2 days ago

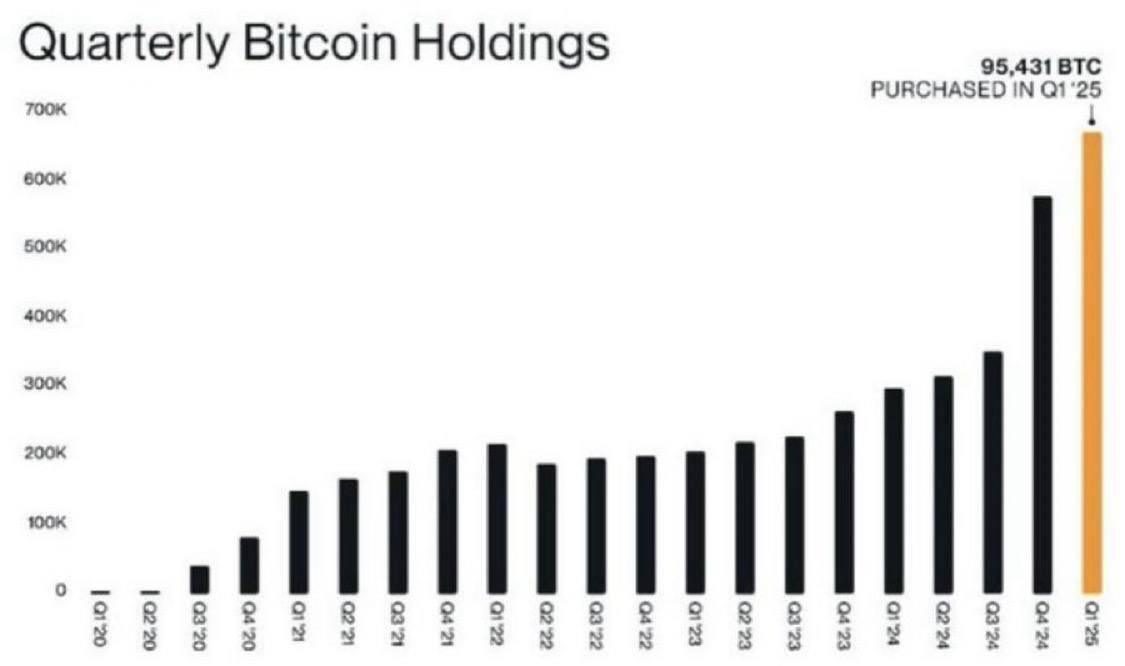

🚀Public companies just went ALL IN on Bitcoin in Q1 2025, scooping up a whopping 95,000+ BTC!

This is the largest amount of Bitcoin ever purchased by corporations in a single quarter. 🤑

The race to accumulate BTC is heating up, with big players jumping in to get a piece of the action. 💰

What will the future hold for these companies, and for Bitcoin? Stay tuned for more crypto updates! 🔥

#bitcoin #crypto #Investment

This is the largest amount of Bitcoin ever purchased by corporations in a single quarter. 🤑

The race to accumulate BTC is heating up, with big players jumping in to get a piece of the action. 💰

What will the future hold for these companies, and for Bitcoin? Stay tuned for more crypto updates! 🔥

#bitcoin #crypto #Investment

5 days ago

SOL Strategies files to raise up to $1 billion to expand Solana investment

SOL Strategies Inc., a Vancouver-based company specializing in Solana blockchain investments, has filed a preliminary short-form base shelf prospectus with Canadian securities regulators to raise up to $1 billion over the next 25 months.

(via: https://www.theblock.co/po...

SOL Strategies Inc., a Vancouver-based company specializing in Solana blockchain investments, has filed a preliminary short-form base shelf prospectus with Canadian securities regulators to raise up to $1 billion over the next 25 months.

(via: https://www.theblock.co/po...

6 days ago

BlackRock’s $BUIDL fund is now LIVE on Avalanche!

#blackrock , the world's largest asset manager, has launched its USD Institutional Digital Liquidity Fund (BUIDL) on the Avalanche blockchain platform. This represents a major milestone in institutional adoption of blockchain technology, bringing traditional financial infrastructure onto decentralized networks.

Fund Overview:-

Fund Size: $500M+

Token Structure: One share = One BUIDL token

Target Value: $1 per token

Distribution: Daily accrued dividends paid directly to wallets

Investment Minimum: $5 million

#Avalanche

(via: https://www.avax.network/a...

