7 hours ago

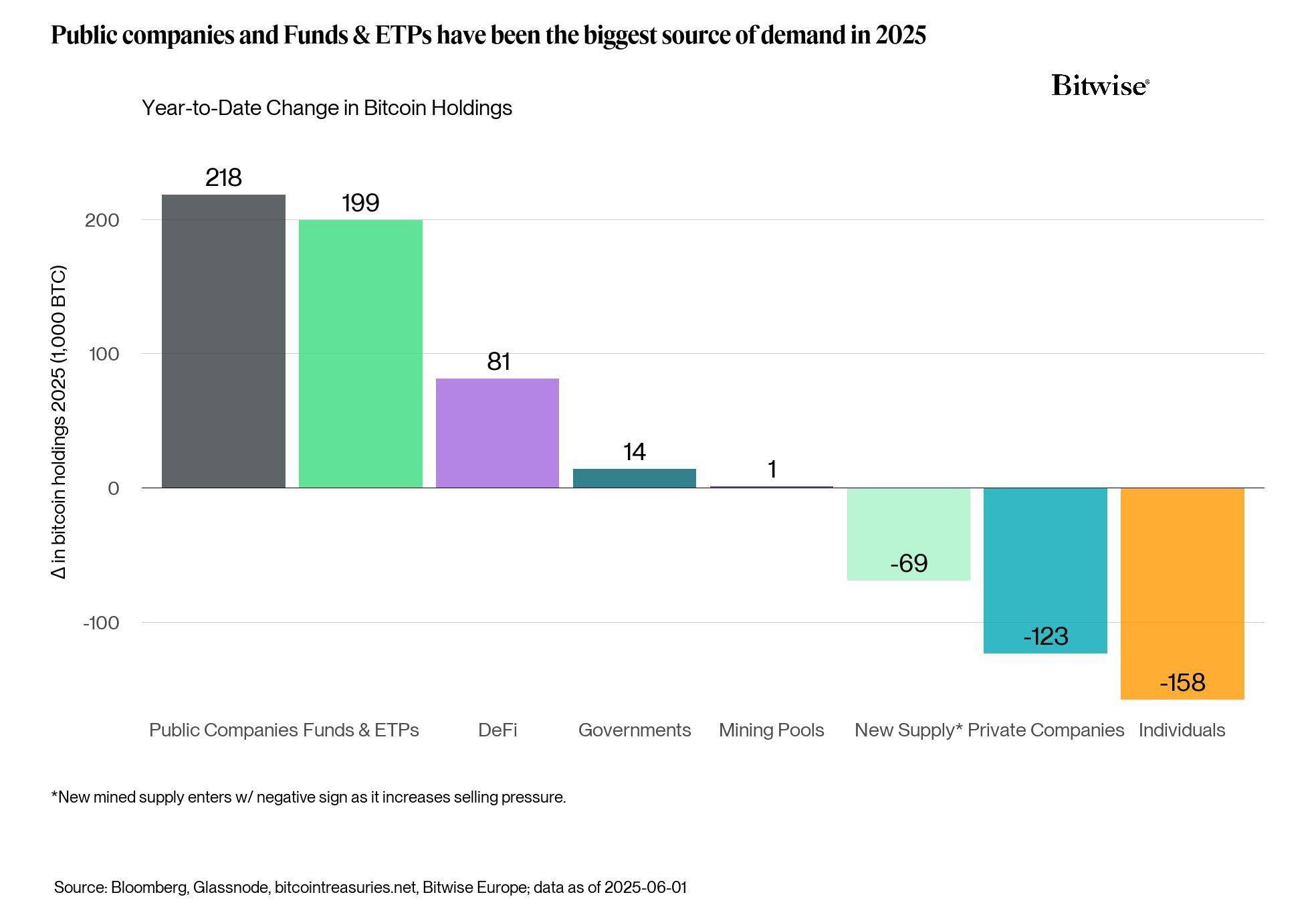

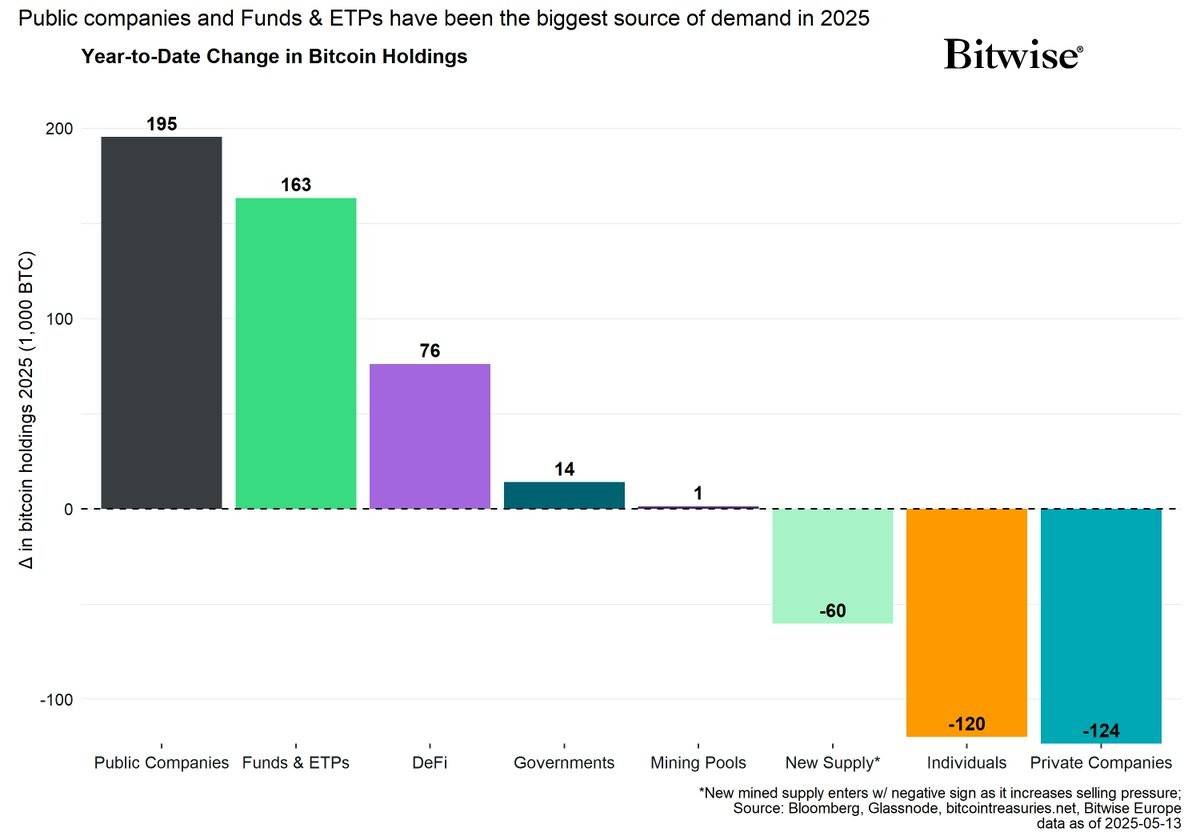

📊 Bitcoin Demand Update (2025 YTD):

Institutional buyers are leading the charge — adding 417,000 $BTC so far this year. Meanwhile, individual investors have sold off 158,000 $BTC, per Bitwise data.

The tide continues to shift as institutions double down on Bitcoin. What does this mean for retail? Thoughts? 💬 #bitcoin #CryptoUpdate #BTC #InstitutionalInvesting

Institutional buyers are leading the charge — adding 417,000 $BTC so far this year. Meanwhile, individual investors have sold off 158,000 $BTC, per Bitwise data.

The tide continues to shift as institutions double down on Bitcoin. What does this mean for retail? Thoughts? 💬 #bitcoin #CryptoUpdate #BTC #InstitutionalInvesting

5 days ago

Ripple’s Hidden Road has just rolled out OTC crypto swaps in the US, paving the way for institutional investors to engage in cash-settled trades with top digital assets.

This could be a game-changer for the market!

source: https://cointelegraph.com/...

#cryptonews #ripple #HiddenRoad

This could be a game-changer for the market!

source: https://cointelegraph.com/...

