1 day ago

🚨 RUMOR 🚨

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and crypto in the United States!

If implemented, this could be a MASSIVE boost for the crypto market and a game-changer for investors. 🚀

#bitcoin #cryptonews #Trump #TaxPlan #BitcoinBoom #CryptoTwitter

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and crypto in the United States!

If implemented, this could be a MASSIVE boost for the crypto market and a game-changer for investors. 🚀

#bitcoin #cryptonews #Trump #TaxPlan #BitcoinBoom #CryptoTwitter

6 days ago

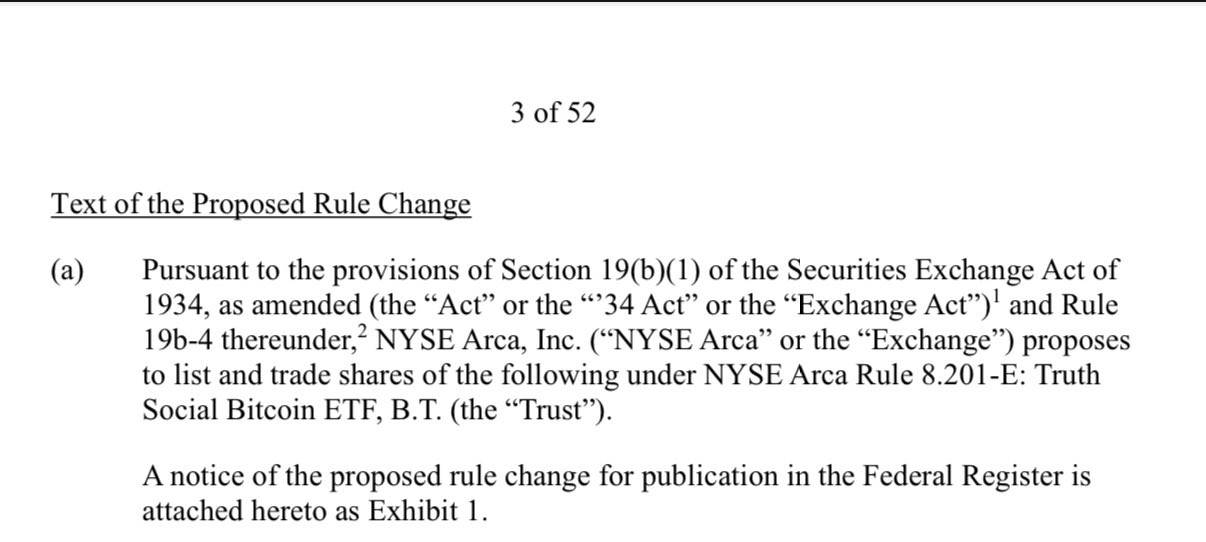

Trump’s company just filed for a Truth Social Bitcoin ETF, which will track spot bitcoin and list on NYSE.

