1 day ago

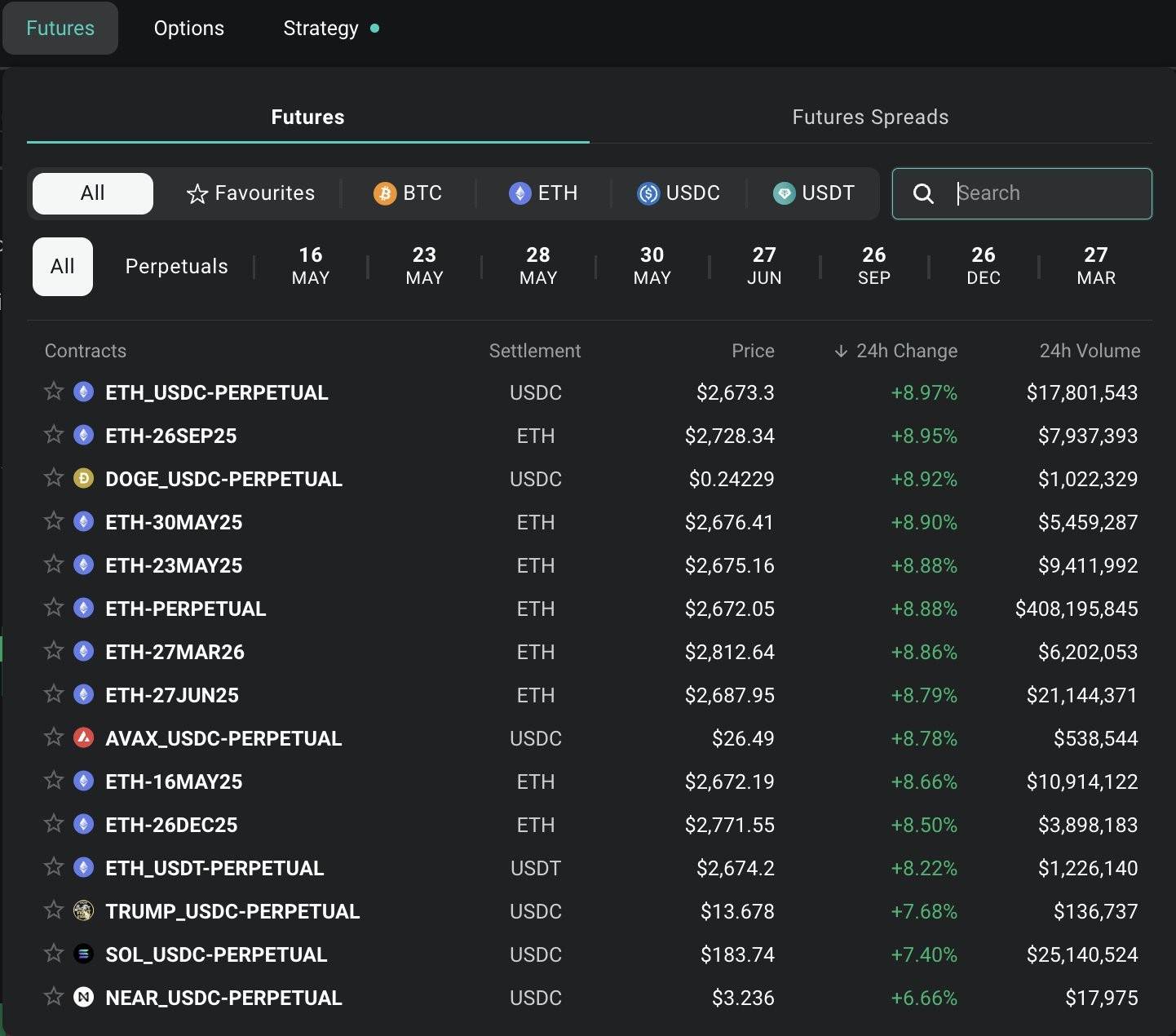

🔥 ETH Futures Are On Fire Across the Curve 💥

📈 +9% Gains on Most Contracts

🌊 Over $400M 24H Volume on Perpetuals

The bulls are charging hard. Are you ready for what’s next?

#ethereum #cryptomarket #ETHFutures #TradingAction

📈 +9% Gains on Most Contracts

🌊 Over $400M 24H Volume on Perpetuals

The bulls are charging hard. Are you ready for what’s next?

