seen in the past. The creation of artificial volatility by unlicensed offshore market makers will be regulated out of mainstream crypto.

This means the bear markets will shrink in spread. The super cycle begins because the participants have changed.

Over the next year we will share this experience together. I will report on all pertinent regulation, events, alpha, and significant geo political news as we navigate this new dynamic.

13 days ago

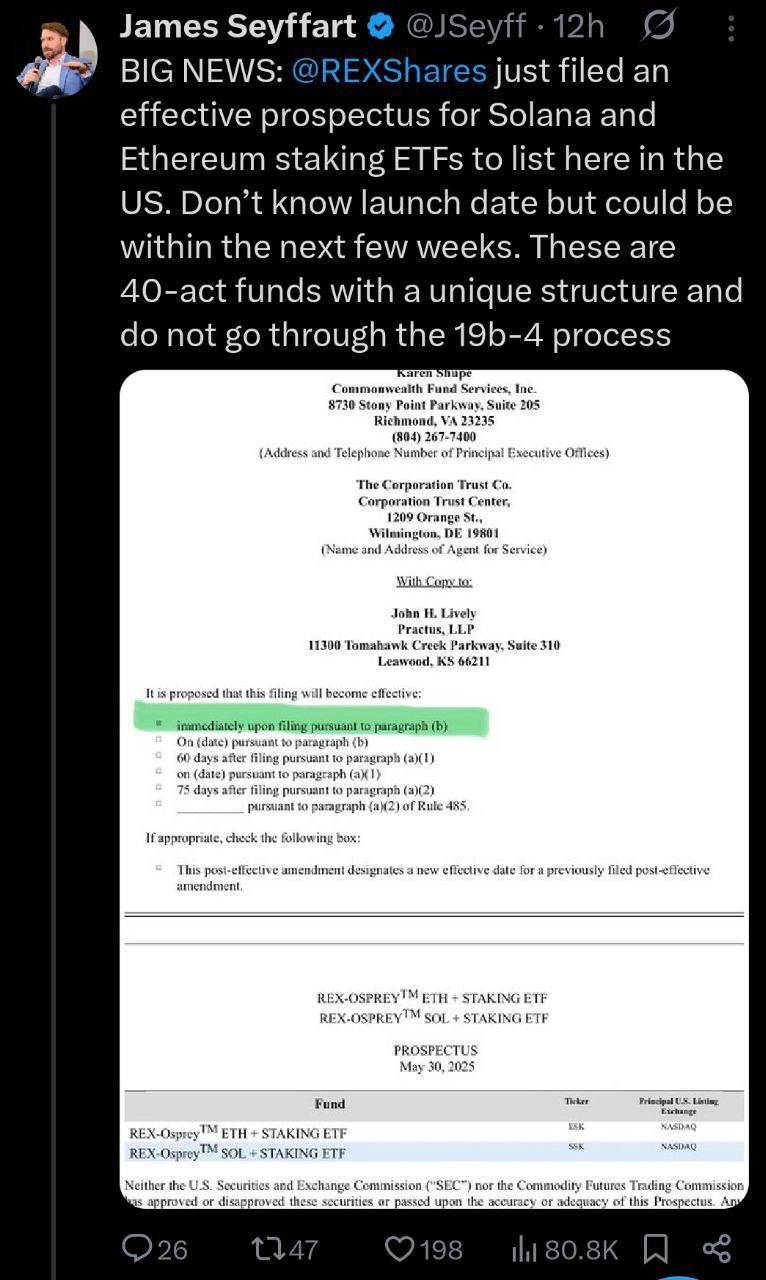

🚨 BIG NEWS FOR CRYPTO INVESTORS! 🚨

According to Bloomberg's ETF analyst, Ethereum and Solana staking ETFs could get approved as early as June!

If this happens, it could be a MAJOR step toward mainstream adoption and a game-changer for the crypto market.

Let’s see what June has in store… 📈💎

#cryptonews #ethereum #solana #ETF #CryptoTwitter #Web3 #Investing #Blockchain

According to Bloomberg's ETF analyst, Ethereum and Solana staking ETFs could get approved as early as June!

If this happens, it could be a MAJOR step toward mainstream adoption and a game-changer for the crypto market.

