1 day ago

🟠Challenges Ahead for Bitcoin in Reaching a New All-Time High

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

1 day ago

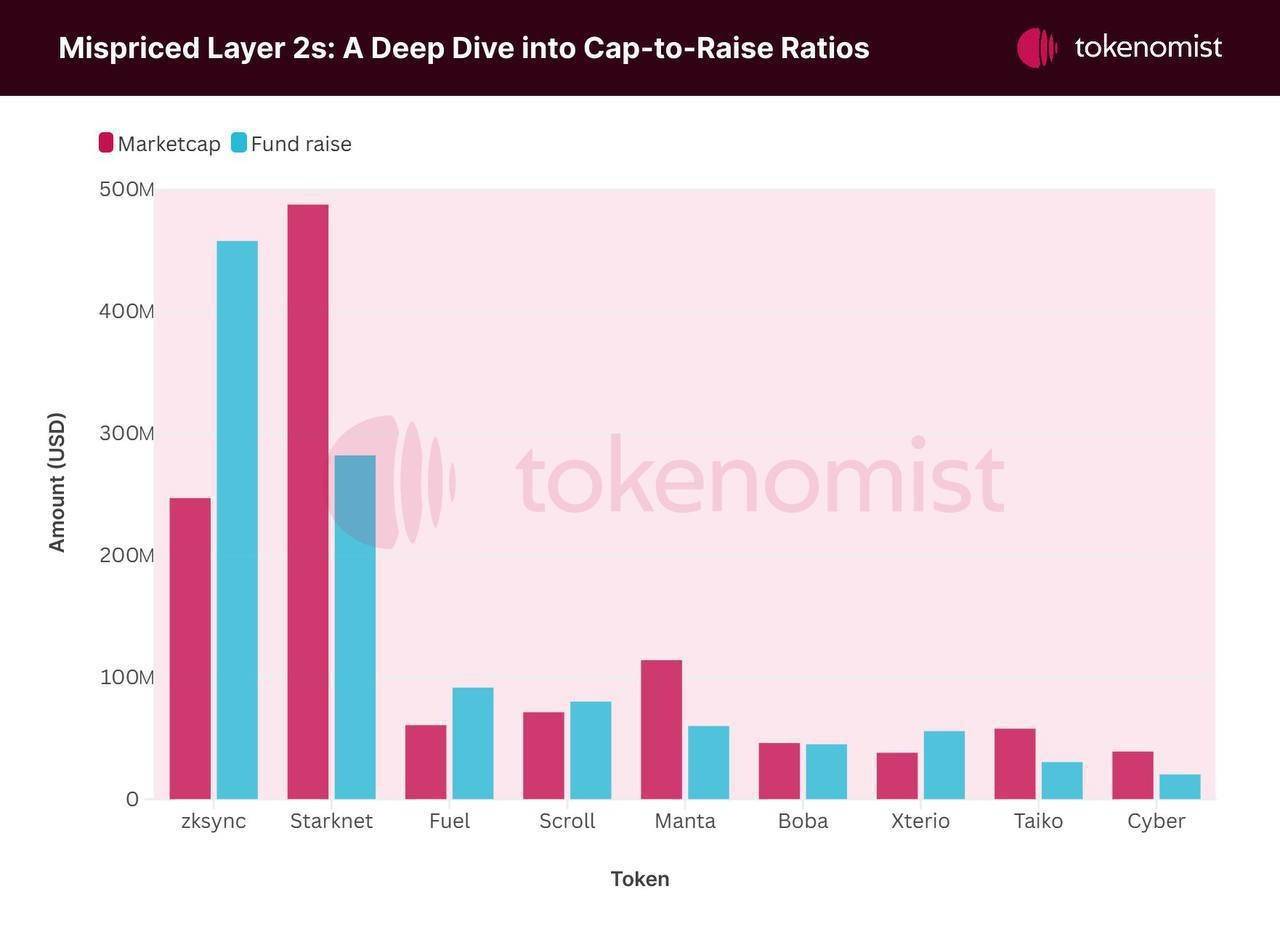

Market Cap Below Funding: The Strange Case of L2 Projects

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

1 day ago

🚨 ETF Flow Alert! 🚨

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

2 days ago

Ripple’s Hidden Road has just rolled out OTC crypto swaps in the US, paving the way for institutional investors to engage in cash-settled trades with top digital assets.