#ethereum #cryptomarket #ETHFutures #TradingAction

1 day ago

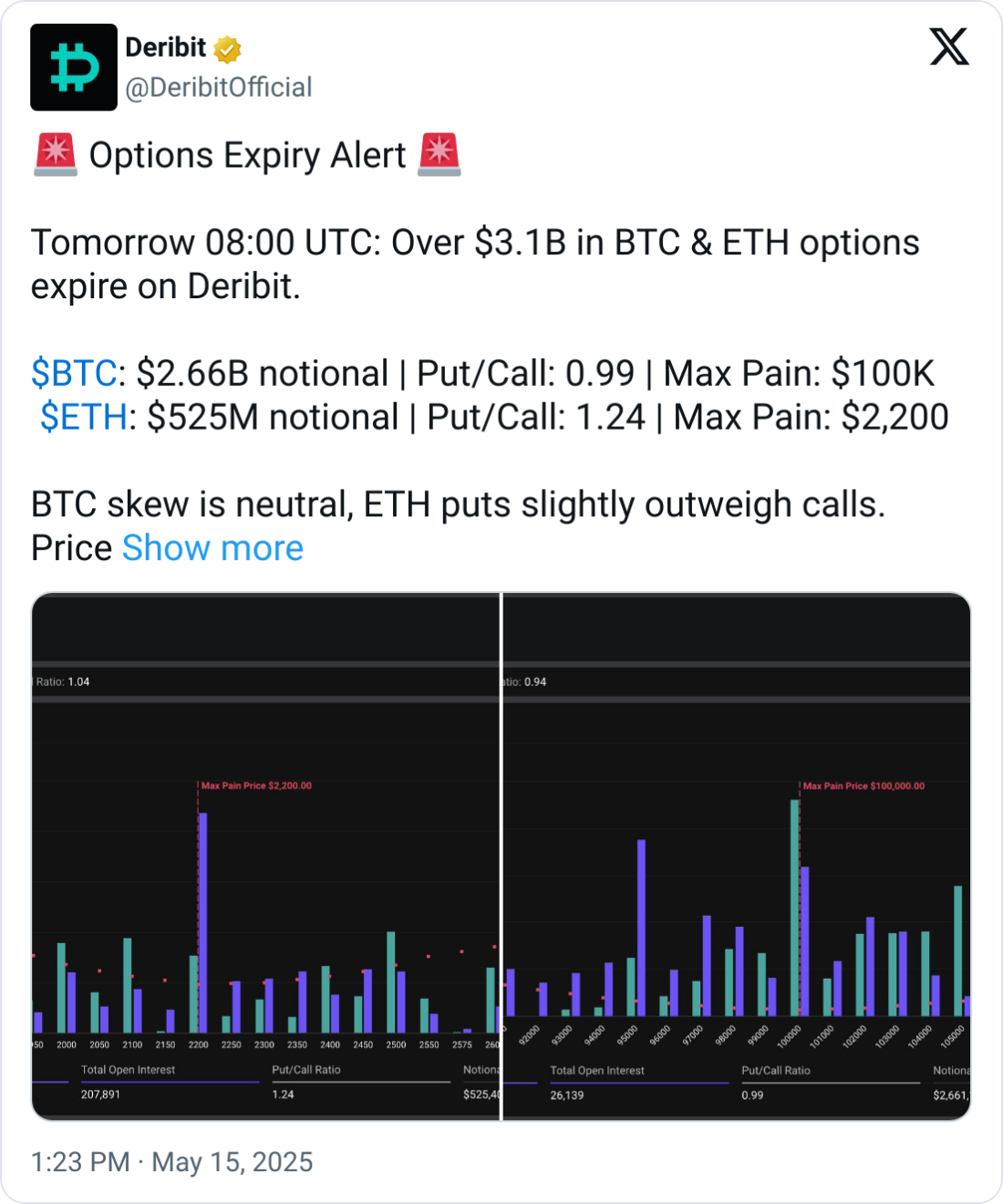

🚨 Bitcoin & Ethereum Alert! 🚨

🔥 $3.2B worth of BTC & ETH options are expiring today! Market volatility is expected to spike as traders react.

📉 Max Pain Prices:

- Bitcoin: $100K

- Ethereum: $2,200

💰 Bitcoin briefly surpassed $100K but is facing resistance near $105K. Could we see a correction or further upside? 🤔

📊 Investors are adjusting strategies—taking profits, shifting to defensive positions, and eyeing key strike prices.

🚀 Altcoins are mixed: DOGE, LINK & AVAX trending lower, while BNB & SUI see gains.

Stay tuned—this could be a pivotal moment for the crypto market! 💎🔥

#bitcoin #ethereum #cryptonews #MarketTrends #BTC #ETH

🔥 $3.2B worth of BTC & ETH options are expiring today! Market volatility is expected to spike as traders react.

📉 Max Pain Prices:

- Bitcoin: $100K

- Ethereum: $2,200

💰 Bitcoin briefly surpassed $100K but is facing resistance near $105K. Could we see a correction or further upside? 🤔

📊 Investors are adjusting strategies—taking profits, shifting to defensive positions, and eyeing key strike prices.

🚀 Altcoins are mixed: DOGE, LINK & AVAX trending lower, while BNB & SUI see gains.

Stay tuned—this could be a pivotal moment for the crypto market! 💎🔥

#bitcoin #ethereum #cryptonews #MarketTrends #BTC #ETH

1 day ago

🚀 Tether Launches Decentralized AI Platform QVAC 🚀

Tether, the company behind USDT, is shaking up the AI landscape with **QVAC**—a decentralized platform that prioritizes **privacy** and **autonomy** by running AI applications **directly on users' devices** instead of relying on the cloud. 🌐

💡 Key Features:

✔ No reliance on centralized servers

✔ Enhanced privacy—data stays with users

✔ AI-powered tools like real-time transcription & media translation

✔ Crypto integration—AI agents can transact using #bitcoin & #USDT

With its new **Wallet Development Kit**, Tether is enabling AI-driven payments, further expanding its footprint beyond stablecoins.

📢 What do you think? Is decentralization the future of AI?

#AI #Blockchain #Tether #PrivacyFirst #CryptoPayments #Web3 #bitcoin #USDT

Tether, the company behind USDT, is shaking up the AI landscape with **QVAC**—a decentralized platform that prioritizes **privacy** and **autonomy** by running AI applications **directly on users' devices** instead of relying on the cloud. 🌐

💡 Key Features:

✔ No reliance on centralized servers

✔ Enhanced privacy—data stays with users

✔ AI-powered tools like real-time transcription & media translation

✔ Crypto integration—AI agents can transact using #bitcoin & #USDT

With its new **Wallet Development Kit**, Tether is enabling AI-driven payments, further expanding its footprint beyond stablecoins.

📢 What do you think? Is decentralization the future of AI?

#AI #Blockchain #Tether #PrivacyFirst #CryptoPayments #Web3 #bitcoin #USDT

1 day ago

(E)

🚀 Altcoin Season on the Horizon as Bitcoin Nears All-Time High? 🚀

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

1 day ago

Addentax Group Corp. (NASDAQ: ATXG), a Chinese garment manufacturer and logistics services provider, has announced plans to acquire up to 8,000 Bitcoins and other cryptocurrencies, valued at approximately $800 million. However, it's crucial to note that this announcement comes with several important caveats and uncertainties.

