3 days ago

Bitcoin dominance dropping can often signal a shift in the market. When Bitcoin's share of the total crypto market cap decreases, it frequently means capital is flowing into altcoins, potentially setting the stage for some exciting gains.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

6 days ago

🚨 Bitcoin Could Hit $120K in Weeks If Momentum Continues — JoeDiPasquale of BitBullCapital

Bullish signals are flashing as BTC's rally gains steam. Watch the key levels that could set the stage for a massive breakout.

#crypto #BTC #bitcoin #MarketUpdate #CryptoTrader #DigitalAssets

Bullish signals are flashing as BTC's rally gains steam. Watch the key levels that could set the stage for a massive breakout.

#crypto #BTC #bitcoin #MarketUpdate #CryptoTrader #DigitalAssets

6 days ago

XRP May Experience a Decline Due to Concerns About Market Peaks

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

10 days ago

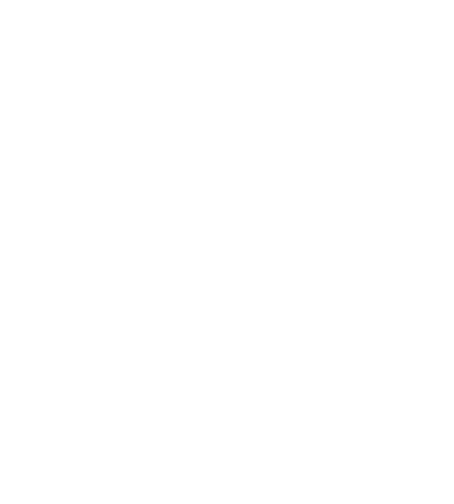

The new http://cookie.fun platform is literally 10 times better than Kaito. You can see stats per project and the data does look really good!

Also: I'm in the top 10 mindshare for $LINK together with legends like ChrisBarrett ChainLinkGod TheLinkPanda and more.

Also: I'm in the top 10 mindshare for $LINK together with legends like ChrisBarrett ChainLinkGod TheLinkPanda and more.

