1 month ago

"MANTRA community - we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team. We are looking into it and will share more details about what happened as soon as we can."

Link: https://x.com/MANTRA_Chain...

Link: https://x.com/MANTRA_Chain...

1 month ago

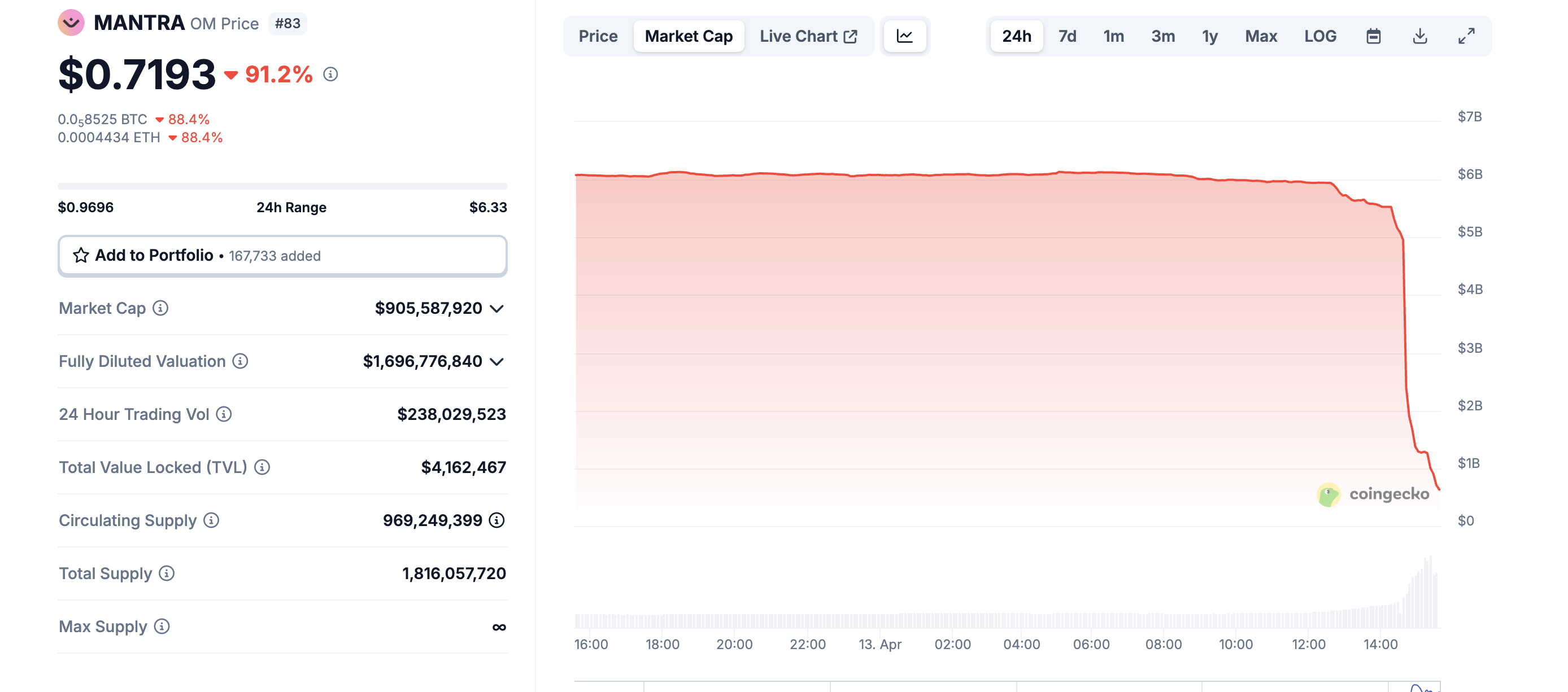

📊 NEW: MANTRA token price fell by over 90% in the last 24 hours.

Mantra co-founder JP Mullin addresses the OM token crash, confirming their Telegram remains active and team tokens haven't been moved. Its team claimed that the price crash was "triggered by reckless liquidations" and not related to the team.

Mantra co-founder JP Mullin addresses the OM token crash, confirming their Telegram remains active and team tokens haven't been moved. Its team claimed that the price crash was "triggered by reckless liquidations" and not related to the team.

1 month ago

(E)

🔴 Crypto Crash Triggered by Trump’s 104% Tariffs on China?!

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

🇺🇸 The White House has confirmed the implementation of 104% tariffs on China, which appears to have triggered a significant downturn in the crypto market. After briefly spiking to $79,000, Bitcoin dropped to $76,000, leading to $300M in liquidations across the crypto space.

🇨🇳

These tariffs could heavily impact the markets, especially publicly traded crypto-related companies. For example, MicroStrategy’s stock has dropped over 11%, while #coinbase , Robinhood, and major Bitcoin mining firms have seen declines of around 5%. This might just be the beginning of further downside.

