17 hours ago

10 days ago

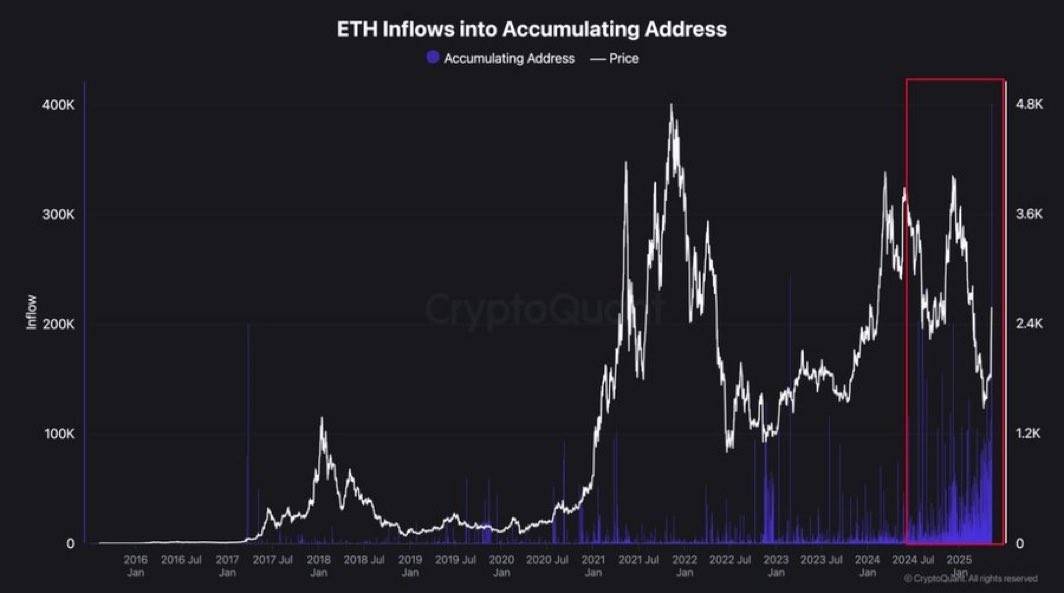

Ethereum exchange balances are dropping fast, over 1 million ETH withdrawn in just a month.

That’s 5.5% of ETH held on exchanges gone.

After the Pectra upgrade, users seem to prefer HODLing over trading.

#ethereum

That’s 5.5% of ETH held on exchanges gone.

After the Pectra upgrade, users seem to prefer HODLing over trading.

