9 days ago

🚀 Bitcoin to $150K by October? 👀

Dutch crypto manager Michael van de Poppe is mapping out a bullish path for BTC — citing technical patterns and ETF inflows as key drivers. With the halving hype still strong and market momentum building, could we really see a $150K Bitcoin within months?

📈 Is this the breakout we've been waiting for or just another hopium injection?

🔗 Full story: https://cryptopotato.com/d...

#bitcoin #cryptonews #BTC150K #bullrun #cryptomarket #MichaelVandePoppe #Halving2024

Dutch crypto manager Michael van de Poppe is mapping out a bullish path for BTC — citing technical patterns and ETF inflows as key drivers. With the halving hype still strong and market momentum building, could we really see a $150K Bitcoin within months?

📈 Is this the breakout we've been waiting for or just another hopium injection?

🔗 Full story: https://cryptopotato.com/d...

#bitcoin #cryptonews #BTC150K #bullrun #cryptomarket #MichaelVandePoppe #Halving2024

Dutch Crypto Manager Spies Path For Bitcoin to $150K By October

Bitcoin decoupled from stocks in mid-April. Meanwhile, the total crypto market cap respected an 18-month support line. If BTC repeats a recent pattern, it's pacing for $150K by Q4.

https://cryptopotato.com/dutch-crypto-manager-spies-path-for-bitcoin-to-150k-by-october/

10 days ago

The crypto seas just trembled—a $6.6 BILLION Bitcoin whale has stirred after years of dormancy. When these leviathans move, they don’t just make ripples… they create tidal waves across the market.

But who is this whale? Why now? And what could this mean for Bitcoin's next move? Let’s dive into this breaking development that has every trader, analyst, and HODLer watching closely.

🧠 The Awakening: 94,500 BTC Moved After 5+ Years

On-chain analysts confirmed a jaw-dropping transaction: a wallet containing 94,500 BTC—worth roughly $6.6 billion—moved funds for the first time since 2019. That’s pre-pandemic Bitcoin, bought at a fraction of today’s price.

This isn't your average whale.

This is a legacy address, possibly tied to early miners, institutions, or even an exchange cold wallet. But the timing and scale are what's making jaws drop.

Whether it's reallocation, institutional movement, or prep for ETF flows, one thing’s clear: the giants of crypto are waking up... and they’re not swimming quietly.

#BitcoinWhales #BTCAlert #CryptoNewss #cryptomarket #BTCVolatility

But who is this whale? Why now? And what could this mean for Bitcoin's next move? Let’s dive into this breaking development that has every trader, analyst, and HODLer watching closely.

🧠 The Awakening: 94,500 BTC Moved After 5+ Years

On-chain analysts confirmed a jaw-dropping transaction: a wallet containing 94,500 BTC—worth roughly $6.6 billion—moved funds for the first time since 2019. That’s pre-pandemic Bitcoin, bought at a fraction of today’s price.

This isn't your average whale.

This is a legacy address, possibly tied to early miners, institutions, or even an exchange cold wallet. But the timing and scale are what's making jaws drop.

Whether it's reallocation, institutional movement, or prep for ETF flows, one thing’s clear: the giants of crypto are waking up... and they’re not swimming quietly.

#BitcoinWhales #BTCAlert #CryptoNewss #cryptomarket #BTCVolatility

16 days ago

⚡️ TODAY: Binance founder CZ reminds the crypto community to focus on fundamentals, projects with users, revenues, and profits rather than chasing narratives.

Do you agree? 👇

Do you agree? 👇

16 days ago

*NEW* Hackathon challenge alert!!

$2,000 bounty for knowledge graph creation!

More on: https://x.com/bioprotocol/...

$2,000 bounty for knowledge graph creation!

More on: https://x.com/bioprotocol/...

19 days ago

From Pensions to Crypto: The Bold New Frontier of Retirement Investing

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

1 month ago

1 month ago

According to Coinglass data, Bitcoin’s price movement is approaching high-impact liquidation zones on mainstream centralized exchanges (CEXs).