This could be a game-changer for the market!

source: https://cointelegraph.com/...

#cryptonews #ripple #HiddenRoad

This could be a game-changer for the market!

source: https://cointelegraph.com/...

#cryptonews #ripple #HiddenRoad

2 days ago

DeFi Development Corp. Embraces Liquid Staking to Expand Solana Holdings.

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

2 days ago

SOL Strategies files to raise up to $1 billion to expand Solana investment

SOL Strategies Inc., a Vancouver-based company specializing in Solana blockchain investments, has filed a preliminary short-form base shelf prospectus with Canadian securities regulators to raise up to $1 billion over the next 25 months.

(via: https://www.theblock.co/po...

SOL Strategies Inc., a Vancouver-based company specializing in Solana blockchain investments, has filed a preliminary short-form base shelf prospectus with Canadian securities regulators to raise up to $1 billion over the next 25 months.

(via: https://www.theblock.co/po...

3 days ago

BlackRock’s $BUIDL fund is now LIVE on Avalanche!

#blackrock , the world's largest asset manager, has launched its USD Institutional Digital Liquidity Fund (BUIDL) on the Avalanche blockchain platform. This represents a major milestone in institutional adoption of blockchain technology, bringing traditional financial infrastructure onto decentralized networks.

Fund Overview:-

Fund Size: $500M+

Token Structure: One share = One BUIDL token

Target Value: $1 per token

Distribution: Daily accrued dividends paid directly to wallets

Investment Minimum: $5 million

#Avalanche

(via: https://www.avax.network/a...

#blackrock , the world's largest asset manager, has launched its USD Institutional Digital Liquidity Fund (BUIDL) on the Avalanche blockchain platform. This represents a major milestone in institutional adoption of blockchain technology, bringing traditional financial infrastructure onto decentralized networks.

Fund Overview:-

Fund Size: $500M+

Token Structure: One share = One BUIDL token

Target Value: $1 per token

Distribution: Daily accrued dividends paid directly to wallets

Investment Minimum: $5 million

#Avalanche

(via: https://www.avax.network/a...

4 days ago

Dubai just took a major leap into the future by launching a real estate tokenization platform on the XRP Ledger! 🏙️🔗

This groundbreaking move is set to revolutionize property investment—making it more accessible, transparent, and efficient. 🚀💼

#Dubai #RealEstate #Tokenization #xrp #Blockchain #FutureCities #PropTech #Innovation #cryptonews #SmartInvesting

This groundbreaking move is set to revolutionize property investment—making it more accessible, transparent, and efficient. 🚀💼

#Dubai #RealEstate #Tokenization #xrp #Blockchain #FutureCities #PropTech #Innovation #cryptonews #SmartInvesting