#blackrock , the world's largest asset manager, has launched its USD Institutional Digital Liquidity Fund (BUIDL) on the Avalanche blockchain platform. This represents a major milestone in institutional adoption of blockchain technology, bringing traditional financial infrastructure onto decentralized networks.

Fund Overview:-

Fund Size: $500M+

Token Structure: One share = One BUIDL token

Target Value: $1 per token

Distribution: Daily accrued dividends paid directly to wallets

Investment Minimum: $5 million

#Avalanche

(via: https://www.avax.network/a...

7 days ago

Dubai just took a major leap into the future by launching a real estate tokenization platform on the XRP Ledger! 🏙️🔗

This groundbreaking move is set to revolutionize property investment—making it more accessible, transparent, and efficient. 🚀💼

#Dubai #RealEstate #Tokenization #xrp #Blockchain #FutureCities #PropTech #Innovation #cryptonews #SmartInvesting

This groundbreaking move is set to revolutionize property investment—making it more accessible, transparent, and efficient. 🚀💼

#Dubai #RealEstate #Tokenization #xrp #Blockchain #FutureCities #PropTech #Innovation #cryptonews #SmartInvesting

12 days ago

JUST IN: Michael Saylor's 'Strategy' currently has a $22.7 billion unrealized profit on its Bitcoin investment.

15 days ago

🚨 LATEST: Crypto elites are hiring bodyguards as risks rise.

Coinbase spent $6.2M on CEO security last year, per Bloomberg.

Security Investment Context:

- Coinbase's $6.2M security expenditure exceeds the combined security costs for CEOs of major companies including JPMorgan Chase, Goldman Sachs, and Nvidia.

- Recent incidents have accelerated the trend toward enhanced security measures.

Recent Threats and Incidents:

1. Paymium CEO Family Attack

- Attempted abduction of the CEO's family members in Paris

- Three masked assailants used mace and firearms

- Targeted a 34-year-old daughter and a toddler

- Attack thwarted by husband and neighbors

2. Ledger Co-founder Incident

- Violent kidnapping of David Balland and his wife in France

- Part of an increasing pattern of violent attacks targeting crypto executives

💡 Read more: https://www.bloomberg.com/...

Coinbase spent $6.2M on CEO security last year, per Bloomberg.

Security Investment Context:

- Coinbase's $6.2M security expenditure exceeds the combined security costs for CEOs of major companies including JPMorgan Chase, Goldman Sachs, and Nvidia.

- Recent incidents have accelerated the trend toward enhanced security measures.

Recent Threats and Incidents:

1. Paymium CEO Family Attack

- Attempted abduction of the CEO's family members in Paris

- Three masked assailants used mace and firearms

- Targeted a 34-year-old daughter and a toddler

- Attack thwarted by husband and neighbors

2. Ledger Co-founder Incident

- Violent kidnapping of David Balland and his wife in France

- Part of an increasing pattern of violent attacks targeting crypto executives

💡 Read more: https://www.bloomberg.com/...

18 days ago

🚀 Big Move in the Crypto World!

Abu Dhabi’s sovereign wealth fund just dropped $408 million on BlackRock’s Spot Bitcoin ETF — signaling serious institutional confidence in #bitcoin .

This is more than an investment… it’s a vote of trust in crypto’s future. 💼💰

(Source - https://www.nasdaq.com/art...

#bitcoin #ETF #cryptonews #blackrock #InstitutionalInvesting #BTC

Abu Dhabi’s sovereign wealth fund just dropped $408 million on BlackRock’s Spot Bitcoin ETF — signaling serious institutional confidence in #bitcoin .

This is more than an investment… it’s a vote of trust in crypto’s future. 💼💰

(Source - https://www.nasdaq.com/art...

#bitcoin #ETF #cryptonews #blackrock #InstitutionalInvesting #BTC

18 days ago

🔍 Interesting Development!

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

29 days ago

Cantor Fitzgerald is diving deeper into crypto! 💰

They've struck a $3.6bn venture deal with SoftBank and Tether. What does this mean for the future of institutional investment in digital assets? 🤔

#crypto #finance #investments #CantorFitzgerald #SoftBank #Tether

Read more here:

https://www.ft.com/content...

