17 days ago

🚨 BIG MOVEMENT ALERT 🚨

Trader James Wynn is currently holding a massive $1.26 billion LONG position in Bitcoin — one of the largest bets in the market right now.

👀 All eyes on the liquidation price: $105,179

Is this a moon mission or a margin call waiting to happen? Let’s see how this plays out.

#bitcoin #CryptoTrader #BTC #MarketWatch #JamesWynn #CryptoFutures #TradingLive

Trader James Wynn is currently holding a massive $1.26 billion LONG position in Bitcoin — one of the largest bets in the market right now.

👀 All eyes on the liquidation price: $105,179

Is this a moon mission or a margin call waiting to happen? Let’s see how this plays out.

#bitcoin #CryptoTrader #BTC #MarketWatch #JamesWynn #CryptoFutures #TradingLive

19 days ago

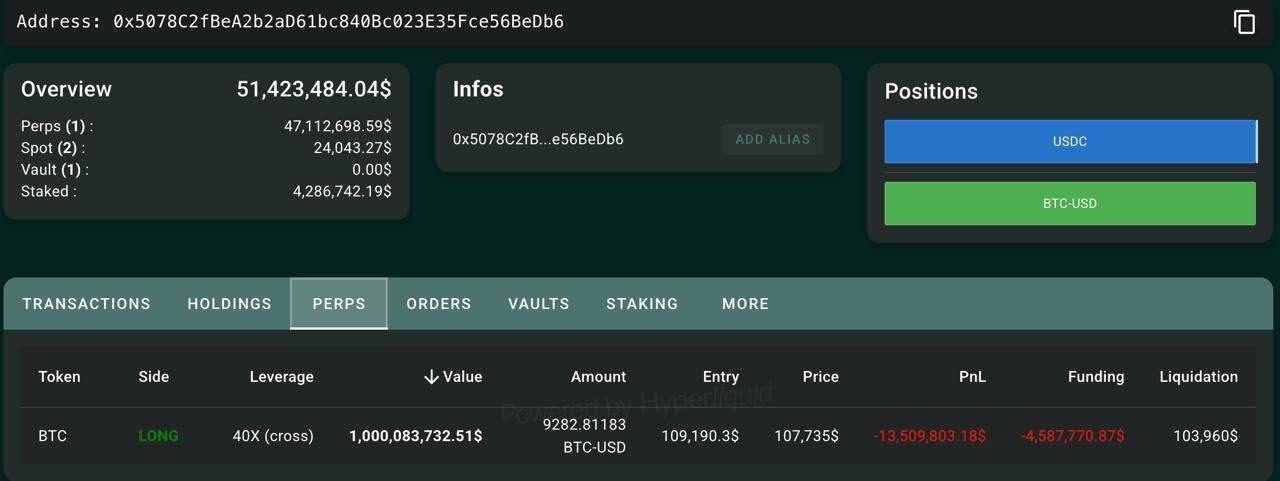

🚨 BREAKING:

THE 40X BITCOIN WHALE POSITION IS

NOW OVER $1 BILLION. HE'S SITTING

ON $18M IN UNREALIZED LOSS.

WHAT DO YOU THINK IS COMING NEXT?

HIS LIQUIDATION OR BTC NEW ATH?

THE 40X BITCOIN WHALE POSITION IS

NOW OVER $1 BILLION. HE'S SITTING

ON $18M IN UNREALIZED LOSS.

WHAT DO YOU THINK IS COMING NEXT?

HIS LIQUIDATION OR BTC NEW ATH?

21 days ago

Cryptocurrency Market Experiences Significant Liquidations

Data from Coinglass reveals that the cryptocurrency market witnessed substantial liquidations over the past 24 hours, totaling approximately $462 million.

Long positions accounted for $192 million of the liquidations, while short positions amounted to $269 million.

#bitcoin saw liquidations of $188 million, and #ethereum experienced $126 million in liquidations.

Data from Coinglass reveals that the cryptocurrency market witnessed substantial liquidations over the past 24 hours, totaling approximately $462 million.

Long positions accounted for $192 million of the liquidations, while short positions amounted to $269 million.

#bitcoin saw liquidations of $188 million, and #ethereum experienced $126 million in liquidations.

25 days ago

💥 BREAKING:

A whale just opened a $276 MILLION 40x long on #bitcoin .

Liquidation price? $95,000.

Let that sink in…

He knows something we don’t.

$BTC about to go wild? 🚀

A whale just opened a $276 MILLION 40x long on #bitcoin .

Liquidation price? $95,000.

Let that sink in…

He knows something we don’t.

$BTC about to go wild? 🚀

2 months ago

A whale has borrowed $34.75M $USDT to buy 19,973.34 $ETH at a price of $1,740 per ETH.

The same #whale sold 30,894 $ETH ($55.63M) to avoid liquidation, incurring a loss of ~$40M.