#cryptonews #ripple #HiddenRoad

5 days ago

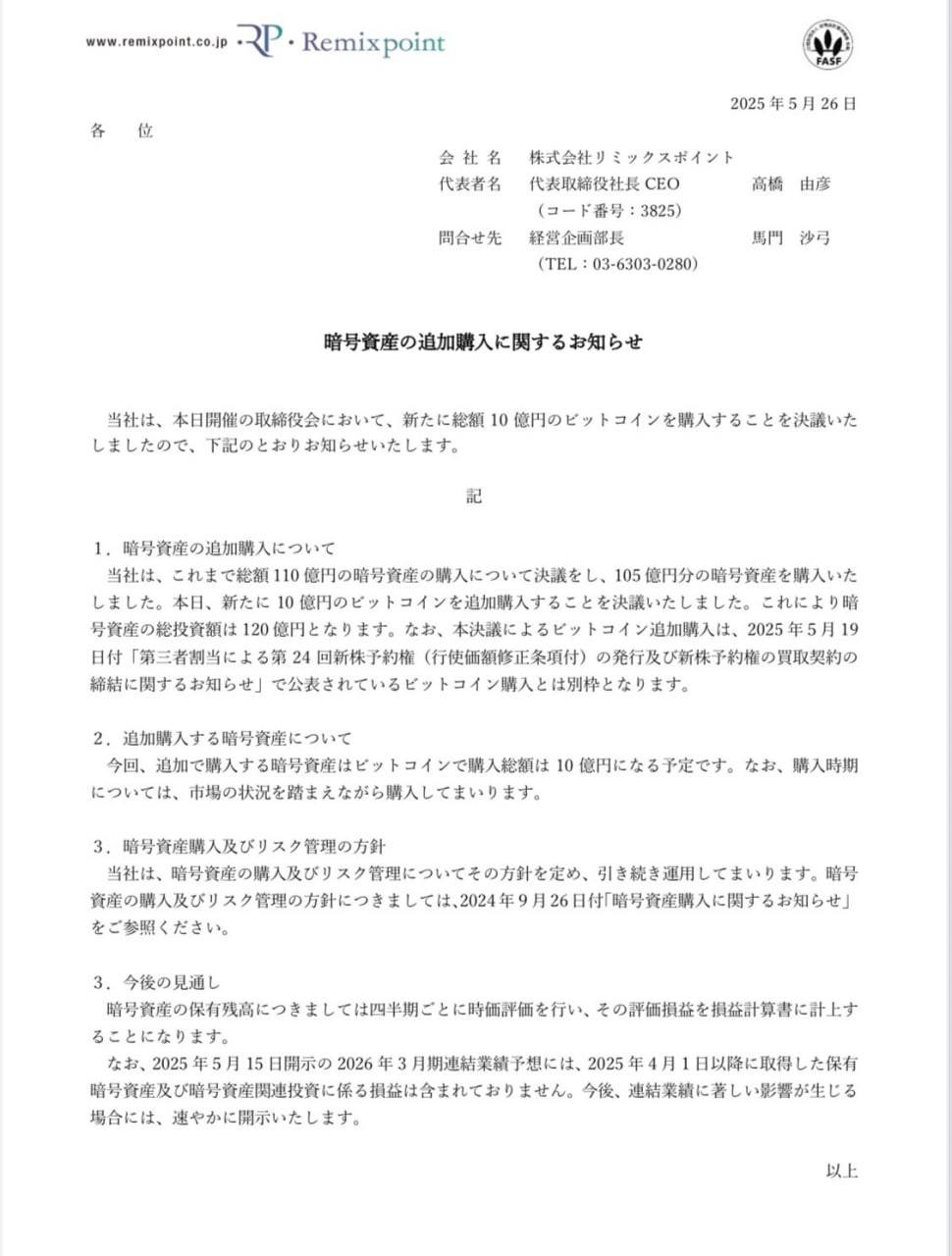

🚀 JUST IN:

🇯🇵 Japanese public company Remixpoint is buying another 200 #bitcoin 💸

🔥 For ¥1 Billion — that’s serious commitment!

They’re on a mission to hit 1,000 BTC …

And they’re not slowing down.

This is what #institutional adoption looks like.

What’s your move? 👀

#BTC #BitcoinNews #OnChain #CryptoIsMoney #HODL

🇯🇵 Japanese public company Remixpoint is buying another 200 #bitcoin 💸

🔥 For ¥1 Billion — that’s serious commitment!

They’re on a mission to hit 1,000 BTC …

And they’re not slowing down.

This is what #institutional adoption looks like.

What’s your move? 👀

#BTC #BitcoinNews #OnChain #CryptoIsMoney #HODL

6 days ago

BlackRock’s $BUIDL fund is now LIVE on Avalanche!

#blackrock , the world's largest asset manager, has launched its USD Institutional Digital Liquidity Fund (BUIDL) on the Avalanche blockchain platform. This represents a major milestone in institutional adoption of blockchain technology, bringing traditional financial infrastructure onto decentralized networks.

Fund Overview:-

Fund Size: $500M+

Token Structure: One share = One BUIDL token

Target Value: $1 per token

Distribution: Daily accrued dividends paid directly to wallets

Investment Minimum: $5 million

#Avalanche

(via: https://www.avax.network/a...

#blackrock , the world's largest asset manager, has launched its USD Institutional Digital Liquidity Fund (BUIDL) on the Avalanche blockchain platform. This represents a major milestone in institutional adoption of blockchain technology, bringing traditional financial infrastructure onto decentralized networks.

Fund Overview:-

Fund Size: $500M+

Token Structure: One share = One BUIDL token

Target Value: $1 per token

Distribution: Daily accrued dividends paid directly to wallets

Investment Minimum: $5 million

#Avalanche

(via: https://www.avax.network/a...

7 days ago

🚨 BREAKING: Trump Media Group Plans to Raise $3 Billion to Invest in Crypto! 🚀

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

14 days ago

Institutional Accumulation Explained👇

Every time you sell BTC, it might end up in the hands of a #blackrock or MicroStrategy.

They don't trade. They hold.

The result?🤔

#bitcoin supply is getting locked up in institutional vaults.

Less liquid BTC = potential future supply shock.

Think before you sell.

Every time you sell BTC, it might end up in the hands of a #blackrock or MicroStrategy.

