2 days ago

2 days ago

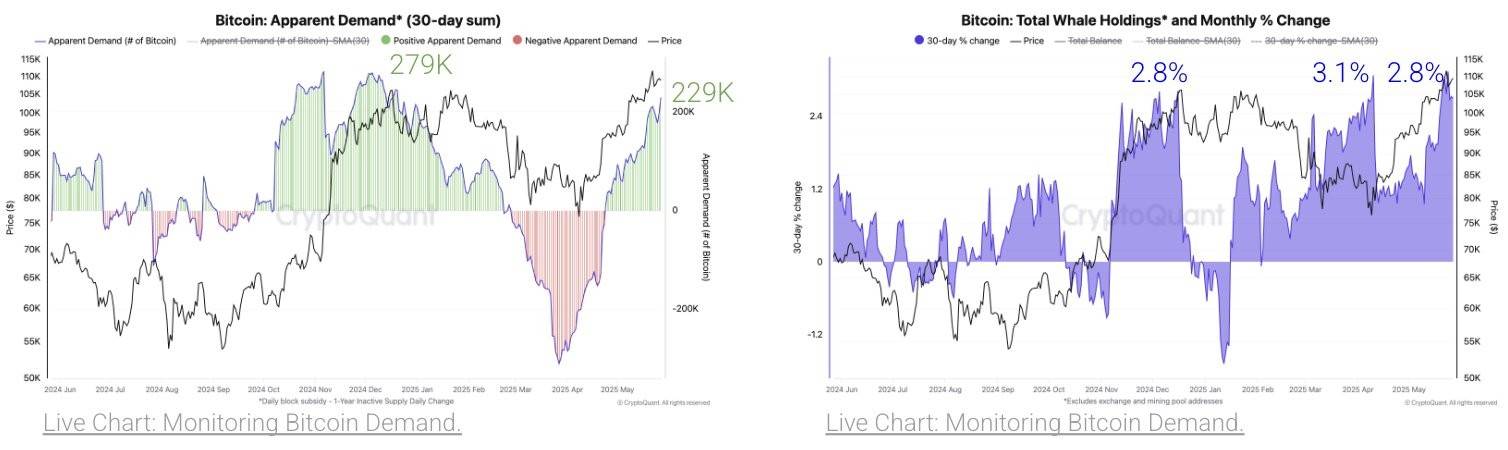

Bitcoin demand growth is cooling off.

30-day growth has hit 229K BTC, close to the 279K peak from Dec 2024.

Whale balances are up 2.8% MoM, a rate that often slows before tops.

30-day growth has hit 229K BTC, close to the 279K peak from Dec 2024.

Whale balances are up 2.8% MoM, a rate that often slows before tops.

2 days ago

LATEST: Revolut to relaunch crypto services in the US, says Head of Crypto Mazen ElJundi.