Currently, the whale's liquidation price is $1,586.80.

Address: 0xa339d279e0a14BexZMoP1gqvSbLZSfYigjUvfcXkroScK

The same #whale sold 30,894 $ETH ($55.63M) to avoid liquidation, incurring a loss of ~$40M.

Currently, the whale's liquidation price is $1,586.80.

Address: 0xa339d279e0a14BexZMoP1gqvSbLZSfYigjUvfcXkroScK

2 months ago

Mantra has issued a statement regarding the unexpected significant drop in the price of its OM token. The statement clarifies that the Mantra team has not engaged in any selling activities. The funds of the Mantra mainnet OM team and advisory team remain 100% locked, while the ERC-20 tokens are publicly circulating and not under team control. Currently, 77.5 million OM tokens are in circulation, with over 200,000 mainnet OM wallets.

The initial forced liquidation sales exerted downward pressure on the price, triggering automatic liquidation events on exchanges for leveraged positions using OM as collateral. This led to further liquidation and collateral seizure, adding additional downward pressure. Some major OM traders were liquidated by centralized exchanges.

Mantra plans to release details of an OM Token support plan, which will include a token buyback and supply destruction strategy. Mantra CEO John Patrick Mullin has publicly committed to destroying the tokens allocated to his team.

https://www.mantrachain.io...

The initial forced liquidation sales exerted downward pressure on the price, triggering automatic liquidation events on exchanges for leveraged positions using OM as collateral. This led to further liquidation and collateral seizure, adding additional downward pressure. Some major OM traders were liquidated by centralized exchanges.

Mantra plans to release details of an OM Token support plan, which will include a token buyback and supply destruction strategy. Mantra CEO John Patrick Mullin has publicly committed to destroying the tokens allocated to his team.

https://www.mantrachain.io...

2 months ago

"MANTRA community - we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team. We are looking into it and will share more details about what happened as soon as we can."

Link: https://x.com/MANTRA_Chain...

Link: https://x.com/MANTRA_Chain...