#china #Cryptocrash #WhiteHouse #bitcoin

1 month ago

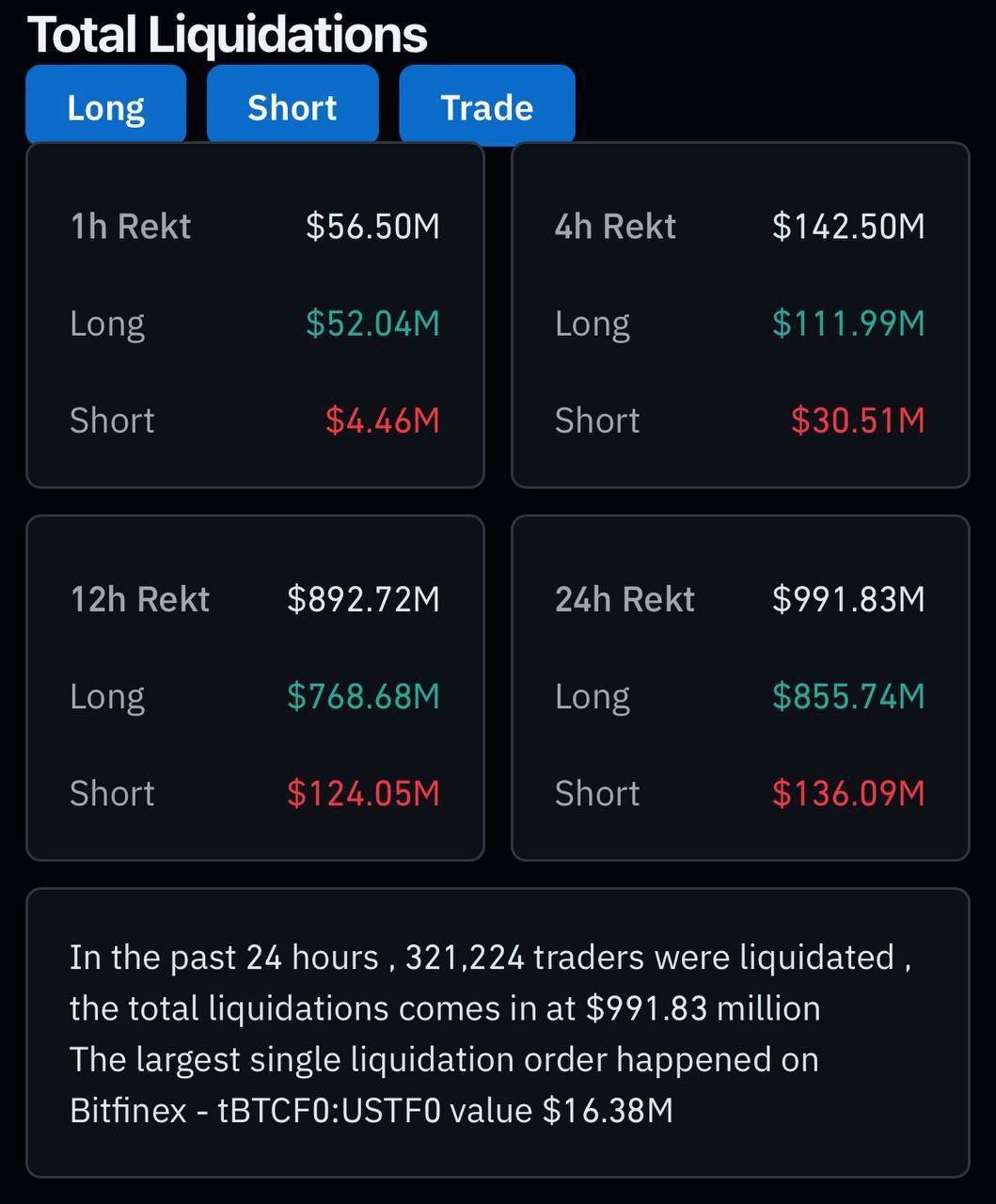

⚠️ Bitcoin Drops Below $80,000 – $1B in Liquidations

🩸 Bitcoin fell below the $80,000 mark on Sunday, triggering nearly $1 billion in liquidations. The drop came amid rising inflation concerns and overall weakness in global financial markets.

🔽 Roughly $885 million of the liquidations were from long positions, with over 321,000 traders liquidated in a single day. The broader crypto market saw a 2.45% decline, while Bitcoin still dominates with 62% market share.

📉 Meanwhile, the announcement of Trump-era tariffs wiped out $8.2 trillion from the stock market, surpassing losses seen in the worst week of the 2008 financial crisis.

#bitcoin #Liquidation #BitcoinLiquidation

🩸 Bitcoin fell below the $80,000 mark on Sunday, triggering nearly $1 billion in liquidations. The drop came amid rising inflation concerns and overall weakness in global financial markets.