visit: https://www.revolut.com/

visit: https://www.revolut.com/

2 days ago

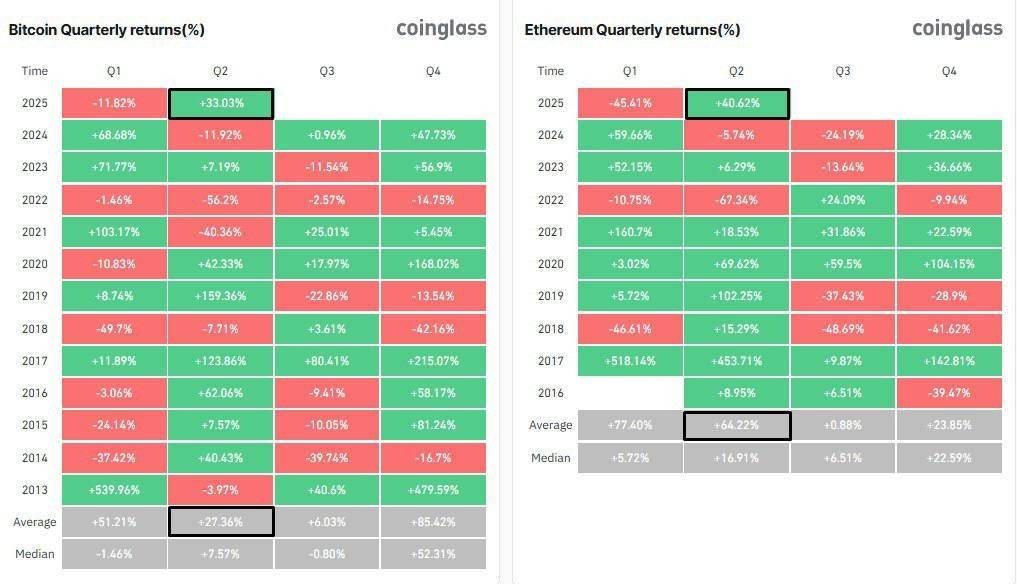

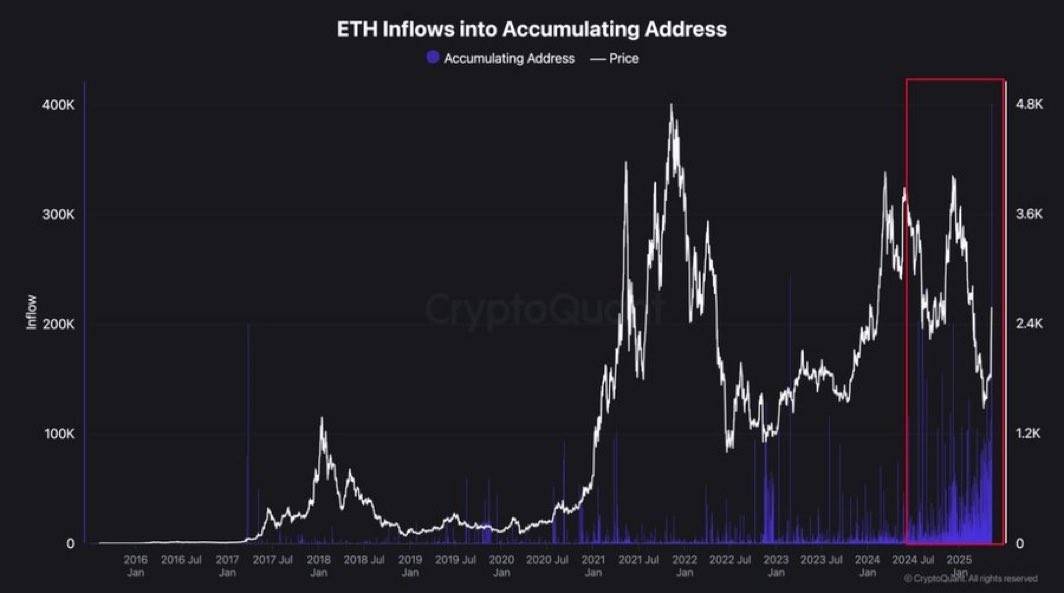

Ethereum is outshining Bitcoin in Q2 2025 with an incredible performance surge! 📈

This isn't just hype—it's backed by solid fundamentals, especially the game-changing Pectra upgrade that's set to boost network efficiency and user experience to new heights. 🌐

Currently, the ETH/BTC pair sits at around 0.023, showing Ethereum still has room to climb compared to its past peaks against Bitcoin. What do you think—will ETH keep this momentum going? Let’s discuss! 💬

#ethereum #bitcoin #cryptonews

This isn't just hype—it's backed by solid fundamentals, especially the game-changing Pectra upgrade that's set to boost network efficiency and user experience to new heights. 🌐

Currently, the ETH/BTC pair sits at around 0.023, showing Ethereum still has room to climb compared to its past peaks against Bitcoin. What do you think—will ETH keep this momentum going? Let’s discuss! 💬