They don't trade. They hold.

The result?🤔

#bitcoin supply is getting locked up in institutional vaults.

Less liquid BTC = potential future supply shock.

Think before you sell.

18 days ago

(E)

🚀 Altcoin Season on the Horizon as Bitcoin Nears All-Time High? 🚀

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

18 days ago

🚨 BREAKING: According to recent reports, BlackRock has indeed made a significant Ethereum purchase, acquiring 4,542 ETH valued at approximately $8.4 million.

BlackRock's move aligns with broader institutional interest in Ethereum-based financial products. The Chicago Board Options Exchange (Cboe) has recently submitted a request to the SEC seeking permission for staking features within Ethereum spot ETFs

The world’s largest asset manager is doubling down on crypto — what does that tell YOU? 🧠💸.

This isn’t just a trend… it’s a massive shift in the financial landscape. 🚀

#crypto #ethereum #Blockchain #finance #bitcoin #Web3 #Investing #MarketUpdate

BlackRock's move aligns with broader institutional interest in Ethereum-based financial products. The Chicago Board Options Exchange (Cboe) has recently submitted a request to the SEC seeking permission for staking features within Ethereum spot ETFs

The world’s largest asset manager is doubling down on crypto — what does that tell YOU? 🧠💸.

This isn’t just a trend… it’s a massive shift in the financial landscape. 🚀

#crypto #ethereum #Blockchain #finance #bitcoin #Web3 #Investing #MarketUpdate

18 days ago

BREAKING: BlackRock Just Dropped Serious Crypto Heat!

📈 They’ve acquired:

🔹 $232.9 Million in BITCOIN

🔹 $57.6 Million in ETHEREUM

This isn’t just news — it’s a statement . The world’s largest asset manager is doubling down on digital assets.

🔥 What does this mean for the future of crypto?

💡 Institutional adoption is accelerating… and the bull run might just be getting started.

#bitcoin #ethereum #cryptonews #blackrock #BTC #ETH #InstitutionalInvesting #Web3 #FutureOfFinance

📈 They’ve acquired:

🔹 $232.9 Million in BITCOIN

🔹 $57.6 Million in ETHEREUM

This isn’t just news — it’s a statement . The world’s largest asset manager is doubling down on digital assets.

🔥 What does this mean for the future of crypto?

💡 Institutional adoption is accelerating… and the bull run might just be getting started.

#bitcoin #ethereum #cryptonews #blackrock #BTC #ETH #InstitutionalInvesting #Web3 #FutureOfFinance

18 days ago

🚀 Big Move in the Crypto World!

Abu Dhabi’s sovereign wealth fund just dropped $408 million on BlackRock’s Spot Bitcoin ETF — signaling serious institutional confidence in #bitcoin .

This is more than an investment… it’s a vote of trust in crypto’s future. 💼💰

(Source - https://www.nasdaq.com/art...

#bitcoin #ETF #cryptonews #blackrock #InstitutionalInvesting #BTC

Abu Dhabi’s sovereign wealth fund just dropped $408 million on BlackRock’s Spot Bitcoin ETF — signaling serious institutional confidence in #bitcoin .

This is more than an investment… it’s a vote of trust in crypto’s future. 💼💰

(Source - https://www.nasdaq.com/art...

#bitcoin #ETF #cryptonews #blackrock #InstitutionalInvesting #BTC

18 days ago

🔍 Interesting Development!

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

29 days ago

Cantor Fitzgerald is diving deeper into crypto! 💰

They've struck a $3.6bn venture deal with SoftBank and Tether. What does this mean for the future of institutional investment in digital assets? 🤔

#crypto #finance #investments #CantorFitzgerald #SoftBank #Tether

Read more here:

https://www.ft.com/content...

They've struck a $3.6bn venture deal with SoftBank and Tether. What does this mean for the future of institutional investment in digital assets? 🤔

#crypto #finance #investments #CantorFitzgerald #SoftBank #Tether

Read more here:

https://www.ft.com/content...

1 month ago

📢 Big Update for #stablecoins : The U.S. SEC has officially closed its investigation into PayPal’s stablecoin, PYUSD, without taking any enforcement action.

In a recent filing, PayPal revealed the SEC issued a document subpoena in Nov 2023 and concluded the probe in Feb 2025. While this is positive news, PayPal also warned of potential future compliance costs from evolving regulations — and risks if PYUSD is ever tied to illicit activity or litigation.

For now, this closure could help ease institutional concerns around stablecoin adoption. 🚀

#cryptonews #PayPal #PYUSD #SEC #Regulation #fintech #DigitalCurrency

In a recent filing, PayPal revealed the SEC issued a document subpoena in Nov 2023 and concluded the probe in Feb 2025. While this is positive news, PayPal also warned of potential future compliance costs from evolving regulations — and risks if PYUSD is ever tied to illicit activity or litigation.