Let’s see what June has in store… 📈💎

#cryptonews #ethereum #solana #ETF #CryptoTwitter #Web3 #Investing #Blockchain

14 days ago

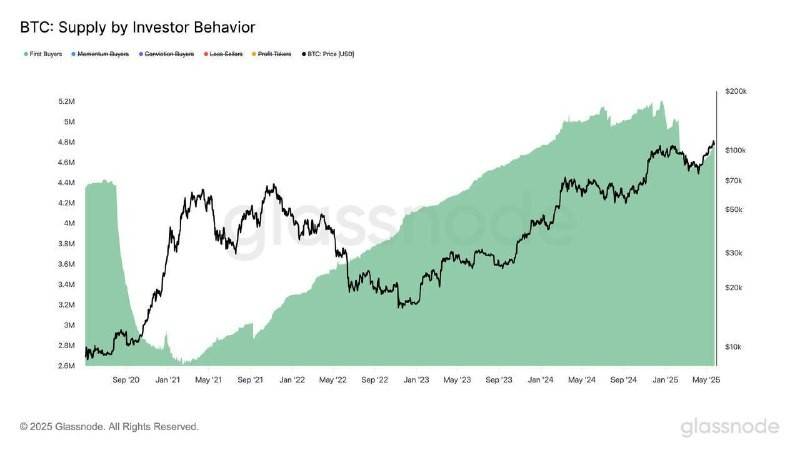

New Buyers’ Entry: Key Driver of Bitcoin’s Continued Uptrend

Sustained bullish trends in the Bitcoin market require the influx of new demand. Data analysis shows significant spikes in the number of first-time Bitcoin buyers (First Buyers) during the periods of July to December 2024 and March to May 2025.

These two periods directly coincided with phases of price growth. The notable increase in new buyers indicates fresh capital entering the Bitcoin ecosystem, strengthening the market structure and supporting the continuation of upward trends.

Sustained bullish trends in the Bitcoin market require the influx of new demand. Data analysis shows significant spikes in the number of first-time Bitcoin buyers (First Buyers) during the periods of July to December 2024 and March to May 2025.

These two periods directly coincided with phases of price growth. The notable increase in new buyers indicates fresh capital entering the Bitcoin ecosystem, strengthening the market structure and supporting the continuation of upward trends.