2 months ago

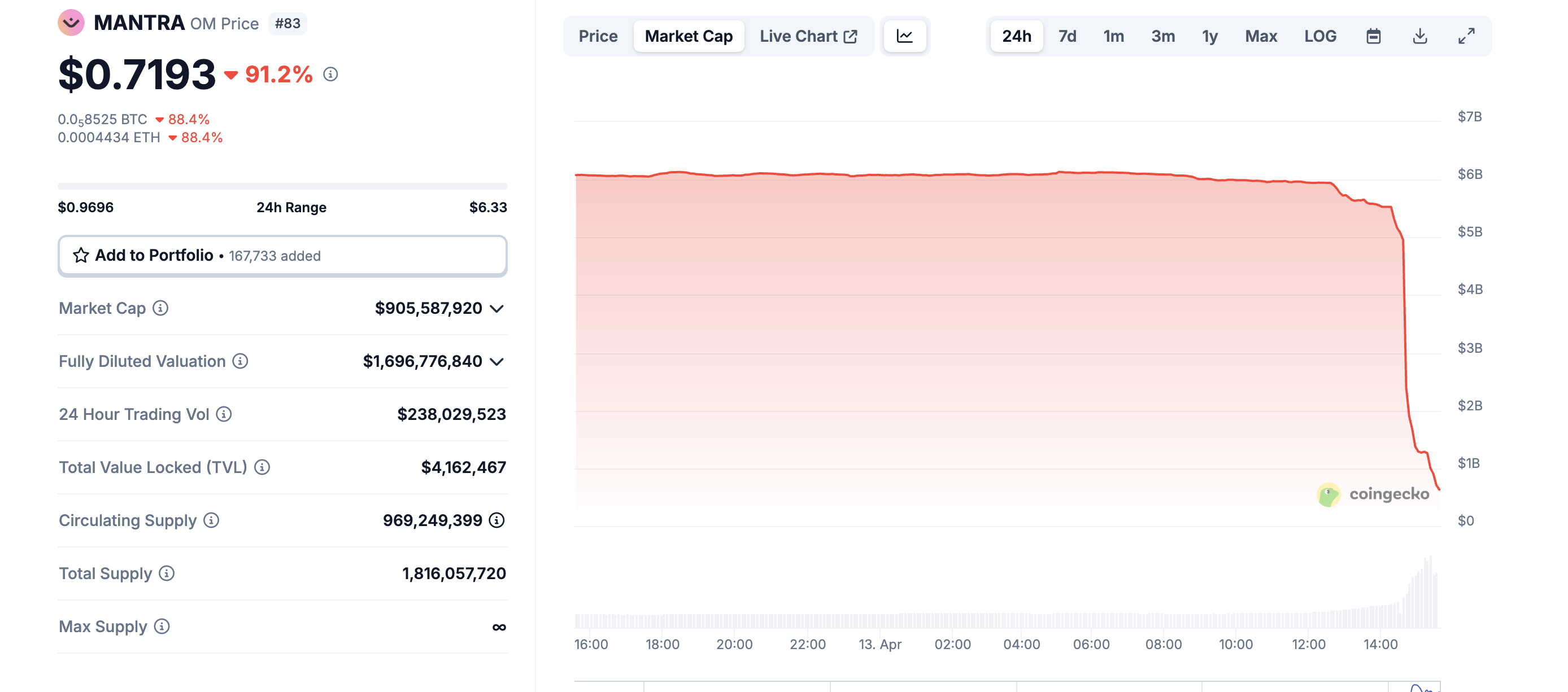

📊 NEW: MANTRA token price fell by over 90% in the last 24 hours.

Mantra co-founder JP Mullin addresses the OM token crash, confirming their Telegram remains active and team tokens haven't been moved. Its team claimed that the price crash was "triggered by reckless liquidations" and not related to the team.

Mantra co-founder JP Mullin addresses the OM token crash, confirming their Telegram remains active and team tokens haven't been moved. Its team claimed that the price crash was "triggered by reckless liquidations" and not related to the team.

2 months ago

(E)

🔴 Crypto Crash Triggered by Trump’s 104% Tariffs on China?!

