4 days ago

$IBIT on fire lately, now has $72b in assets, which ranks it 23rd overall, absolutely bonkers for a one-year-old.

1 month ago

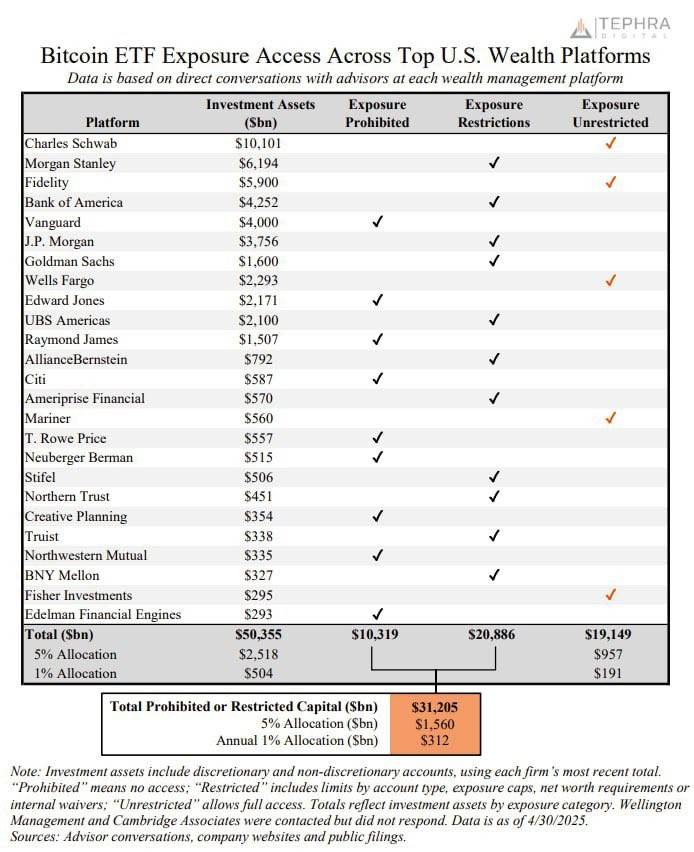

🚨 Breaking the Chains: Over $31 trillion in U.S. wealth platform capital is still RESTRICTED or PROHIBITED from accessing #BitcoinETFs .

Structural constraints are holding back inflows — but they’re also creating MAJOR opportunities.

This won’t last forever. The floodgates will open.

Data sourced directly from conversations with advisors at each platform. #crypto #bitcoin #Investing #ETF

Structural constraints are holding back inflows — but they’re also creating MAJOR opportunities.

This won’t last forever. The floodgates will open.

Data sourced directly from conversations with advisors at each platform. #crypto #bitcoin #Investing #ETF

1 month ago

🔐 BREAKING: U.S. Court Rules OFAC’s Sanctions on Tornado Cash Were Illegal

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

1 month ago

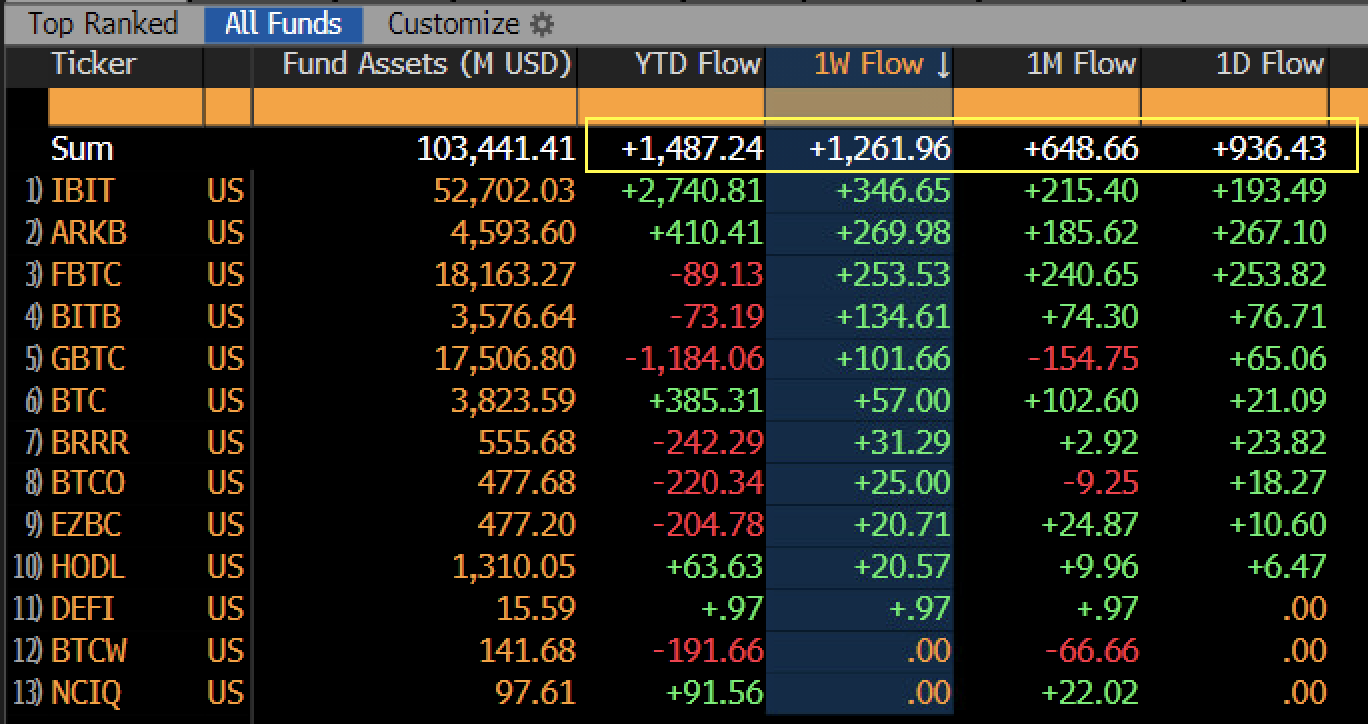

🚨 Bitcoin ETFs are heating up! 🚀

Over $1.26B in net inflows this past week alone — and guess who’s leading the pack?