They've struck a $3.6bn venture deal with SoftBank and Tether. What does this mean for the future of institutional investment in digital assets? 🤔

#crypto #finance #investments #CantorFitzgerald #SoftBank #Tether

Read more here:

https://www.ft.com/content...

1 month ago

Coinbase Launches Bitcoin Yield Fund for Institutions

#coinbase Asset Management is launching a new investment product for institutional investors to earn passive income on their bitcoin.

The Coinbase Bitcoin Yield Fund (CBYF) goes live on May 1, 2025 and will pay 4% to 8% annual net returns in bitcoin.

#coinbase Asset Management is launching a new investment product for institutional investors to earn passive income on their bitcoin.

The Coinbase Bitcoin Yield Fund (CBYF) goes live on May 1, 2025 and will pay 4% to 8% annual net returns in bitcoin.

1 month ago

🚨 BREAKING 🚨

Someone purchased the "AI dot com" domain in 1993 for $65, right now he’s selling that same domain for $100m

That’s a 153,846,054% return, or 1,538,461x his initial investment

Someone purchased the "AI dot com" domain in 1993 for $65, right now he’s selling that same domain for $100m

That’s a 153,846,054% return, or 1,538,461x his initial investment

1 month ago

🚀 BIG NEWS: Fidelity Acquires $35.9 Million in Ethereum (ETH)!

The investment giant continues to expand its crypto holdings—bullish move for #ethereum and the future of #defi ! 💎

What’s your take on this? 👀 #crypto #Blockchain #Investing

[📈 Drop a comment below!]

#fidelity #ETH #DigitalAssets

The investment giant continues to expand its crypto holdings—bullish move for #ethereum and the future of #defi ! 💎

What’s your take on this? 👀 #crypto #Blockchain #Investing

[📈 Drop a comment below!]

#fidelity #ETH #DigitalAssets

1 month ago

🐳 Whale Increases Ethereum Holdings with Significant Purchase⚡️

A notable cryptocurrency whale has recently expanded its Ethereum holdings. Six hours ago, the whale acquired an additional 2,400 ETH, valued at $3.85 million.

Over the past ten days, this entity has purchased a total of 12,010 ETH at an average price of $1,531 per ETH, amounting to $18.39 million in total investments.

A notable cryptocurrency whale has recently expanded its Ethereum holdings. Six hours ago, the whale acquired an additional 2,400 ETH, valued at $3.85 million.

Over the past ten days, this entity has purchased a total of 12,010 ETH at an average price of $1,531 per ETH, amounting to $18.39 million in total investments.

2 months ago

DWF Labs has announced a notable $25 million investment in World Liberty Financial (WLFI), a decentralized finance protocol with ties to the Trump family. This investment is seen as a significant step into the U.S. market for DWF Labs, which plans to open an office in New York City to foster relationships with regulators and financial institutions. The investment, which highlights DWF's confidence in the U.S. as a growing region for institutional crypto adoption, comes amidst existing political controversies surrounding WLFI.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

2 months ago

🚨 Big news from Hong Kong! 🚨

Hong Kong's first virtual asset ETFs — including the Bosera Ether ETF (03009) and its USD counter (09009) — have officially received the green light to participate in staking activities starting April 25! 🔥

Bosera International's Chairman & CEO, Lian Shaodong, shared that the company will continue to harness its strengths in investment and fintech to bridge traditional finance with Web 3.0 — aiming to deepen the connection between on-chain and off-chain ecosystems while diversifying market products. 🌐💹

Web3 is evolving fast — and Hong Kong is right at the front! 🚀

Source : https://www.prnewswire.com...

#Web3 #CryptoETF #staking #ethereum #HongKong #Bosera #VirtualAssets #fintech #BlockchainNews #CryptoInnovation

Hong Kong's first virtual asset ETFs — including the Bosera Ether ETF (03009) and its USD counter (09009) — have officially received the green light to participate in staking activities starting April 25! 🔥

Bosera International's Chairman & CEO, Lian Shaodong, shared that the company will continue to harness its strengths in investment and fintech to bridge traditional finance with Web 3.0 — aiming to deepen the connection between on-chain and off-chain ecosystems while diversifying market products. 🌐💹

Web3 is evolving fast — and Hong Kong is right at the front! 🚀

Source : https://www.prnewswire.com...