Key Details-

1. Acquisition Plan: Up to 8,000 Bitcoins plus "Official Trump" tokens

2. Total Value: Approximately $800 million

3. Payment Method: Share issuance, not cash

4. Current Status: No definitive agreement reached yet.

Source - https://www.prnewswire.com...

Key Details-

1. Acquisition Plan: Up to 8,000 Bitcoins plus "Official Trump" tokens

2. Total Value: Approximately $800 million

3. Payment Method: Share issuance, not cash

4. Current Status: No definitive agreement reached yet.

Source - https://www.prnewswire.com...

1 day ago

(E)

🚀 BIG NEWS: Mastercard, serving 1.54 billion users , is enabling crypto payments across its network of 150 million merchants worldwide !

This is a MASSIVE step toward mainstream adoption. The future of digital money just got a whole lot closer. 💸✨

Source - https://www.mastercard.com...

#crypto #bitcoin #Mastercard #CBDC #futureofmoney #Blockchain #fintech

This is a MASSIVE step toward mainstream adoption. The future of digital money just got a whole lot closer. 💸✨

Source - https://www.mastercard.com...

#crypto #bitcoin #Mastercard #CBDC #futureofmoney #Blockchain #fintech

1 day ago

🚀 BREAKING: JPMorgan Just Made History!

JPMorgan has completed its FIRST-EVER transaction on a public blockchain — partnering with Chainlink and Ondo Finance in a $4 TRILLION deal.

This is MASSIVE.

The world’s biggest banks are officially stepping onto the blockchain. The future of finance isn’t coming… it’s HERE. 🔥

#BlockchainRevolution #Web3 #cryptonews #defi #JPMorgan #Chainlink #OndoFinance #FutureOfFinance

JPMorgan has completed its FIRST-EVER transaction on a public blockchain — partnering with Chainlink and Ondo Finance in a $4 TRILLION deal.

This is MASSIVE.

The world’s biggest banks are officially stepping onto the blockchain. The future of finance isn’t coming… it’s HERE. 🔥

#BlockchainRevolution #Web3 #cryptonews #defi #JPMorgan #Chainlink #OndoFinance #FutureOfFinance

2 days ago

SEC Delays Decision on 21Shares Polkadot Spot ETF

The U.S. Securities and Exchange Commission (SEC) has postponed its decision regarding the 21Shares Polkadot Spot Exchange-Traded Fund (ETF). The delay comes as the SEC continues to evaluate the proposal, which aims to offer investors exposure to Polkadot, a blockchain platform known for its interoperability and scalability features. The decision is part of the SEC's ongoing assessment of cryptocurrency-related financial products, reflecting the regulatory body's cautious approach to the rapidly evolving digital asset market. The postponement highlights the complexities involved in integrating cryptocurrency offerings into traditional financial systems, as the SEC seeks to ensure investor protection and market stability.

#SEC #ETF

The U.S. Securities and Exchange Commission (SEC) has postponed its decision regarding the 21Shares Polkadot Spot Exchange-Traded Fund (ETF). The delay comes as the SEC continues to evaluate the proposal, which aims to offer investors exposure to Polkadot, a blockchain platform known for its interoperability and scalability features. The decision is part of the SEC's ongoing assessment of cryptocurrency-related financial products, reflecting the regulatory body's cautious approach to the rapidly evolving digital asset market. The postponement highlights the complexities involved in integrating cryptocurrency offerings into traditional financial systems, as the SEC seeks to ensure investor protection and market stability.

#SEC #ETF

2 days ago

Tether's Blacklisting Delays Lead to $78 Million USDT Transfers

Blockchain compliance firm AMLBot has released a report highlighting delays in Tether's blacklisting process since 2017. These delays have allowed over $78 million in USDT to be transferred before the freeze could take effect. The issue arises from Tether's multi-signature contract mechanism on Ethereum and Tron, which requires two multi-signature transaction confirmations, resulting in an average delay of 44 minutes. During this window, attackers can monitor blacklist submission transactions in real-time and swiftly move assets to evade freezing measures. The report indicates that approximately 170 Tron addresses exploited this delay, with each address transferring nearly $290,000 on average before being officially blacklisted. This incident has raised concerns about the efficiency of Tether's compliance enforcement.

#ETH #USDT

Blockchain compliance firm AMLBot has released a report highlighting delays in Tether's blacklisting process since 2017. These delays have allowed over $78 million in USDT to be transferred before the freeze could take effect. The issue arises from Tether's multi-signature contract mechanism on Ethereum and Tron, which requires two multi-signature transaction confirmations, resulting in an average delay of 44 minutes. During this window, attackers can monitor blacklist submission transactions in real-time and swiftly move assets to evade freezing measures. The report indicates that approximately 170 Tron addresses exploited this delay, with each address transferring nearly $290,000 on average before being officially blacklisted. This incident has raised concerns about the efficiency of Tether's compliance enforcement.

#ETH #USDT

8 days ago

🚀 Ethereum Soars Over 20% to $2,400!

Fuelled by the successful #PectraUpgrade and easing global trade tensions, ETH is charging ahead — proving once again why it's a top player in the crypto space.

What’s your take? Is this the start of the next big bull run? 💬👇

#cryptonews #ethereum #ETH #Blockchain #cryptomarket

Fuelled by the successful #PectraUpgrade and easing global trade tensions, ETH is charging ahead — proving once again why it's a top player in the crypto space.

What’s your take? Is this the start of the next big bull run? 💬👇

#cryptonews #ethereum #ETH #Blockchain #cryptomarket

8 days ago

⚡ 🚀 Breaking: Florida-based pharma company Wellgistics is going all-in on #xrp for real-time payments in a $50M financing deal !