#ethereum #bitcoin #cryptonews

2 days ago

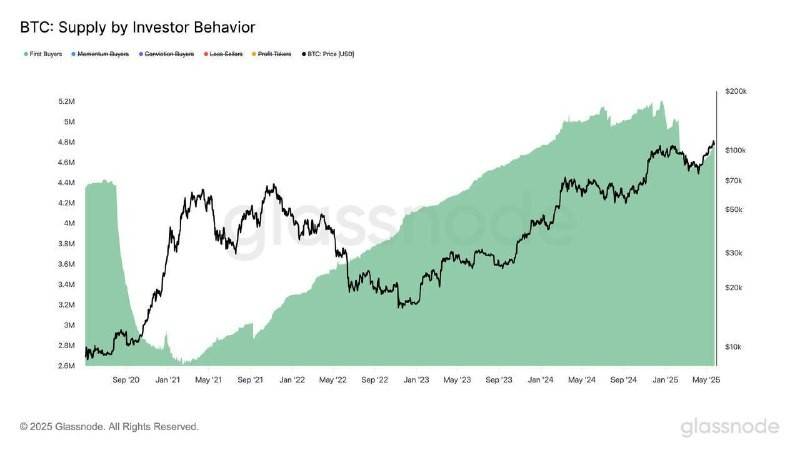

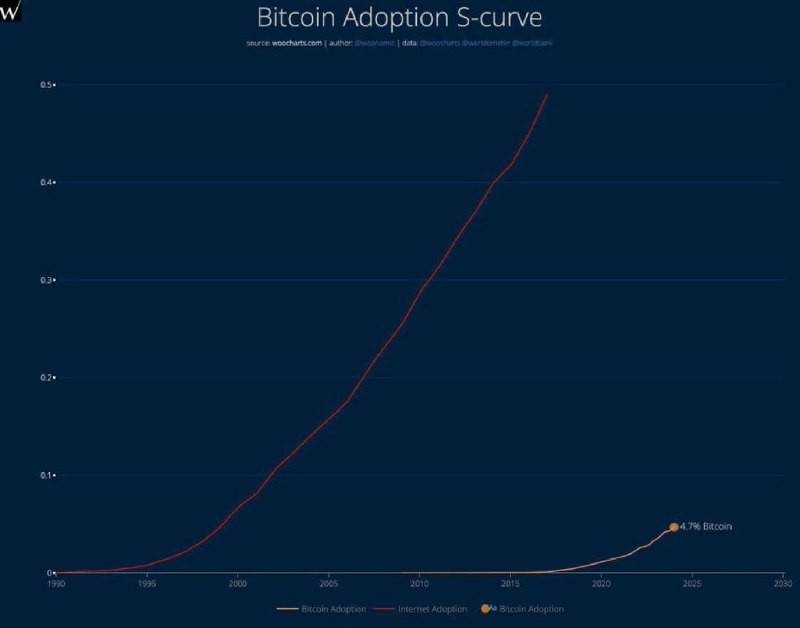

New Buyers’ Entry: Key Driver of Bitcoin’s Continued Uptrend

Sustained bullish trends in the Bitcoin market require the influx of new demand. Data analysis shows significant spikes in the number of first-time Bitcoin buyers (First Buyers) during the periods of July to December 2024 and March to May 2025.

These two periods directly coincided with phases of price growth. The notable increase in new buyers indicates fresh capital entering the Bitcoin ecosystem, strengthening the market structure and supporting the continuation of upward trends.

Sustained bullish trends in the Bitcoin market require the influx of new demand. Data analysis shows significant spikes in the number of first-time Bitcoin buyers (First Buyers) during the periods of July to December 2024 and March to May 2025.

These two periods directly coincided with phases of price growth. The notable increase in new buyers indicates fresh capital entering the Bitcoin ecosystem, strengthening the market structure and supporting the continuation of upward trends.