11 days ago

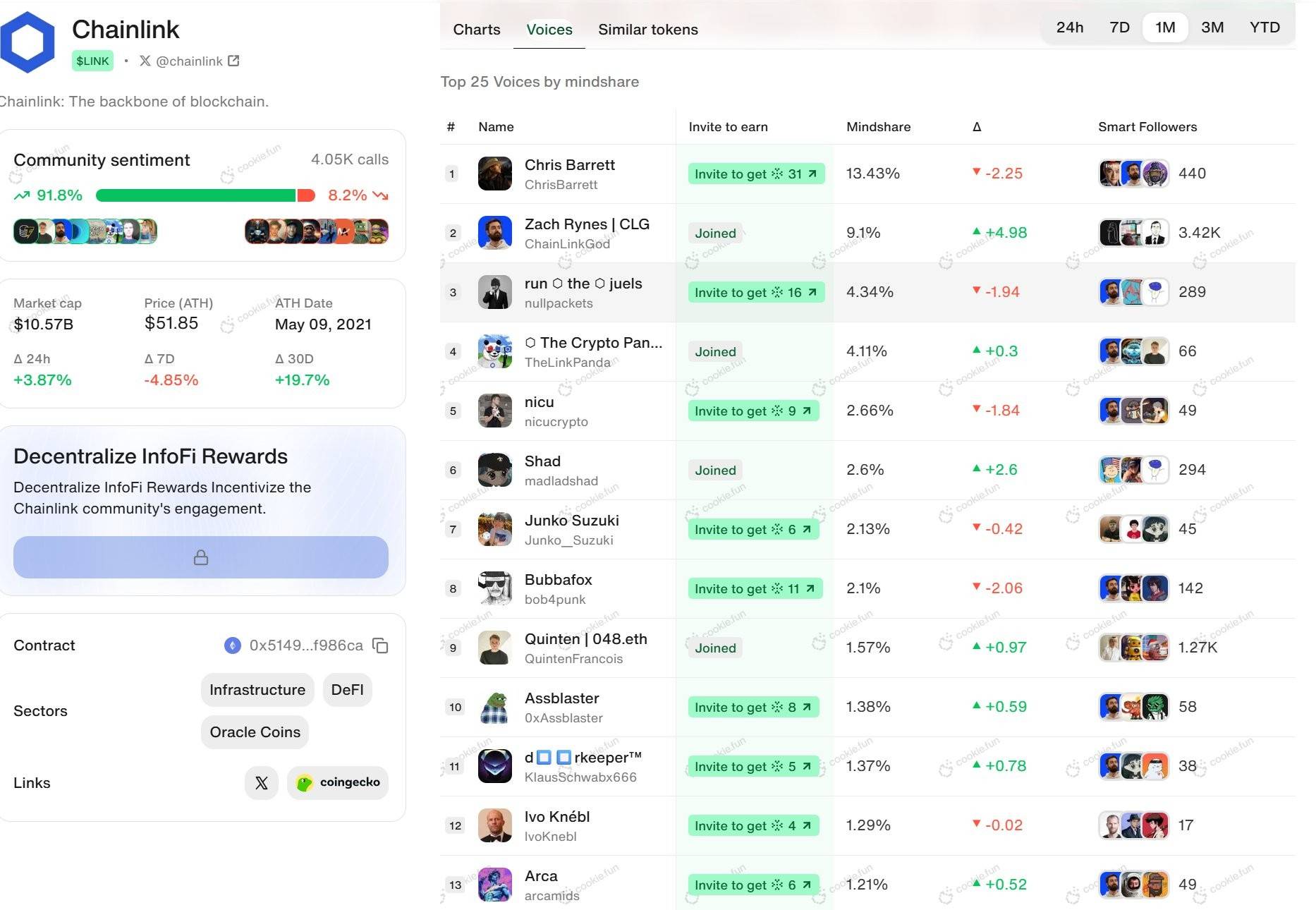

🚀 Solana’s stablecoin market cap just hit $12B as of May 20 — up from $6.4B on Jan 1!

That’s a massive 87.5% surge in just a few months. 💸✨

The Solana ecosystem is firing on all cylinders — where’s the next leg of the rally coming from? 🚨📈

#solana #sol #stablecoins #CryptoGrowth #Blockchain #defi #OnChainReality

That’s a massive 87.5% surge in just a few months. 💸✨

The Solana ecosystem is firing on all cylinders — where’s the next leg of the rally coming from? 🚨📈

#solana #sol #stablecoins #CryptoGrowth #Blockchain #defi #OnChainReality

17 days ago

(E)

🚀 Altcoin Season on the Horizon as Bitcoin Nears All-Time High? 🚀

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

1 month ago

🚀 BREAKING: Jack Mallers' New Company, TWENTY ONE, Surges Over 160% After Buying 42,000 #bitcoin !

🔥 The founder of Strike continues to make waves in crypto. Is this the next big play in Bitcoin adoption?

📈 Bullish Signal? With institutional demand heating up, could this trigger another #BTC rally?

What’s your take? 👇 #crypto #BitcoinNews

🔥 The founder of Strike continues to make waves in crypto. Is this the next big play in Bitcoin adoption?

📈 Bullish Signal? With institutional demand heating up, could this trigger another #BTC rally?

What’s your take? 👇 #crypto #BitcoinNews

1 month ago

Riot Platforms has secured a $100 million credit facility from Coinbase Credit, a subsidiary of Coinbase Global, Inc. The credit facility, Riot's first bitcoin-backed facility, will provide the company with non-dilutive funding at an attractive financing cost.

Key Points:

Purpose: Riot intends to use the proceeds from the credit facility for strategic initiatives and general corporate purposes.

Terms: The loan has a variable annual interest rate of at least 7.75%, calculated as the greater of 3.25% or the federal funds rate upper bound, plus 4.5%. It will mature 364 days after the effective date, with a possible one-year extension subject to Coinbase's consent.

Collateral: The loan is secured by a portion of Riot's total bitcoin holdings. As of April 2025, Riot held 19,223 BTC, valued at approximately $1.8 billion.

Strategic Importance: The credit facility is a key part of Riot's efforts to diversify funding sources, support operations, and pursue strategic growth initiatives, with a focus on long-term stockholder value creation.

Market Reaction: Following the announcement, shares of Riot Platforms (RIOT) rose more than 8% on April 23, amid a broad rally for Bitcoin miners and the overall stock market.

Key Points:

Purpose: Riot intends to use the proceeds from the credit facility for strategic initiatives and general corporate purposes.

Terms: The loan has a variable annual interest rate of at least 7.75%, calculated as the greater of 3.25% or the federal funds rate upper bound, plus 4.5%. It will mature 364 days after the effective date, with a possible one-year extension subject to Coinbase's consent.

Collateral: The loan is secured by a portion of Riot's total bitcoin holdings. As of April 2025, Riot held 19,223 BTC, valued at approximately $1.8 billion.

Strategic Importance: The credit facility is a key part of Riot's efforts to diversify funding sources, support operations, and pursue strategic growth initiatives, with a focus on long-term stockholder value creation.

Market Reaction: Following the announcement, shares of Riot Platforms (RIOT) rose more than 8% on April 23, amid a broad rally for Bitcoin miners and the overall stock market.

2 months ago

MASSIVE WEEK AHEAD

📅 April 1 – ISM Manufacturing Data

📅 April 2 – Major Tariffs Announcement

📅 April 3 – Initial Jobless Claims Report

📅 April 4 – Fed Chair Powell Speaks @ SABEW Conference

📅 April 4 – U.S. Unemployment Data Release

With economic indicators in focus, traders are on high alert.

If the data leans bullish, could we see the next big market rally?

📅 April 1 – ISM Manufacturing Data

📅 April 2 – Major Tariffs Announcement

📅 April 3 – Initial Jobless Claims Report

📅 April 4 – Fed Chair Powell Speaks @ SABEW Conference

📅 April 4 – U.S. Unemployment Data Release

With economic indicators in focus, traders are on high alert.