4 days ago

🚨 BREAKING: Trump Media Group Plans to Raise $3 Billion to Invest in Crypto! 🚀

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

4 days ago

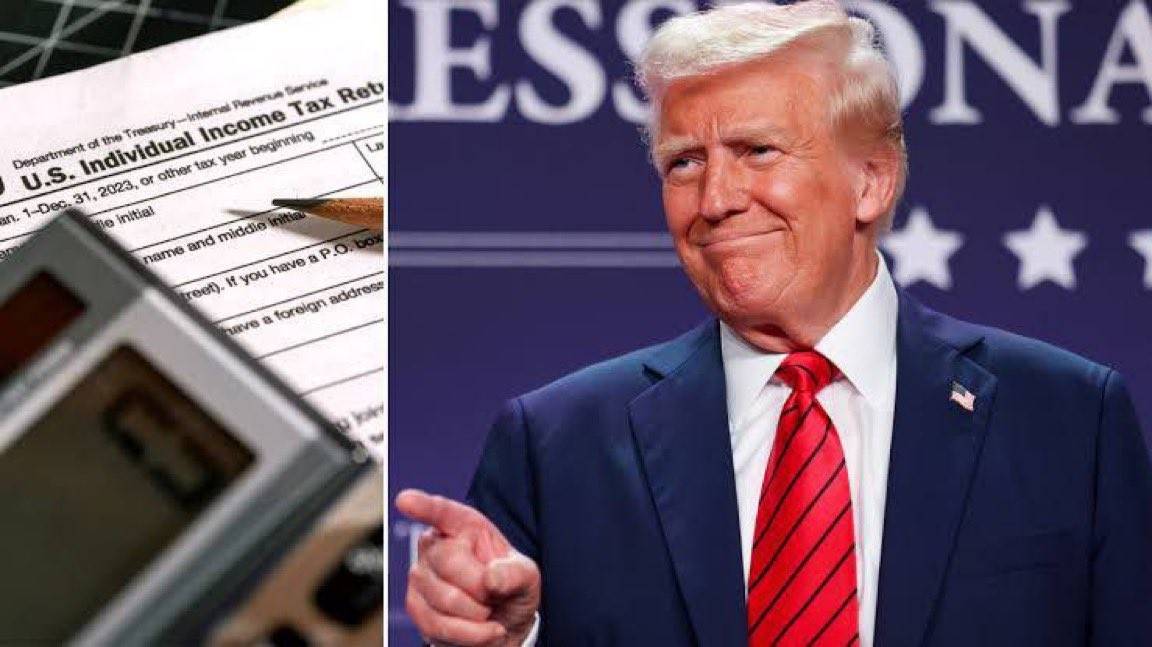

🚨 RUMOR ALERT 🚨

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and cryptocurrencies in the United States.

If true, this could be a MASSIVE boost for crypto adoption and investor freedom. 🚀

Stay tuned for official updates — and remember, always verify before you invest.

#crypto #bitcoin #BTC #Trump #TaxCut #cryptonews #Rumor #MarketUpdate

Donald Trump is reportedly planning to introduce a 0% capital gains tax on Bitcoin and cryptocurrencies in the United States.

If true, this could be a MASSIVE boost for crypto adoption and investor freedom. 🚀

Stay tuned for official updates — and remember, always verify before you invest.

#crypto #bitcoin #BTC #Trump #TaxCut #cryptonews #Rumor #MarketUpdate

5 days ago

🚀 BREAKING: Florida Just Made History!

Governor Ron DeSantis has signed legislation making Florida the FIRST state in the nation to eliminate the capital gains tax on Bitcoin!

This monumental move positions Florida as a crypto-friendly powerhouse, attracting innovators, investors, and freedom-focused individuals from around the globe.

💼 Lower taxes. 📈 More freedom. 💸 A stronger future for digital assets.

#bitcoin #CryptoFriendlyFlorida #defi #BitcoinTaxFree #BlockchainFuture #InvestInFlorida

MORE ADOPTION COMING! 🚀

Governor Ron DeSantis has signed legislation making Florida the FIRST state in the nation to eliminate the capital gains tax on Bitcoin!

This monumental move positions Florida as a crypto-friendly powerhouse, attracting innovators, investors, and freedom-focused individuals from around the globe.

💼 Lower taxes. 📈 More freedom. 💸 A stronger future for digital assets.

#bitcoin #CryptoFriendlyFlorida #defi #BitcoinTaxFree #BlockchainFuture #InvestInFlorida

MORE ADOPTION COMING! 🚀

5 days ago

XRP May Experience a Decline Due to Concerns About Market Peaks

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

9 days ago

Bitcoin is trading flat at its ATH 📊

While retail investors are sleeping, institutions are quietly buying… and debt markets are plummeting.

The calm before the storm? 🌩️

#bitcoin #CryptoMarkets #InstitutionalInvesting #BTC

While retail investors are sleeping, institutions are quietly buying… and debt markets are plummeting.