10 days ago

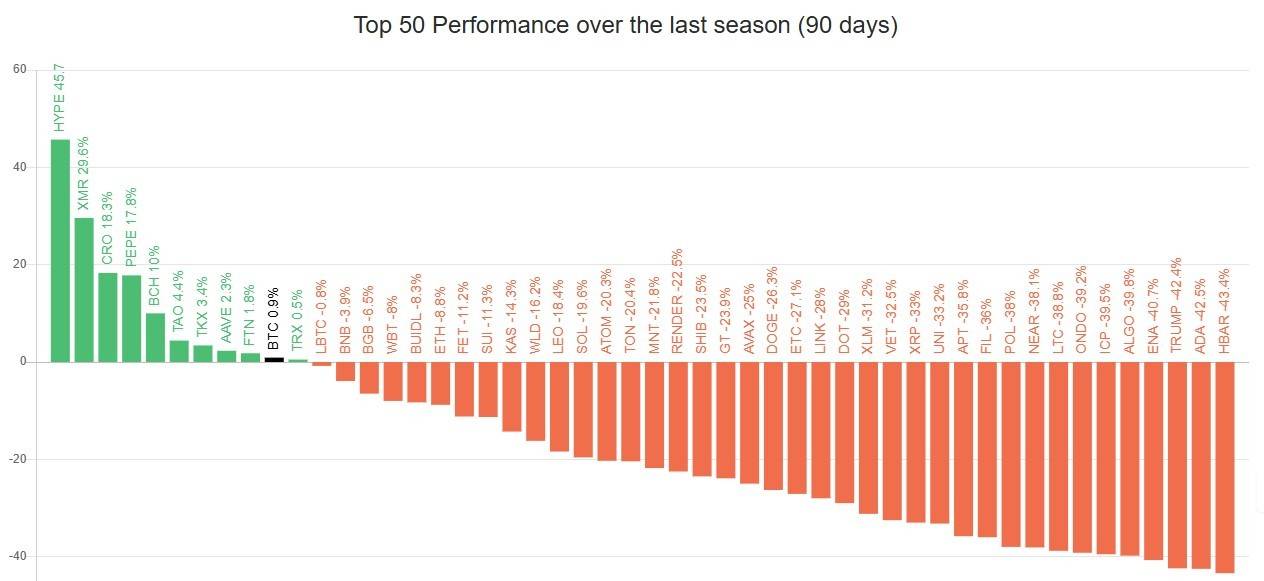

📊 Top 50 Crypto Performance Over the Last Season (90 Days)

🔥 The Winners:

-HYPE leads the pack with an impressive 45.7% gain !

-XMR follows closely with a 29.6% increase , making it a strong contender.

-CRO and PEPE also shine, up by 18.3% and 17.8% , respectively.

📈 Mid-Range Performers:

-Cryptos like BCH (10%) , TAO (4.4%) , and TKX (3.4%) show moderate growth.

-AVAX (2.3%) and FIN (1.8%) are steady but not as explosive.

⚠️ The Losers:

-BTC barely holds its ground with just 0.9% growth.

-LTC (-39.8%) , ADA (-42.5%) , and HBAR (-43.4%) take some of the hardest hits.

-TRUMP (-42.4%) and ALGO (-39.5%) also see significant declines.

💡 Key Takeaways:

HYPE is the clear standout, proving why it's been all over the news lately.

The altcoin space is highly volatile, with both massive gains and losses.

If you're in crypto, diversification might be your best bet to weather these swings!

#crypto #Performance #altcoins #bitcoin #MarketAnalysis

🔥 The Winners:

-HYPE leads the pack with an impressive 45.7% gain !

-XMR follows closely with a 29.6% increase , making it a strong contender.

-CRO and PEPE also shine, up by 18.3% and 17.8% , respectively.

📈 Mid-Range Performers:

-Cryptos like BCH (10%) , TAO (4.4%) , and TKX (3.4%) show moderate growth.

-AVAX (2.3%) and FIN (1.8%) are steady but not as explosive.

⚠️ The Losers:

-BTC barely holds its ground with just 0.9% growth.

-LTC (-39.8%) , ADA (-42.5%) , and HBAR (-43.4%) take some of the hardest hits.

-TRUMP (-42.4%) and ALGO (-39.5%) also see significant declines.

💡 Key Takeaways:

HYPE is the clear standout, proving why it's been all over the news lately.

The altcoin space is highly volatile, with both massive gains and losses.

If you're in crypto, diversification might be your best bet to weather these swings!

#crypto #Performance #altcoins #bitcoin #MarketAnalysis

13 days ago

Day 2 of TheBitcoinConf 2025 is in full swing. 🕺

🚀 The Trump family took the stage, calling themselves ambassadors for crypto and predicting Bitcoin could reach $1M.

🇵🇰 Pakistan announced a strategic Bitcoin reserve, while mining, supply strain, and financial freedom led the conversations.

A great day and news for the crypto people. 🙌

#Bitcoin2025 #bitcoin

🚀 The Trump family took the stage, calling themselves ambassadors for crypto and predicting Bitcoin could reach $1M.

🇵🇰 Pakistan announced a strategic Bitcoin reserve, while mining, supply strain, and financial freedom led the conversations.

A great day and news for the crypto people. 🙌

#Bitcoin2025 #bitcoin

15 days ago

🚨 BREAKING: Trump Media Group Plans to Raise $3 Billion to Invest in Crypto! 🚀

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

15 days ago

🚨 RUMOR ALERT 🚨

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and cryptocurrencies in the United States.