14 days ago

🟠Challenges Ahead for Bitcoin in Reaching a New All-Time High

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

14 days ago

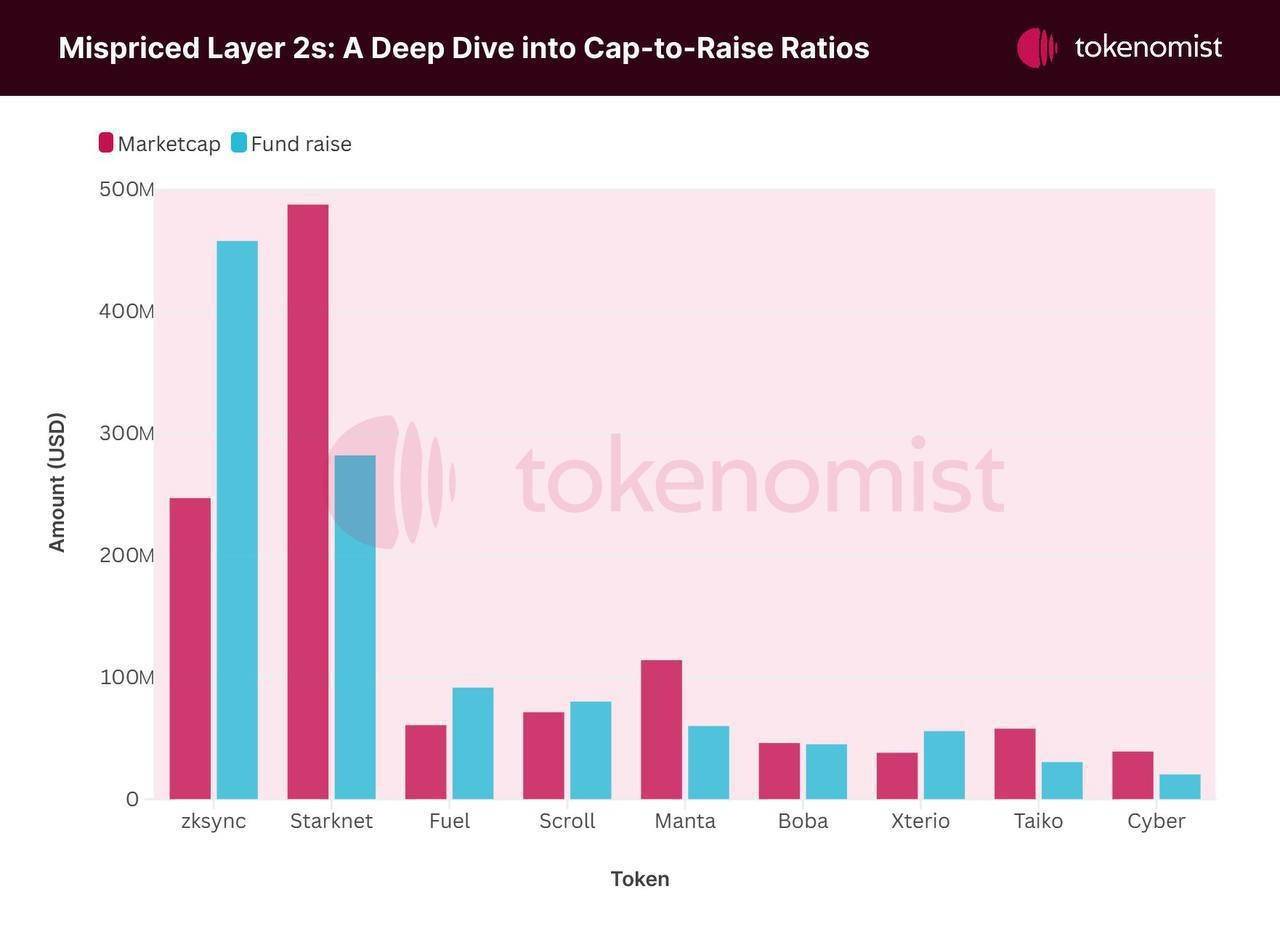

Market Cap Below Funding: The Strange Case of L2 Projects

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

14 days ago

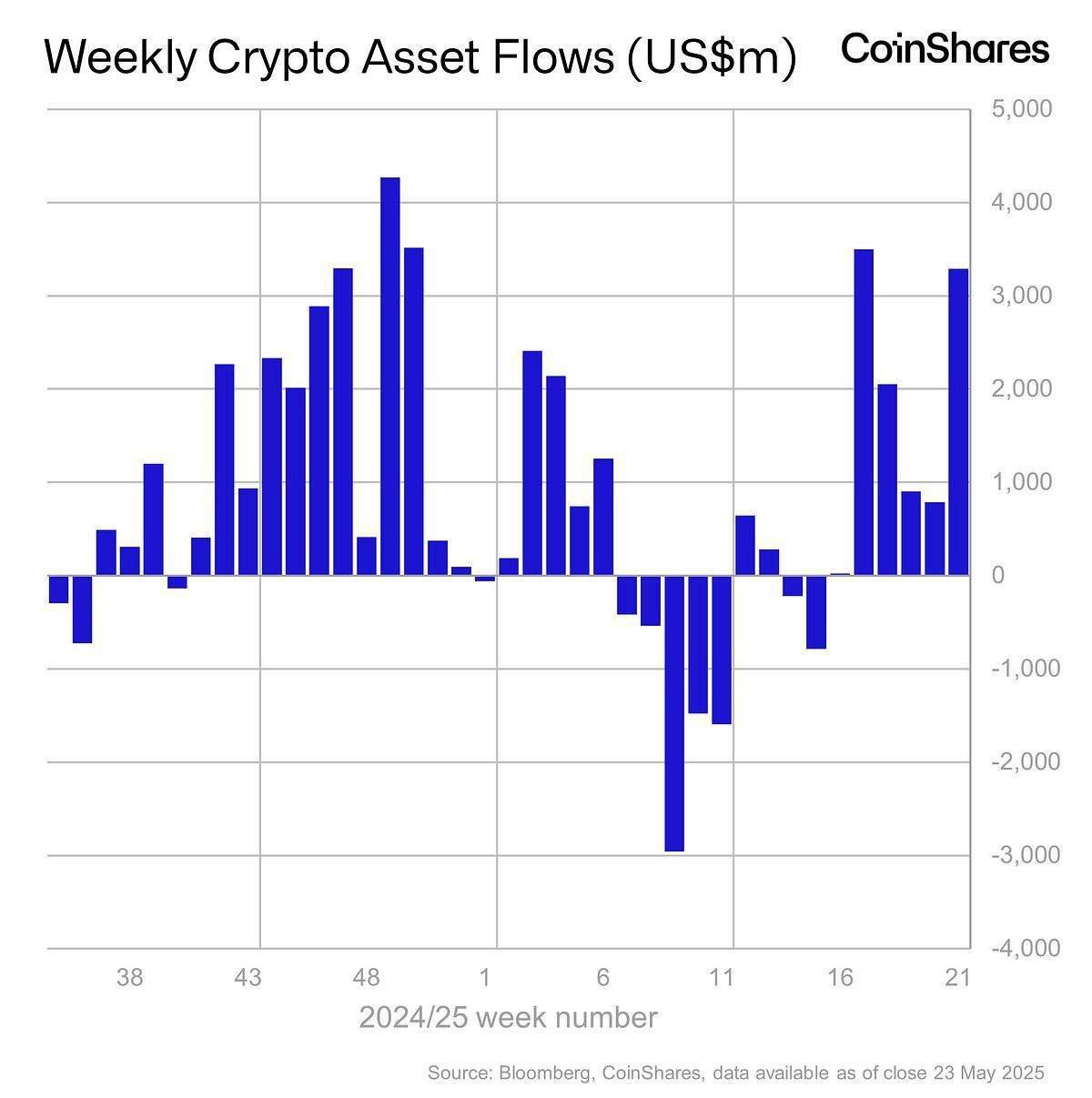

New Record in Digital Asset Inflows

Last week, total inflows into digital assets reached $3.3 billion, pushing year-to-date inflows in 2025 to an all-time high of $10.8 billion. As a result, total assets under management (AUM) hit a record $187.5 billion.

Bitcoin led the market with $2.9 billion in inflows. Meanwhile, Short Bitcoin products also saw notable activity, attracting $12.7 million, marking their largest weekly inflow since December 2024.

Last week, total inflows into digital assets reached $3.3 billion, pushing year-to-date inflows in 2025 to an all-time high of $10.8 billion. As a result, total assets under management (AUM) hit a record $187.5 billion.

Bitcoin led the market with $2.9 billion in inflows. Meanwhile, Short Bitcoin products also saw notable activity, attracting $12.7 million, marking their largest weekly inflow since December 2024.

14 days ago

🚨 ETF Flow Alert! 🚨

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

15 days ago

Ripple’s Hidden Road has just rolled out OTC crypto swaps in the US, paving the way for institutional investors to engage in cash-settled trades with top digital assets.