#ethereum

1 month ago

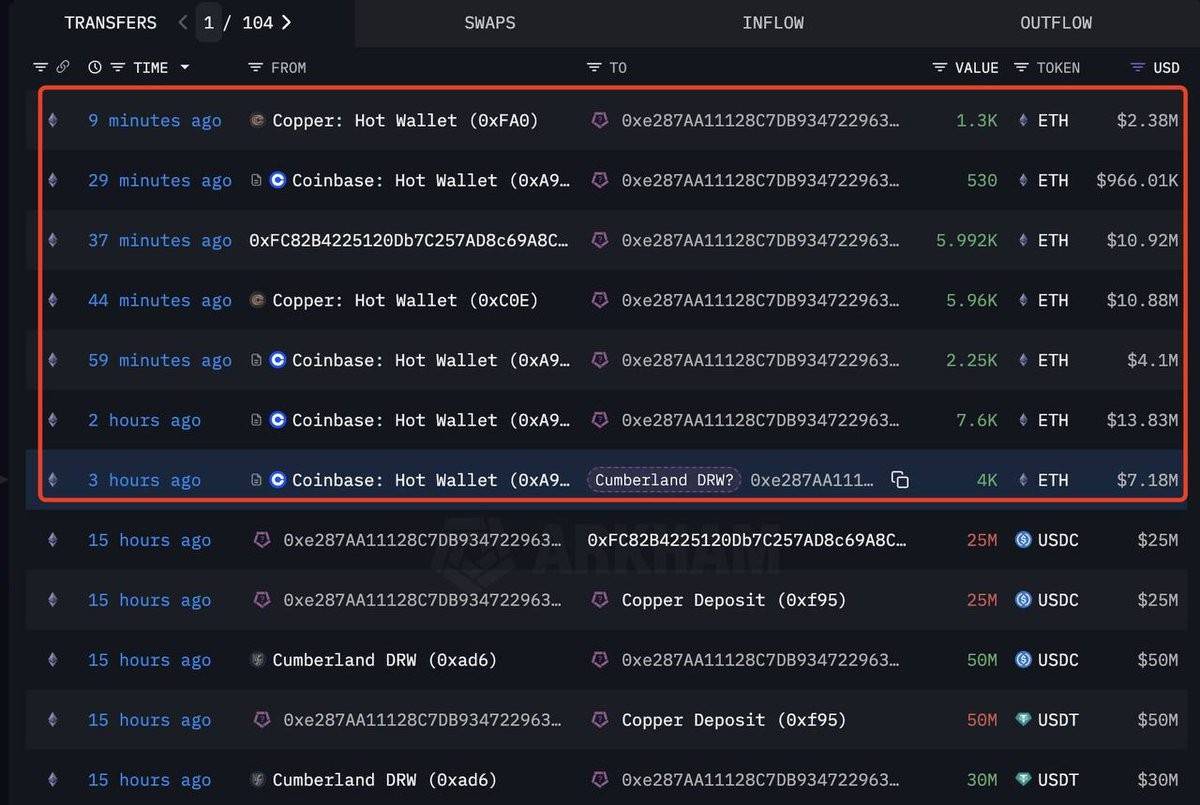

🔥 BREAKING : A wallet linked to Cumberland has withdrawn 27,632 ETH (≈**$50.24M**) from Copper , Binance , and Coinbase in just the past 3 hours .

Big moves like this always raise eyebrows — what’s the play here? 🧠💸

#crypto #ethereum #OnchainAlerts #WhaleWatch #Cumberland #ETHWithdrawals

Big moves like this always raise eyebrows — what’s the play here? 🧠💸

#crypto #ethereum #OnchainAlerts #WhaleWatch #Cumberland #ETHWithdrawals

1 month ago

🚀 BIG NEWS: Fidelity Acquires $35.9 Million in Ethereum (ETH)!

The investment giant continues to expand its crypto holdings—bullish move for #ethereum and the future of #defi ! 💎

What’s your take on this? 👀 #crypto #Blockchain #Investing

[📈 Drop a comment below!]

#fidelity #ETH #DigitalAssets

The investment giant continues to expand its crypto holdings—bullish move for #ethereum and the future of #defi ! 💎

What’s your take on this? 👀 #crypto #Blockchain #Investing

[📈 Drop a comment below!]

#fidelity #ETH #DigitalAssets

1 month ago

🚨 BREAKING: BLACKROCK JUST BOUGHT $54.4M WORTH OF $ETH 🔥

The institutions are not slowing down. Are you paying attention? 👀 #ethereum #crypto #blackrock

The institutions are not slowing down. Are you paying attention? 👀 #ethereum #crypto #blackrock

1 month ago

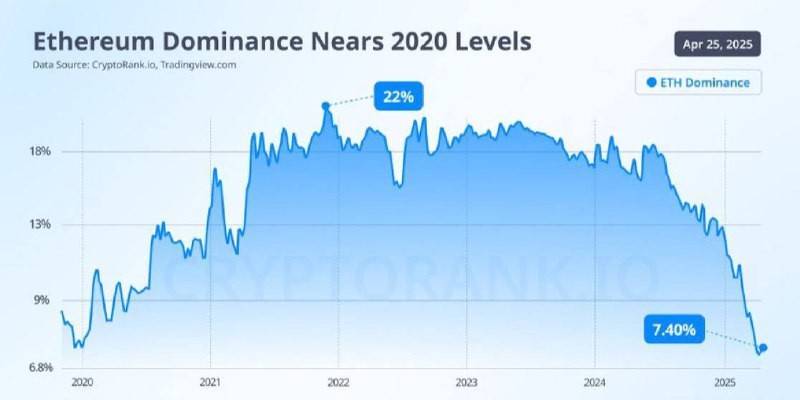

🚨 Ethereum is losing ground fast! 🚨

🔻 ETH market dominance has dropped to just 7.4%.

📈 In 2021, 1 ETH = 0.08 BTC.

⚡ In 2023, 1 ETH = 111 SOL.

Today?