If true, this could be a MASSIVE boost for crypto adoption and investor freedom. 🚀

Stay tuned for official updates — and remember, always verify before you invest.

#crypto #bitcoin #BTC #Trump #TaxCut #cryptonews #Rumor #MarketUpdate

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and cryptocurrencies in the United States.

If true, this could be a MASSIVE boost for crypto adoption and investor freedom. 🚀

Stay tuned for official updates — and remember, always verify before you invest.

#crypto #bitcoin #BTC #Trump #TaxCut #cryptonews #Rumor #MarketUpdate

26 days ago

Addentax Group Corp. (NASDAQ: ATXG), a Chinese garment manufacturer and logistics services provider, has announced plans to acquire up to 8,000 Bitcoins and other cryptocurrencies, valued at approximately $800 million. However, it's crucial to note that this announcement comes with several important caveats and uncertainties.

Key Details-

1. Acquisition Plan: Up to 8,000 Bitcoins plus "Official Trump" tokens

2. Total Value: Approximately $800 million

3. Payment Method: Share issuance, not cash

4. Current Status: No definitive agreement reached yet.

Source - https://www.prnewswire.com...

Key Details-

1. Acquisition Plan: Up to 8,000 Bitcoins plus "Official Trump" tokens

2. Total Value: Approximately $800 million

3. Payment Method: Share issuance, not cash

4. Current Status: No definitive agreement reached yet.

Source - https://www.prnewswire.com...

1 month ago

President Trump is denying claims he's profiting from the TRUMP memecoin, despite reports linking significant earnings to wallets associated with his NFT collection.

The token, largely controlled by CIC Digital LLC and Fight Fight Fight LLC, has seen strong market activity, up 20% over the last month. Interestingly, the White House is planning a dinner with the top 220 $TRUMP token holders!

#Trump #crypto #memecoin #Politics

Read more: https://www.coindesk.com/p...

The token, largely controlled by CIC Digital LLC and Fight Fight Fight LLC, has seen strong market activity, up 20% over the last month. Interestingly, the White House is planning a dinner with the top 220 $TRUMP token holders!

#Trump #crypto #memecoin #Politics

Read more: https://www.coindesk.com/p...

President Trump Dismisses Claims of Profiting From TRUMP Token

The TRUMP token is up 20% over the last month, according to market data

https://www.coindesk.com/policy/2025/05/05/donald-trump-denies-claims-of-profiting-from-trump-token

1 month ago

🚀 Breaking: Trump-Backed Stablecoin USD1 Hits $1.02B Market Cap Across Ethereum & BNB Chain!

The stablecoin USD1 from World Liberty Financial (WLFI), the crypto project tied to the Trump family, has now surpassed $1.02 billion in total market value — with over $1B+ on BNB Chain alone!

On-chain data reveals three rapid minting events recently on BNB Chain, injecting hundreds of millions of USD1 into the network. Paired with existing supply on Ethereum, the token’s footprint is rapidly expanding.

Analysts suggest this surge could be part of a larger strategy to boost USD1’s adoption across DeFi protocols, cross-chain liquidity pools, and major trading platforms.

Is USD1 positioning itself as a major player in the stablecoin ecosystem? Time will tell — but the momentum is undeniable. 💸

#crypto #stablecoin #USD1 #BNBChain #ethereum #TrumpCoin #defi #Blockchain #Web3 #WLFI

The stablecoin USD1 from World Liberty Financial (WLFI), the crypto project tied to the Trump family, has now surpassed $1.02 billion in total market value — with over $1B+ on BNB Chain alone!

On-chain data reveals three rapid minting events recently on BNB Chain, injecting hundreds of millions of USD1 into the network. Paired with existing supply on Ethereum, the token’s footprint is rapidly expanding.

Analysts suggest this surge could be part of a larger strategy to boost USD1’s adoption across DeFi protocols, cross-chain liquidity pools, and major trading platforms.

Is USD1 positioning itself as a major player in the stablecoin ecosystem? Time will tell — but the momentum is undeniable. 💸

#crypto #stablecoin #USD1 #BNBChain #ethereum #TrumpCoin #defi #Blockchain #Web3 #WLFI

1 month ago

🔥 Breaking: Trump’s bold crypto play, World Liberty Financial , just dropped not one, but multiple MEME coins — and now they're going full crypto with the launch of USD1 , a dollar-backed stablecoin.