If the data leans bullish, could we see the next big market rally?

2 months ago

3 months ago

JUST IN🚨: The price of Toncoin surged after reports indicated that Pavel Durov has left France.

Telegram founder arrested in France on Aug. 24, 2024, the price of TON plummeted by over 35%, from roughly $6.88 to $4.44 by September 2024.

#Toncoin reached a high of $7.20 on December 4, 2024, amid a historic rally in the crypto markets in response to the re-election of President Donald Trump in the United States.

However, TON’s price collapsed by roughly 67% after the post-election rally, reaching a low of $2.36 on March 11, 2025.

Telegram founder arrested in France on Aug. 24, 2024, the price of TON plummeted by over 35%, from roughly $6.88 to $4.44 by September 2024.

#Toncoin reached a high of $7.20 on December 4, 2024, amid a historic rally in the crypto markets in response to the re-election of President Donald Trump in the United States.

However, TON’s price collapsed by roughly 67% after the post-election rally, reaching a low of $2.36 on March 11, 2025.

3 months ago

(E)

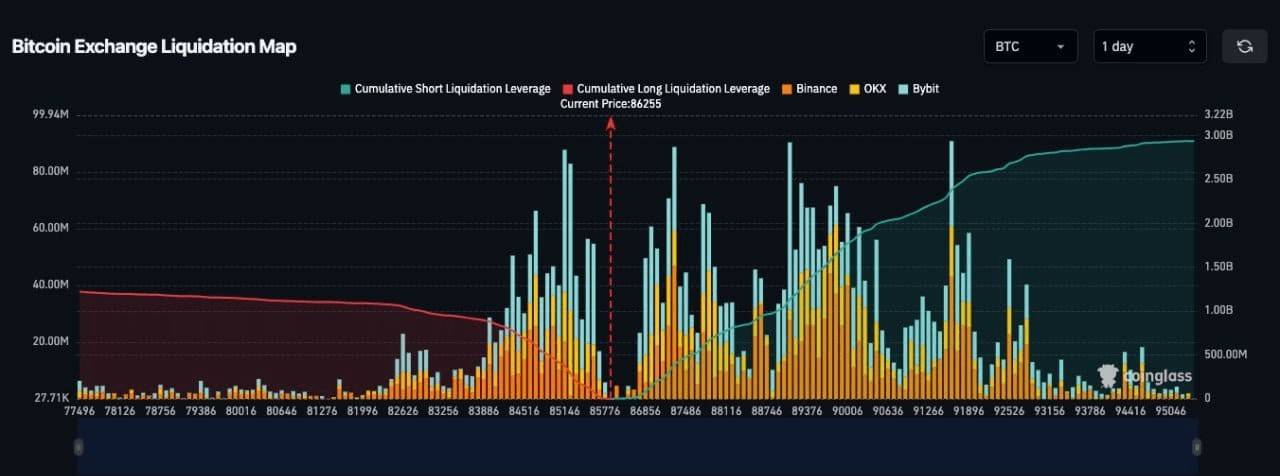

🚨 Bitcoin Liquidation Alert: Massive Short Squeeze Incoming

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

3 months ago

(E)

Bitcoin Defies FUD: Surges 4% Amid Crash Speculation 🚨

$BTC soared past $86K (+4%) after a brief dip, silencing panic over a $70K crash. CryptoQuant CEO Ki Young Ju backs stability: "Too early to panic – $77K floor likely."

📊 Key Levels:

- Resistance: $88K-$89K (break = rally signal)

- Analysts spot buy zones 👀

Verdict: Bulls in control, but tread wisely.

#BitcoinBounce #buythedip #BTCResistance

$BTC soared past $86K (+4%) after a brief dip, silencing panic over a $70K crash. CryptoQuant CEO Ki Young Ju backs stability: "Too early to panic – $77K floor likely."

📊 Key Levels:

- Resistance: $88K-$89K (break = rally signal)

- Analysts spot buy zones 👀

Verdict: Bulls in control, but tread wisely.

#BitcoinBounce #buythedip #BTCResistance

3 months ago

#bitcoin has been in the $90K-$110K price zone for almost four months now. Nothing has changed. We will simply have to be more patient. No one knows what will happen in the coming weeks/months - literally no one; that's a fact - but I prefer panic buying, instead of panic selling.

10 months ago

10 months ago

Analyst predicts that Terra Classic is ready for a significant rally of 280% due to a strong recovery.

11 months ago

Bitcoin (BTC) Price Tops $66K Amid Global CrowdStrike Outage; Solana (SOL) Hits $170

Friday's crypto rally defied past days' correlation with U.S equities, which continued their losing streak.

https://www.coindesk.com/markets/2024/07/19/bitcoin-tops-66k-as-cryptos-rally-amid-global-it-outage-solanas-sol-leads-altcoins/

Sponsored by

Administrator

11 months ago