💡Key Liquidation Levels:

1. If Bitcoin surpasses $88,000, short orders worth $371 million could be liquidated across major CEXs.

2. If Bitcoin drops below $84,000, long orders worth $422 million could face liquidation.

💡Understanding the Liquidation Chart:

1. The liquidation chart does not indicate the exact number of contracts or their value but rather the relative importance of each liquidation cluster.

2. Larger liquidation columns signal a higher likelihood of significant price movements when Bitcoin reaches a particular level.

3. The stronger the liquidation cluster, the more volatile Bitcoin’s price reaction is expected to be.

#bitcoin #Liquidation #CEX

💡Key Liquidation Levels:

1. If Bitcoin surpasses $88,000, short orders worth $371 million could be liquidated across major CEXs.

2. If Bitcoin drops below $84,000, long orders worth $422 million could face liquidation.

💡Understanding the Liquidation Chart:

1. The liquidation chart does not indicate the exact number of contracts or their value but rather the relative importance of each liquidation cluster.

2. Larger liquidation columns signal a higher likelihood of significant price movements when Bitcoin reaches a particular level.

3. The stronger the liquidation cluster, the more volatile Bitcoin’s price reaction is expected to be.

#bitcoin #Liquidation #CEX

1 month ago

Trump's Crypto Reserve Plan: Understanding the Path to $500,000 Bitcoin

Standard Chartered analysts have suggested that a proposed "crypto reserve" plan by U.S. President Donald Trump could potentially drive Bitcoin prices to $500,000 if successfully implemented. This prediction highlights the significant impact such a policy could have on the #cryptocurrency market.

Reserve Implementation Details:

1. Current Holdings

- U.S. government already holds approximately 200,000 Bitcoin ($17 billion value)

- Assets obtained primarily through criminal seizures

2. Proposed Structure

- Will include five cryptocurrencies: Bitcoin, Ethereum, XRP, Solana, and Cardano

- No new taxpayer funding planned; utilizing existing seized assets

#bitcoin #standardchartered #crypto #Trump

Standard Chartered analysts have suggested that a proposed "crypto reserve" plan by U.S. President Donald Trump could potentially drive Bitcoin prices to $500,000 if successfully implemented. This prediction highlights the significant impact such a policy could have on the #cryptocurrency market.

Reserve Implementation Details:

1. Current Holdings

- U.S. government already holds approximately 200,000 Bitcoin ($17 billion value)

- Assets obtained primarily through criminal seizures

2. Proposed Structure

- Will include five cryptocurrencies: Bitcoin, Ethereum, XRP, Solana, and Cardano

- No new taxpayer funding planned; utilizing existing seized assets

#bitcoin #standardchartered #crypto #Trump

2 months ago

(E)

Ethereum Documentary 'Vitalik: The Story of Ethereum' Set for April Release

The cryptocurrency documentary 'Vitalik: The Story of Ethereum' is scheduled to premiere on April 15 on Apple TV and Prime Video.

The film chronicles the journey of Vitalik Buterin and the Ethereum community as they strive for an open internet.

Release Platform: Available at EthereumFilm.xyz

#cryptocurrency #ethereum #Documentary #Vitalik #TheStoryofEthereum

https://gathr.com/films/vi...

The cryptocurrency documentary 'Vitalik: The Story of Ethereum' is scheduled to premiere on April 15 on Apple TV and Prime Video.

The film chronicles the journey of Vitalik Buterin and the Ethereum community as they strive for an open internet.

Release Platform: Available at EthereumFilm.xyz

#cryptocurrency #ethereum #Documentary #Vitalik #TheStoryofEthereum

https://gathr.com/films/vi...

Vitalik: An Ethereum Story - Film - Gathr

Vitalik: An Ethereum Story is a feature documentary chronicling tech visionary Vitalik Buterin and Ethereum’s community of builders as they fight for an open internet accessible to all.

https://gathr.com/films/vitalik-an-ethereum-story

2 months ago

[A whale with 67,000 ETH on the verge of liquidation] reduced his position by 2,882 ETH and exchanged it for 5.21 million DAI to repay the loan before the Oracle price update at 10 o'clock, which slightly reduced the liquidation price to $1,781.