3 days ago

🟠Challenges Ahead for Bitcoin in Reaching a New All-Time High

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

3 days ago

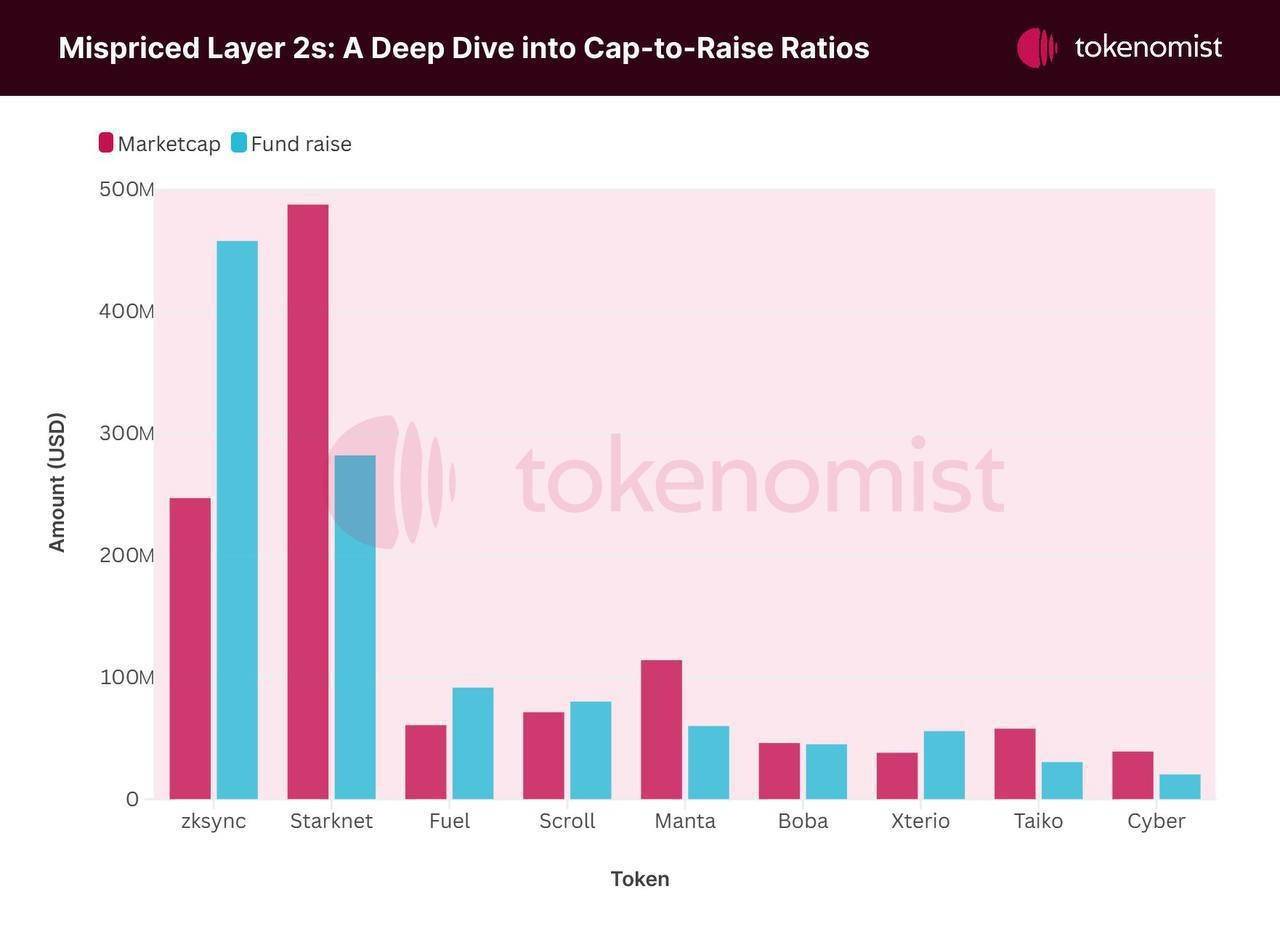

Market Cap Below Funding: The Strange Case of L2 Projects

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

3 days ago