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

2 months ago

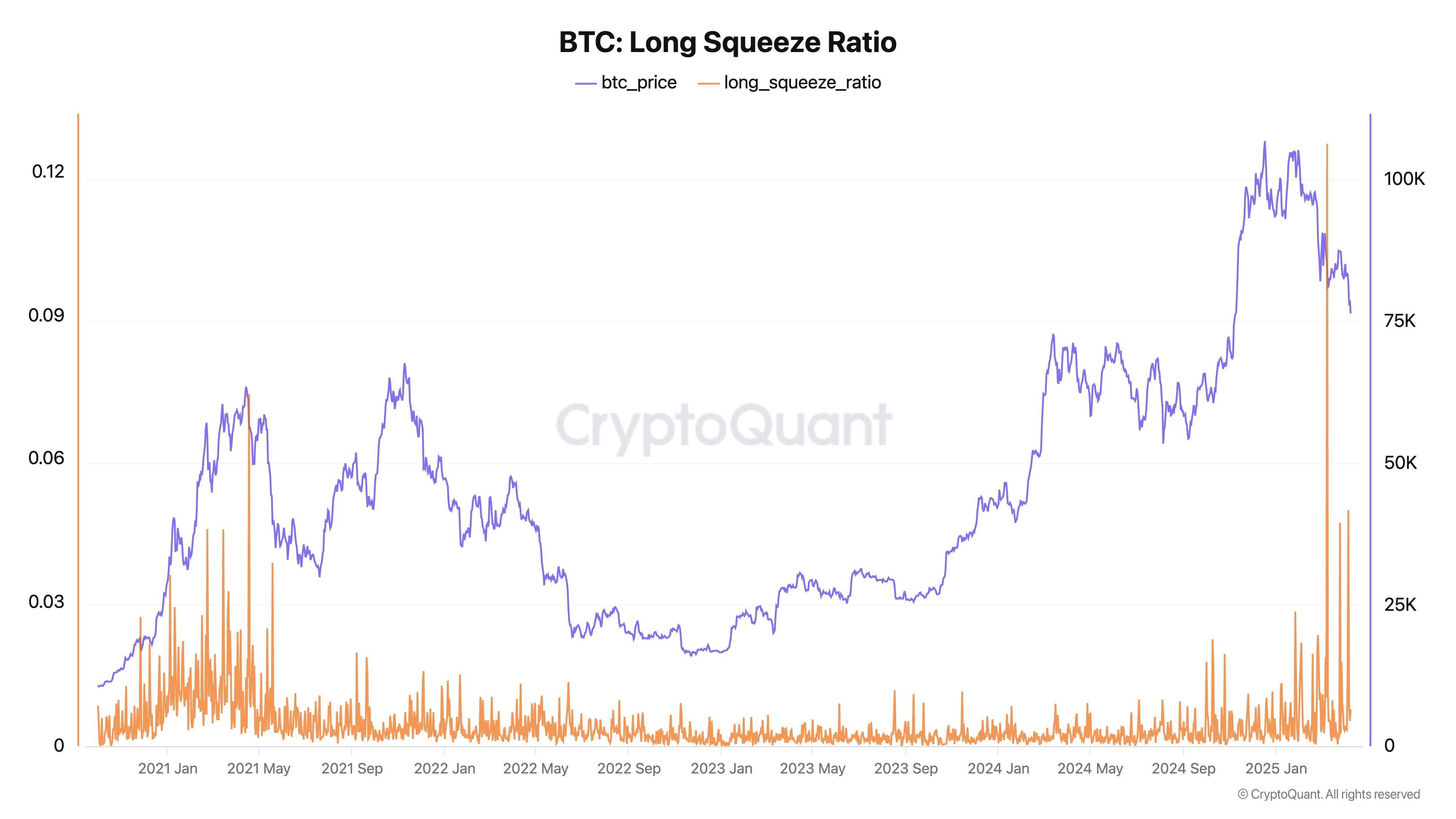

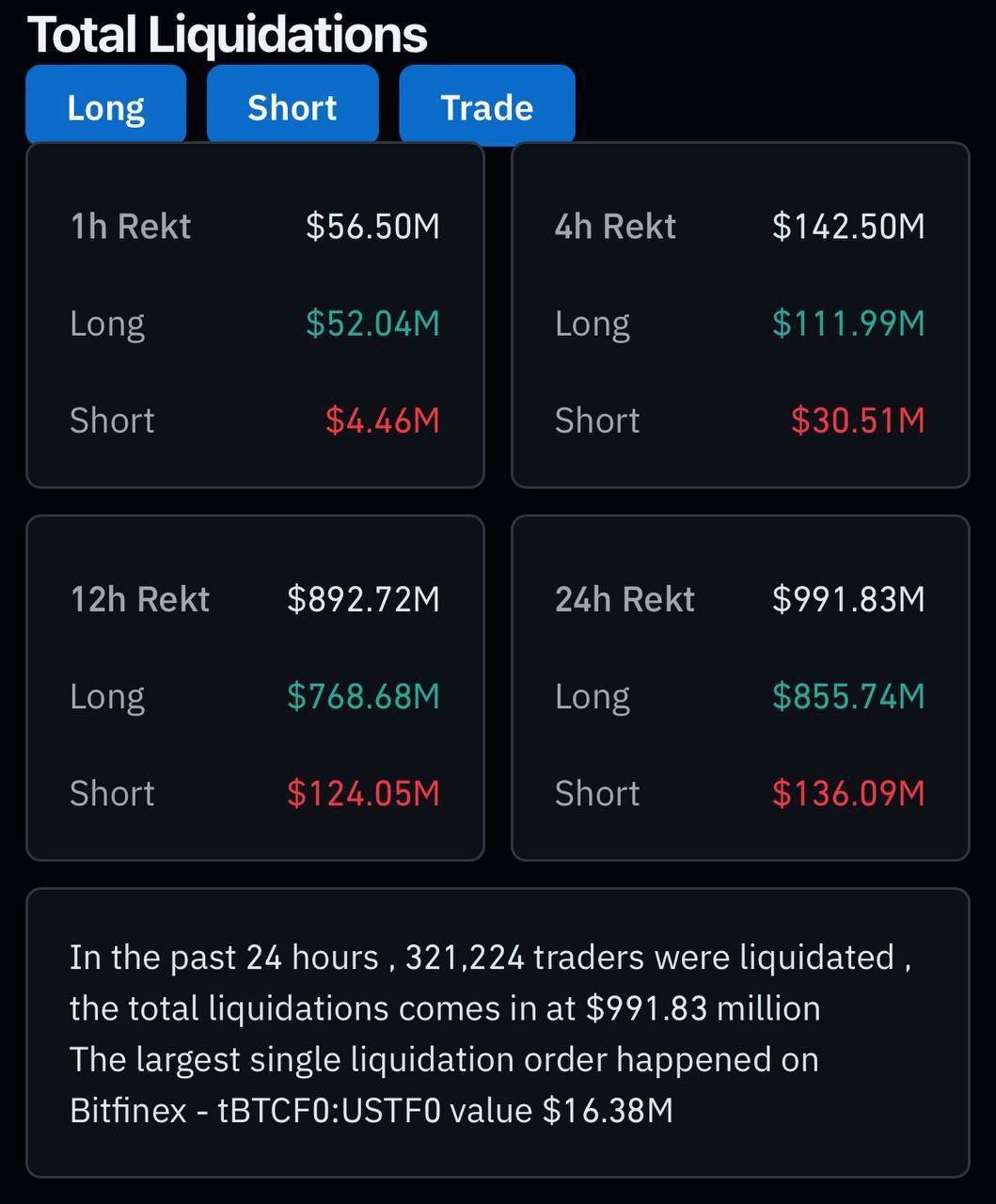

⚠️ Bitcoin Drops Below $80,000 – $1B in Liquidations

🩸 Bitcoin fell below the $80,000 mark on Sunday, triggering nearly $1 billion in liquidations. The drop came amid rising inflation concerns and overall weakness in global financial markets.

🔽 Roughly $885 million of the liquidations were from long positions, with over 321,000 traders liquidated in a single day. The broader crypto market saw a 2.45% decline, while Bitcoin still dominates with 62% market share.

📉 Meanwhile, the announcement of Trump-era tariffs wiped out $8.2 trillion from the stock market, surpassing losses seen in the worst week of the 2008 financial crisis.