At present, ETH has rebounded a bit, and the next oracle price is also higher than its liquidation price. At least, I can breathe a sigh of relief for the time being.

Current Position

- Original holdings: 67,000 ETH

- Position reduction: 2,882 ETH (approximately 4.3% of total holdings)

- DAI received: 5.21 million DAI

- New liquidation price: $1,781

- Current status: ETH price has rebounded above the liquidation price

According to coindesk.com, this case reflects broader market conditions:

Approximately $336 million in assets at risk of liquidation (within 20% ETH price range)

Multiple large positions in danger zones, including:

- $117 million in debt at $1,780 ETH liquidation price

- $13.6 million in debt at $1,857 ETH liquidation price

#ethereum #ether #ETH #whale

Source:

https://debank.com/profile...

At present, ETH has rebounded a bit, and the next oracle price is also higher than its liquidation price. At least, I can breathe a sigh of relief for the time being.

Current Position

- Original holdings: 67,000 ETH

- Position reduction: 2,882 ETH (approximately 4.3% of total holdings)

- DAI received: 5.21 million DAI

- New liquidation price: $1,781

- Current status: ETH price has rebounded above the liquidation price

According to coindesk.com, this case reflects broader market conditions:

Approximately $336 million in assets at risk of liquidation (within 20% ETH price range)

Multiple large positions in danger zones, including:

- $117 million in debt at $1,780 ETH liquidation price

- $13.6 million in debt at $1,857 ETH liquidation price

#ethereum #ether #ETH #whale

Source:

https://debank.com/profile...