This move aims to:

✅ Eliminate banking delays

✅ Slash cross-border FX costs

✅ Supercharge supply chain efficiency

The future of finance is here — and it’s powered by blockchain. 💡💰

#ripple #fintech #Blockchain #SupplyChain #crypto

This move aims to:

✅ Eliminate banking delays

✅ Slash cross-border FX costs

✅ Supercharge supply chain efficiency

The future of finance is here — and it’s powered by blockchain. 💡💰

#ripple #fintech #Blockchain #SupplyChain #crypto

12 days ago

(E)

UK to Ban Borrowing for Crypto Purchases

New rules from the #FCA aim to curb risky financial behavior by stopping lenders from offering credit specifically for buying #cryptocurrencies .

Is this a step toward safer investing, or overreach? Let’s talk👇

#CryptoRegulation #bitcoin #FinanceNews #UKPolicy

🔗 Full story: https://www.ft.com/content...

New rules from the #FCA aim to curb risky financial behavior by stopping lenders from offering credit specifically for buying #cryptocurrencies .

Is this a step toward safer investing, or overreach? Let’s talk👇

#CryptoRegulation #bitcoin #FinanceNews #UKPolicy

🔗 Full story: https://www.ft.com/content...

12 days ago

President Trump is denying claims he's profiting from the TRUMP memecoin, despite reports linking significant earnings to wallets associated with his NFT collection.

The token, largely controlled by CIC Digital LLC and Fight Fight Fight LLC, has seen strong market activity, up 20% over the last month. Interestingly, the White House is planning a dinner with the top 220 $TRUMP token holders!

#Trump #crypto #memecoin #Politics

Read more: https://www.coindesk.com/p...

The token, largely controlled by CIC Digital LLC and Fight Fight Fight LLC, has seen strong market activity, up 20% over the last month. Interestingly, the White House is planning a dinner with the top 220 $TRUMP token holders!

#Trump #crypto #memecoin #Politics

Read more: https://www.coindesk.com/p...

President Trump Dismisses Claims of Profiting From TRUMP Token

The TRUMP token is up 20% over the last month, according to market data

https://www.coindesk.com/policy/2025/05/05/donald-trump-denies-claims-of-profiting-from-trump-token

12 days ago

🚀 Big news for Dogecoin enthusiasts! 🚀 Nasdaq has filed with the SEC to list the 21Shares Dogecoin ETF. 📈

21Shares has partnered with the House of Doge to track DOGE's performance using the CF DOGE-Dollar US Settlement Price Index. 💰 Coinbase Custody Trust will hold the fund’s tokens as the official custodian. 🔒

This ETF aims to provide a straightforward way to invest in Dogecoin without using leverage or derivatives. 🚫 Meanwhile, the SEC is still reviewing Bitwise’s spot DOGE ETF application, with a decision expected by June 15. 🤔

#dogecoin #DOGE #ETF #crypto #21Shares #Nasdaq

Read more here https://www.coindesk.com/m...

21Shares has partnered with the House of Doge to track DOGE's performance using the CF DOGE-Dollar US Settlement Price Index. 💰 Coinbase Custody Trust will hold the fund’s tokens as the official custodian. 🔒

This ETF aims to provide a straightforward way to invest in Dogecoin without using leverage or derivatives. 🚫 Meanwhile, the SEC is still reviewing Bitwise’s spot DOGE ETF application, with a decision expected by June 15. 🤔

#dogecoin #DOGE #ETF #crypto #21Shares #Nasdaq

Read more here https://www.coindesk.com/m...

DOGE News: Nasdaq Seeks SEC Approval to List 21Shares’ Dogecoin ETF

Coinbase Custody Trust will hold the fund’s tokens and serve as the official custodian for the ETF.

https://www.coindesk.com/markets/2025/04/30/nasdaq-seeks-sec-approval-to-list-21shares-dogecoin-etf

12 days ago

Bitcoin opened the week flat above $94,500, down 1.2%, as traders awaited updates on U.S.–China trade talks.

Read: https://www.coindesk.com/m...

Read: https://www.coindesk.com/m...

Bitcoin Price News: BTC Starts the Week Above $94K as Market Awaits Progress on China Trade Deal

BTC traders are cautiously optimistic that a deal can be reached and traders are taking a breather.

https://www.coindesk.com/markets/2025/05/05/bitcoin-hovers-above-94k-as-market-awaits-news-on-us-china-trade-deal

12 days ago

Maldives Could Soon Become a Crypto Hub Thanks to Dubai Family Office's $9B Commitment

A Dubai-based family office plans to invest up to $8.8 billion in a blockchain-focused financial hub in the Maldives, part of an effort by the island nation to expand beyond its reliance on tourism and fisheries and address mounting debt obligations.

Read - https://www.ft.com/content...

A Dubai-based family office plans to invest up to $8.8 billion in a blockchain-focused financial hub in the Maldives, part of an effort by the island nation to expand beyond its reliance on tourism and fisheries and address mounting debt obligations.

Read - https://www.ft.com/content...

Subscribe to read

Dubai-based family office plans financial zone for the Indian Ocean archipelago

https://www.ft.com/content/70cba9ec-caad-4958-bed9-59d43e8da6c2

13 days ago

The real Bitcoin Founder is suited in jail for life!

This is Paul Le Roux, the man who holds $64B in BTC

I researched all the interviews and leaked data

Here is the truth about BTC founder and what can be his next move🧵👇🏻

2/➫ Let's talk about Paul Le Roux

❍ Not just some coder - this guy was a genius who built encryption software, ran a global criminal empire, and might just be Satoshi Nakamoto

❍ Sounds wild? Let's dive into the facts👇

3/➫ A major clue appeared during the Kleiman v. Wright lawsuit

❍ Craig Wright oddly linked Le Roux’s Wikipedia page in an unredacted footnote labeled "Document 187."

❍ This unusual mention sparked immediate speculation that Wright knew something crucial about Le Roux's identity

4/➫ Following this revelation, an anonymous user leaked Le Roux’s Congo Republic ID card on 4chan

❍ It displays his full name as “Paul Soloci Calder Le Roux.”