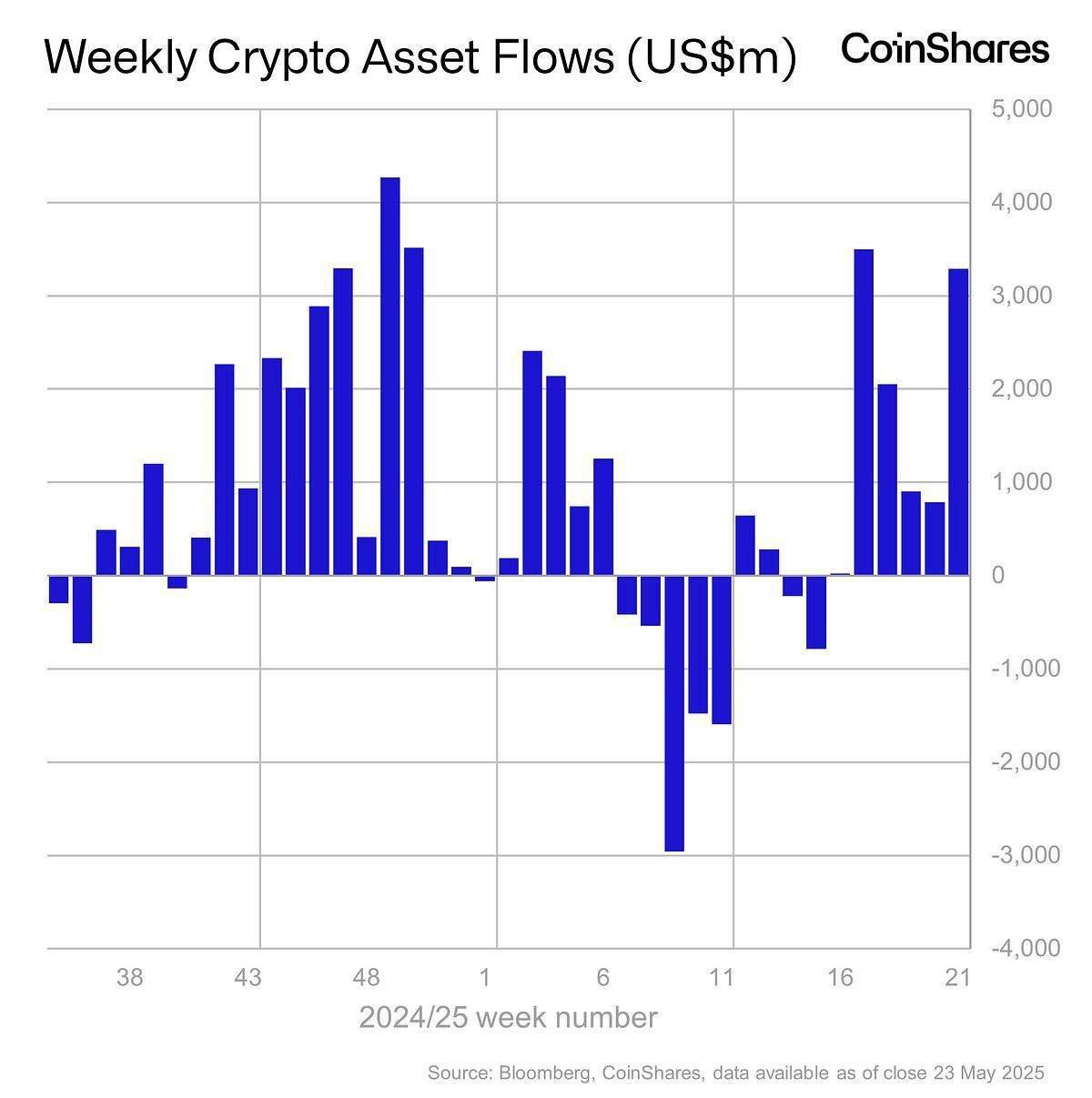

New Record in Digital Asset Inflows

Last week, total inflows into digital assets reached $3.3 billion, pushing year-to-date inflows in 2025 to an all-time high of $10.8 billion. As a result, total assets under management (AUM) hit a record $187.5 billion.