2 months ago

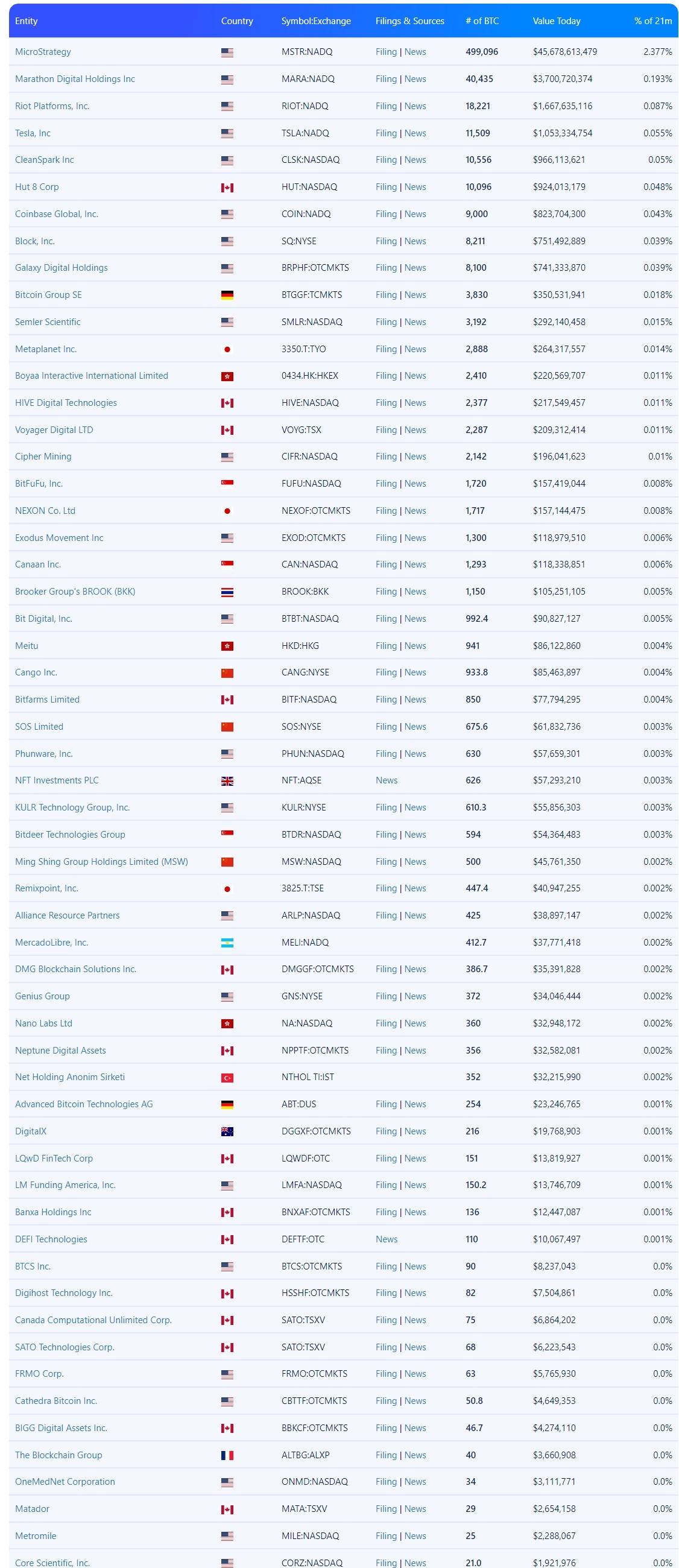

Public Companies that Own #bitcoin

1 MicroStrategy ₿499,096 | $45,678,613,479

2 Marathon Digital Holdings Inc ₿40,435 | $3,700,720,374

3 Riot Platforms, Inc. ₿18,221 | $1,667,635,116

4 Tesla, Inc ₿11,509 | $1,053,334,754

1 MicroStrategy ₿499,096 | $45,678,613,479

2 Marathon Digital Holdings Inc ₿40,435 | $3,700,720,374

3 Riot Platforms, Inc. ₿18,221 | $1,667,635,116

4 Tesla, Inc ₿11,509 | $1,053,334,754

2 months ago

Berachain Co-Founder Reflects on Early Investment Decisions 🔥

The journey to success is never a straight path, and Berachain’s co-founder knows this all too well! 🏆🚀

In a recent reflection, they opened up about the crucial investment decisions that helped shape the future of Berachain. From early bets on blockchain innovation to navigating market uncertainties, every choice played a role in creating the high-performance, EVM-compatible L1 that Berachain is today. 🐻🔗

💡 Key Takeaways from Their Reflection:

✅ Taking calculated risks in unproven markets 💰🎯

✅ Staying true to the vision despite market fluctuations 📈🔥

✅ Building a strong community and ecosystem 👥🤝

✅ Learning from mistakes and adapting quickly 🏃♂️💨

With Berachain’s unique proof-of-liquidity model driving innovation in DeFi, it’s clear that those early investment decisions set the stage for something revolutionary. 🌍🔮 Looking back, the co-founder’s insights remind us that bold moves and unwavering belief can lead to massive breakthroughs!

What do you think? 🤔 Would you have made the same early bets? Share your thoughts below! ⬇️🐻💬

#Berachain #cryptoinvestment

The journey to success is never a straight path, and Berachain’s co-founder knows this all too well! 🏆🚀

In a recent reflection, they opened up about the crucial investment decisions that helped shape the future of Berachain. From early bets on blockchain innovation to navigating market uncertainties, every choice played a role in creating the high-performance, EVM-compatible L1 that Berachain is today. 🐻🔗

💡 Key Takeaways from Their Reflection:

✅ Taking calculated risks in unproven markets 💰🎯

✅ Staying true to the vision despite market fluctuations 📈🔥

✅ Building a strong community and ecosystem 👥🤝

✅ Learning from mistakes and adapting quickly 🏃♂️💨

With Berachain’s unique proof-of-liquidity model driving innovation in DeFi, it’s clear that those early investment decisions set the stage for something revolutionary. 🌍🔮 Looking back, the co-founder’s insights remind us that bold moves and unwavering belief can lead to massive breakthroughs!

What do you think? 🤔 Would you have made the same early bets? Share your thoughts below! ⬇️🐻💬

#Berachain #cryptoinvestment

2 months ago

Crypto Fraudster's Ex-Partner Guilty

Iris Ramaya Au, the former partner of #cryptocurrency fraudster Adam Iza, known as the "Godfather," has pleaded guilty to federal tax charges. She admitted to failing to report over $2.6 million in illicit gains acquired through Iza's criminal activities.