The calm before the storm? 🌩️

#bitcoin #CryptoMarkets #InstitutionalInvesting #BTC

10 days ago

Argentina President Javier Milei shuts down unit investigating Libra crypto scandal.

https://watcher.guru/news/...

https://watcher.guru/news/...

Argentina President Shuts Down Libra Crypto Scandal Investigation

Argentina's President Javier Milei has shut down the unit investigating the Libra crypto scandal, ending the government's internal probe

https://watcher.guru/news/argentina-president-shuts-down-libra-crypto-scandal-investigation

10 days ago

JUST IN: Michael Saylor's 'Strategy' currently has a $22.7 billion unrealized profit on its Bitcoin investment.

12 days ago

🚨 LATEST: Crypto elites are hiring bodyguards as risks rise.

Coinbase spent $6.2M on CEO security last year, per Bloomberg.

Security Investment Context:

- Coinbase's $6.2M security expenditure exceeds the combined security costs for CEOs of major companies including JPMorgan Chase, Goldman Sachs, and Nvidia.

- Recent incidents have accelerated the trend toward enhanced security measures.

Recent Threats and Incidents:

1. Paymium CEO Family Attack

- Attempted abduction of the CEO's family members in Paris

- Three masked assailants used mace and firearms

- Targeted a 34-year-old daughter and a toddler

- Attack thwarted by husband and neighbors

2. Ledger Co-founder Incident

- Violent kidnapping of David Balland and his wife in France

- Part of an increasing pattern of violent attacks targeting crypto executives

💡 Read more: https://www.bloomberg.com/...

Coinbase spent $6.2M on CEO security last year, per Bloomberg.

Security Investment Context:

- Coinbase's $6.2M security expenditure exceeds the combined security costs for CEOs of major companies including JPMorgan Chase, Goldman Sachs, and Nvidia.

- Recent incidents have accelerated the trend toward enhanced security measures.

Recent Threats and Incidents:

1. Paymium CEO Family Attack

- Attempted abduction of the CEO's family members in Paris

- Three masked assailants used mace and firearms

- Targeted a 34-year-old daughter and a toddler

- Attack thwarted by husband and neighbors

2. Ledger Co-founder Incident

- Violent kidnapping of David Balland and his wife in France

- Part of an increasing pattern of violent attacks targeting crypto executives

💡 Read more: https://www.bloomberg.com/...