Bitcoin led the market with $2.9 billion in inflows. Meanwhile, Short Bitcoin products also saw notable activity, attracting $12.7 million, marking their largest weekly inflow since December 2024.

Last week, total inflows into digital assets reached $3.3 billion, pushing year-to-date inflows in 2025 to an all-time high of $10.8 billion. As a result, total assets under management (AUM) hit a record $187.5 billion.

Bitcoin led the market with $2.9 billion in inflows. Meanwhile, Short Bitcoin products also saw notable activity, attracting $12.7 million, marking their largest weekly inflow since December 2024.

3 days ago

JUST IN: 🇫🇷 European soccer giant Paris Saint Germain announces they adopted a #bitcoin treasury reserve 🤯

3 days ago

JUST IN: 🟠 Paolo Ardoino, Tether's CEO, announces Tether owns over 100,000 #bitcoin and more than 50 tons of gold 🔥

3 days ago

NEW: 🟠 Cypherpunk legend Adam Back predicts #bitcoin price to hit $1 million in 5 years 🚀

3 days ago

ADAM BACK: 🟠 The future of finance runs on Bitcoin 🙌

Adam Back took the stage at Bitcoin 2025 to unveil Blockstream’s new self-custodial app and a bold new strategy built around Consumer, Enterprise, and BAM.

Adam Back took the stage at Bitcoin 2025 to unveil Blockstream’s new self-custodial app and a bold new strategy built around Consumer, Enterprise, and BAM.

3 days ago

NEW: 🇦🇷 Milei tried to shut down Argentina’s state-run TV station but was not allowed to.

Instead, he ordered the channel to air Tuttle Twins, the US animated series that teaches children about capitalism, inflation, and #bitcoin .

Instead, he ordered the channel to air Tuttle Twins, the US animated series that teaches children about capitalism, inflation, and #bitcoin .

3 days ago

🚨 Big Moves by BlackRock! 🚨

On May 29, BlackRock's spot ETFs made significant purchases, snapping up 1,160 $BTC and a hefty 18,800 $ETH! 📈💰

This shows continued confidence in both Bitcoin and Ethereum from the world’s largest asset manager.

#blackrock #bitcoin #ethereum #cryptonews

On May 29, BlackRock's spot ETFs made significant purchases, snapping up 1,160 $BTC and a hefty 18,800 $ETH! 📈💰

This shows continued confidence in both Bitcoin and Ethereum from the world’s largest asset manager.

#blackrock #bitcoin #ethereum #cryptonews

3 days ago

Here are the Top 4 #bitcoin Holders as of the latest data! 🤑📊

1️⃣ coinbase: 1,001,000 $BTC (6.44% of supply)

2️⃣ BlackRock: 659,847 $BTC (4.24%)

3️⃣ binance: 623,349 $BTC (4.01%)

4️⃣ MicroStrategy: 580,250 $BTC (3.73%)

These giants are holding a massive chunk of the Bitcoin supply!

What do you think this means for the future of $BTC? 🤔 Drop your thoughts below! 👇

#bitcoin #cryptonews #BTCWhales #cryptomarket

1️⃣ coinbase: 1,001,000 $BTC (6.44% of supply)

2️⃣ BlackRock: 659,847 $BTC (4.24%)

3️⃣ binance: 623,349 $BTC (4.01%)

4️⃣ MicroStrategy: 580,250 $BTC (3.73%)

These giants are holding a massive chunk of the Bitcoin supply!