For now, this closure could help ease institutional concerns around stablecoin adoption. 🚀

#cryptonews #PayPal #PYUSD #SEC #Regulation #fintech #DigitalCurrency

1 month ago

🚨 BIG Bitcoin Move Alert! 🚨

Yesterday alone, ETFs bought 6,310 BTC .

Over the last 6 trading days? A whopping ~40,000 BTC !

The institutional appetite for Bitcoin is accelerating — this is no dip. This is demand like we've never seen before. 💸🔥

#bitcoin #CryptoUpdate #ETF #OnChainData #BTC #InstitutionalInvesting

Yesterday alone, ETFs bought 6,310 BTC .

Over the last 6 trading days? A whopping ~40,000 BTC !

The institutional appetite for Bitcoin is accelerating — this is no dip. This is demand like we've never seen before. 💸🔥

#bitcoin #CryptoUpdate #ETF #OnChainData #BTC #InstitutionalInvesting

1 month ago

(E)

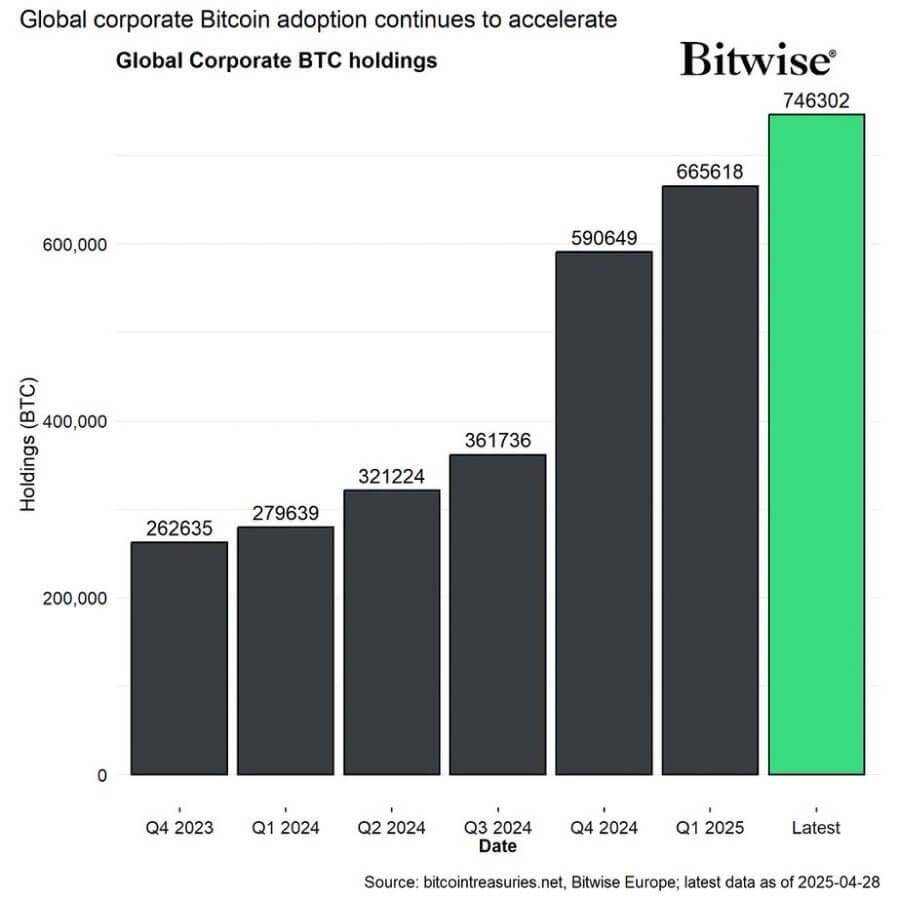

📊 UPDATE: Big Bitcoin Move in April

Corporations added nearly 100,000 $BTC to their reserves last month — a major signal of growing institutional adoption.

Strategy led the charge with 25,370 BTC , accounting for 26.3% of April’s total corporate accumulation.

And it’s not just the usual suspects — 15 new firms added Bitcoin to their balance sheets last month, per Bitwise.

The trend is clear: #bitcoin is becoming a cornerstone asset. 🚀

#cryptonews #BitcoinAdoption #InstitutionalInvesting #BTC #Blockchain

Corporations added nearly 100,000 $BTC to their reserves last month — a major signal of growing institutional adoption.

Strategy led the charge with 25,370 BTC , accounting for 26.3% of April’s total corporate accumulation.

And it’s not just the usual suspects — 15 new firms added Bitcoin to their balance sheets last month, per Bitwise.

The trend is clear: #bitcoin is becoming a cornerstone asset. 🚀

#cryptonews #BitcoinAdoption #InstitutionalInvesting #BTC #Blockchain

1 month ago

NEW: BlackRock’s CIO says institutional investors are "largely focused on Bitcoin right now with Ethereum as a distant second.”