🏆 IBIT crushes it with +$346.65M in weekly flows

🔥 ARKB & FBTC follow with +$269.98M & +$253.53M

📉 Meanwhile, GBTC continues its outflow streak: -$1.18B YTD 😬

Total BTC ETF assets now over $103B. Institutions aren’t just watching — they’re BUYING. 📈

#bitcoin #ETF #CryptoFunds #BTC #InstitutionalAdoption #IBIT #ARKB #FBTC #BloombergData #CryptoFlows

Over $1.26B in net inflows this past week alone — and guess who’s leading the pack?

🏆 IBIT crushes it with +$346.65M in weekly flows

🔥 ARKB & FBTC follow with +$269.98M & +$253.53M

📉 Meanwhile, GBTC continues its outflow streak: -$1.18B YTD 😬

Total BTC ETF assets now over $103B. Institutions aren’t just watching — they’re BUYING. 📈

#bitcoin #ETF #CryptoFunds #BTC #InstitutionalAdoption #IBIT #ARKB #FBTC #BloombergData #CryptoFlows

3 months ago

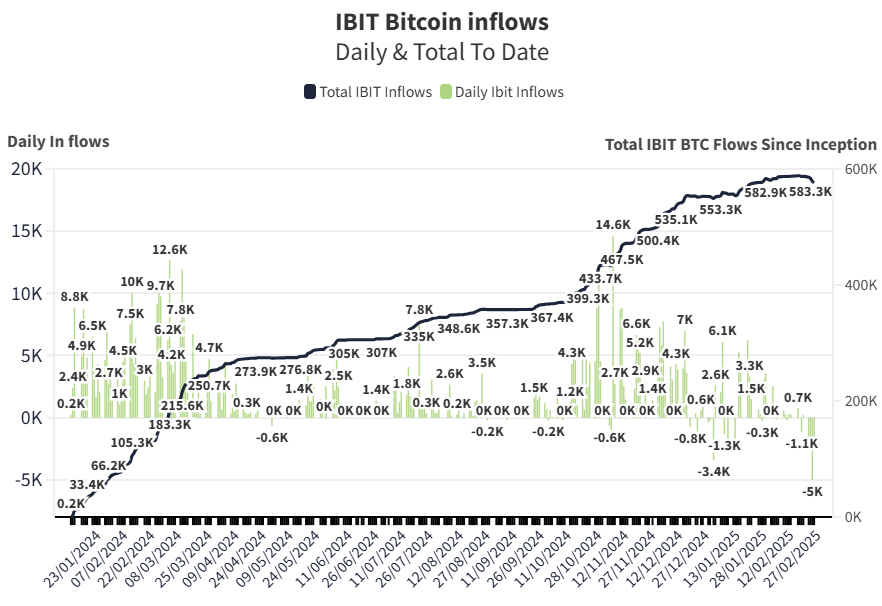

BlackRock's Bitcoin ETF has increased its holdings by $47.5 million.

Recent on-chain monitoring data shared by Bitcoin Magazine on the X platform indicates that BlackRock's Bitcoin Exchange-Traded Fund (ETF), IBIT, has increased its Bitcoin holdings by approximately $47.5 million. This acquisition, which occurred just 55 minutes ago, has brought the total to 568.311 Bitcoins.

#bitcoin #blackrock #ETF #IBIT #BitcoinHoldings

Recent on-chain monitoring data shared by Bitcoin Magazine on the X platform indicates that BlackRock's Bitcoin Exchange-Traded Fund (ETF), IBIT, has increased its Bitcoin holdings by approximately $47.5 million. This acquisition, which occurred just 55 minutes ago, has brought the total to 568.311 Bitcoins.

#bitcoin #blackrock #ETF #IBIT #BitcoinHoldings

3 months ago

🚨Blackrock Sells 1865 Bitcoin - IBIT's Second largest outflow since launch

🚨Fidelity Sells 3920 Bitcoin - Largest sell-off since ETFs launched

#bitcoin #BTC #sell #bearmarket #blackrock #fidelity #ETF

🚨Fidelity Sells 3920 Bitcoin - Largest sell-off since ETFs launched

#bitcoin #BTC #sell #bearmarket #blackrock #fidelity #ETF

11 months ago

### Spot Bitcoin ETFs Experience Highest Inflow Day in Over Five Weeks

On July 12, spot Bitcoin exchange-traded funds (ETFs) based in the United States saw over $310 million in inflows, making it their best-performing day since June 5.

Leading the inflows were BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), which recorded $120 million and $115.1 million respectively, according to Farside Investors data.

The Bitwise Bitcoin ETF ranked third with $28.4 million in inflows, while the Grayscale Bitcoin Trust (GBTC) experienced a rare inflow day at $23 million.

Additionally, the VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF reported inflows of $6 million and $4 million, respectively

On July 12, spot Bitcoin exchange-traded funds (ETFs) based in the United States saw over $310 million in inflows, making it their best-performing day since June 5.

Leading the inflows were BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), which recorded $120 million and $115.1 million respectively, according to Farside Investors data.

The Bitwise Bitcoin ETF ranked third with $28.4 million in inflows, while the Grayscale Bitcoin Trust (GBTC) experienced a rare inflow day at $23 million.

Additionally, the VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF reported inflows of $6 million and $4 million, respectively

Sponsored by

Administrator

11 months ago