What do you think this means for the future of $BTC? 🤔 Drop your thoughts below! 👇

#bitcoin #cryptonews #BTCWhales #cryptomarket

3 days ago

Jack Mallers' Twenty One Capital just raised another $100M through convertible notes, pushing their total capital to an incredible $685M! 💰📈

This Bitcoin treasury powerhouse plans to use the fresh funds to stack even more $BTC. Big moves in the crypto space! What do you think this means for Bitcoin’s future? 🤔 Drop your thoughts below! 👇

#bitcoin #TwentyOneCapital #JackMallers #cryptonews

This Bitcoin treasury powerhouse plans to use the fresh funds to stack even more $BTC. Big moves in the crypto space! What do you think this means for Bitcoin’s future? 🤔 Drop your thoughts below! 👇

#bitcoin #TwentyOneCapital #JackMallers #cryptonews

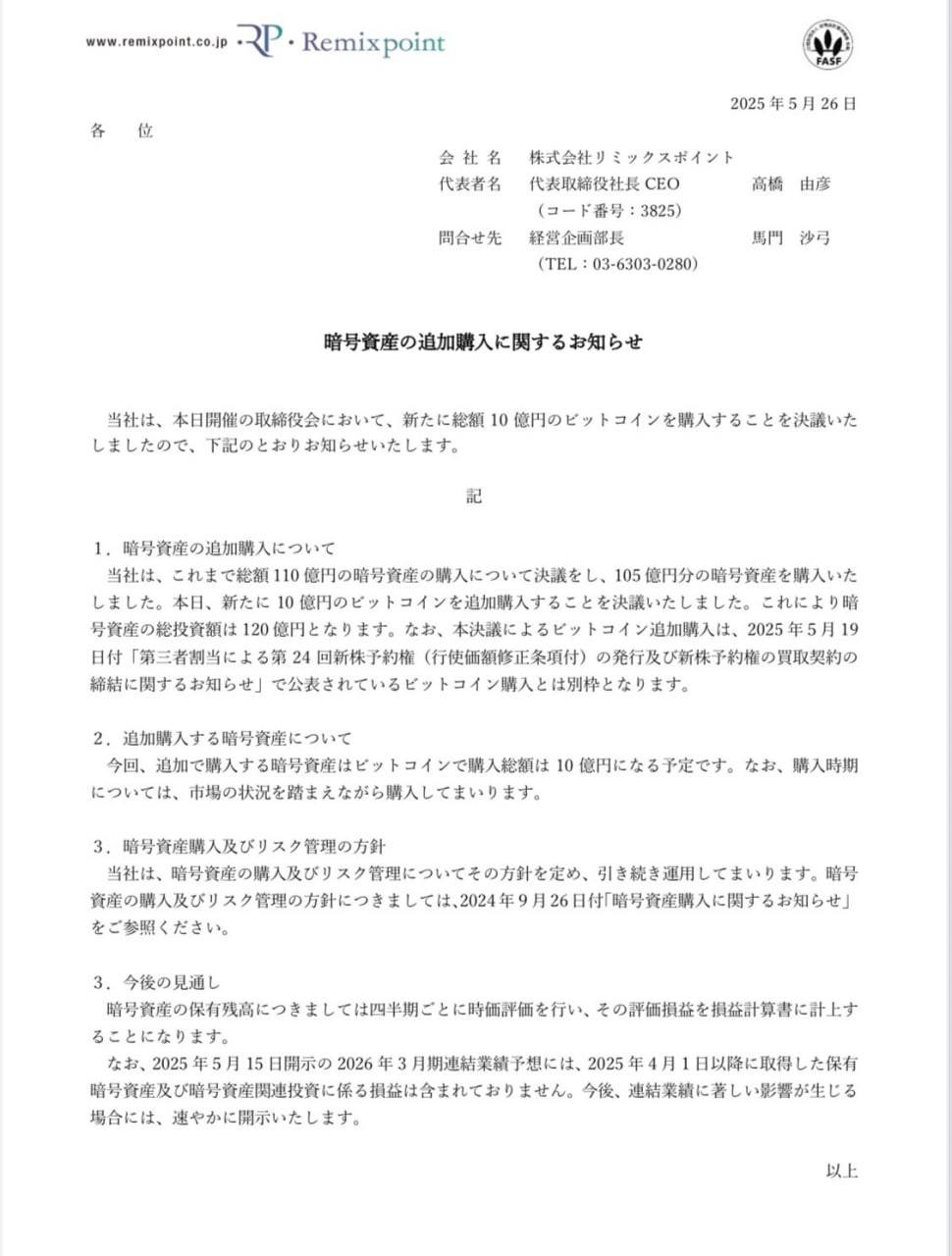

4 days ago

🚀 JUST IN:

🇯🇵 Japanese public company Remixpoint is buying another 200 #bitcoin 💸

🔥 For ¥1 Billion — that’s serious commitment!

They’re on a mission to hit 1,000 BTC …

And they’re not slowing down.

This is what #institutional adoption looks like.

What’s your move? 👀

#BTC #BitcoinNews #OnChain #CryptoIsMoney #HODL

🇯🇵 Japanese public company Remixpoint is buying another 200 #bitcoin 💸

🔥 For ¥1 Billion — that’s serious commitment!

They’re on a mission to hit 1,000 BTC …

And they’re not slowing down.

This is what #institutional adoption looks like.

What’s your move? 👀

#BTC #BitcoinNews #OnChain #CryptoIsMoney #HODL

4 days ago

HISTORY: 🟠 This man begged everyone to buy just $1 worth of bitcoin back in 2013.

Did you listen?

Did you listen?

4 days ago

4 days ago

$IBIT on fire lately, now has $72b in assets, which ranks it 23rd overall, absolutely bonkers for a one-year-old.

4 days ago

4 days ago

BREAKING:

🇺🇸 BLACKROCK, FIDELITY & GRAYSCALE JUST BOUGHT $84.9 MILLION IN ETHEREUM

WHALES ARE BUYING AGGRESSIVELY 🚀