➡️ 1 ETH = 0.018 BTC

➡️ 1 ETH = 11.5 SOL

That’s 4x less compared to Bitcoin and 10x less compared to Solana! 👀

The market is shifting... Are you watching closely? 👇 #crypto #ethereum #bitcoin #solana

🔻 ETH market dominance has dropped to just 7.4%.

📈 In 2021, 1 ETH = 0.08 BTC.

⚡ In 2023, 1 ETH = 111 SOL.

Today?

➡️ 1 ETH = 0.018 BTC

➡️ 1 ETH = 11.5 SOL

That’s 4x less compared to Bitcoin and 10x less compared to Solana! 👀

The market is shifting... Are you watching closely? 👇 #crypto #ethereum #bitcoin #solana

1 month ago

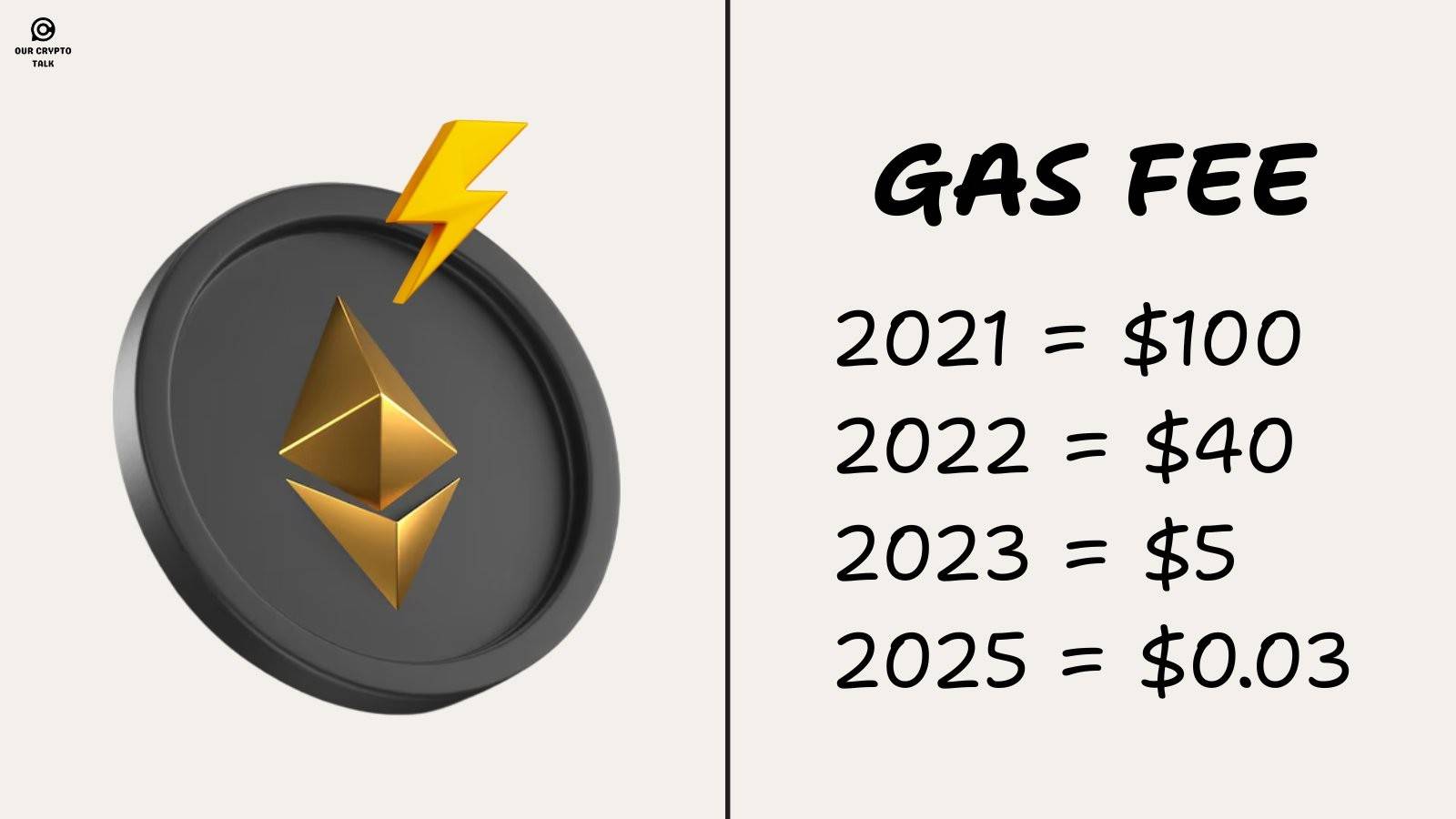

🚨Ethereum Gas Fees Drop ⛽

#ethereum 's gas fees have reached a notably low level, with the cost of revoking a single token authorization approximately $0.01. This presents an opportunity for users to utilize tools like RevokeCash and Rabby to cancel any uncertain or potentially unsafe authorizations. Even when processing hundreds of authorizations in bulk, the cost remains just a few dollars, effectively mitigating potential high-risk exposures.

#ethereum 's gas fees have reached a notably low level, with the cost of revoking a single token authorization approximately $0.01. This presents an opportunity for users to utilize tools like RevokeCash and Rabby to cancel any uncertain or potentially unsafe authorizations. Even when processing hundreds of authorizations in bulk, the cost remains just a few dollars, effectively mitigating potential high-risk exposures.

1 month ago

📊 Ethereum ETF Update – April 17 📊

According to SoSoValue, all 9 Ethereum Spot ETFs recorded zero net inflows or outflows yesterday — holding steady with no change throughout the day.

🔹 Total Net Asset Value: $5.269 Billion

🔹 Net Asset Ratio: 2.76% (compared to ETH's market cap)