#bitcoin #Liquidation #BitcoinLiquidation

🩸 Bitcoin fell below the $80,000 mark on Sunday, triggering nearly $1 billion in liquidations. The drop came amid rising inflation concerns and overall weakness in global financial markets.

🔽 Roughly $885 million of the liquidations were from long positions, with over 321,000 traders liquidated in a single day. The broader crypto market saw a 2.45% decline, while Bitcoin still dominates with 62% market share.

📉 Meanwhile, the announcement of Trump-era tariffs wiped out $8.2 trillion from the stock market, surpassing losses seen in the worst week of the 2008 financial crisis.

#bitcoin #Liquidation #BitcoinLiquidation

2 months ago

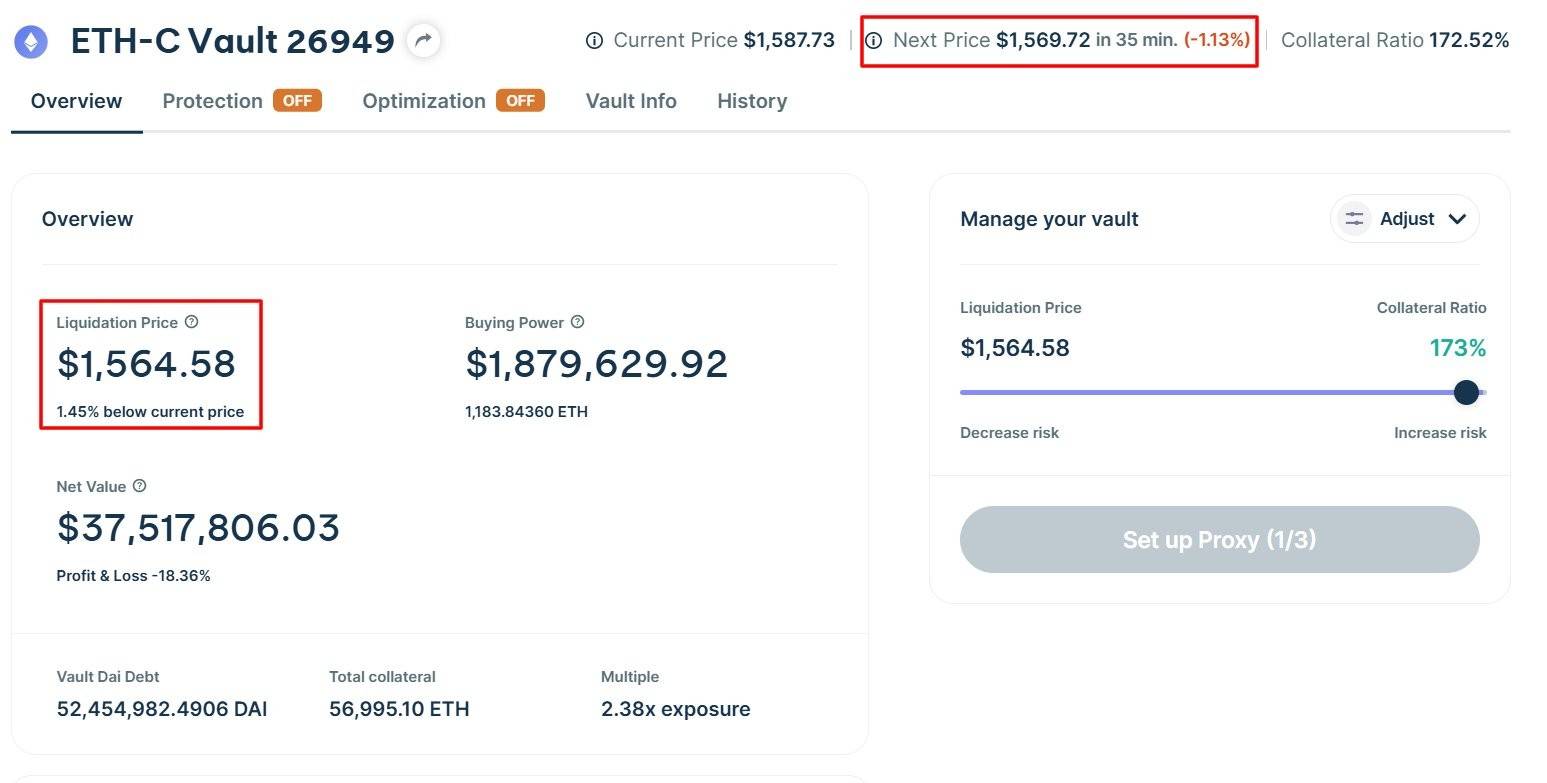

💥BREAKING:

Whale just got liquidated for a whopping $106M after supplying $67,569 $ETH at $1,650 to repay a $74.49M $DAI loan.

https://pro.summer.fi/ethe...