This could be a game-changer for the market!

source: https://cointelegraph.com/...

#cryptonews #ripple #HiddenRoad

This could be a game-changer for the market!

source: https://cointelegraph.com/...

#cryptonews #ripple #HiddenRoad

15 days ago

🔥 BREAKING: MagicEden's Revenue Milestone! 📊

Mind-blowing numbers coming in! In just 365 days, MagicEden has crushed it with $19.9M in royalty earnings! 🚀

The real kicker? A whopping 56% came straight from Solana! 💎

This is what dominating the NFT marketplace looks like. Solana proving once again why it's a powerhouse in the Web3 space! 📈

#MagicEden #solana #NFTs #Web3 #cryptonews #BullishAF 🌟

What are your thoughts on these impressive numbers? 👇

Mind-blowing numbers coming in! In just 365 days, MagicEden has crushed it with $19.9M in royalty earnings! 🚀

The real kicker? A whopping 56% came straight from Solana! 💎

This is what dominating the NFT marketplace looks like. Solana proving once again why it's a powerhouse in the Web3 space! 📈

#MagicEden #solana #NFTs #Web3 #cryptonews #BullishAF 🌟

What are your thoughts on these impressive numbers? 👇

15 days ago

Bitcoin dominance dropping can often signal a shift in the market. When Bitcoin's share of the total crypto market cap decreases, it frequently means capital is flowing into altcoins, potentially setting the stage for some exciting gains.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

15 days ago

DeFi Development Corp. Embraces Liquid Staking to Expand Solana Holdings.