Au's guilty plea includes acknowledging that she provided false information on her tax return regarding these earnings from 2020 to 2023.

As a result of her actions, she faces a potential sentence of up to three years in federal prison. This development follows Iza's own guilty plea to multiple charges, including conspiracy, wire fraud, and tax evasion, where he is expected to face a significantly longer sentence of up to 35 years in prison.

#crypto #Fraud #cryptocurrencyfraudster #cryptocurrency #cryptoscam

Iris Ramaya Au, the former partner of #cryptocurrency fraudster Adam Iza, known as the "Godfather," has pleaded guilty to federal tax charges. She admitted to failing to report over $2.6 million in illicit gains acquired through Iza's criminal activities.

Au's guilty plea includes acknowledging that she provided false information on her tax return regarding these earnings from 2020 to 2023.

As a result of her actions, she faces a potential sentence of up to three years in federal prison. This development follows Iza's own guilty plea to multiple charges, including conspiracy, wire fraud, and tax evasion, where he is expected to face a significantly longer sentence of up to 35 years in prison.

#crypto #Fraud #cryptocurrencyfraudster #cryptocurrency #cryptoscam

2 months ago

Amouranth, a popular streamer, was reportedly robbed at gunpoint, with the attackers demanding #cryptocurrency .

On March 2nd, streamer Amouranth (Kaitlyn Siragusa) reported a violent home invasion in Houston where attackers demanded Bitcoin.

Amouranth shared on X (formerly Twitter) that she was pulled out of bed at gunpoint and instructed to make a crypto payment. She tweeted about the incident while it was happening, explaining that calling emergency services would have been too dangerous.

Quote from Amouranth: "I'm being too robbed at gunpoint...They wanted crypto is what they were yelling they pulled me out of bed." She also stated, "Was at gun point they gave me phone and said log in with gun to my head and I tweeted because calling would be a death sentence."

#crypto #cryptorobbery #robbed #bitcoin

On March 2nd, streamer Amouranth (Kaitlyn Siragusa) reported a violent home invasion in Houston where attackers demanded Bitcoin.

Amouranth shared on X (formerly Twitter) that she was pulled out of bed at gunpoint and instructed to make a crypto payment. She tweeted about the incident while it was happening, explaining that calling emergency services would have been too dangerous.

Quote from Amouranth: "I'm being too robbed at gunpoint...They wanted crypto is what they were yelling they pulled me out of bed." She also stated, "Was at gun point they gave me phone and said log in with gun to my head and I tweeted because calling would be a death sentence."

#crypto #cryptorobbery #robbed #bitcoin

2 months ago

Swiss National Bank Rejects #bitcoin Reserves Proposal

According to CoinDesk, Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of incorporating bitcoin into Switzerland's central bank reserves. Schlegel highlighted concerns over the cryptocurrency's volatility, liquidity, and security as primary reasons for this decision. In an interview with the Tamedia group, he emphasized that the instability of #cryptocurrencies makes them unsuitable for preserving long-term value.

Schlegel further explained that the central bank's reserves must remain highly liquid to be readily available for monetary policy interventions. He also pointed out the inherent security risks associated with software-based assets, noting that software can be prone to bugs and vulnerabilities. These remarks come amid a broader discussion in Switzerland regarding the potential inclusion of Bitcoin in the SNB's reserves.

A recent initiative, spearheaded by entrepreneur Yves Bennaim, is advocating for a constitutional amendment that would require the SNB to hold bitcoin alongside gold in its reserves. This initiative, launched in December, aims to gather 100,000 signatures within 18 months to prompt a nationwide vote on the matter. While the proposal does not specify the exact bitcoin allocations, it suggests that the reserves should be built from the bank's earnings.

Despite the increasing acceptance of cryptocurrencies in Switzerland, with several Swiss banks offering cryptocurrency-related services, Schlegel remains skeptical.

According to CoinDesk, Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of incorporating bitcoin into Switzerland's central bank reserves. Schlegel highlighted concerns over the cryptocurrency's volatility, liquidity, and security as primary reasons for this decision. In an interview with the Tamedia group, he emphasized that the instability of #cryptocurrencies makes them unsuitable for preserving long-term value.