15 days ago

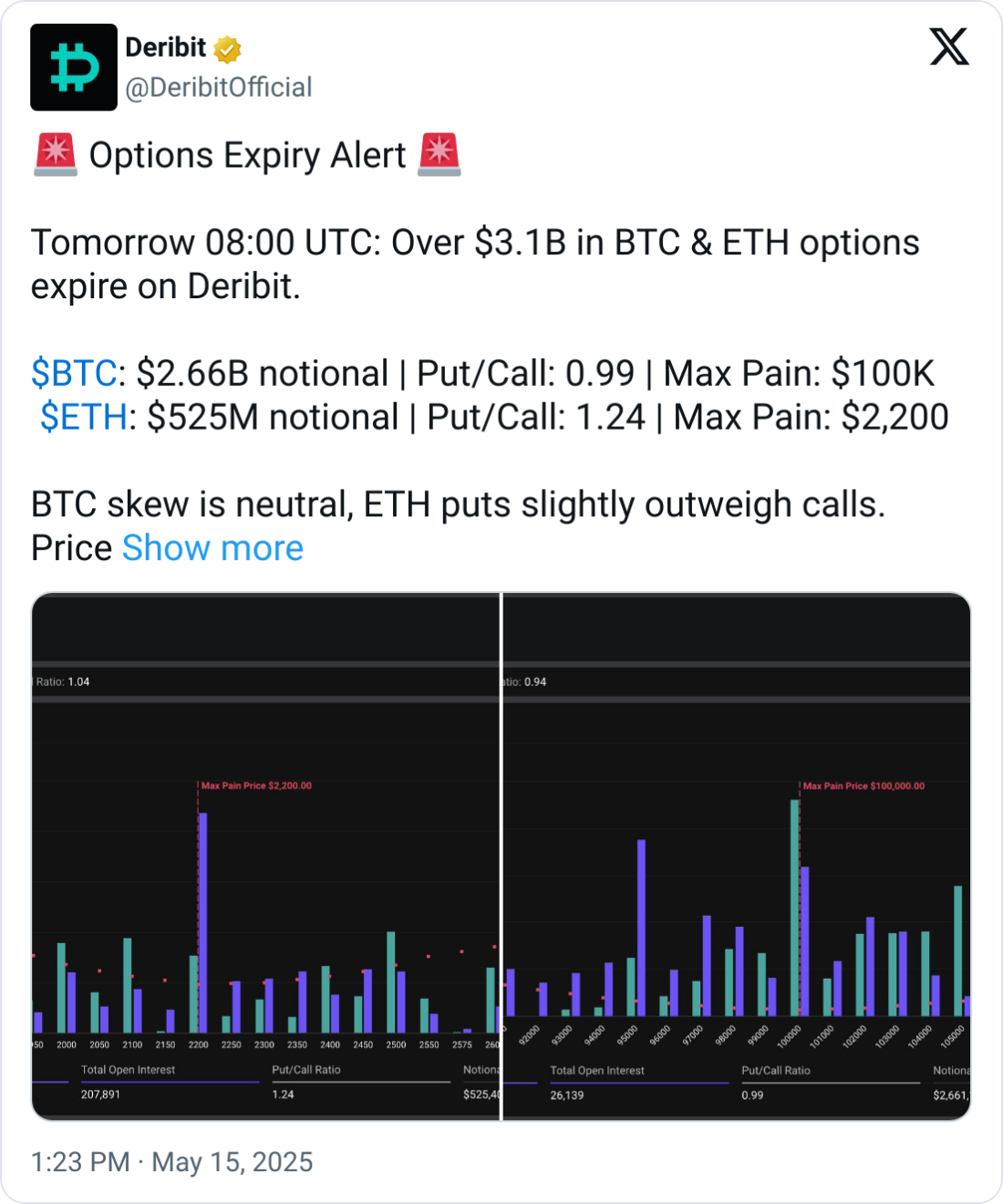

🚨 Bitcoin & Ethereum Alert! 🚨

🔥 $3.2B worth of BTC & ETH options are expiring today! Market volatility is expected to spike as traders react.

📉 Max Pain Prices:

- Bitcoin: $100K

- Ethereum: $2,200

💰 Bitcoin briefly surpassed $100K but is facing resistance near $105K. Could we see a correction or further upside? 🤔

📊 Investors are adjusting strategies—taking profits, shifting to defensive positions, and eyeing key strike prices.

🚀 Altcoins are mixed: DOGE, LINK & AVAX trending lower, while BNB & SUI see gains.

Stay tuned—this could be a pivotal moment for the crypto market! 💎🔥

#bitcoin #ethereum #cryptonews #MarketTrends #BTC #ETH

🔥 $3.2B worth of BTC & ETH options are expiring today! Market volatility is expected to spike as traders react.

📉 Max Pain Prices:

- Bitcoin: $100K

- Ethereum: $2,200

💰 Bitcoin briefly surpassed $100K but is facing resistance near $105K. Could we see a correction or further upside? 🤔

📊 Investors are adjusting strategies—taking profits, shifting to defensive positions, and eyeing key strike prices.

🚀 Altcoins are mixed: DOGE, LINK & AVAX trending lower, while BNB & SUI see gains.

Stay tuned—this could be a pivotal moment for the crypto market! 💎🔥

#bitcoin #ethereum #cryptonews #MarketTrends #BTC #ETH

15 days ago

(E)

🚀 Altcoin Season on the Horizon as Bitcoin Nears All-Time High? 🚀

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

15 days ago

🚀 Big Move in the Crypto World!