The former president is all in on blockchain — love it or hate it, this is big news for crypto markets. 💸

#Trump #crypto #memecoin #stablecoin #USD1 #WorldLibertyFinancial #Blockchain #bitcoin #cryptonews

The former president is all in on blockchain — love it or hate it, this is big news for crypto markets. 💸

#Trump #crypto #memecoin #stablecoin #USD1 #WorldLibertyFinancial #Blockchain #bitcoin #cryptonews

1 month ago

🚨 BREAKING 🚨

Donald Trump will launch a new crypto token, $WLFI, tied to his company, "World Liberty Financial" in the next 2 weeks.

Donald Trump will launch a new crypto token, $WLFI, tied to his company, "World Liberty Financial" in the next 2 weeks.

2 months ago

🐋 NEW: A whale sold all 630,339 $TRUMP tokens ($5.48M) at $8.70 just hours before the Trump dinner news, making a ~$483K profit.

Had he waited, his profit could’ve exceeded $4.5 million.

#whalealert

Had he waited, his profit could’ve exceeded $4.5 million.

#whalealert

2 months ago

🇺🇸 NEW: Gold briefly hit a record $3,500/oz after Trump slammed Fed Chair Powell, fueling investor demand for safe-haven assets.

2 months ago

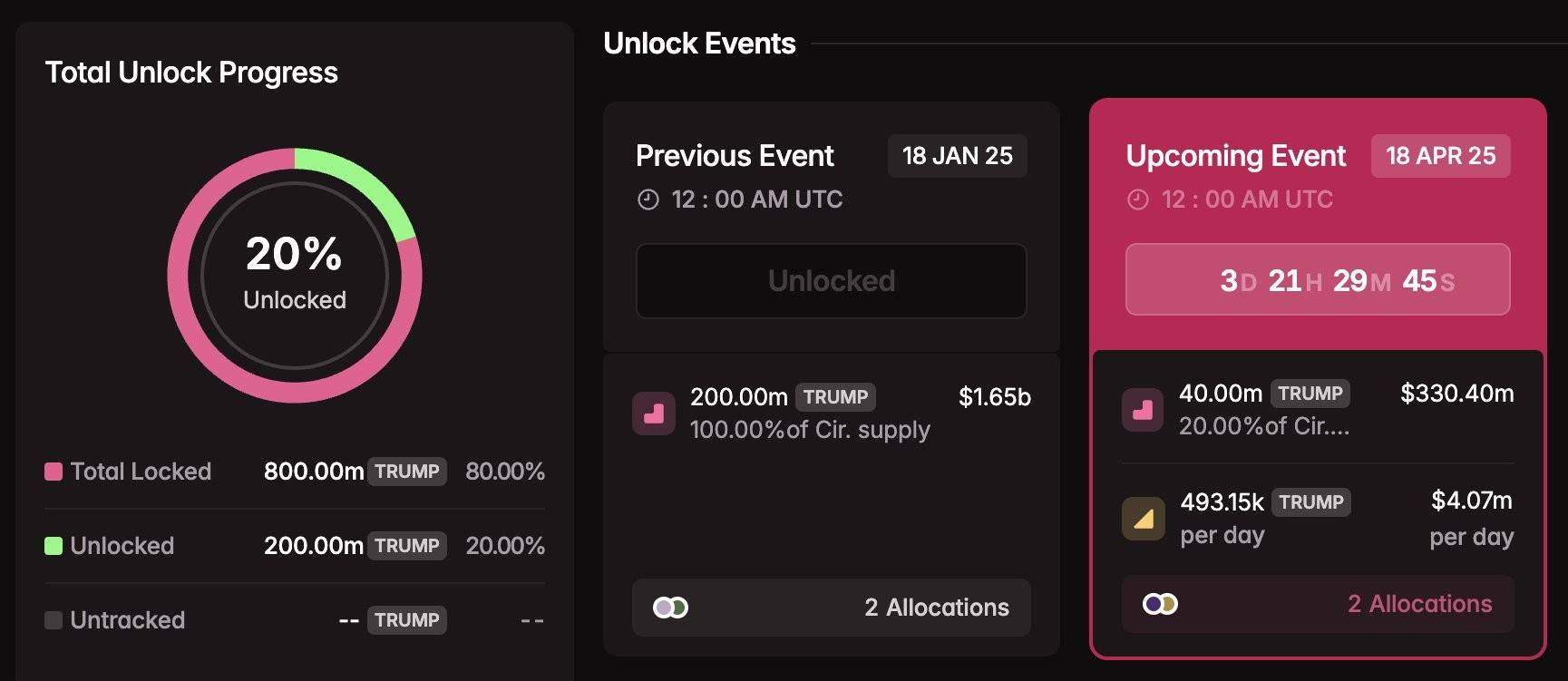

🚨 Just In: U.S. President Donald Trump unlocked 40 million tokens (approx. $300M) just 5 hours ago — that's 20% of the total circulation! 👀💰

🔓 Plus, there's a daily linear unlock of around 493,000 tokens (~$4.12M).

Big moves happening — eyes on the market! 👇📉📈

#cryptonews #TokenUnlock #Trump #Blockchain #CryptoAlert #WhaleWatch

🔓 Plus, there's a daily linear unlock of around 493,000 tokens (~$4.12M).

Big moves happening — eyes on the market! 👇📉📈

#cryptonews #TokenUnlock #Trump #Blockchain #CryptoAlert #WhaleWatch

2 months ago