Schlegel further explained that the central bank's reserves must remain highly liquid to be readily available for monetary policy interventions. He also pointed out the inherent security risks associated with software-based assets, noting that software can be prone to bugs and vulnerabilities. These remarks come amid a broader discussion in Switzerland regarding the potential inclusion of Bitcoin in the SNB's reserves.

A recent initiative, spearheaded by entrepreneur Yves Bennaim, is advocating for a constitutional amendment that would require the SNB to hold bitcoin alongside gold in its reserves. This initiative, launched in December, aims to gather 100,000 signatures within 18 months to prompt a nationwide vote on the matter. While the proposal does not specify the exact bitcoin allocations, it suggests that the reserves should be built from the bank's earnings.

Despite the increasing acceptance of cryptocurrencies in Switzerland, with several Swiss banks offering cryptocurrency-related services, Schlegel remains skeptical.

2 months ago

JUST IN 🚨 China's Supreme Court And Judicial Authorities Have Gathered To Discuss How To Handle Crypto Legal Cases 🇨🇳

#crypto #china #CryptoLegal #freecrypto

#crypto #china #CryptoLegal #freecrypto

2 months ago

2 months ago

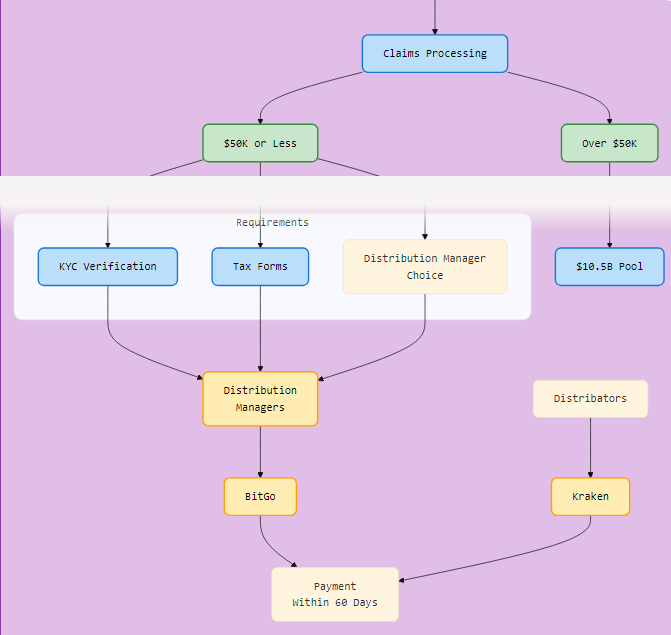

FTX's estate is beginning its payment plan today, though the initial distribution will be approximately $1.2 billion rather than $2.4 billion.

- Starting today, FTX will begin repayments to creditors with claims of $50,000 or less ("convenience class" creditors).

-These creditors will receive approximately 119% of their claimed amount, including principal plus interest.

- Payments must be completed within 60 days of the effective date.

Market Impact Analysis:

- Analysts estimate approximately $2.4 billion may flow back into crypto markets following the distribution

- $3.9 billion of total claims were acquired by credit funds, which typically won't reinvest in crypto assets

- 33% of remaining claims belong to sanctioned countries, individuals without KYC verification, or those unable to claim funds

Total Distribution Scope:

- Total estimated distribution will range between $14.7 billion and $16.5 billion

- BitGo and Kraken have been designated to manage initial distributions for retail and institutional customers in supported jurisdictions

- Creditors must complete KYC verification and submit tax forms through the FTX Debtors' Customer Portal to receive payments

MANY WILL INVEST IN #bitcoin 🚀

- Starting today, FTX will begin repayments to creditors with claims of $50,000 or less ("convenience class" creditors).

-These creditors will receive approximately 119% of their claimed amount, including principal plus interest.

- Payments must be completed within 60 days of the effective date.