🇺🇸 BLACKROCK, FIDELITY & GRAYSCALE JUST BOUGHT $84.9 MILLION IN ETHEREUM

WHALES ARE BUYING AGGRESSIVELY 🚀

4 days ago

DeFi Development Corp. Embraces Liquid Staking to Expand Solana Holdings.

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

4 days ago

SOL Strategies files to raise up to $1 billion to expand Solana investment

SOL Strategies Inc., a Vancouver-based company specializing in Solana blockchain investments, has filed a preliminary short-form base shelf prospectus with Canadian securities regulators to raise up to $1 billion over the next 25 months.

(via: https://www.theblock.co/po...

SOL Strategies Inc., a Vancouver-based company specializing in Solana blockchain investments, has filed a preliminary short-form base shelf prospectus with Canadian securities regulators to raise up to $1 billion over the next 25 months.

(via: https://www.theblock.co/po...

3 days ago

Bitcoin dominance dropping can often signal a shift in the market. When Bitcoin's share of the total crypto market cap decreases, it frequently means capital is flowing into altcoins, potentially setting the stage for some exciting gains.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

3 days ago

10 years ago, Tether launched USD₮—the first stablecoin.

Today, it empowers 400M+ people with instant dollar access.

Tether leads the pack with $51.9M in total fees over the past month!

Tether continues to dominate as a key player in the crypto space. Are you surprised by these numbers? Let us know your thoughts! 💬

#crypto #Blockchain #Tether #defi #cryptonews

Today, it empowers 400M+ people with instant dollar access.

Tether leads the pack with $51.9M in total fees over the past month!

Tether continues to dominate as a key player in the crypto space. Are you surprised by these numbers? Let us know your thoughts! 💬

#crypto #Blockchain #Tether #defi #cryptonews

3 days ago