❍ This middle name "Solotshi" closely mirrors "Satoshi," suggesting a deliberate hint

5/➫ The anonymous 4chan poster claimed Le Roux invented Bitcoin specifically for money laundering

❍ According to them, Bitcoin was the project of an "evil genius," designed to serve his criminal empire

❍ They noted his arrest in 2012 abruptly ended his Satoshi identity

6/➫ Le Roux’s technical expertise also aligns perfectly with Satoshi’s known skills

❍ He created E4M ("Encryption for the Masses"), an influential open-source encryption program

❍ A derivative called TrueCrypt was released later, though Le Roux denies involvement

7/➫ Further bolstering this connection is Le

This is Paul Le Roux, the man who holds $64B in BTC

I researched all the interviews and leaked data

Here is the truth about BTC founder and what can be his next move🧵👇🏻

2/➫ Let's talk about Paul Le Roux

❍ Not just some coder - this guy was a genius who built encryption software, ran a global criminal empire, and might just be Satoshi Nakamoto

❍ Sounds wild? Let's dive into the facts👇

3/➫ A major clue appeared during the Kleiman v. Wright lawsuit

❍ Craig Wright oddly linked Le Roux’s Wikipedia page in an unredacted footnote labeled "Document 187."

❍ This unusual mention sparked immediate speculation that Wright knew something crucial about Le Roux's identity

4/➫ Following this revelation, an anonymous user leaked Le Roux’s Congo Republic ID card on 4chan

❍ It displays his full name as “Paul Soloci Calder Le Roux.”

❍ This middle name "Solotshi" closely mirrors "Satoshi," suggesting a deliberate hint

5/➫ The anonymous 4chan poster claimed Le Roux invented Bitcoin specifically for money laundering

❍ According to them, Bitcoin was the project of an "evil genius," designed to serve his criminal empire

❍ They noted his arrest in 2012 abruptly ended his Satoshi identity

6/➫ Le Roux’s technical expertise also aligns perfectly with Satoshi’s known skills

❍ He created E4M ("Encryption for the Masses"), an influential open-source encryption program

❍ A derivative called TrueCrypt was released later, though Le Roux denies involvement

7/➫ Further bolstering this connection is Le

16 days ago

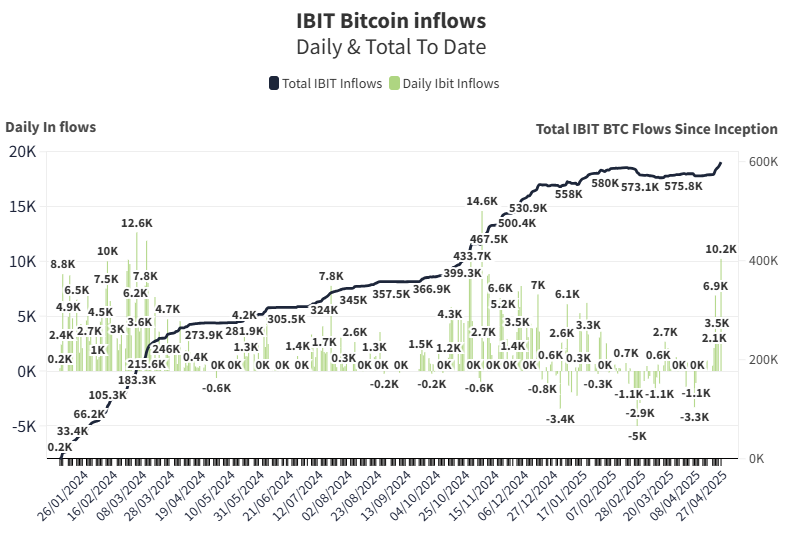

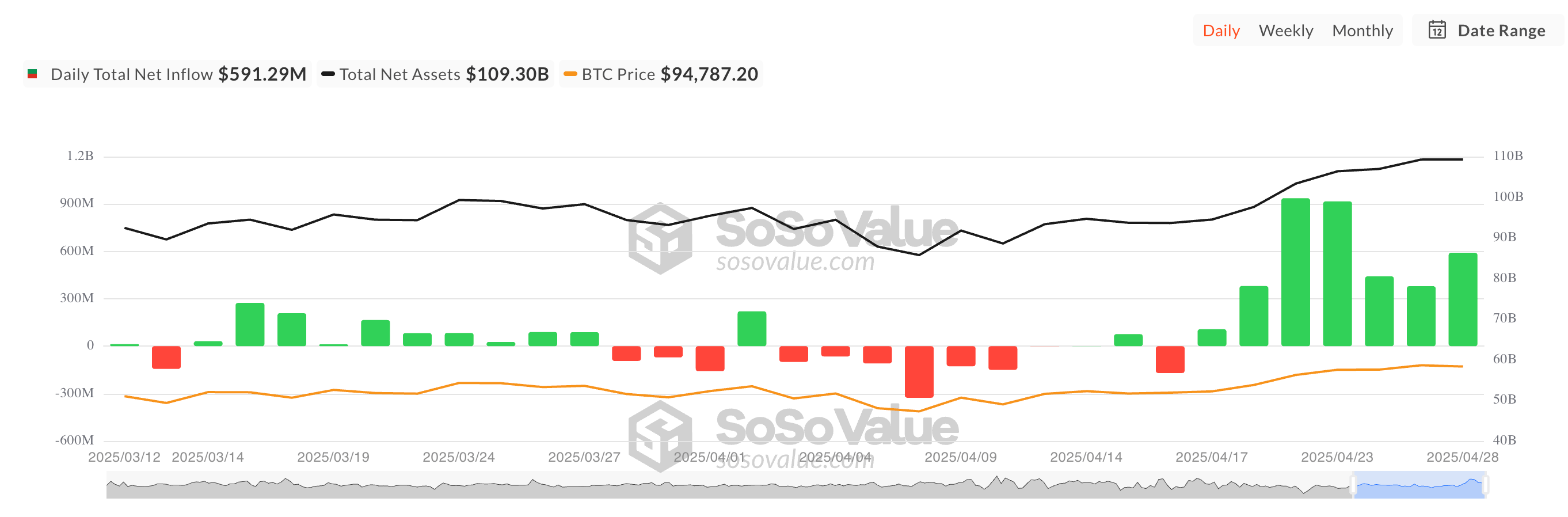

🚀 Bitcoin ETF Chart Pack Alert – Just dropped today on Bloomberg.