#bitcoin #blackrock

#bitcoin #blackrock

1 month ago

Coinbase Launches Bitcoin Yield Fund for Institutions

#coinbase Asset Management is launching a new investment product for institutional investors to earn passive income on their bitcoin.

The Coinbase Bitcoin Yield Fund (CBYF) goes live on May 1, 2025 and will pay 4% to 8% annual net returns in bitcoin.

#coinbase Asset Management is launching a new investment product for institutional investors to earn passive income on their bitcoin.

The Coinbase Bitcoin Yield Fund (CBYF) goes live on May 1, 2025 and will pay 4% to 8% annual net returns in bitcoin.

1 month ago

🚀 BREAKING: Jack Mallers' New Company, TWENTY ONE, Surges Over 160% After Buying 42,000 #bitcoin !

🔥 The founder of Strike continues to make waves in crypto. Is this the next big play in Bitcoin adoption?

📈 Bullish Signal? With institutional demand heating up, could this trigger another #BTC rally?

What’s your take? 👇 #crypto #BitcoinNews

🔥 The founder of Strike continues to make waves in crypto. Is this the next big play in Bitcoin adoption?

📈 Bullish Signal? With institutional demand heating up, could this trigger another #BTC rally?

What’s your take? 👇 #crypto #BitcoinNews

2 months ago

The crypto seas just trembled—a $6.6 BILLION Bitcoin whale has stirred after years of dormancy. When these leviathans move, they don’t just make ripples… they create tidal waves across the market.

But who is this whale? Why now? And what could this mean for Bitcoin's next move? Let’s dive into this breaking development that has every trader, analyst, and HODLer watching closely.

🧠 The Awakening: 94,500 BTC Moved After 5+ Years

On-chain analysts confirmed a jaw-dropping transaction: a wallet containing 94,500 BTC—worth roughly $6.6 billion—moved funds for the first time since 2019. That’s pre-pandemic Bitcoin, bought at a fraction of today’s price.

This isn't your average whale.

This is a legacy address, possibly tied to early miners, institutions, or even an exchange cold wallet. But the timing and scale are what's making jaws drop.

Whether it's reallocation, institutional movement, or prep for ETF flows, one thing’s clear: the giants of crypto are waking up... and they’re not swimming quietly.

#BitcoinWhales #BTCAlert #CryptoNewss #cryptomarket #BTCVolatility

But who is this whale? Why now? And what could this mean for Bitcoin's next move? Let’s dive into this breaking development that has every trader, analyst, and HODLer watching closely.

🧠 The Awakening: 94,500 BTC Moved After 5+ Years

On-chain analysts confirmed a jaw-dropping transaction: a wallet containing 94,500 BTC—worth roughly $6.6 billion—moved funds for the first time since 2019. That’s pre-pandemic Bitcoin, bought at a fraction of today’s price.

This isn't your average whale.

This is a legacy address, possibly tied to early miners, institutions, or even an exchange cold wallet. But the timing and scale are what's making jaws drop.

Whether it's reallocation, institutional movement, or prep for ETF flows, one thing’s clear: the giants of crypto are waking up... and they’re not swimming quietly.

#BitcoinWhales #BTCAlert #CryptoNewss #cryptomarket #BTCVolatility

2 months ago

📈 Since the launch of U.S. spot Bitcoin ETPs, a total of 529,325 BTC have been scooped up — while only 249,725 BTC have been mined during the same period.

That’s more than 2x the new supply! 🔥

This massive imbalance shows that institutional demand is outpacing supply, big time. The appetite for #bitcoin is still very real. 🚀

#bitcoin #crypto #BTC #ETP #InstitutionalAdoption #BULLISH

That’s more than 2x the new supply! 🔥

This massive imbalance shows that institutional demand is outpacing supply, big time. The appetite for #bitcoin is still very real. 🚀

#bitcoin #crypto #BTC #ETP #InstitutionalAdoption #BULLISH

2 months ago

DWF Labs has announced a notable $25 million investment in World Liberty Financial (WLFI), a decentralized finance protocol with ties to the Trump family. This investment is seen as a significant step into the U.S. market for DWF Labs, which plans to open an office in New York City to foster relationships with regulators and financial institutions. The investment, which highlights DWF's confidence in the U.S. as a growing region for institutional crypto adoption, comes amidst existing political controversies surrounding WLFI.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

2 months ago

(E)

🔁 Bitcoin's Evolution: From Digital Gold to Economic Backbone 💥

Bitcoin isn't just a buzzword anymore — it's a movement that reshaped finance. From humble beginnings to becoming a cornerstone of modern economies, here's how it all unfolded:

📜 2009–2012: The Genesis Era

➡️ A decentralized idea was born. Mostly a niche experiment among cypherpunks and tech enthusiasts.

🏆 2013–2017: The Digital Gold Era

➡️ Seen as a store of value. The “digital gold” narrative took off. Hodlers were born.