Abu Dhabi’s sovereign wealth fund just dropped $408 million on BlackRock’s Spot Bitcoin ETF — signaling serious institutional confidence in #bitcoin .

This is more than an investment… it’s a vote of trust in crypto’s future. 💼💰

(Source - https://www.nasdaq.com/art...

#bitcoin #ETF #cryptonews #blackrock #InstitutionalInvesting #BTC

Abu Dhabi’s sovereign wealth fund just dropped $408 million on BlackRock’s Spot Bitcoin ETF — signaling serious institutional confidence in #bitcoin .

This is more than an investment… it’s a vote of trust in crypto’s future. 💼💰

(Source - https://www.nasdaq.com/art...

#bitcoin #ETF #cryptonews #blackrock #InstitutionalInvesting #BTC

15 days ago

🔍 Interesting Development!

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

The Saudi Central Bank has revealed ownership of shares in Strategy Holdings (formerly MicroStrategy), signaling an indirect investment in Bitcoin.

This move reflects a growing institutional interest in crypto and highlights the bank’s forward-looking strategy in navigating digital assets. 🧭💰

#bitcoin #cryptonews #CentralBank #Investing #MicroStrategy #StrategyHoldings #SaudiArabia #FinanceUpdate

16 days ago

SEC Delays Decision on 21Shares Polkadot Spot ETF

The U.S. Securities and Exchange Commission (SEC) has postponed its decision regarding the 21Shares Polkadot Spot Exchange-Traded Fund (ETF). The delay comes as the SEC continues to evaluate the proposal, which aims to offer investors exposure to Polkadot, a blockchain platform known for its interoperability and scalability features. The decision is part of the SEC's ongoing assessment of cryptocurrency-related financial products, reflecting the regulatory body's cautious approach to the rapidly evolving digital asset market. The postponement highlights the complexities involved in integrating cryptocurrency offerings into traditional financial systems, as the SEC seeks to ensure investor protection and market stability.

#SEC #ETF

The U.S. Securities and Exchange Commission (SEC) has postponed its decision regarding the 21Shares Polkadot Spot Exchange-Traded Fund (ETF). The delay comes as the SEC continues to evaluate the proposal, which aims to offer investors exposure to Polkadot, a blockchain platform known for its interoperability and scalability features. The decision is part of the SEC's ongoing assessment of cryptocurrency-related financial products, reflecting the regulatory body's cautious approach to the rapidly evolving digital asset market. The postponement highlights the complexities involved in integrating cryptocurrency offerings into traditional financial systems, as the SEC seeks to ensure investor protection and market stability.

#SEC #ETF

22 days ago

🚨 BREAKING: Celsius Founder Alex Mashinsky Sentenced to 12 Years in Prison 🚨

After a highly publicized trial, Alex Mashinsky, founder of collapsed crypto lending platform Celsius Network, has been sentenced to 12 years in prison for orchestrating an $11 billion fraud scheme that left thousands of investors reeling.

Once a major player in the crypto space, Celsius promised high returns through its yield-bearing accounts — but prosecutors argued those returns were fueled by deception and mismanagement.

This case marks a significant moment in the ongoing regulatory crackdown on cryptocurrency misconduct.

#crypto #Celsius #AlexMashinsky #Fraud #Blockchain #cryptonews #Regulation #Investing #bitcoin #ethereum

After a highly publicized trial, Alex Mashinsky, founder of collapsed crypto lending platform Celsius Network, has been sentenced to 12 years in prison for orchestrating an $11 billion fraud scheme that left thousands of investors reeling.

Once a major player in the crypto space, Celsius promised high returns through its yield-bearing accounts — but prosecutors argued those returns were fueled by deception and mismanagement.

This case marks a significant moment in the ongoing regulatory crackdown on cryptocurrency misconduct.

#crypto #Celsius #AlexMashinsky #Fraud #Blockchain #cryptonews #Regulation #Investing #bitcoin #ethereum

26 days ago

(E)

UK to Ban Borrowing for Crypto Purchases

New rules from the #FCA aim to curb risky financial behavior by stopping lenders from offering credit specifically for buying #cryptocurrencies .