The momentum continues: Bitcoin ETFs have pulled in nearly $4 billion over 8 consecutive days of inflows. 🚨

Here’s a look at how the cumulative flows have evolved over time – the adoption train isn’t slowing down. ⏳📈

#bitcoin #ETF #CryptoInvesting #MarketUpdate #Bloomberg

The momentum continues: Bitcoin ETFs have pulled in nearly $4 billion over 8 consecutive days of inflows. 🚨

Here’s a look at how the cumulative flows have evolved over time – the adoption train isn’t slowing down. ⏳📈

#bitcoin #ETF #CryptoInvesting #MarketUpdate #Bloomberg

16 days ago

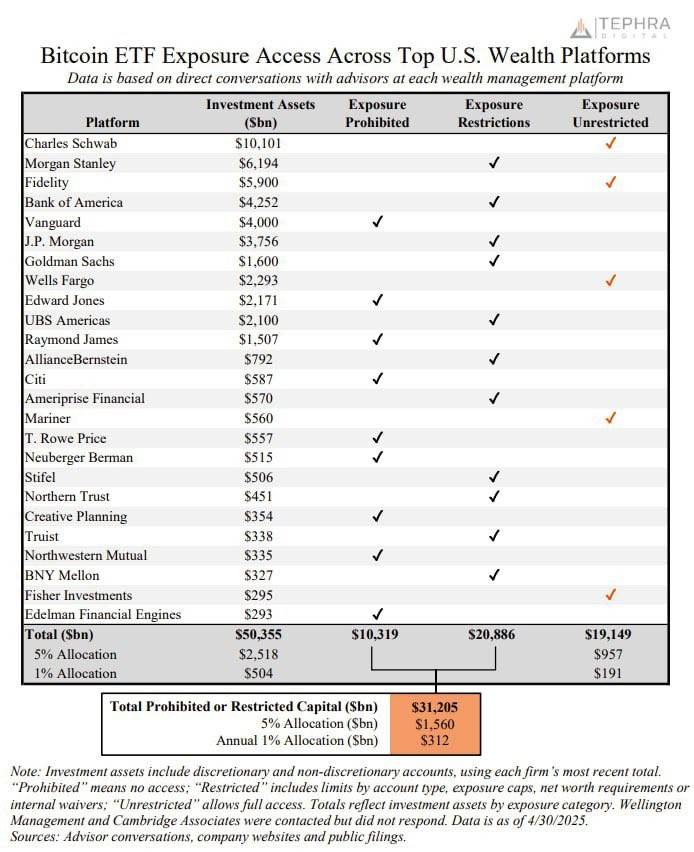

🚨 Breaking the Chains: Over $31 trillion in U.S. wealth platform capital is still RESTRICTED or PROHIBITED from accessing #BitcoinETFs .

Structural constraints are holding back inflows — but they’re also creating MAJOR opportunities.

This won’t last forever. The floodgates will open.

Data sourced directly from conversations with advisors at each platform. #crypto #bitcoin #Investing #ETF

Structural constraints are holding back inflows — but they’re also creating MAJOR opportunities.

This won’t last forever. The floodgates will open.

Data sourced directly from conversations with advisors at each platform. #crypto #bitcoin #Investing #ETF

17 days ago

🔍 Big developments in crypto policy!

The UK Treasury has announced plans to collaborate with the United States to boost innovation in the cryptocurrency sector.

In a statement released on April 30, UK Finance Minister Rachel Reeves outlined the “Change Plan ”—a regulatory initiative aimed at creating new rules for crypto asset providers like Bitcoin and Ethereum. The goal? Strengthen investor confidence and fuel industry growth.

Reeves recently met with US Treasury Secretary Scott Bessent in Washington to discuss cross-border cooperation on digital asset regulation. They’re working closely through the UK-US Financial Regulatory Working Group, including exploring ideas from SEC Commissioner Hester Peirce.

This follows recent pro-crypto moves by the UK government, like revising the Financial Services and Markets Act 2000 in January to ease restrictions on staking services—marking a clear shift toward fostering innovation.

💡 The message is clear: the UK wants to be "the best place for innovation in the world ."

#cryptonews #DigitalAssets #Regulation #bitcoin #ethereum #UKPolicy #USFinance #BlockchainInnovation #RachelReeves #CryptoRegulation

The UK Treasury has announced plans to collaborate with the United States to boost innovation in the cryptocurrency sector.

In a statement released on April 30, UK Finance Minister Rachel Reeves outlined the “Change Plan ”—a regulatory initiative aimed at creating new rules for crypto asset providers like Bitcoin and Ethereum. The goal? Strengthen investor confidence and fuel industry growth.

Reeves recently met with US Treasury Secretary Scott Bessent in Washington to discuss cross-border cooperation on digital asset regulation. They’re working closely through the UK-US Financial Regulatory Working Group, including exploring ideas from SEC Commissioner Hester Peirce.

This follows recent pro-crypto moves by the UK government, like revising the Financial Services and Markets Act 2000 in January to ease restrictions on staking services—marking a clear shift toward fostering innovation.

💡 The message is clear: the UK wants to be "the best place for innovation in the world ."

