1 month ago

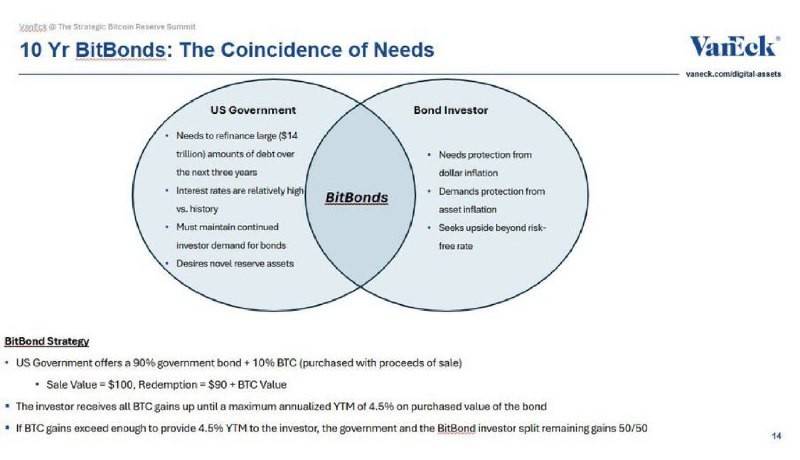

🚨 JUST IN: 🇺🇸 $110B asset manager VanEck proposes BitBonds – a bold new plan for the U.S. to buy more Bitcoin 🟠 and refinance $14 TRILLION in national debt! 💥📉

#bitcoin #vaneck #bitbonds #cryptonews #BTC #DebtCrisis #DigitalAssets #CryptoRevolution

#bitcoin #vaneck #bitbonds #cryptonews #BTC #DebtCrisis #DigitalAssets #CryptoRevolution

1 month ago

🚨 NEW: Bitcoin could soar to $180K in the second half of 2025, according to VanEck’s Head of Digital Assets Research, Matthew Sigel. 👀📈

Is the next bull run loading? 🔥💰

#bitcoin #crypto #BTC #vaneck #cryptonews #BullRun2025

Is the next bull run loading? 🔥💰

#bitcoin #crypto #BTC #vaneck #cryptonews #BullRun2025

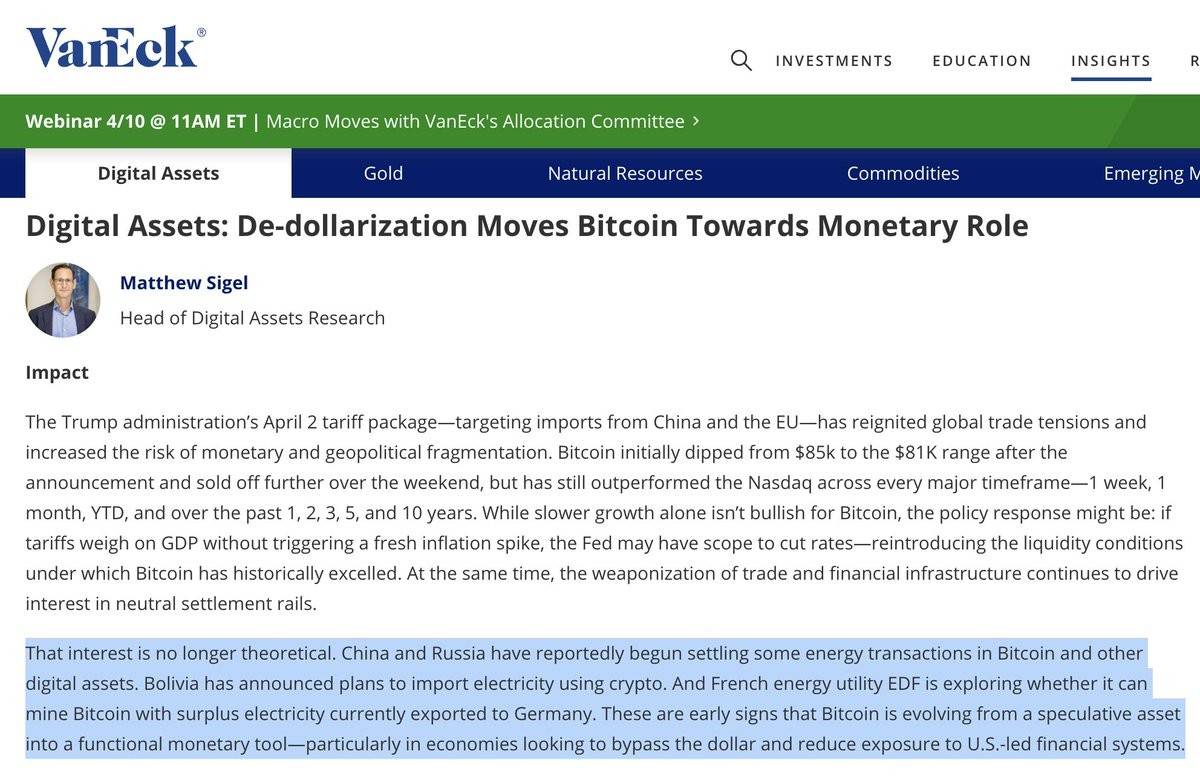

2 months ago

JUST IN: 🟠 $115 billion VanEck on President Trump's tariffs:

"Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems."

"Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems."

3 months ago

11 months ago

(E)

Solana: VanEck Believes a SOL ETF Is More Likely If SEC Replaces Gensler #Gensle

Solana: VanEck Says SOL ETF is More Likely if SEC Fires Gensler

With Solana hopeful for an ETF, VanEck has said that the odds increase if the SEC replaces its current Chair, Gary Gensler

https://watcher.guru/news/solana-vaneck-says-sol-etf-is-more-likely-if-sec-fires-gensler

11 months ago

### Spot Bitcoin ETFs Experience Highest Inflow Day in Over Five Weeks

On July 12, spot Bitcoin exchange-traded funds (ETFs) based in the United States saw over $310 million in inflows, making it their best-performing day since June 5.

Leading the inflows were BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), which recorded $120 million and $115.1 million respectively, according to Farside Investors data.

The Bitwise Bitcoin ETF ranked third with $28.4 million in inflows, while the Grayscale Bitcoin Trust (GBTC) experienced a rare inflow day at $23 million.

Additionally, the VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF reported inflows of $6 million and $4 million, respectively

On July 12, spot Bitcoin exchange-traded funds (ETFs) based in the United States saw over $310 million in inflows, making it their best-performing day since June 5.

Leading the inflows were BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), which recorded $120 million and $115.1 million respectively, according to Farside Investors data.

The Bitwise Bitcoin ETF ranked third with $28.4 million in inflows, while the Grayscale Bitcoin Trust (GBTC) experienced a rare inflow day at $23 million.

Additionally, the VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF reported inflows of $6 million and $4 million, respectively

Sponsored by

Administrator

11 months ago