2 days ago

🔍 Interesting Development!

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

25 days ago

🚨 JUST IN: Europe’s MicroStrategy, "The Blockchain Group", is now the BEST performing stock on the Paris Stock Exchange! 🇫🇷📈

It’s up a staggering 530% in just 6 months.

Crypto fever is REAL. Tighten your seatbelts, this ride is just getting started! 🔥🚀💸

#CryptoStocks #BlockchainBoom #ParisStockExchange #TheBlockchainGroup #530Percent #bullrun

It’s up a staggering 530% in just 6 months.

Crypto fever is REAL. Tighten your seatbelts, this ride is just getting started! 🔥🚀💸

#CryptoStocks #BlockchainBoom #ParisStockExchange #TheBlockchainGroup #530Percent #bullrun

1 month ago

From Pensions to Crypto: The Bold New Frontier of Retirement Investing

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

1 month ago

(E)

🔴 Crypto Crash Triggered by Trump’s 104% Tariffs on China?!

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

1 month ago

Michael Saylor will be WORLD’S FIRST TRILLIONAIRE

MicroStrategy will buy more #bitcoin tomorrow 💥💥🚀🚀

MicroStrategy will buy more #bitcoin tomorrow 💥💥🚀🚀

2 months ago

(E)

🚨 BREAKING NEWS 🚨 : Michael Saylor pushes $81tn Bitcoin master plan to White House to ‘own the future’

Michael Saylor, founder of MicroStrategy, has presented an ambitious plan for the U.S. government to strategically acquire between 5% and 25% of the total Bitcoin supply by 2035.

His proposal, introduced at a White House summit on March 7, 2025, envisions that such acquisitions could lead to significant economic benefits, generating up to $81 trillion for the U.S. Treasury by 2045.

Saylor advocates a policy of never selling the acquired Bitcoin, asserting that it could serve as a national asset to bolster economic stability and counter national debt.

Saylor's plan, which he outlines in a document titled “A Digital Assets Strategy to Dominate the 21st Century Global Economy,” emphasizes systematic and programmatic purchases to establish the United States as the largest holder of Bitcoin globally, with up to 5.25 million BTC.

His initiative aligns with President Trump's recent executive order creating a Strategic Bitcoin Reserve, although the immediate purchase strategy has not yet been fleshed out.

https://assets.contentstac...

#Saylor #Trump #bitcoin #WhiteHouse

Michael Saylor, founder of MicroStrategy, has presented an ambitious plan for the U.S. government to strategically acquire between 5% and 25% of the total Bitcoin supply by 2035.

His proposal, introduced at a White House summit on March 7, 2025, envisions that such acquisitions could lead to significant economic benefits, generating up to $81 trillion for the U.S. Treasury by 2045.

Saylor advocates a policy of never selling the acquired Bitcoin, asserting that it could serve as a national asset to bolster economic stability and counter national debt.

Saylor's plan, which he outlines in a document titled “A Digital Assets Strategy to Dominate the 21st Century Global Economy,” emphasizes systematic and programmatic purchases to establish the United States as the largest holder of Bitcoin globally, with up to 5.25 million BTC.

His initiative aligns with President Trump's recent executive order creating a Strategic Bitcoin Reserve, although the immediate purchase strategy has not yet been fleshed out.

https://assets.contentstac...