🔹 Cumulative Net Inflows (All-time): $2.244 Billion

Steady day for ETH ETFs — eyes on the next move. 👀💼

According to SoSoValue, all 9 Ethereum Spot ETFs recorded zero net inflows or outflows yesterday — holding steady with no change throughout the day.

🔹 Total Net Asset Value: $5.269 Billion

🔹 Net Asset Ratio: 2.76% (compared to ETH's market cap)

🔹 Cumulative Net Inflows (All-time): $2.244 Billion

Steady day for ETH ETFs — eyes on the next move. 👀💼

1 month ago

Ethereum Whales Sell $1.8 Billion in ETH as Price Fails Recovery.

In the past three days, addresses holding between 100,000 and 1 million ETH have aggressively sold about 1.19 million ETH, worth more than $1.8 billion. These whales’ decision to offload significant amounts of #ethereum highlights a shift in market sentiment, as they likely aim to offset potential losses from the stalled recovery.

In the past three days, addresses holding between 100,000 and 1 million ETH have aggressively sold about 1.19 million ETH, worth more than $1.8 billion. These whales’ decision to offload significant amounts of #ethereum highlights a shift in market sentiment, as they likely aim to offset potential losses from the stalled recovery.

2 months ago

🚨 Just in: Vitalik Buterin has dropped a simplified Layer 1 privacy roadmap!

The focus? Enhancing privacy without major Ethereum consensus changes. 🔒✨

Here are the 4 key areas:

1️⃣ Onchain payment privacy

2️⃣ Activity anonymization

3️⃣ RPC call privacy

4️⃣ Network anonymization

A big step toward a more private and secure Ethereum future! 🛡️

#ethereum #VitalikButerin #CryptoPrivacy #Web3

The focus? Enhancing privacy without major Ethereum consensus changes. 🔒✨

Here are the 4 key areas:

1️⃣ Onchain payment privacy

2️⃣ Activity anonymization

3️⃣ RPC call privacy

4️⃣ Network anonymization

A big step toward a more private and secure Ethereum future! 🛡️

#ethereum #VitalikButerin #CryptoPrivacy #Web3

2 months ago

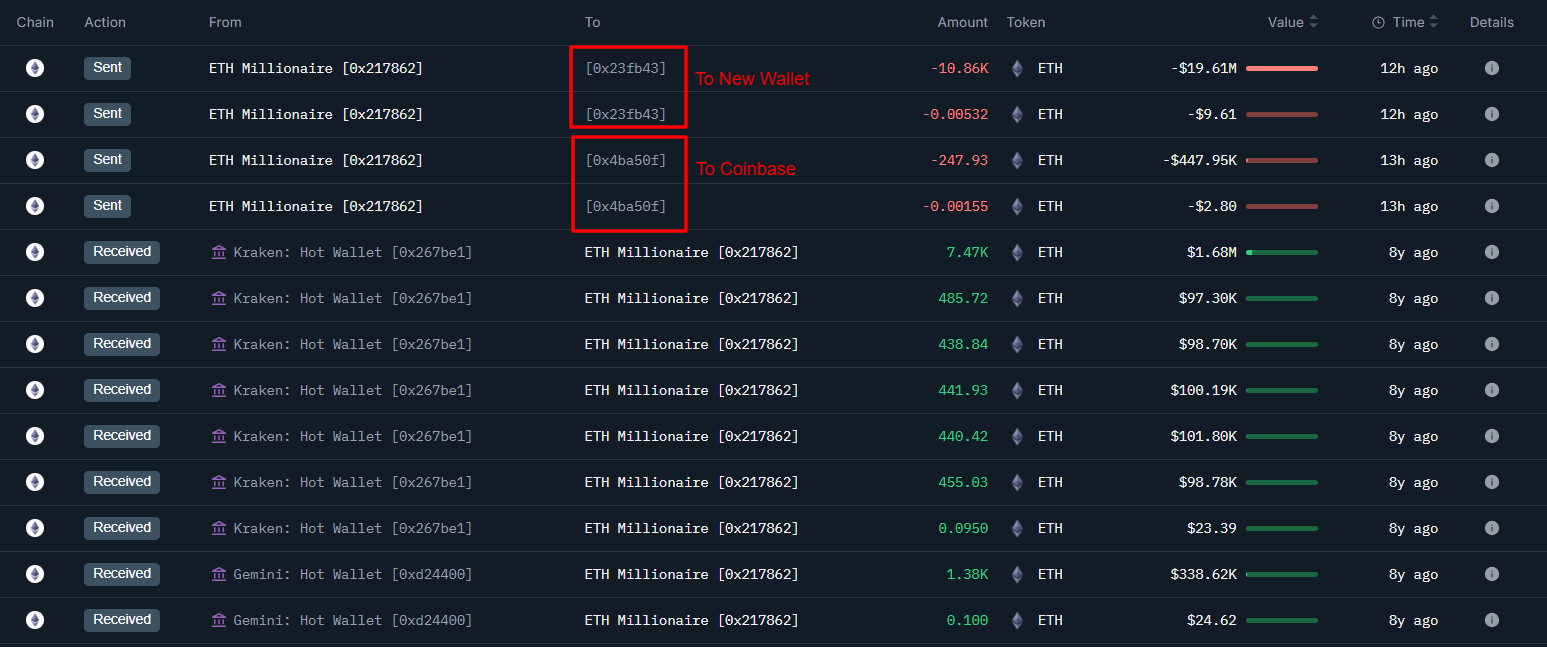

(E)

💥BREAKING: After 8 years, a dormant wallet has finally moved 11,104 $ETH worth a whopping $19.97M!

Of this, 247.93 $ETH was sent to #coinbase and 10,856 $ETH to a new wallet.

The whale initially withdrew $ETH for $2.51M from #Kraken and #Gemini , 8 years ago. Currently making a profit of $17.45M.

Main: 0x21786202e5a25e5cca759939c7d56d428dbee352

Holding: 0x23fb435dd0d25718a80ea105ab63c27567bd4661

What could be the story behind this sudden awakening?

#ethereum #crypto #WalletActivity

Of this, 247.93 $ETH was sent to #coinbase and 10,856 $ETH to a new wallet.

The whale initially withdrew $ETH for $2.51M from #Kraken and #Gemini , 8 years ago. Currently making a profit of $17.45M.

Main: 0x21786202e5a25e5cca759939c7d56d428dbee352

Holding: 0x23fb435dd0d25718a80ea105ab63c27567bd4661

What could be the story behind this sudden awakening?