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

16 days ago

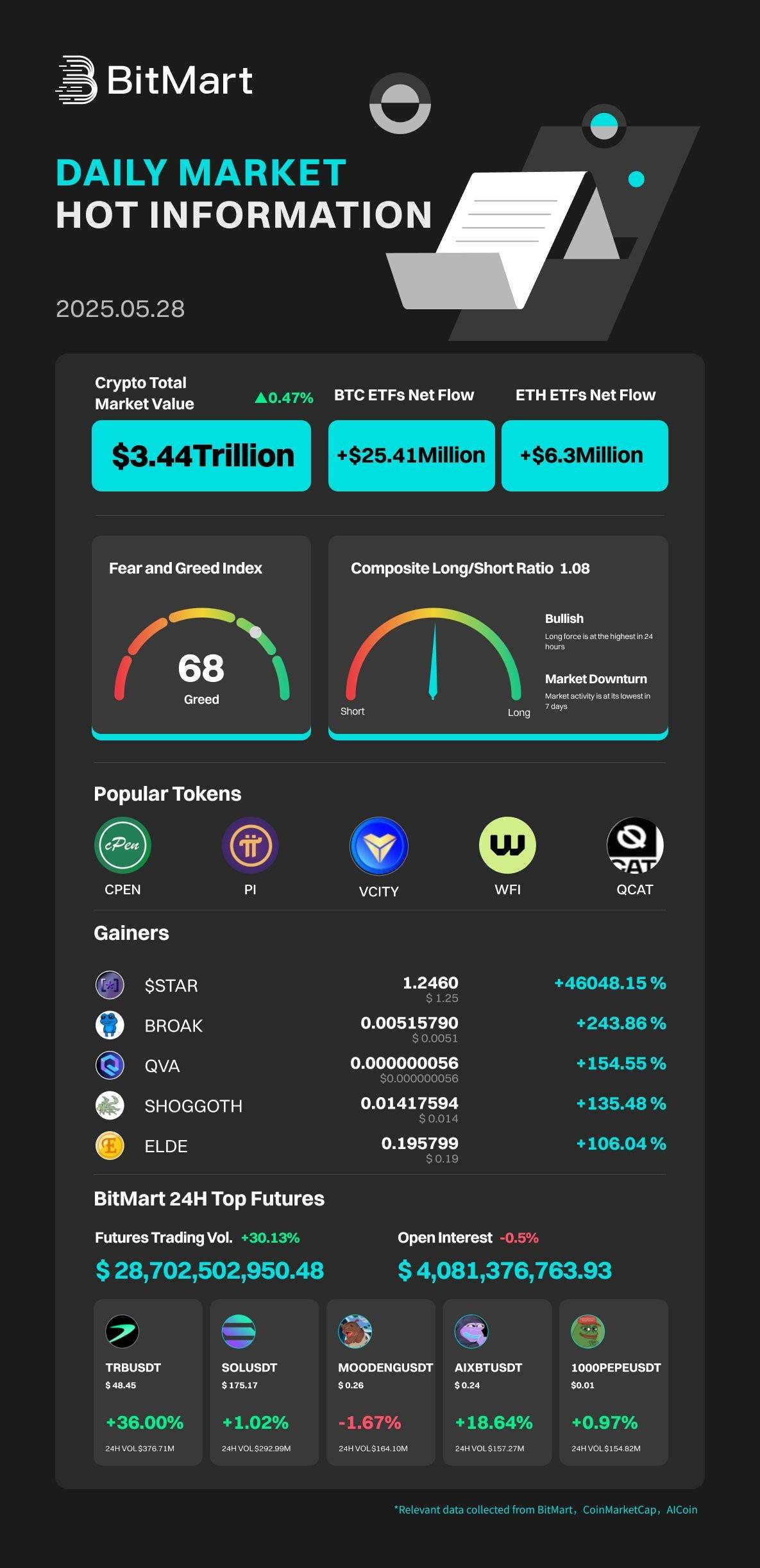

#BitMart Daily Market Hot Information - May 28, 2025 🚀

📊Crypto Market Cap: $3.44 Trillion (+0.47%)

📈BTC ETF Net Flow: +$25.41M

📉ETH ETF Net Flow: +$6.3M

🤑Fear & Greed Index: 68 (Greed)

🔥 Top Gainers: $STAR (+46048.15%), $BROAK (+243.86%), $QVA (+154.55%) & more!

📢 Stay ahead with the latest trends!

#crypto #cryptonews

📊Crypto Market Cap: $3.44 Trillion (+0.47%)

📈BTC ETF Net Flow: +$25.41M

📉ETH ETF Net Flow: +$6.3M

🤑Fear & Greed Index: 68 (Greed)

🔥 Top Gainers: $STAR (+46048.15%), $BROAK (+243.86%), $QVA (+154.55%) & more!

📢 Stay ahead with the latest trends!