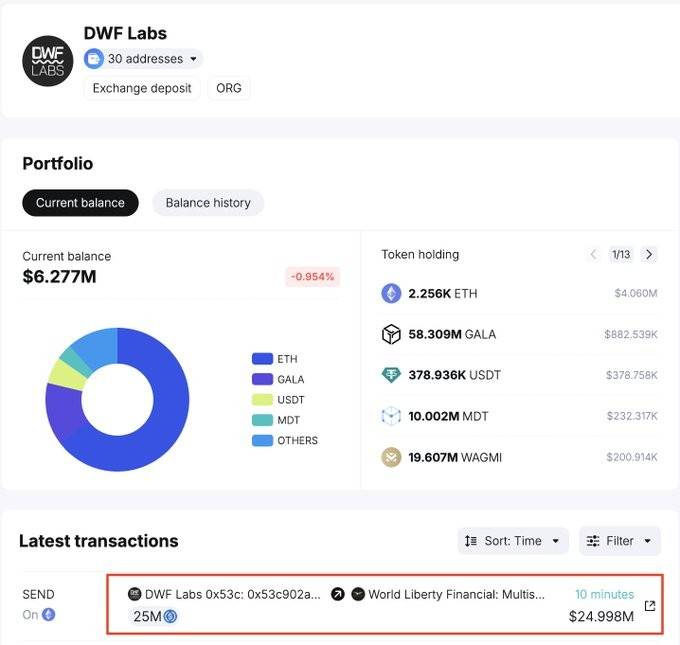

DWF Labs has announced a notable $25 million investment in World Liberty Financial (WLFI), a decentralized finance protocol with ties to the Trump family. This investment is seen as a significant step into the U.S. market for DWF Labs, which plans to open an office in New York City to foster relationships with regulators and financial institutions. The investment, which highlights DWF's confidence in the U.S. as a growing region for institutional crypto adoption, comes amidst existing political controversies surrounding WLFI.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

2 months ago

Zach Shapiro, the policy director at the Bitcoin Policy Institute (BPI), remarked that if the U.S. were to announce plans to acquire one million bitcoins, it could trigger significant global disruption, potentially sending the price of #bitcoin soaring to approximately one million dollars.

Matthew Pines, the executive director of BPI, highlighted that the United States' ambition to become a Bitcoin superpower depends on the quantity of Bitcoin it holds. This will provide a standard for assessing how successfully U.S. President Donald Trump meets this declared goal.

Matthew Pines, the executive director of BPI, highlighted that the United States' ambition to become a Bitcoin superpower depends on the quantity of Bitcoin it holds. This will provide a standard for assessing how successfully U.S. President Donald Trump meets this declared goal.

2 months ago

🚨 LATEST: Greg Cipolaro, head of global research at NYDIG, states that the crypto markets have remained relatively orderly despite the widespread market panic caused by President Trump's tariff chaos.