Market Impact Analysis:

- Analysts estimate approximately $2.4 billion may flow back into crypto markets following the distribution

- $3.9 billion of total claims were acquired by credit funds, which typically won't reinvest in crypto assets

- 33% of remaining claims belong to sanctioned countries, individuals without KYC verification, or those unable to claim funds

Total Distribution Scope:

- Total estimated distribution will range between $14.7 billion and $16.5 billion

- BitGo and Kraken have been designated to manage initial distributions for retail and institutional customers in supported jurisdictions

- Creditors must complete KYC verification and submit tax forms through the FTX Debtors' Customer Portal to receive payments

MANY WILL INVEST IN #bitcoin 🚀

5 months ago

Marathon Digital Holdings has acquired 11,774 BTC for $1.1 billion at $96,000 per #bitcoin .

Source-https://www.sec.gov/ix?doc...

Source-https://www.sec.gov/ix?doc...

9 months ago

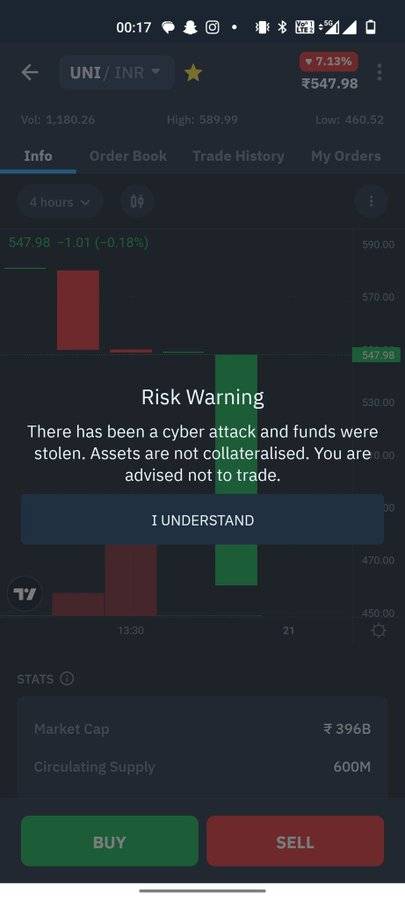

BREAKING: Recently hacked Indian 🇮🇳 crypto exchange

WazirX India pauses trading and says ‘The path to a total recovery of 💰 $230m will be longer’.

WazirX India pauses trading and says ‘The path to a total recovery of 💰 $230m will be longer’.

9 months ago

(E)

Quantum Computing and Bitcoin Mining: Summary

Connection

Quantum computing can process information exponentially faster than classical computing, potentially transforming Bitcoin mining, which relies on solving complex mathematical problems.

Potential Advantages

Improved Efficiency: Quantum computers can solve hashing problems much quicker, enhancing mining efficiency.

Reduced Energy Consumption: They could lower the energy required for mining, making it more environmentally friendly.

Enhanced Security: New post-quantum encryption methods will be needed to counteract quantum threats, improving transaction security.

Decentralized Mining: Widespread quantum computing could make mining more accessible and decentralized, reducing the concentration of mining power in large server farms.

Conclusion

Quantum computing could revolutionize Bitcoin mining by boosting efficiency, reducing energy use, and enhancing security, while also posing new challenges.

Connection

Quantum computing can process information exponentially faster than classical computing, potentially transforming Bitcoin mining, which relies on solving complex mathematical problems.

Potential Advantages

Improved Efficiency: Quantum computers can solve hashing problems much quicker, enhancing mining efficiency.

Reduced Energy Consumption: They could lower the energy required for mining, making it more environmentally friendly.

Enhanced Security: New post-quantum encryption methods will be needed to counteract quantum threats, improving transaction security.

Decentralized Mining: Widespread quantum computing could make mining more accessible and decentralized, reducing the concentration of mining power in large server farms.

Conclusion

Quantum computing could revolutionize Bitcoin mining by boosting efficiency, reducing energy use, and enhancing security, while also posing new challenges.

Subscribe to Unlock

For 1$ / Monthly

10 months ago

If you want to attract people to your site, you will succeed thanks to me and my contacts in the industry. With our network and expertise, we can generate interest and gather an engaged audience around your project. Don’t hesitate to highlight your strengths to maximize this opportunity.

Subscribe to Unlock

For 1$ / Monthly

Sponsored by

Administrator

10 months ago