#Saylor #Trump #bitcoin #WhiteHouse

2 months ago

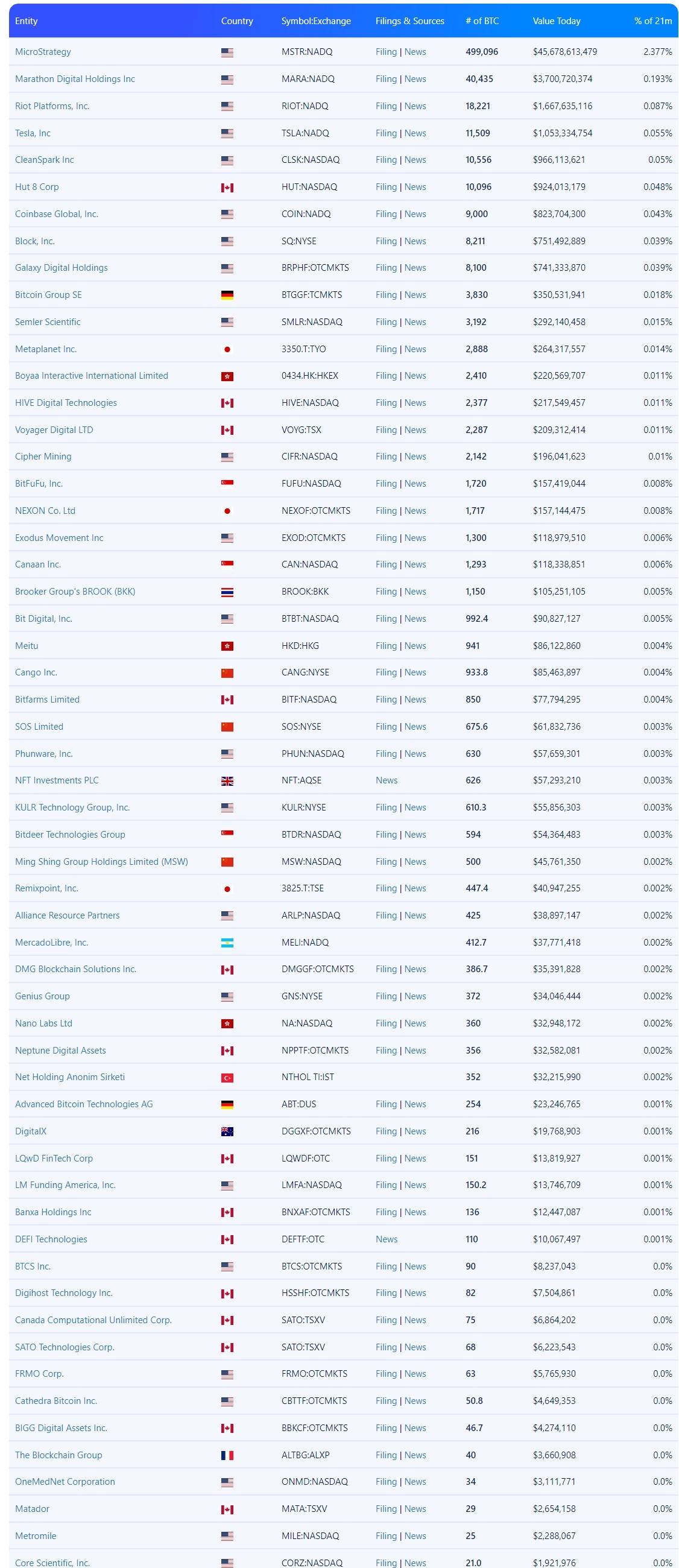

Public Companies that Own #bitcoin

1 MicroStrategy ₿499,096 | $45,678,613,479

2 Marathon Digital Holdings Inc ₿40,435 | $3,700,720,374

3 Riot Platforms, Inc. ₿18,221 | $1,667,635,116

4 Tesla, Inc ₿11,509 | $1,053,334,754

1 MicroStrategy ₿499,096 | $45,678,613,479

2 Marathon Digital Holdings Inc ₿40,435 | $3,700,720,374

3 Riot Platforms, Inc. ₿18,221 | $1,667,635,116

4 Tesla, Inc ₿11,509 | $1,053,334,754

3 months ago

5 months ago

In recent years, big institutions have amassed a growing slice of the #bitcoin supply. This includes public companies such as MicroStrategy and Tesla; financial firms, including exchange-traded funds that hold bitcoin on behalf of investors; and governments. The U.S., which acquires cryptocurrencies seized from criminals, is the biggest government holder of bitcoin.

The emergence of such hoards is bullish for the price of bitcoin because it means more of bitcoin’s supply is locked up.

The emergence of such hoards is bullish for the price of bitcoin because it means more of bitcoin’s supply is locked up.

5 months ago

(E)

MicroStrategy's #bitcoin Investment: Then vs. Now (2020 vs. 2024)

August 11, 2020:

Bitcoin Held: 21,454 BTC

Investment: $250 Million

Average Price per BTC: $11,863

December 8, 2024:

Bitcoin Held: 21,550 BTC

Current Value: $25 Billion

Average Price per BTC: $99,850

This reflects a staggering 850% profit (approximately $2 Billion) in just over 4 years!

The Question:

If MicroStrategy's holdings are now worth $25 Billion, what could this investment grow to in the next 4 years? 🚀

August 11, 2020:

Bitcoin Held: 21,454 BTC

Investment: $250 Million

Average Price per BTC: $11,863

December 8, 2024:

Bitcoin Held: 21,550 BTC

Current Value: $25 Billion

Average Price per BTC: $99,850

This reflects a staggering 850% profit (approximately $2 Billion) in just over 4 years!

The Question:

If MicroStrategy's holdings are now worth $25 Billion, what could this investment grow to in the next 4 years? 🚀

Sponsored by

Administrator

11 months ago