#crypto #cryptonews

17 days ago

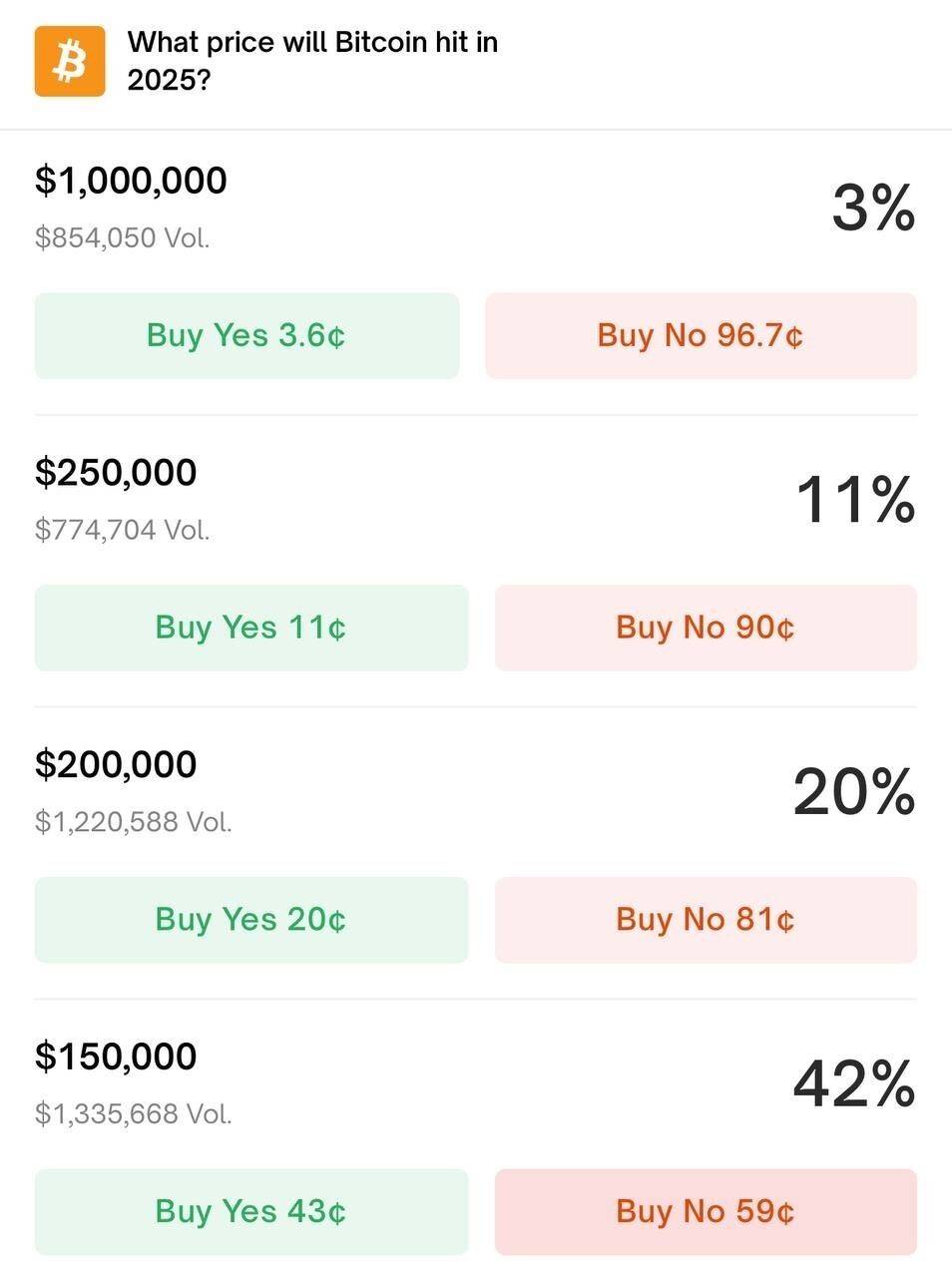

On Polymarket, users are bullish:

🔮 42% predict $150K for Bitcoin,

📈 20% betting on $200K. 🌚

And according to Bitwise, capital flows into Bitcoin could surpass $120B by late 2025 — hitting $300B in 2026 .

Buckle up. The future looks electric. 💯 #bitcoin #crypto #MarketTalk

🔮 42% predict $150K for Bitcoin,

📈 20% betting on $200K. 🌚

And according to Bitwise, capital flows into Bitcoin could surpass $120B by late 2025 — hitting $300B in 2026 .