And it's not just them! Whale 2 is also on the verge of liquidation, having supplied 56,995 $WETH ($90M) to borrow $DAI at a liquidation price of $1,564.58.

https://pro.summer.fi/ethe...

The crypto market is getting intense! Stay vigilant and protect your assets! #cryptocurrency #whale #Liquidation

Whale just got liquidated for a whopping $106M after supplying $67,569 $ETH at $1,650 to repay a $74.49M $DAI loan.

https://pro.summer.fi/ethe...

And it's not just them! Whale 2 is also on the verge of liquidation, having supplied 56,995 $WETH ($90M) to borrow $DAI at a liquidation price of $1,564.58.

https://pro.summer.fi/ethe...

The crypto market is getting intense! Stay vigilant and protect your assets! #cryptocurrency #whale #Liquidation

2 months ago

🚩BREAKING: A significant Ethereum whale with 57,000 ETH is on the brink of liquidation at $1,564. This isn't the first time this whale has faced a similar situation, having previously held 67,500 ETH at a similar price point.

To avoid liquidation, they've already reduced their holdings, but their position remains at risk. A further reduction is needed to mitigate the risk of liquidation.

#ethereum #crypto #whale #LiquidationRisk

To avoid liquidation, they've already reduced their holdings, but their position remains at risk. A further reduction is needed to mitigate the risk of liquidation.

#ethereum #crypto #whale #LiquidationRisk

2 months ago

The past four hours have seen significant liquidations across the global market, totaling $125 million.

Of this amount, long positions accounted for $120 million, while short positions experienced liquidations of $4.8771 million. The data highlights the volatility and rapid changes in the market dynamics.

Of this amount, long positions accounted for $120 million, while short positions experienced liquidations of $4.8771 million. The data highlights the volatility and rapid changes in the market dynamics.

3 months ago

According to Coinglass data, Bitcoin’s price movement is approaching high-impact liquidation zones on mainstream centralized exchanges (CEXs).

💡Key Liquidation Levels:

1. If Bitcoin surpasses $88,000, short orders worth $371 million could be liquidated across major CEXs.

2. If Bitcoin drops below $84,000, long orders worth $422 million could face liquidation.

💡Understanding the Liquidation Chart:

1. The liquidation chart does not indicate the exact number of contracts or their value but rather the relative importance of each liquidation cluster.

2. Larger liquidation columns signal a higher likelihood of significant price movements when Bitcoin reaches a particular level.

3. The stronger the liquidation cluster, the more volatile Bitcoin’s price reaction is expected to be.

#bitcoin #Liquidation #CEX

💡Key Liquidation Levels:

1. If Bitcoin surpasses $88,000, short orders worth $371 million could be liquidated across major CEXs.

2. If Bitcoin drops below $84,000, long orders worth $422 million could face liquidation.

💡Understanding the Liquidation Chart:

1. The liquidation chart does not indicate the exact number of contracts or their value but rather the relative importance of each liquidation cluster.

2. Larger liquidation columns signal a higher likelihood of significant price movements when Bitcoin reaches a particular level.

3. The stronger the liquidation cluster, the more volatile Bitcoin’s price reaction is expected to be.

#bitcoin #Liquidation #CEX

3 months ago

Data from Coinglass reveals that the total liquidations across the network amounted to $239 million over the past 12 hours. Of this, short positions accounted for $175 million.

#Liquidation

#Liquidation

3 months ago

A massive $521 million Bitcoin short position held by a trader on the platform Hyperliquid is drawing attention from other traders.

These traders are attempting to force a liquidation, a move that could have significant implications for the market, potentially driving up Bitcoin prices as short positions are reversed.

#bitcoin

These traders are attempting to force a liquidation, a move that could have significant implications for the market, potentially driving up Bitcoin prices as short positions are reversed.

#bitcoin

3 months ago

Cryptocurrency Market Experiences $178 Million in Liquidations

Recent data from Coinglass indicates that the cryptocurrency market experienced liquidations totaling $178 million in the past 24 hours. Of this total, long positions accounted for $126 million, while short positions amounted to $51.63 million. Specifically, Bitcoin (BTC) had liquidations of $36.22 million, and Ethereum (ETH) saw $33.48 million in liquidations.

#cryptocurrency #ethereum #bitcoin #Coinglass #liquidations

Recent data from Coinglass indicates that the cryptocurrency market experienced liquidations totaling $178 million in the past 24 hours. Of this total, long positions accounted for $126 million, while short positions amounted to $51.63 million. Specifically, Bitcoin (BTC) had liquidations of $36.22 million, and Ethereum (ETH) saw $33.48 million in liquidations.

#cryptocurrency #ethereum #bitcoin #Coinglass #liquidations

3 months ago

$BTC

Short Liquidation Alert!