2 months ago

🚨 UPDATE: $TRUMP memecoin is set to unlock this week on April 18, releasing 40 million tokens worth $330 million, or 20% of the circulating supply.

2 months ago

📅 Big Week Ahead in Markets & Policy! 🇺🇸💼

Here’s what to watch:

🔹 Monday:

- President Donald Trump is expected to reveal more details on semiconductor tariffs—a hot topic for tech & trade watchers. 💻📉

🔹 Tuesday: A Fed-heavy day!

- Patrick Harker (2026 FOMC voter, Philly Fed) talks Fed roles.

- Raphael Bostic (2027 FOMC voter, Atlanta Fed) weighs in on monetary policy. 🏛️💬

🔹 Thursday:

- Fed Chair Jerome Powell takes the stage at the Chicago Economic Club. 👔📢

- Weekly jobless claims data (week ending Apr 12) drops—key labor market signal. 📊

🔹 Friday:

- 📍 NYSE will be closed for the day—plan your trades accordingly! 🛑📈

Stay tuned for a week full of market-moving moments!

#FinanceNews #FOMC #FederalReserve #Markets #Trump #Semiconductors #JeromePowell #NYSE #EconomicUpdates

Here’s what to watch:

🔹 Monday:

- President Donald Trump is expected to reveal more details on semiconductor tariffs—a hot topic for tech & trade watchers. 💻📉

🔹 Tuesday: A Fed-heavy day!

- Patrick Harker (2026 FOMC voter, Philly Fed) talks Fed roles.

- Raphael Bostic (2027 FOMC voter, Atlanta Fed) weighs in on monetary policy. 🏛️💬

🔹 Thursday:

- Fed Chair Jerome Powell takes the stage at the Chicago Economic Club. 👔📢

- Weekly jobless claims data (week ending Apr 12) drops—key labor market signal. 📊

🔹 Friday:

- 📍 NYSE will be closed for the day—plan your trades accordingly! 🛑📈

Stay tuned for a week full of market-moving moments!

#FinanceNews #FOMC #FederalReserve #Markets #Trump #Semiconductors #JeromePowell #NYSE #EconomicUpdates

2 months ago

Trump’s Crypto Project Has Raised $550 Million in Token Sales

A company affiliated with #Trump receives 75% of net revenue as a fee, including the proceeds of token sales, according to the offering document for World Liberty’s initial token sale.

The company sold $300 and $250 million worth of WLFI tokens in two different sales, although it is not clear when each took place. The coins were marketed both inside and outside the U.S. and more than 85,000 investors participated, according to the company.

https://www.bloomberg.com/...

A company affiliated with #Trump receives 75% of net revenue as a fee, including the proceeds of token sales, according to the offering document for World Liberty’s initial token sale.

The company sold $300 and $250 million worth of WLFI tokens in two different sales, although it is not clear when each took place. The coins were marketed both inside and outside the U.S. and more than 85,000 investors participated, according to the company.

https://www.bloomberg.com/...

2 months ago

(E)

🚨 BREAKING 🚨

DONALD TRUMP IS IN A TOTAL LOSS OF $145,600,000

Source - https://www.cryptoninjas.n...

#Trump

DONALD TRUMP IS IN A TOTAL LOSS OF $145,600,000

Source - https://www.cryptoninjas.n...

#Trump

2 months ago

Bitcoin surges past $80K after Trump announces suspension of "reciprocal" tariffs on imports from 75 countries

2 months ago

2 months ago

(E)

🔴 Crypto Crash Triggered by Trump’s 104% Tariffs on China?!