#ethereum #crypto #WalletActivity

2 months ago

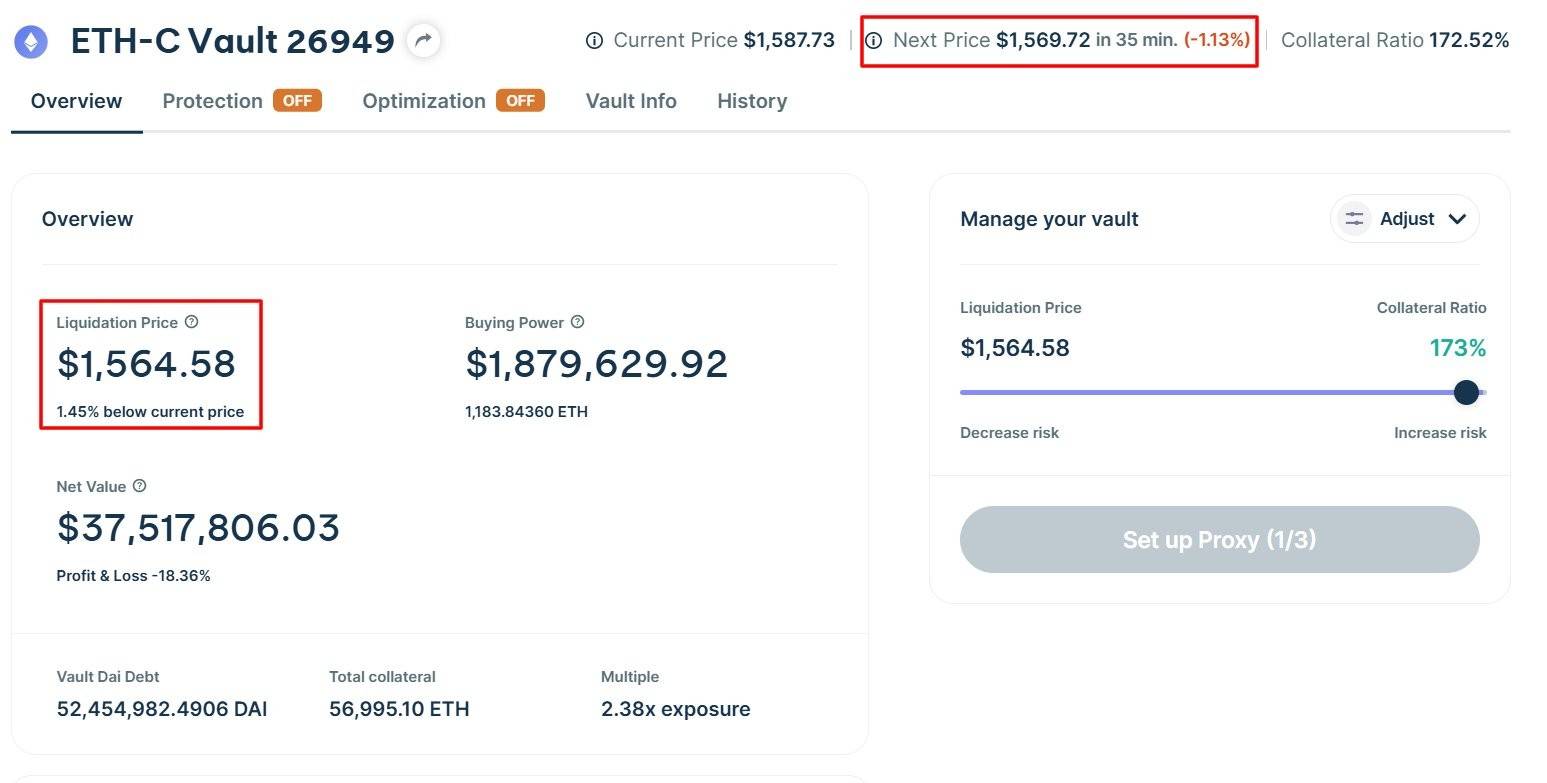

💥BREAKING:

Whale just got liquidated for a whopping $106M after supplying $67,569 $ETH at $1,650 to repay a $74.49M $DAI loan.

https://pro.summer.fi/ethe...

And it's not just them! Whale 2 is also on the verge of liquidation, having supplied 56,995 $WETH ($90M) to borrow $DAI at a liquidation price of $1,564.58.

https://pro.summer.fi/ethe...

The crypto market is getting intense! Stay vigilant and protect your assets! #cryptocurrency #whale #Liquidation

Whale just got liquidated for a whopping $106M after supplying $67,569 $ETH at $1,650 to repay a $74.49M $DAI loan.

https://pro.summer.fi/ethe...