Buckle up. The future looks electric. 💯 #bitcoin #crypto #MarketTalk

18 days ago

🚨 BREAKING: Trump Media Group Plans to Raise $3 Billion to Invest in Crypto! 🚀

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

18 days ago

🚨 BIG MOVEMENT ALERT 🚨

Trader James Wynn is currently holding a massive $1.26 billion LONG position in Bitcoin — one of the largest bets in the market right now.

👀 All eyes on the liquidation price: $105,179

Is this a moon mission or a margin call waiting to happen? Let’s see how this plays out.

#bitcoin #CryptoTrader #BTC #MarketWatch #JamesWynn #CryptoFutures #TradingLive

Trader James Wynn is currently holding a massive $1.26 billion LONG position in Bitcoin — one of the largest bets in the market right now.

👀 All eyes on the liquidation price: $105,179

Is this a moon mission or a margin call waiting to happen? Let’s see how this plays out.

#bitcoin #CryptoTrader #BTC #MarketWatch #JamesWynn #CryptoFutures #TradingLive

18 days ago

XRP May Experience a Decline Due to Concerns About Market Peaks

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

19 days ago

The market value of stablecoins has experienced a slight increase over the past week.

According to data from DefiLlama, the total market capitalization of #stablecoins across the network is currently $246.365 billion.

In the past week, this represents a growth of 1.02%. The market share of USDT has remained almost unchanged, holding steady at 62.25%.

According to data from DefiLlama, the total market capitalization of #stablecoins across the network is currently $246.365 billion.

In the past week, this represents a growth of 1.02%. The market share of USDT has remained almost unchanged, holding steady at 62.25%.

22 days ago

Bitcoin is trading flat at its ATH 📊

While retail investors are sleeping, institutions are quietly buying… and debt markets are plummeting.

The calm before the storm? 🌩️

#bitcoin #CryptoMarkets #InstitutionalInvesting #BTC

While retail investors are sleeping, institutions are quietly buying… and debt markets are plummeting.

The calm before the storm? 🌩️

#bitcoin #CryptoMarkets #InstitutionalInvesting #BTC

22 days ago

🚨 #bitcoin Retail Is Getting Outplayed

Since Jan 1st:

⛏️ Miners produced: 61,200 BTC

💼 Corporations bought: +196,207 BTC

That’s 3x more demand than supply — for every 1 Bitcoin mined, 3 are being swept off the market.

The institutions aren’t just playing the game… they’re changing the rules.

Time to act accordingly.

#BTC #CryptoTwitter #BitcoinMarket #OnChain

Since Jan 1st:

⛏️ Miners produced: 61,200 BTC

💼 Corporations bought: +196,207 BTC

That’s 3x more demand than supply — for every 1 Bitcoin mined, 3 are being swept off the market.

The institutions aren’t just playing the game… they’re changing the rules.

Time to act accordingly.

#BTC #CryptoTwitter #BitcoinMarket #OnChain

22 days ago

🚀 Solana’s stablecoin market cap just hit $12B as of May 20 — up from $6.4B on Jan 1!

That’s a massive 87.5% surge in just a few months. 💸✨

The Solana ecosystem is firing on all cylinders — where’s the next leg of the rally coming from? 🚨📈

#solana #sol #stablecoins #CryptoGrowth #Blockchain #defi #OnChainReality

That’s a massive 87.5% surge in just a few months. 💸✨

The Solana ecosystem is firing on all cylinders — where’s the next leg of the rally coming from? 🚨📈

#solana #sol #stablecoins #CryptoGrowth #Blockchain #defi #OnChainReality

22 days ago

Cryptocurrency Market Experiences Significant Liquidations

Data from Coinglass reveals that the cryptocurrency market witnessed substantial liquidations over the past 24 hours, totaling approximately $462 million.

Long positions accounted for $192 million of the liquidations, while short positions amounted to $269 million.

#bitcoin saw liquidations of $188 million, and #ethereum experienced $126 million in liquidations.

Data from Coinglass reveals that the cryptocurrency market witnessed substantial liquidations over the past 24 hours, totaling approximately $462 million.

Long positions accounted for $192 million of the liquidations, while short positions amounted to $269 million.

#bitcoin saw liquidations of $188 million, and #ethereum experienced $126 million in liquidations.

Sponsored by

Administrator

12 months ago