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

2 months ago

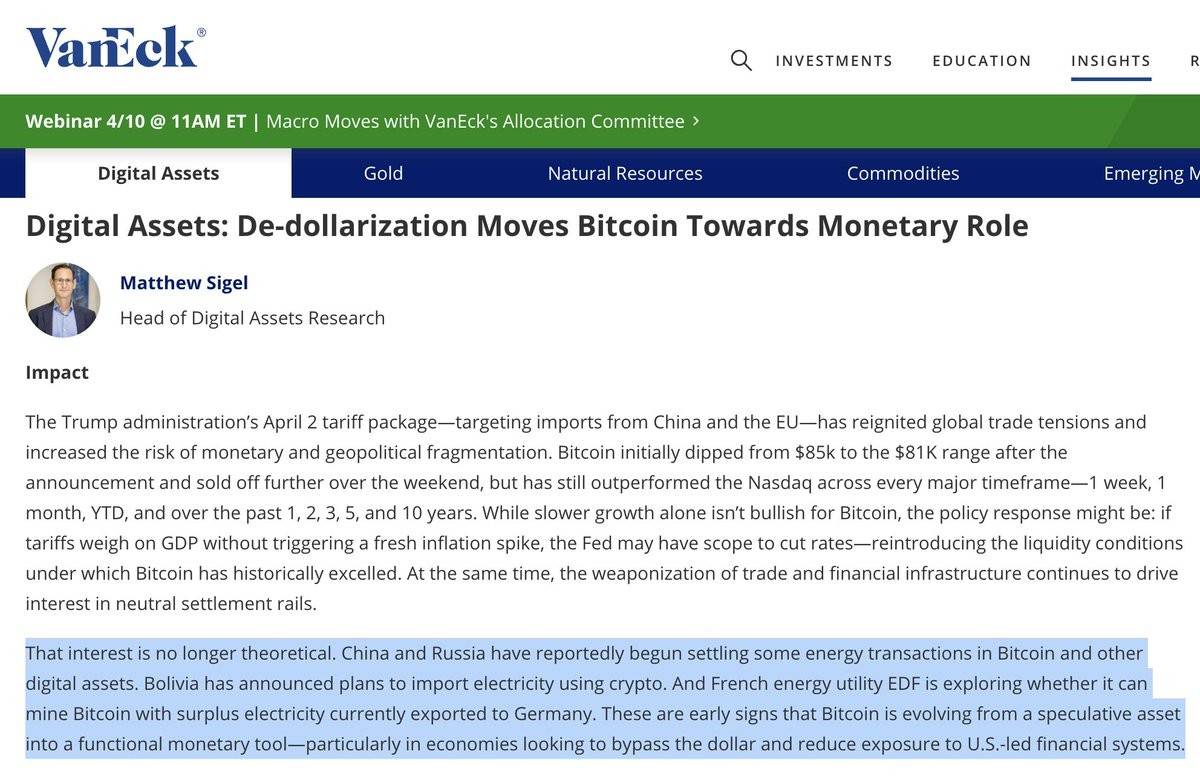

JUST IN: 🟠 $115 billion VanEck on President Trump's tariffs:

"Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems."

"Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems."