A massive $53,823 short liquidation just hit at $84,362.5! This shows sellers are getting liquidated, and bulls are stepping in with power. If #bitcoin holds above $84,000, we could see a big upward push soon.

What’s Next?

Buy Zone: $83,800 - $84,300

Entry: $84,000

Target 1: $85,800

Target 2: $87,500

Stop Loss: $83,200

Trade smart! Always manage your risk. This is not financial advice. Do your own research before making any moves.

Short Liquidation Alert!

A massive $53,823 short liquidation just hit at $84,362.5! This shows sellers are getting liquidated, and bulls are stepping in with power. If #bitcoin holds above $84,000, we could see a big upward push soon.

What’s Next?

Buy Zone: $83,800 - $84,300

Entry: $84,000

Target 1: $85,800

Target 2: $87,500

Stop Loss: $83,200

Trade smart! Always manage your risk. This is not financial advice. Do your own research before making any moves.

3 months ago

[A whale with 67,000 ETH on the verge of liquidation] reduced his position by 2,882 ETH and exchanged it for 5.21 million DAI to repay the loan before the Oracle price update at 10 o'clock, which slightly reduced the liquidation price to $1,781.

At present, ETH has rebounded a bit, and the next oracle price is also higher than its liquidation price. At least, I can breathe a sigh of relief for the time being.

Current Position

- Original holdings: 67,000 ETH

- Position reduction: 2,882 ETH (approximately 4.3% of total holdings)

- DAI received: 5.21 million DAI

- New liquidation price: $1,781

- Current status: ETH price has rebounded above the liquidation price

According to coindesk.com, this case reflects broader market conditions:

Approximately $336 million in assets at risk of liquidation (within 20% ETH price range)

Multiple large positions in danger zones, including:

- $117 million in debt at $1,780 ETH liquidation price

- $13.6 million in debt at $1,857 ETH liquidation price

#ethereum #ether #ETH #whale

Source:

https://debank.com/profile...

At present, ETH has rebounded a bit, and the next oracle price is also higher than its liquidation price. At least, I can breathe a sigh of relief for the time being.

Current Position

- Original holdings: 67,000 ETH

- Position reduction: 2,882 ETH (approximately 4.3% of total holdings)

- DAI received: 5.21 million DAI

- New liquidation price: $1,781

- Current status: ETH price has rebounded above the liquidation price

According to coindesk.com, this case reflects broader market conditions:

Approximately $336 million in assets at risk of liquidation (within 20% ETH price range)

Multiple large positions in danger zones, including:

- $117 million in debt at $1,780 ETH liquidation price

- $13.6 million in debt at $1,857 ETH liquidation price

#ethereum #ether #ETH #whale

Source:

https://debank.com/profile...

3 months ago

🚨 A whale sold 25,800 ETH (worth $47.8 million) to avoid liquidation, taking a loss of over $32 million.

The whale still holds 35,034 ETH (valued at $64.68 million) on Aave, with a health rate of 1.4 and a liquidation price of approximately $1,316.

Total ETH sold: 25,800

Sale price: $1,853 per ETH

Original purchase price: $3,084 (July 2024)

Total realized loss: $31.75 million

https://debank.com/profile...

#ethereum #ether #ETH #whale

The whale still holds 35,034 ETH (valued at $64.68 million) on Aave, with a health rate of 1.4 and a liquidation price of approximately $1,316.

Total ETH sold: 25,800

Sale price: $1,853 per ETH

Original purchase price: $3,084 (July 2024)

Total realized loss: $31.75 million

https://debank.com/profile...

#ethereum #ether #ETH #whale

3 months ago

The Ethereum Foundation deposited 30,098 ETH (worth approximately $56.08 million) into Maker five hours ago to reduce liquidation risk.

The total holdings of this wallet on Maker have now reached 100,394 ETH (approximately $182 million). The latest liquidation price has dropped to $1,127.06.

Source: https://intel.arkm.com/exp...

https://pro.summer.fi/ethe...

#ethereum #ether #ETH #Maker

The total holdings of this wallet on Maker have now reached 100,394 ETH (approximately $182 million). The latest liquidation price has dropped to $1,127.06.

Source: https://intel.arkm.com/exp...

https://pro.summer.fi/ethe...