#Web3 #CryptoETF #staking #ethereum #HongKong #Bosera #VirtualAssets #fintech #BlockchainNews #CryptoInnovation

2 months ago

(E)

🚨 BREAKING 🚨

DONALD TRUMP IS IN A TOTAL LOSS OF $145,600,000

Source - https://www.cryptoninjas.n...

#Trump

DONALD TRUMP IS IN A TOTAL LOSS OF $145,600,000

Source - https://www.cryptoninjas.n...

#Trump

2 months ago

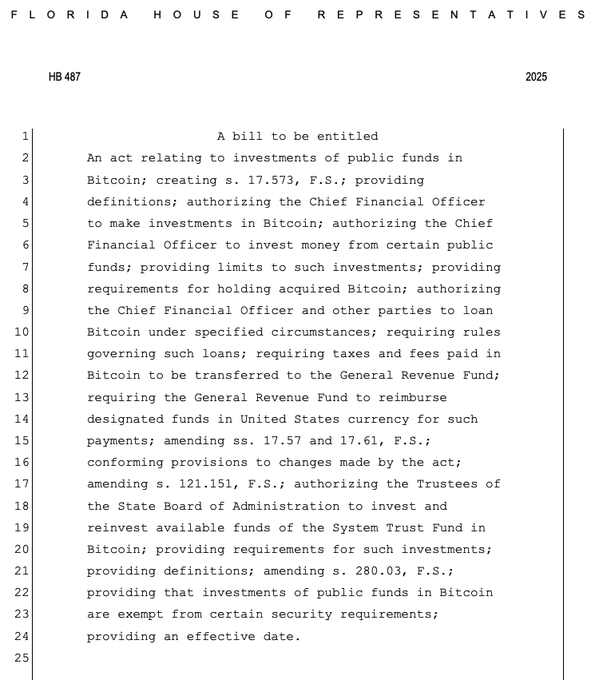

NEW: 🇺🇸 Florida's House Bill 487 unanimously passed the House Insurance and Banking Subcommittee, proposing to allow the investment of up to 10% of key public funds in Bitcoin.

2 months ago

From Pensions to Crypto: The Bold New Frontier of Retirement Investing

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

2 months ago

BREAKING: Swedish MP Nordin calls on Finance Minister to diversify foreign currency holdings into BITCOIN!

"Time to rethink our investments! Sweden's foreign currency holdings are heavily concentrated in EUR & USD. It's time to diversify & protect our economy from potential risks."

#bitcoin #Sweden #ForeignCurrency #Diversification

"Time to rethink our investments! Sweden's foreign currency holdings are heavily concentrated in EUR & USD. It's time to diversify & protect our economy from potential risks."

#bitcoin #Sweden #ForeignCurrency #Diversification

2 months ago

🌟BIG WIN!

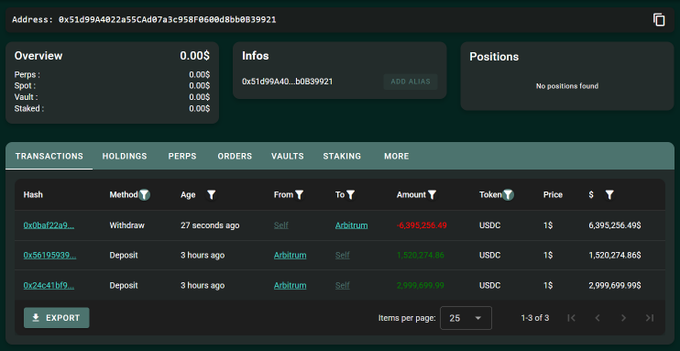

🐳A whale trader just closed a 20x long position on $ETH, pocketing a whopping $1.87M profit in just 3 hours!

That's a return of over 41% on their initial $4.52M investment! What a whale of a trade!

https://hypurrscan.io/addr...

#ETH #CryptoTrading #tradingwin #whale

🐳A whale trader just closed a 20x long position on $ETH, pocketing a whopping $1.87M profit in just 3 hours!

That's a return of over 41% on their initial $4.52M investment! What a whale of a trade!

https://hypurrscan.io/addr...

#ETH #CryptoTrading #tradingwin #whale

2 months ago

A cryptocurrency trader transformed an investment of $2,000 in PEPE into $43 million and eventually sold it for a profit of $10 million.

https://cointelegraph.com/...

#crypto #pepe #memecoin

https://cointelegraph.com/...