🌪️ 2017–2021: Financial Disruption Era

➡️ Bitcoin challenged traditional finance. DeFi emerged. Mainstream media took notice.

🏦 2022–Present: Institutional Adoption Era

➡️ Big money arrived. ETFs approved. Banks and governments can’t ignore it anymore.

🔗 From a whitepaper to Wall Street — Bitcoin's journey is far from over.

#bitcoin #crypto #BTC #Blockchain #FinancialRevolution #digitalgold #CryptoHistory

Bitcoin isn't just a buzzword anymore — it's a movement that reshaped finance. From humble beginnings to becoming a cornerstone of modern economies, here's how it all unfolded:

📜 2009–2012: The Genesis Era

➡️ A decentralized idea was born. Mostly a niche experiment among cypherpunks and tech enthusiasts.

🏆 2013–2017: The Digital Gold Era

➡️ Seen as a store of value. The “digital gold” narrative took off. Hodlers were born.

🌪️ 2017–2021: Financial Disruption Era

➡️ Bitcoin challenged traditional finance. DeFi emerged. Mainstream media took notice.

🏦 2022–Present: Institutional Adoption Era

➡️ Big money arrived. ETFs approved. Banks and governments can’t ignore it anymore.

🔗 From a whitepaper to Wall Street — Bitcoin's journey is far from over.

#bitcoin #crypto #BTC #Blockchain #FinancialRevolution #digitalgold #CryptoHistory

2 months ago

Ripple, a cryptocurrency company, is set to acquire the prime broker 'Hidden Road' for $1.25 billion.✨

Hidden Road clears $3 trillion annually across markets with over 300 institutional clients. The deal will allow the Hidden Road to expand exponentially using Ripple's balance sheet and become the largest non-bank prime broker globally, the crypto company said.

#ripple #xrp #HiddenRoad #crypto

Hidden Road clears $3 trillion annually across markets with over 300 institutional clients. The deal will allow the Hidden Road to expand exponentially using Ripple's balance sheet and become the largest non-bank prime broker globally, the crypto company said.

#ripple #xrp #HiddenRoad #crypto

2 months ago

JUST In:

$1.75 BILLION BitGo just integrated the Bitcoin Lightning Network for 1,500 institutional clients!

Huge step for #BTC adoption. Instant, low-cost transactions incoming!

#cryptonews #LightningNetwork #bitcoin #bitgo

$1.75 BILLION BitGo just integrated the Bitcoin Lightning Network for 1,500 institutional clients!

Huge step for #BTC adoption. Instant, low-cost transactions incoming!

#cryptonews #LightningNetwork #bitcoin #bitgo

3 months ago

Bitcoin Hovers Near $83K As Whales and Miners Cash Out – Will BTC Drop to $75K?

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

3 months ago

(E)

🚨Breaking: Solana Preparing for a Massive Change

Here's what this massive change means:

- Current inflation: 4.7% annually

- New rate: Could drop to just 1.5%

- Impact: Billions less SOL entering circulation each year

The Good:

- Less sell pressure on SOL price

- More attractive for institutional investors

- Could boost SOL's value long-term

The Bad:

- Small validators might struggle to survive

- Could reduce network decentralization

- Impact on DeFi protocols still uncertain

The proposal, called SIMD-0228, changes how new SOL tokens are created. Instead of following a fixed schedule, it uses a "smart emissions" system that adjusts based on how many tokens are being staked.

This is a huge moment for Solana - potentially making it more attractive to investors but risking the health of its decentralized network. The change needs a two-thirds majority to pass, and voting is happening now!

#solana #sol #cryptocurrency #Blockchain #defi

Here's what this massive change means:

- Current inflation: 4.7% annually

- New rate: Could drop to just 1.5%

- Impact: Billions less SOL entering circulation each year

The Good:

- Less sell pressure on SOL price

- More attractive for institutional investors

- Could boost SOL's value long-term

The Bad:

- Small validators might struggle to survive

- Could reduce network decentralization

- Impact on DeFi protocols still uncertain

The proposal, called SIMD-0228, changes how new SOL tokens are created. Instead of following a fixed schedule, it uses a "smart emissions" system that adjusts based on how many tokens are being staked.

This is a huge moment for Solana - potentially making it more attractive to investors but risking the health of its decentralized network. The change needs a two-thirds majority to pass, and voting is happening now!

#solana #sol #cryptocurrency #Blockchain #defi

3 months ago

🚨Breaking News!

Singapore Exchange (SGX) just announced plans to launch Bitcoin perpetual futures in H2 2025!

1. First major traditional exchange in Singapore to offer crypto perpetual futures

2. Targeting institutional investors and professional traders

3. Backed by SGX's Aa2 rating from Moody's for added security

4. Aims to bridge traditional finance with crypto markets

This move marks a significant step in bringing cryptocurrency trading into mainstream financial markets!