And it's not just them! Whale 2 is also on the verge of liquidation, having supplied 56,995 $WETH ($90M) to borrow $DAI at a liquidation price of $1,564.58.

https://pro.summer.fi/ethe...

The crypto market is getting intense! Stay vigilant and protect your assets! #cryptocurrency #whale #Liquidation

2 months ago

🚨BREAKING: Onchain Lens reports two major Ethereum acquisitions!

1. '7 Sibling' invests $41.78M in USDC/USDT to buy 25,092 ETH at $1,665 avg price

2. Another new wallet spends $8.13M in DAI to acquire 4,983.56 ETH at $1,631 avg price

Source - https://x.com/OnchainLens/...

What's driving these massive buys? #ethereum #defi #cryptocurrency "

1. '7 Sibling' invests $41.78M in USDC/USDT to buy 25,092 ETH at $1,665 avg price

2. Another new wallet spends $8.13M in DAI to acquire 4,983.56 ETH at $1,631 avg price

Source - https://x.com/OnchainLens/...

What's driving these massive buys? #ethereum #defi #cryptocurrency "

2 months ago

🚩BREAKING: A significant Ethereum whale with 57,000 ETH is on the brink of liquidation at $1,564. This isn't the first time this whale has faced a similar situation, having previously held 67,500 ETH at a similar price point.

To avoid liquidation, they've already reduced their holdings, but their position remains at risk. A further reduction is needed to mitigate the risk of liquidation.

#ethereum #crypto #whale #LiquidationRisk

To avoid liquidation, they've already reduced their holdings, but their position remains at risk. A further reduction is needed to mitigate the risk of liquidation.

#ethereum #crypto #whale #LiquidationRisk

2 months ago

2 months ago

2 months ago

2 months ago

🚀 ATTENTION ETHEREUM HOLDERS! 🚀

Ethereum is surging once again! With ETH currently at $2,041.21 (+7.26%), the market is heating up fast. But now is NOT the time to be passive.

#ethereum

Ethereum is surging once again! With ETH currently at $2,041.21 (+7.26%), the market is heating up fast. But now is NOT the time to be passive.

#ethereum

3 months ago

[A whale with 67,000 ETH on the verge of liquidation] reduced his position by 2,882 ETH and exchanged it for 5.21 million DAI to repay the loan before the Oracle price update at 10 o'clock, which slightly reduced the liquidation price to $1,781.

At present, ETH has rebounded a bit, and the next oracle price is also higher than its liquidation price. At least, I can breathe a sigh of relief for the time being.

Current Position

- Original holdings: 67,000 ETH

- Position reduction: 2,882 ETH (approximately 4.3% of total holdings)

- DAI received: 5.21 million DAI

- New liquidation price: $1,781

- Current status: ETH price has rebounded above the liquidation price

According to coindesk.com, this case reflects broader market conditions:

Approximately $336 million in assets at risk of liquidation (within 20% ETH price range)

Multiple large positions in danger zones, including:

- $117 million in debt at $1,780 ETH liquidation price

- $13.6 million in debt at $1,857 ETH liquidation price

#ethereum #ether #ETH #whale

Source:

https://debank.com/profile...

At present, ETH has rebounded a bit, and the next oracle price is also higher than its liquidation price. At least, I can breathe a sigh of relief for the time being.

Current Position

- Original holdings: 67,000 ETH

- Position reduction: 2,882 ETH (approximately 4.3% of total holdings)

- DAI received: 5.21 million DAI

- New liquidation price: $1,781

- Current status: ETH price has rebounded above the liquidation price

According to coindesk.com, this case reflects broader market conditions:

Approximately $336 million in assets at risk of liquidation (within 20% ETH price range)

Multiple large positions in danger zones, including:

- $117 million in debt at $1,780 ETH liquidation price

- $13.6 million in debt at $1,857 ETH liquidation price

#ethereum #ether #ETH #whale

Source:

https://debank.com/profile...

3 months ago

🚨 A whale sold 25,800 ETH (worth $47.8 million) to avoid liquidation, taking a loss of over $32 million.

The whale still holds 35,034 ETH (valued at $64.68 million) on Aave, with a health rate of 1.4 and a liquidation price of approximately $1,316.

Total ETH sold: 25,800

Sale price: $1,853 per ETH

Original purchase price: $3,084 (July 2024)

Total realized loss: $31.75 million

https://debank.com/profile...