#ethereum #ether #ETH #Maker

3 months ago

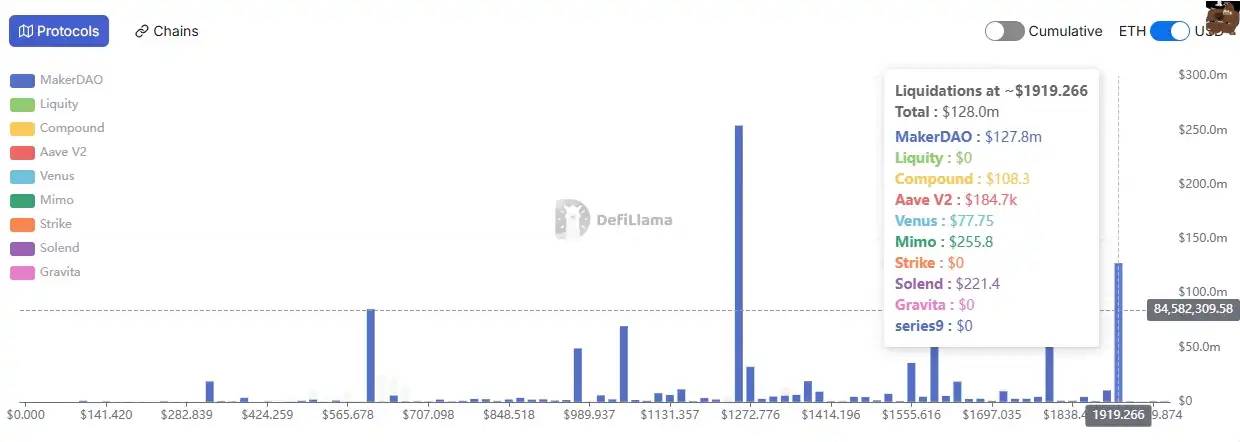

Ethereum Faces $1.28 Billion in Potential On-Chain Liquidation at $1,919

Data from #DeFiLlama shows that Ethereum is at risk of an on-chain liquidation totaling $128 million if its price hits $1,919.266. The bulk of this liquidation, approximately $127.8 million, is linked to the MakerDAO protocol.

#ethereum

Data from #DeFiLlama shows that Ethereum is at risk of an on-chain liquidation totaling $128 million if its price hits $1,919.266. The bulk of this liquidation, approximately $127.8 million, is linked to the MakerDAO protocol.

#ethereum

3 months ago

(E)

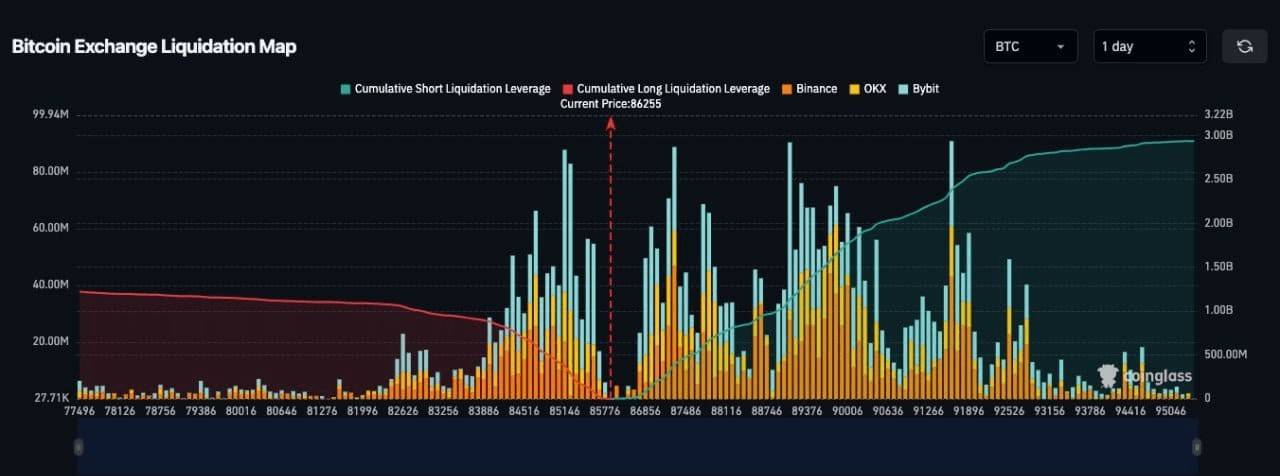

🚨 Bitcoin Liquidation Alert: Massive Short Squeeze Incoming

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

3 months ago

#bitcoin and #altcoins experienced a significant rebound, leading to nearly $1 billion in liquidations in the #crypto market.

The graph shows that Bitcoin nearly reached the $95,000 mark during its surge, but it has since experienced a slight pullback to $92,800. Ethereum has followed a similar trend; however, its decline from $2,550 to $2,360 has been noticeably larger than that of Bitcoin.

In terms of the individual symbols, Bitcoin and #ethereum have predictably come out on top with $353 million and $182 million in liquidations, respectively.

The graph shows that Bitcoin nearly reached the $95,000 mark during its surge, but it has since experienced a slight pullback to $92,800. Ethereum has followed a similar trend; however, its decline from $2,550 to $2,360 has been noticeably larger than that of Bitcoin.

In terms of the individual symbols, Bitcoin and #ethereum have predictably come out on top with $353 million and $182 million in liquidations, respectively.

Sponsored by

Administrator

12 months ago