#SGX #bitcoin #cryptocurrency #FinancialMarkets #InstitutionalInvesting #Singapore

Singapore Exchange (SGX) just announced plans to launch Bitcoin perpetual futures in H2 2025!

1. First major traditional exchange in Singapore to offer crypto perpetual futures

2. Targeting institutional investors and professional traders

3. Backed by SGX's Aa2 rating from Moody's for added security

4. Aims to bridge traditional finance with crypto markets

This move marks a significant step in bringing cryptocurrency trading into mainstream financial markets!

#SGX #bitcoin #cryptocurrency #FinancialMarkets #InstitutionalInvesting #Singapore

3 months ago

Attention: 👀

$CPOOL LISTED ON BINANCE

ALPHA PRE-SELECTION POOL.

https://www.binance.com/en...

- 💸 $750M in Loans Originated: Major institutions like Jane Street and Wintermute are already on board! 🏦🔥

- 📈 Descending Broadening Wedge: A bullish pattern that could signal a breakout! 🎯

- 💡 Institutional Confidence: Big players are trusting $CPOOL with their liquidity. 🚀

$CPOOL LISTED ON BINANCE

ALPHA PRE-SELECTION POOL.

https://www.binance.com/en...

- 💸 $750M in Loans Originated: Major institutions like Jane Street and Wintermute are already on board! 🏦🔥

- 📈 Descending Broadening Wedge: A bullish pattern that could signal a breakout! 🎯

- 💡 Institutional Confidence: Big players are trusting $CPOOL with their liquidity. 🚀

3 months ago

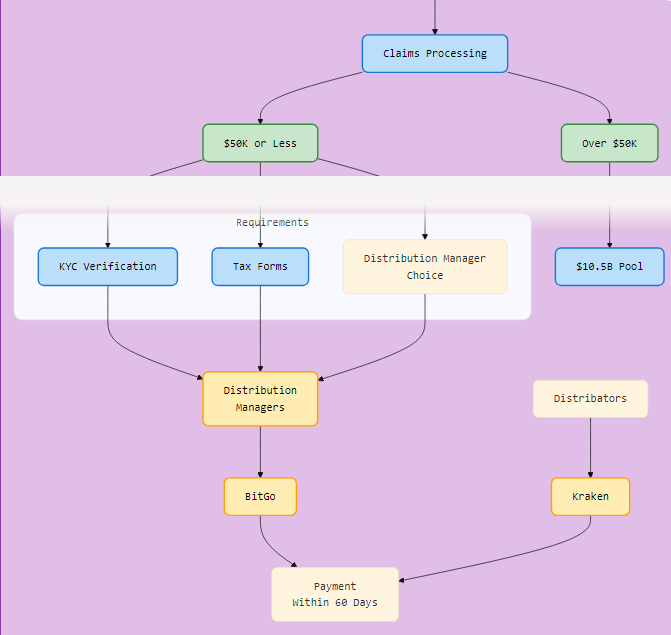

FTX's estate is beginning its payment plan today, though the initial distribution will be approximately $1.2 billion rather than $2.4 billion.

- Starting today, FTX will begin repayments to creditors with claims of $50,000 or less ("convenience class" creditors).

-These creditors will receive approximately 119% of their claimed amount, including principal plus interest.

- Payments must be completed within 60 days of the effective date.

Market Impact Analysis:

- Analysts estimate approximately $2.4 billion may flow back into crypto markets following the distribution

- $3.9 billion of total claims were acquired by credit funds, which typically won't reinvest in crypto assets

- 33% of remaining claims belong to sanctioned countries, individuals without KYC verification, or those unable to claim funds

Total Distribution Scope:

- Total estimated distribution will range between $14.7 billion and $16.5 billion

- BitGo and Kraken have been designated to manage initial distributions for retail and institutional customers in supported jurisdictions

- Creditors must complete KYC verification and submit tax forms through the FTX Debtors' Customer Portal to receive payments

MANY WILL INVEST IN #bitcoin 🚀

- Starting today, FTX will begin repayments to creditors with claims of $50,000 or less ("convenience class" creditors).

-These creditors will receive approximately 119% of their claimed amount, including principal plus interest.

- Payments must be completed within 60 days of the effective date.

Market Impact Analysis:

- Analysts estimate approximately $2.4 billion may flow back into crypto markets following the distribution

- $3.9 billion of total claims were acquired by credit funds, which typically won't reinvest in crypto assets

- 33% of remaining claims belong to sanctioned countries, individuals without KYC verification, or those unable to claim funds

Total Distribution Scope:

- Total estimated distribution will range between $14.7 billion and $16.5 billion

- BitGo and Kraken have been designated to manage initial distributions for retail and institutional customers in supported jurisdictions

- Creditors must complete KYC verification and submit tax forms through the FTX Debtors' Customer Portal to receive payments

MANY WILL INVEST IN #bitcoin 🚀

Sponsored by

Administrator

11 months ago