#crypto #pepe #memecoin

2 months ago

(E)

Pakistan plans to create a legal framework for #cryptocurrency trading in a bid to lure international investment.

https://www.bloomberg.com/...

https://www.bloomberg.com/...

3 months ago

⚡️Digital Asset Funds Experience Significant Outflows Amid Global Uncertainty

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

3 months ago

🚨 Clynton Marks Detained in Connection with South African Bitcoin Ponzi Scheme (MTI)

Clynton Marks, the alleged mastermind behind the South African Bitcoin Ponzi scheme Mirror Trading International (MTI), has been detained following his failure to provide satisfactory answers to liquidators regarding Bitcoin withdrawals from his MTI account. Marks claimed, "I am doing my best to respond to all questions, but my memory is insufficient to recall all the transactions. Additionally, I am unable to contact the individuals who managed the account on my behalf." Previously, Marks had entrusted investment and withdrawal operations to two associates, Don Nkomo and Andrew Caw. In 2022, Marks, along with MTI CEO Johann Steynberg and others, was ordered to repay $291 million to defrauded investors.

### Background on MTI's Downfall

MTI, once promoted as a lucrative Bitcoin and forex trading platform, promised investors monthly returns of 10%. However, it was later exposed as a fraudulent Ponzi scheme. In 2023, the Western Cape High Court declared MTI an illegal operation, invalidating all agreements with investors. Despite appeals, the ruling remains in effect. Steynberg, arrested in Brazil, is currently facing extradition, while the U.S. Commodity Futures Trading Commission (CFTC) is pursuing a $1.73 billion claim against the scheme.

South African liquidators, in coordination with international authorities, are working to recover assets, including approximately 29,421 Bitcoins, to compensate affected investors.

#CryptoFraud #bitcoin #cryptocurrency

Clynton Marks, the alleged mastermind behind the South African Bitcoin Ponzi scheme Mirror Trading International (MTI), has been detained following his failure to provide satisfactory answers to liquidators regarding Bitcoin withdrawals from his MTI account. Marks claimed, "I am doing my best to respond to all questions, but my memory is insufficient to recall all the transactions. Additionally, I am unable to contact the individuals who managed the account on my behalf." Previously, Marks had entrusted investment and withdrawal operations to two associates, Don Nkomo and Andrew Caw. In 2022, Marks, along with MTI CEO Johann Steynberg and others, was ordered to repay $291 million to defrauded investors.

### Background on MTI's Downfall

MTI, once promoted as a lucrative Bitcoin and forex trading platform, promised investors monthly returns of 10%. However, it was later exposed as a fraudulent Ponzi scheme. In 2023, the Western Cape High Court declared MTI an illegal operation, invalidating all agreements with investors. Despite appeals, the ruling remains in effect. Steynberg, arrested in Brazil, is currently facing extradition, while the U.S. Commodity Futures Trading Commission (CFTC) is pursuing a $1.73 billion claim against the scheme.

South African liquidators, in coordination with international authorities, are working to recover assets, including approximately 29,421 Bitcoins, to compensate affected investors.

#CryptoFraud #bitcoin #cryptocurrency

3 months ago

(E)

🚨 ALERT:

California has witnessed a dramatic surge in cryptocurrency and AI-related scams during 2024, with regulators identifying seven new types of fraud and recording substantial financial losses. Here's a comprehensive breakdown of the situation:

- 2,668 total complaints filed in 2024

- 42 crypto scam websites shut down by California DOJ

- $6.5 million total losses identified

- Average loss per victim: $146,306

New Types of Scams Identified:

1. Fake Bitcoin Mining Schemes

- Fraudulent investment opportunities in mining operations

- Promise unusually high returns

2. Crypto Gaming Fraud

- Users tricked into depositing funds

- Wallets drained immediately after deposits

3. Cryptocurrency Job Scams

- Require victims to transfer cryptocurrency

- Demand sensitive personal information

4. Private Key Theft

- Executed through fake airdrops

- Results in immediate asset theft

5. AI Investment Scams

- Offer unusually high returns

- Target AI market enthusiasm

Regulatory Response:

1. California Department of Justice (DOJ):

- Successfully dismantled 42 fraudulent websites

- Recovered $6.5 million in stolen funds

2. Department of Financial Protection and Innovation (DFPI):

- Shut down 26 fraudulent sites

- Uncovered $4.6 million in losses

Warning Signs of Scams:

Be cautious of websites featuring-

- Promises of unusually high returns

- No contact information available

- Offers of signup prizes

Crypto Scam Tracker:

https://dfpi.ca.gov/cons

California has witnessed a dramatic surge in cryptocurrency and AI-related scams during 2024, with regulators identifying seven new types of fraud and recording substantial financial losses. Here's a comprehensive breakdown of the situation:

- 2,668 total complaints filed in 2024

- 42 crypto scam websites shut down by California DOJ

- $6.5 million total losses identified

- Average loss per victim: $146,306

New Types of Scams Identified:

1. Fake Bitcoin Mining Schemes

- Fraudulent investment opportunities in mining operations

- Promise unusually high returns

2. Crypto Gaming Fraud

- Users tricked into depositing funds

- Wallets drained immediately after deposits

3. Cryptocurrency Job Scams

- Require victims to transfer cryptocurrency

- Demand sensitive personal information

4. Private Key Theft

- Executed through fake airdrops

- Results in immediate asset theft

5. AI Investment Scams

- Offer unusually high returns

- Target AI market enthusiasm

Regulatory Response:

1. California Department of Justice (DOJ):

- Successfully dismantled 42 fraudulent websites

- Recovered $6.5 million in stolen funds

2. Department of Financial Protection and Innovation (DFPI):

- Shut down 26 fraudulent sites

- Uncovered $4.6 million in losses

Warning Signs of Scams:

Be cautious of websites featuring-

- Promises of unusually high returns

- No contact information available

- Offers of signup prizes

Crypto Scam Tracker:

https://dfpi.ca.gov/cons

3 months ago

Berachain Co-Founder Reflects on Early Investment Decisions 🔥

The journey to success is never a straight path, and Berachain’s co-founder knows this all too well! 🏆🚀

In a recent reflection, they opened up about the crucial investment decisions that helped shape the future of Berachain. From early bets on blockchain innovation to navigating market uncertainties, every choice played a role in creating the high-performance, EVM-compatible L1 that Berachain is today. 🐻🔗

💡 Key Takeaways from Their Reflection:

✅ Taking calculated risks in unproven markets 💰🎯

✅ Staying true to the vision despite market fluctuations 📈🔥

✅ Building a strong community and ecosystem 👥🤝

✅ Learning from mistakes and adapting quickly 🏃♂️💨

With Berachain’s unique proof-of-liquidity model driving innovation in DeFi, it’s clear that those early investment decisions set the stage for something revolutionary. 🌍🔮 Looking back, the co-founder’s insights remind us that bold moves and unwavering belief can lead to massive breakthroughs!

What do you think? 🤔 Would you have made the same early bets? Share your thoughts below! ⬇️🐻💬

#Berachain #cryptoinvestment

The journey to success is never a straight path, and Berachain’s co-founder knows this all too well! 🏆🚀

In a recent reflection, they opened up about the crucial investment decisions that helped shape the future of Berachain. From early bets on blockchain innovation to navigating market uncertainties, every choice played a role in creating the high-performance, EVM-compatible L1 that Berachain is today. 🐻🔗

💡 Key Takeaways from Their Reflection:

✅ Taking calculated risks in unproven markets 💰🎯

✅ Staying true to the vision despite market fluctuations 📈🔥

✅ Building a strong community and ecosystem 👥🤝

✅ Learning from mistakes and adapting quickly 🏃♂️💨

With Berachain’s unique proof-of-liquidity model driving innovation in DeFi, it’s clear that those early investment decisions set the stage for something revolutionary. 🌍🔮 Looking back, the co-founder’s insights remind us that bold moves and unwavering belief can lead to massive breakthroughs!

What do you think? 🤔 Would you have made the same early bets? Share your thoughts below! ⬇️🐻💬

#Berachain #cryptoinvestment

3 months ago

(E)

Metaplanet, a publicly-traded company, has increased its #bitcoin holdings by purchasing 156 BTC, bringing their total to 2,391 BTC.

The Japanese investment firm is also exploring a potential listing outside of #Japan .

CEO Simon Gerovich announced on X that the #BTC was purchased at an average price of about $85,890 per BTC. The latest buy brings its total holdings to 2,391 BTC. The company reported a bitcoin yield of 31.8% for Q1 2025, following a 310% yield in Q4 2024.