#ethereum #ether #ETH #whale

The whale still holds 35,034 ETH (valued at $64.68 million) on Aave, with a health rate of 1.4 and a liquidation price of approximately $1,316.

Total ETH sold: 25,800

Sale price: $1,853 per ETH

Original purchase price: $3,084 (July 2024)

Total realized loss: $31.75 million

https://debank.com/profile...

#ethereum #ether #ETH #whale

3 months ago

The Ethereum Foundation deposited 30,098 ETH (worth approximately $56.08 million) into Maker five hours ago to reduce liquidation risk.

The total holdings of this wallet on Maker have now reached 100,394 ETH (approximately $182 million). The latest liquidation price has dropped to $1,127.06.

Source: https://intel.arkm.com/exp...

https://pro.summer.fi/ethe...

#ethereum #ether #ETH #Maker

The total holdings of this wallet on Maker have now reached 100,394 ETH (approximately $182 million). The latest liquidation price has dropped to $1,127.06.

Source: https://intel.arkm.com/exp...

https://pro.summer.fi/ethe...

#ethereum #ether #ETH #Maker

3 months ago

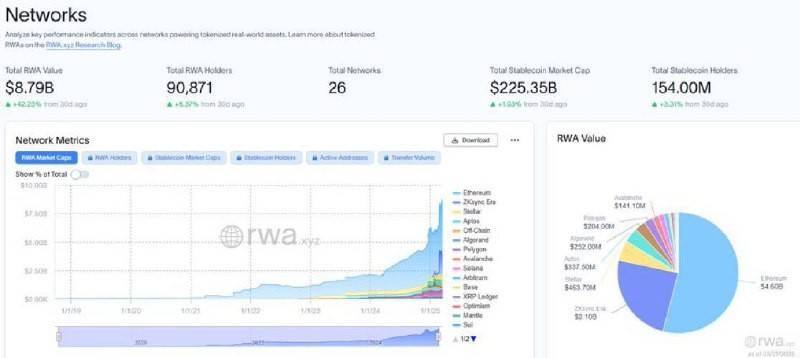

Ethereum Faces $1.28 Billion in Potential On-Chain Liquidation at $1,919

Data from #DeFiLlama shows that Ethereum is at risk of an on-chain liquidation totaling $128 million if its price hits $1,919.266. The bulk of this liquidation, approximately $127.8 million, is linked to the MakerDAO protocol.

#ethereum

Data from #DeFiLlama shows that Ethereum is at risk of an on-chain liquidation totaling $128 million if its price hits $1,919.266. The bulk of this liquidation, approximately $127.8 million, is linked to the MakerDAO protocol.

#ethereum

3 months ago

Ethereum experienced a significant price drop, decreasing by 16.47% to a value of $2110.01. This represents a substantial downturn in its market value.

#ethereum #pricedrop #Ethereumprice #Ethereumcrash

#ethereum #pricedrop #Ethereumprice #Ethereumcrash

3 months ago

There’s a buzz about whales—large investors holding significant amounts of ETH—adding 190,000 Ethereum to their holdings in the last 24 hours as of today, March 1, 2025. This aligns with a broader narrative of ongoing accumulation by big players in the Ethereum market.

The crypto market is a wild beast—fear and uncertainty are high right now, and whale moves don’t always guarantee immediate price pumps. ETH would need to break past resistance levels, like $2,500 or $2,800, to confirm any upward trend. On the flip side, sustained selling pressure could drag it lower.

The 190,000 ETH figure floating around today echoes earlier reports of whales grabbing 110,000 ETH over three days or 140,000 ETH in a single day last week, hinting at a consistent pattern since mid-February.

#cryptomarket #ethereum #ETH #whales

The crypto market is a wild beast—fear and uncertainty are high right now, and whale moves don’t always guarantee immediate price pumps. ETH would need to break past resistance levels, like $2,500 or $2,800, to confirm any upward trend. On the flip side, sustained selling pressure could drag it lower.

The 190,000 ETH figure floating around today echoes earlier reports of whales grabbing 110,000 ETH over three days or 140,000 ETH in a single day last week, hinting at a consistent pattern since mid-February.

#cryptomarket #ethereum #ETH #whales

Sponsored by

Administrator

11 months ago