Is this a step toward safer investing, or overreach? Let’s talk👇

#CryptoRegulation #bitcoin #FinanceNews #UKPolicy

🔗 Full story: https://www.ft.com/content...

New rules from the #FCA aim to curb risky financial behavior by stopping lenders from offering credit specifically for buying #cryptocurrencies .

Is this a step toward safer investing, or overreach? Let’s talk👇

#CryptoRegulation #bitcoin #FinanceNews #UKPolicy

🔗 Full story: https://www.ft.com/content...

26 days ago

Cantor Fitzgerald is diving deeper into crypto! 💰

They've struck a $3.6bn venture deal with SoftBank and Tether. What does this mean for the future of institutional investment in digital assets? 🤔

#crypto #finance #investments #CantorFitzgerald #SoftBank #Tether

Read more here:

https://www.ft.com/content...

They've struck a $3.6bn venture deal with SoftBank and Tether. What does this mean for the future of institutional investment in digital assets? 🤔

#crypto #finance #investments #CantorFitzgerald #SoftBank #Tether

Read more here:

https://www.ft.com/content...

26 days ago

🚀 Big news for Dogecoin enthusiasts! 🚀 Nasdaq has filed with the SEC to list the 21Shares Dogecoin ETF. 📈

21Shares has partnered with the House of Doge to track DOGE's performance using the CF DOGE-Dollar US Settlement Price Index. 💰 Coinbase Custody Trust will hold the fund’s tokens as the official custodian. 🔒

This ETF aims to provide a straightforward way to invest in Dogecoin without using leverage or derivatives. 🚫 Meanwhile, the SEC is still reviewing Bitwise’s spot DOGE ETF application, with a decision expected by June 15. 🤔

#dogecoin #DOGE #ETF #crypto #21Shares #Nasdaq

Read more here https://www.coindesk.com/m...

21Shares has partnered with the House of Doge to track DOGE's performance using the CF DOGE-Dollar US Settlement Price Index. 💰 Coinbase Custody Trust will hold the fund’s tokens as the official custodian. 🔒

This ETF aims to provide a straightforward way to invest in Dogecoin without using leverage or derivatives. 🚫 Meanwhile, the SEC is still reviewing Bitwise’s spot DOGE ETF application, with a decision expected by June 15. 🤔

#dogecoin #DOGE #ETF #crypto #21Shares #Nasdaq

Read more here https://www.coindesk.com/m...

DOGE News: Nasdaq Seeks SEC Approval to List 21Shares’ Dogecoin ETF

Coinbase Custody Trust will hold the fund’s tokens and serve as the official custodian for the ETF.

https://www.coindesk.com/markets/2025/04/30/nasdaq-seeks-sec-approval-to-list-21shares-dogecoin-etf

26 days ago

Maldives Could Soon Become a Crypto Hub Thanks to Dubai Family Office's $9B Commitment

A Dubai-based family office plans to invest up to $8.8 billion in a blockchain-focused financial hub in the Maldives, part of an effort by the island nation to expand beyond its reliance on tourism and fisheries and address mounting debt obligations.

Read - https://www.ft.com/content...

A Dubai-based family office plans to invest up to $8.8 billion in a blockchain-focused financial hub in the Maldives, part of an effort by the island nation to expand beyond its reliance on tourism and fisheries and address mounting debt obligations.

Read - https://www.ft.com/content...