#cryptonews #DigitalAssets #Regulation #bitcoin #ethereum #UKPolicy #USFinance #BlockchainInnovation #RachelReeves #CryptoRegulation

17 days ago

🔐 BREAKING: U.S. Court Rules OFAC’s Sanctions on Tornado Cash Were Illegal

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

17 days ago

🚀 Breaking: Trump-Backed Stablecoin USD1 Hits $1.02B Market Cap Across Ethereum & BNB Chain!

The stablecoin USD1 from World Liberty Financial (WLFI), the crypto project tied to the Trump family, has now surpassed $1.02 billion in total market value — with over $1B+ on BNB Chain alone!

On-chain data reveals three rapid minting events recently on BNB Chain, injecting hundreds of millions of USD1 into the network. Paired with existing supply on Ethereum, the token’s footprint is rapidly expanding.

Analysts suggest this surge could be part of a larger strategy to boost USD1’s adoption across DeFi protocols, cross-chain liquidity pools, and major trading platforms.

Is USD1 positioning itself as a major player in the stablecoin ecosystem? Time will tell — but the momentum is undeniable. 💸

#crypto #stablecoin #USD1 #BNBChain #ethereum #TrumpCoin #defi #Blockchain #Web3 #WLFI

The stablecoin USD1 from World Liberty Financial (WLFI), the crypto project tied to the Trump family, has now surpassed $1.02 billion in total market value — with over $1B+ on BNB Chain alone!

On-chain data reveals three rapid minting events recently on BNB Chain, injecting hundreds of millions of USD1 into the network. Paired with existing supply on Ethereum, the token’s footprint is rapidly expanding.

Analysts suggest this surge could be part of a larger strategy to boost USD1’s adoption across DeFi protocols, cross-chain liquidity pools, and major trading platforms.

Is USD1 positioning itself as a major player in the stablecoin ecosystem? Time will tell — but the momentum is undeniable. 💸

#crypto #stablecoin #USD1 #BNBChain #ethereum #TrumpCoin #defi #Blockchain #Web3 #WLFI

17 days ago

David Marcus, former PayPal President and current CEO of Lightspark, announced the launch of Spark, a new Bitcoin Layer-2 solution compatible with the Lightning Network.

Unveiled at Lightspark’s first partner summit, Lightspark Sync, Spark enables non-custodial use of Bitcoin and stablecoins, enhancing transaction speed and cost-efficiency.

The platform builds on Lightspark’s Universal Money Address (UMA) standard, introducing features like tipping, subscriptions, and invoicing over Lightning, while also integrating with legacy banking systems for broader accessibility.

Marcus aims to position Bitcoin as a global settlement layer, addressing Lightning’s complexity and reliability issues to make it enterprise-grade for institutions and banks.

Unveiled at Lightspark’s first partner summit, Lightspark Sync, Spark enables non-custodial use of Bitcoin and stablecoins, enhancing transaction speed and cost-efficiency.

The platform builds on Lightspark’s Universal Money Address (UMA) standard, introducing features like tipping, subscriptions, and invoicing over Lightning, while also integrating with legacy banking systems for broader accessibility.

Marcus aims to position Bitcoin as a global settlement layer, addressing Lightning’s complexity and reliability issues to make it enterprise-grade for institutions and banks.

17 days ago

BREAKING: #Tether Treasury just minted 2 billion #USDT in two transactions on the Ethereum network (via WhaleAlert).

According to CEO Paolo Ardoino, the newly minted USDT is a replenishment of inventory, part of routine operations.

Notably, this is an authorized but unissued transaction — meaning these tokens will be held as reserve inventory for future issuance requests & chain swaps.

https://etherscan.io/tx/0x...

https://etherscan.io/tx/0x...

Stay tuned for more updates. #stablecoin #cryptonews #Blockchain

According to CEO Paolo Ardoino, the newly minted USDT is a replenishment of inventory, part of routine operations.

Notably, this is an authorized but unissued transaction — meaning these tokens will be held as reserve inventory for future issuance requests & chain swaps.

https://etherscan.io/tx/0x...

https://etherscan.io/tx/0x...

Stay tuned for more updates. #stablecoin #cryptonews #Blockchain

17 days ago

🚨 Russia Moves to Criminalize Illegal Crypto Mining 🚨

Russia's financial watchdog is pushing for criminal charges against illegal cryptocurrency mining, linking it to money laundering risks.

A draft law—prepared with the Ministry of Finance and Central Bank—has already gained backing from key policy groups like the Civic Chamber.

🗣️ Deputy Director German Neglyad: "Crypto must not become a tool for illegal finance."

Also weighing in, Federation Council's Nikolai Zhuravlev stressed the importance of proactive legislation to protect the financial system. Meanwhile, Osman Kabaloev of the MoF confirmed plans to introduce both administrative fines and criminal liability to crack down on abuse of low-cost energy for mining and illicit fund transfers.

🔍 The message is clear: crypto innovation must go hand-in-hand with regulation.

#cryptonews #Russia #MoneyLaundering #Regulation #Blockchain #Policy #mining #finance

Russia's financial watchdog is pushing for criminal charges against illegal cryptocurrency mining, linking it to money laundering risks.

A draft law—prepared with the Ministry of Finance and Central Bank—has already gained backing from key policy groups like the Civic Chamber.

🗣️ Deputy Director German Neglyad: "Crypto must not become a tool for illegal finance."

Also weighing in, Federation Council's Nikolai Zhuravlev stressed the importance of proactive legislation to protect the financial system. Meanwhile, Osman Kabaloev of the MoF confirmed plans to introduce both administrative fines and criminal liability to crack down on abuse of low-cost energy for mining and illicit fund transfers.

🔍 The message is clear: crypto innovation must go hand-in-hand with regulation.

#cryptonews #Russia #MoneyLaundering #Regulation #Blockchain #Policy #mining #finance

18 days ago

🚨 BLACKROCK BUYS 10,220 BITCOIN IN JUST ONE DAY!