2 months ago

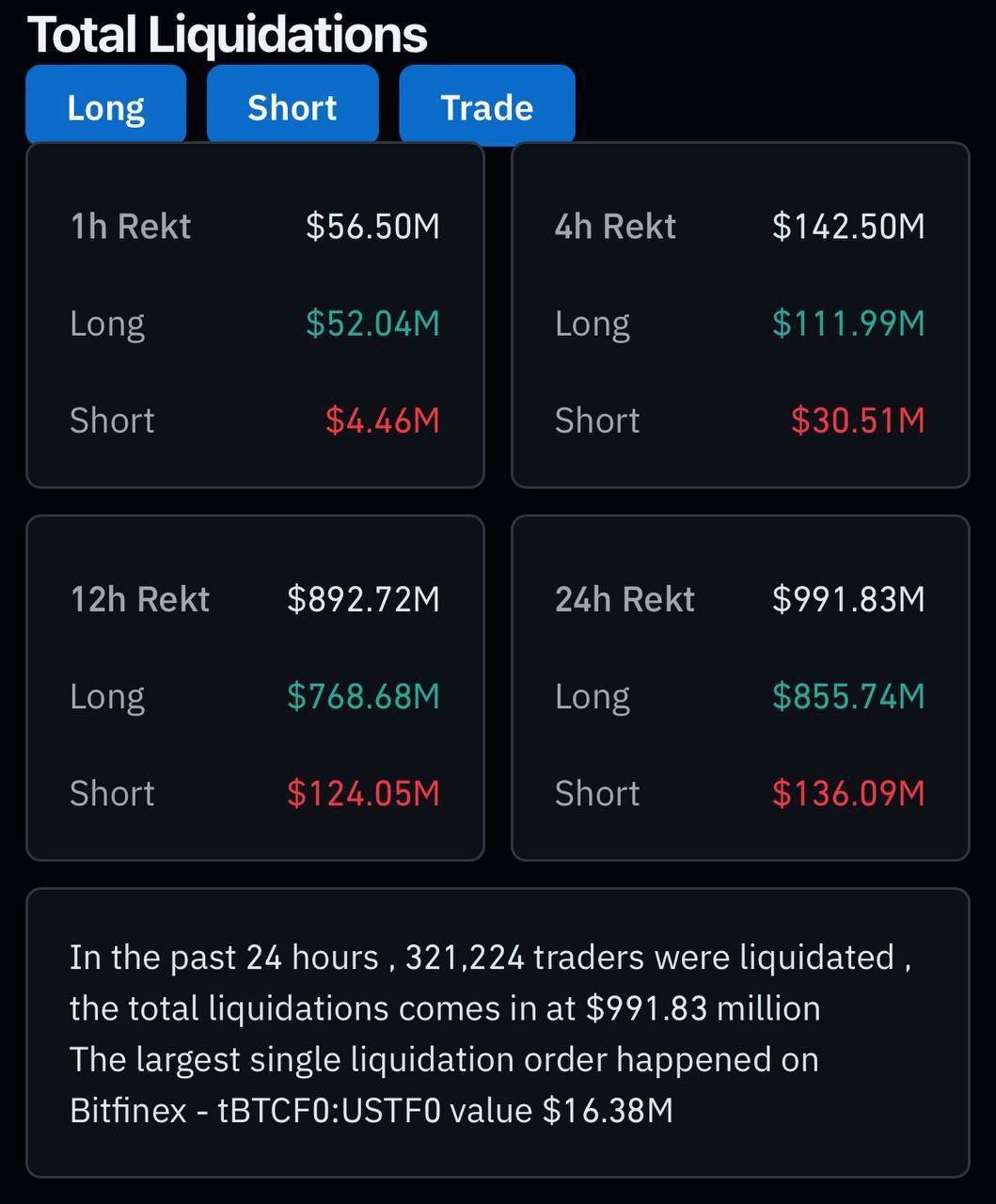

⚠️ Bitcoin Drops Below $80,000 – $1B in Liquidations

🩸 Bitcoin fell below the $80,000 mark on Sunday, triggering nearly $1 billion in liquidations. The drop came amid rising inflation concerns and overall weakness in global financial markets.

🔽 Roughly $885 million of the liquidations were from long positions, with over 321,000 traders liquidated in a single day. The broader crypto market saw a 2.45% decline, while Bitcoin still dominates with 62% market share.

📉 Meanwhile, the announcement of Trump-era tariffs wiped out $8.2 trillion from the stock market, surpassing losses seen in the worst week of the 2008 financial crisis.

#bitcoin #Liquidation #BitcoinLiquidation

🩸 Bitcoin fell below the $80,000 mark on Sunday, triggering nearly $1 billion in liquidations. The drop came amid rising inflation concerns and overall weakness in global financial markets.

🔽 Roughly $885 million of the liquidations were from long positions, with over 321,000 traders liquidated in a single day. The broader crypto market saw a 2.45% decline, while Bitcoin still dominates with 62% market share.

📉 Meanwhile, the announcement of Trump-era tariffs wiped out $8.2 trillion from the stock market, surpassing losses seen in the worst week of the 2008 financial crisis.

#bitcoin #Liquidation #BitcoinLiquidation

2 months ago

DWF Labs just transferred 25M $USDC to Donald Trump’s World Liberty Financial (worldlibertyfi)!

Side note: A day ago, they received 1M #USD1 , the stablecoin launched by WLFI, for market-making purposes.

🌟 DWF Labs: https://platform.spotoncha...

🌟 World Liberty Financial: https://platform.spotoncha...

Side note: A day ago, they received 1M #USD1 , the stablecoin launched by WLFI, for market-making purposes.

🌟 DWF Labs: https://platform.spotoncha...

🌟 World Liberty Financial: https://platform.spotoncha...

2 months ago

Sponsored by

Administrator

11 months ago