🔽 Roughly $885 million of the liquidations were from long positions, with over 321,000 traders liquidated in a single day. The broader crypto market saw a 2.45% decline, while Bitcoin still dominates with 62% market share.

📉 Meanwhile, the announcement of Trump-era tariffs wiped out $8.2 trillion from the stock market, surpassing losses seen in the worst week of the 2008 financial crisis.

#bitcoin #Liquidation #BitcoinLiquidation

2 months ago

The past four hours have seen significant liquidations across the global market, totaling $125 million.

Of this amount, long positions accounted for $120 million, while short positions experienced liquidations of $4.8771 million. The data highlights the volatility and rapid changes in the market dynamics.

Of this amount, long positions accounted for $120 million, while short positions experienced liquidations of $4.8771 million. The data highlights the volatility and rapid changes in the market dynamics.

2 months ago

Data from Coinglass reveals that the total liquidations across the network amounted to $239 million over the past 12 hours. Of this, short positions accounted for $175 million.

#Liquidation

#Liquidation

2 months ago

Cryptocurrency Market Experiences $178 Million in Liquidations

Recent data from Coinglass indicates that the cryptocurrency market experienced liquidations totaling $178 million in the past 24 hours. Of this total, long positions accounted for $126 million, while short positions amounted to $51.63 million. Specifically, Bitcoin (BTC) had liquidations of $36.22 million, and Ethereum (ETH) saw $33.48 million in liquidations.

#cryptocurrency #ethereum #bitcoin #Coinglass #liquidations

Recent data from Coinglass indicates that the cryptocurrency market experienced liquidations totaling $178 million in the past 24 hours. Of this total, long positions accounted for $126 million, while short positions amounted to $51.63 million. Specifically, Bitcoin (BTC) had liquidations of $36.22 million, and Ethereum (ETH) saw $33.48 million in liquidations.

#cryptocurrency #ethereum #bitcoin #Coinglass #liquidations

2 months ago

(E)

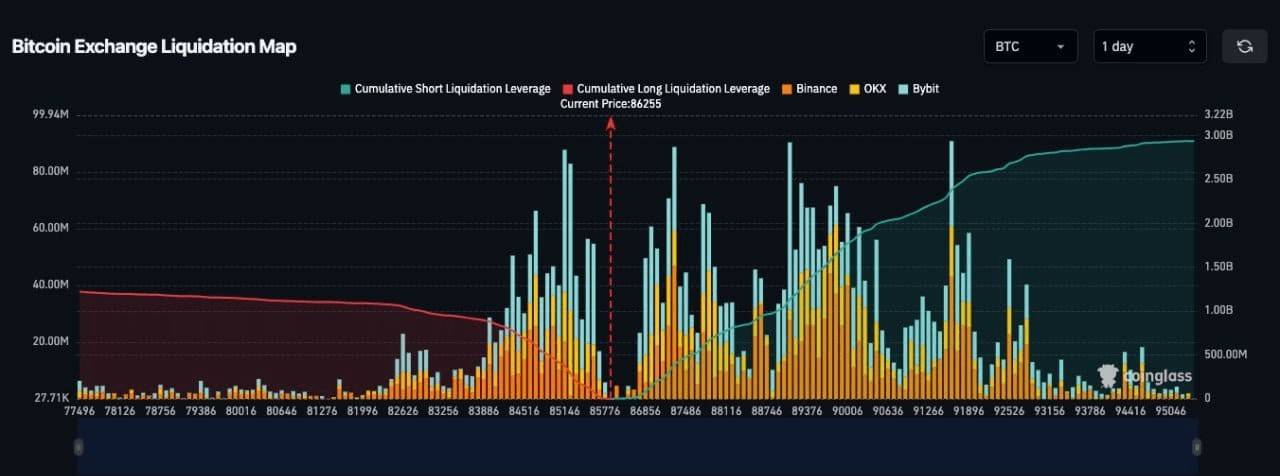

🚨 Bitcoin Liquidation Alert: Massive Short Squeeze Incoming

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

3 months ago

#bitcoin and #altcoins experienced a significant rebound, leading to nearly $1 billion in liquidations in the #crypto market.

The graph shows that Bitcoin nearly reached the $95,000 mark during its surge, but it has since experienced a slight pullback to $92,800. Ethereum has followed a similar trend; however, its decline from $2,550 to $2,360 has been noticeably larger than that of Bitcoin.

In terms of the individual symbols, Bitcoin and #ethereum have predictably come out on top with $353 million and $182 million in liquidations, respectively.

The graph shows that Bitcoin nearly reached the $95,000 mark during its surge, but it has since experienced a slight pullback to $92,800. Ethereum has followed a similar trend; however, its decline from $2,550 to $2,360 has been noticeably larger than that of Bitcoin.

In terms of the individual symbols, Bitcoin and #ethereum have predictably come out on top with $353 million and $182 million in liquidations, respectively.

Sponsored by

Administrator

11 months ago