That’s not a typo — 10,220 BTC flowed into their Bitcoin ETF in a single day. 🚀

This is the kind of momentum we’ve been waiting for. The floodgates are opening, and institutions are diving headfirst into crypto.

What’s next? 💡 Let’s talk about it👇

#bitcoin #BTC #blackrock #cryptonews #ETF #bitcoinetf #MarketUpdate #Web3 #Investing

That’s not a typo — 10,220 BTC flowed into their Bitcoin ETF in a single day. 🚀

This is the kind of momentum we’ve been waiting for. The floodgates are opening, and institutions are diving headfirst into crypto.

What’s next? 💡 Let’s talk about it👇

#bitcoin #BTC #blackrock #cryptonews #ETF #bitcoinetf #MarketUpdate #Web3 #Investing

18 days ago

🚨 JUST IN: The SEC has extended its deadline to decide on the Franklin XRP Fund spot ETF. A decision is now due by June 17, 2025 .

This delay keeps the crypto community on edge as investors await regulatory clarity on what could be a major milestone for XRP and the broader market. What’s your take—bullish or bearish on the outcome? 💭

#xrp #cryptonews #ETF #SEC #FranklinTempleton #bitcoin #crypto

This delay keeps the crypto community on edge as investors await regulatory clarity on what could be a major milestone for XRP and the broader market. What’s your take—bullish or bearish on the outcome? 💭

#xrp #cryptonews #ETF #SEC #FranklinTempleton #bitcoin #crypto

18 days ago

🔥 Breaking: Trump’s bold crypto play, World Liberty Financial , just dropped not one, but multiple MEME coins — and now they're going full crypto with the launch of USD1 , a dollar-backed stablecoin.

The former president is all in on blockchain — love it or hate it, this is big news for crypto markets. 💸

#Trump #crypto #memecoin #stablecoin #USD1 #WorldLibertyFinancial #Blockchain #bitcoin #cryptonews

The former president is all in on blockchain — love it or hate it, this is big news for crypto markets. 💸

#Trump #crypto #memecoin #stablecoin #USD1 #WorldLibertyFinancial #Blockchain #bitcoin #cryptonews

18 days ago

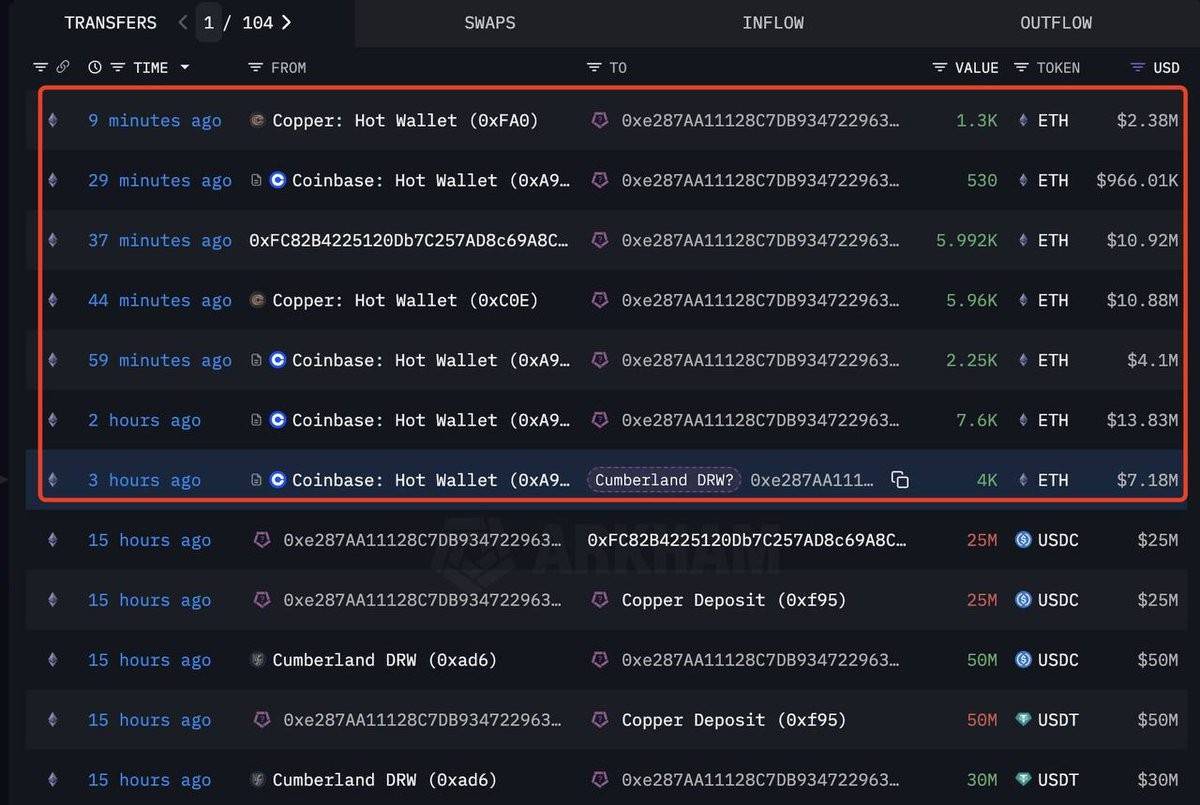

🔥 BREAKING : A wallet linked to Cumberland has withdrawn 27,632 ETH (≈**$50.24M**) from Copper , Binance , and Coinbase in just the past 3 hours .

Big moves like this always raise eyebrows — what’s the play here? 🧠💸

#crypto #ethereum #OnchainAlerts #WhaleWatch #Cumberland #ETHWithdrawals

Big moves like this always raise eyebrows — what’s the play here? 🧠💸

#crypto #ethereum #OnchainAlerts #WhaleWatch #Cumberland #ETHWithdrawals

Sponsored by

Administrator

11 months ago