Subscribe to read

Dubai-based family office plans financial zone for the Indian Ocean archipelago

https://www.ft.com/content/70cba9ec-caad-4958-bed9-59d43e8da6c2

1 month ago

🚨 History in the making! 🚨

Arizona State just went full crypto mode — first U.S. state to launch a Strategic Bitcoin Reserve 💸🔥

They’re doubling down on the future, pledging up to 10% of $31.5 billion in State Assets Funds to invest in Bitcoin. That’s not just bold — that’s revolutionary. 🧠✨

The message is clear: Bitcoin isn’t the future anymore… it’s the present. 🚀

#bitcoin #BTC #Arizona #cryptonews #StateReserve #Investing #FutureMoney #Web3 #FinanceTwitter 😎💼

Arizona State just went full crypto mode — first U.S. state to launch a Strategic Bitcoin Reserve 💸🔥

They’re doubling down on the future, pledging up to 10% of $31.5 billion in State Assets Funds to invest in Bitcoin. That’s not just bold — that’s revolutionary. 🧠✨

The message is clear: Bitcoin isn’t the future anymore… it’s the present. 🚀

#bitcoin #BTC #Arizona #cryptonews #StateReserve #Investing #FutureMoney #Web3 #FinanceTwitter 😎💼

1 month ago

📢 Big Update for #stablecoins : The U.S. SEC has officially closed its investigation into PayPal’s stablecoin, PYUSD, without taking any enforcement action.

In a recent filing, PayPal revealed the SEC issued a document subpoena in Nov 2023 and concluded the probe in Feb 2025. While this is positive news, PayPal also warned of potential future compliance costs from evolving regulations — and risks if PYUSD is ever tied to illicit activity or litigation.

For now, this closure could help ease institutional concerns around stablecoin adoption. 🚀

#cryptonews #PayPal #PYUSD #SEC #Regulation #fintech #DigitalCurrency

In a recent filing, PayPal revealed the SEC issued a document subpoena in Nov 2023 and concluded the probe in Feb 2025. While this is positive news, PayPal also warned of potential future compliance costs from evolving regulations — and risks if PYUSD is ever tied to illicit activity or litigation.

For now, this closure could help ease institutional concerns around stablecoin adoption. 🚀

#cryptonews #PayPal #PYUSD #SEC #Regulation #fintech #DigitalCurrency

1 month ago

🔍 Big developments in crypto policy!

The UK Treasury has announced plans to collaborate with the United States to boost innovation in the cryptocurrency sector.

In a statement released on April 30, UK Finance Minister Rachel Reeves outlined the “Change Plan ”—a regulatory initiative aimed at creating new rules for crypto asset providers like Bitcoin and Ethereum. The goal? Strengthen investor confidence and fuel industry growth.

Reeves recently met with US Treasury Secretary Scott Bessent in Washington to discuss cross-border cooperation on digital asset regulation. They’re working closely through the UK-US Financial Regulatory Working Group, including exploring ideas from SEC Commissioner Hester Peirce.

This follows recent pro-crypto moves by the UK government, like revising the Financial Services and Markets Act 2000 in January to ease restrictions on staking services—marking a clear shift toward fostering innovation.

💡 The message is clear: the UK wants to be "the best place for innovation in the world ."

#cryptonews #DigitalAssets #Regulation #bitcoin #ethereum #UKPolicy #USFinance #BlockchainInnovation #RachelReeves #CryptoRegulation

The UK Treasury has announced plans to collaborate with the United States to boost innovation in the cryptocurrency sector.

In a statement released on April 30, UK Finance Minister Rachel Reeves outlined the “Change Plan ”—a regulatory initiative aimed at creating new rules for crypto asset providers like Bitcoin and Ethereum. The goal? Strengthen investor confidence and fuel industry growth.

Reeves recently met with US Treasury Secretary Scott Bessent in Washington to discuss cross-border cooperation on digital asset regulation. They’re working closely through the UK-US Financial Regulatory Working Group, including exploring ideas from SEC Commissioner Hester Peirce.

This follows recent pro-crypto moves by the UK government, like revising the Financial Services and Markets Act 2000 in January to ease restrictions on staking services—marking a clear shift toward fostering innovation.

💡 The message is clear: the UK wants to be "the best place for innovation in the world ."

#cryptonews #DigitalAssets #Regulation #bitcoin #ethereum #UKPolicy #USFinance #BlockchainInnovation #RachelReeves #CryptoRegulation

Sponsored by

Administrator

11 months ago