Last week, #Metaplanet announced the purchase of 135 BTC, following earlier acquisitions of 68 BTC and 269 BTC in February. According to its "Bitcoin Plan," shared on January 28, Metaplanet aims to accumulate 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026.

The Japanese investment firm is also exploring a potential listing outside of #Japan .

CEO Simon Gerovich announced on X that the #BTC was purchased at an average price of about $85,890 per BTC. The latest buy brings its total holdings to 2,391 BTC. The company reported a bitcoin yield of 31.8% for Q1 2025, following a 310% yield in Q4 2024.

Last week, #Metaplanet announced the purchase of 135 BTC, following earlier acquisitions of 68 BTC and 269 BTC in February. According to its "Bitcoin Plan," shared on January 28, Metaplanet aims to accumulate 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026.

4 months ago

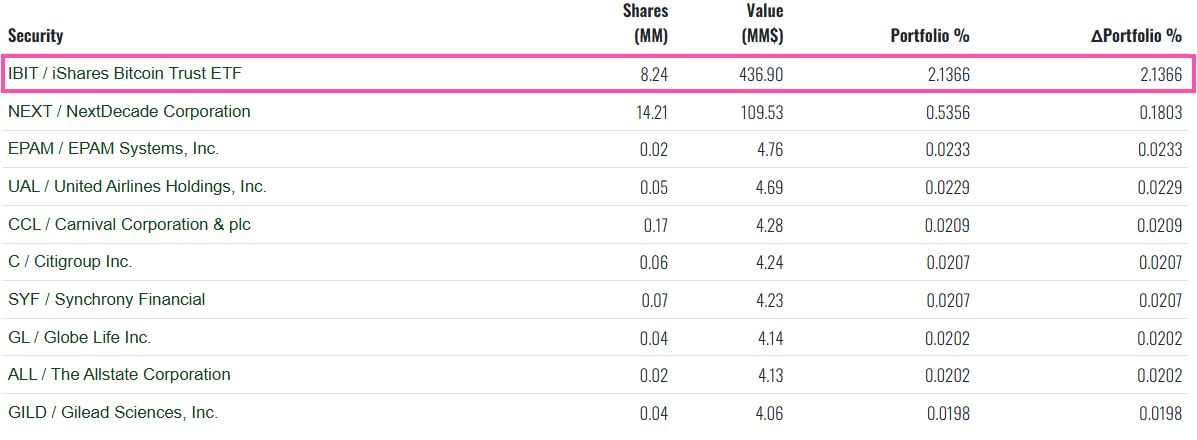

Abu Dhabi's sovereign wealth fund has purchased over $400 million in #bitcoin ETFs.

Mubadala, the Abu Dhabi government's sovereign wealth fund, has announced that it holds $436.9 million in shares of a Bitcoin exchange-traded fund (ETF). The fund has chosen BlackRock’s iShares Bitcoin Trust ETF, which now constitutes approximately 2.1% of Mubadala’s overall portfolio.

https://fintel.io/i/mubada...

Mubadala, the Abu Dhabi government's sovereign wealth fund, has announced that it holds $436.9 million in shares of a Bitcoin exchange-traded fund (ETF). The fund has chosen BlackRock’s iShares Bitcoin Trust ETF, which now constitutes approximately 2.1% of Mubadala’s overall portfolio.

https://fintel.io/i/mubada...

6 months ago

(E)

MicroStrategy's #bitcoin Investment: Then vs. Now (2020 vs. 2024)

August 11, 2020:

Bitcoin Held: 21,454 BTC

Investment: $250 Million

Average Price per BTC: $11,863

December 8, 2024:

Bitcoin Held: 21,550 BTC

Current Value: $25 Billion

Average Price per BTC: $99,850

This reflects a staggering 850% profit (approximately $2 Billion) in just over 4 years!

The Question:

If MicroStrategy's holdings are now worth $25 Billion, what could this investment grow to in the next 4 years? 🚀

August 11, 2020:

Bitcoin Held: 21,454 BTC

Investment: $250 Million

Average Price per BTC: $11,863

December 8, 2024:

Bitcoin Held: 21,550 BTC

Current Value: $25 Billion

Average Price per BTC: $99,850

This reflects a staggering 850% profit (approximately $2 Billion) in just over 4 years!

The Question:

If MicroStrategy's holdings are now worth $25 Billion, what could this investment grow to in the next 4 years? 🚀

Sponsored by

Administrator

11 months ago