2 days ago

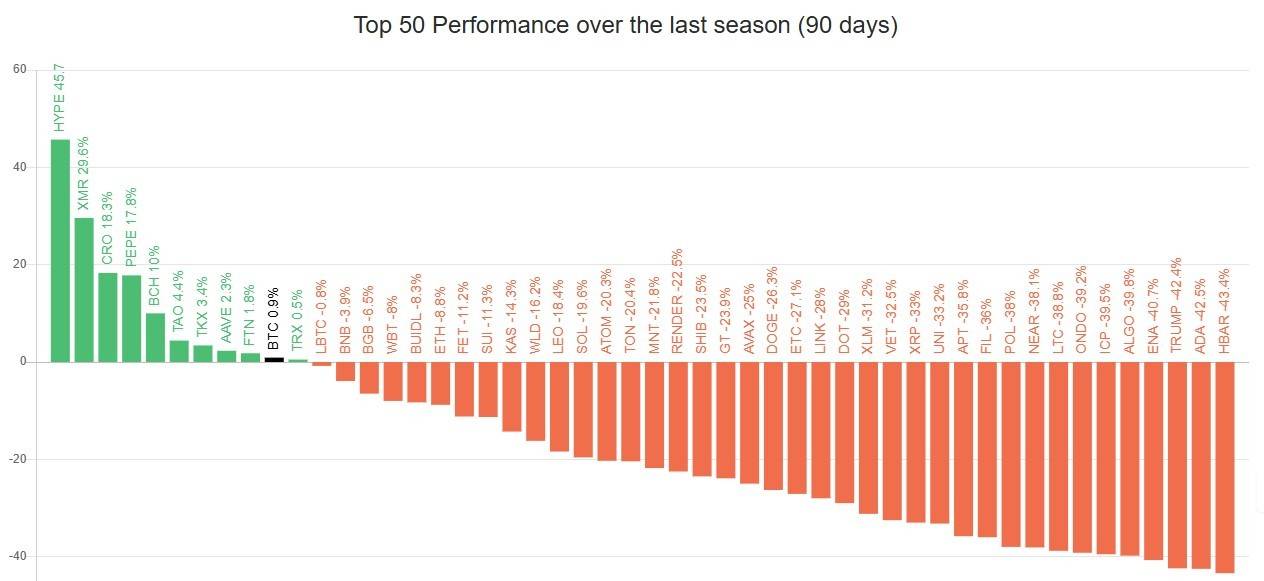

📊 Top 50 Crypto Performance Over the Last Season (90 Days)

🔥 The Winners:

-HYPE leads the pack with an impressive 45.7% gain !

-XMR follows closely with a 29.6% increase , making it a strong contender.

-CRO and PEPE also shine, up by 18.3% and 17.8% , respectively.

📈 Mid-Range Performers:

-Cryptos like BCH (10%) , TAO (4.4%) , and TKX (3.4%) show moderate growth.

-AVAX (2.3%) and FIN (1.8%) are steady but not as explosive.

⚠️ The Losers:

-BTC barely holds its ground with just 0.9% growth.

-LTC (-39.8%) , ADA (-42.5%) , and HBAR (-43.4%) take some of the hardest hits.

-TRUMP (-42.4%) and ALGO (-39.5%) also see significant declines.

💡 Key Takeaways:

HYPE is the clear standout, proving why it's been all over the news lately.

The altcoin space is highly volatile, with both massive gains and losses.

If you're in crypto, diversification might be your best bet to weather these swings!

#crypto #Performance #altcoins #bitcoin #MarketAnalysis

🔥 The Winners:

-HYPE leads the pack with an impressive 45.7% gain !

-XMR follows closely with a 29.6% increase , making it a strong contender.

-CRO and PEPE also shine, up by 18.3% and 17.8% , respectively.

📈 Mid-Range Performers:

-Cryptos like BCH (10%) , TAO (4.4%) , and TKX (3.4%) show moderate growth.

-AVAX (2.3%) and FIN (1.8%) are steady but not as explosive.

⚠️ The Losers:

-BTC barely holds its ground with just 0.9% growth.

-LTC (-39.8%) , ADA (-42.5%) , and HBAR (-43.4%) take some of the hardest hits.

-TRUMP (-42.4%) and ALGO (-39.5%) also see significant declines.

💡 Key Takeaways:

HYPE is the clear standout, proving why it's been all over the news lately.

The altcoin space is highly volatile, with both massive gains and losses.

If you're in crypto, diversification might be your best bet to weather these swings!

#crypto #Performance #altcoins #bitcoin #MarketAnalysis

2 days ago

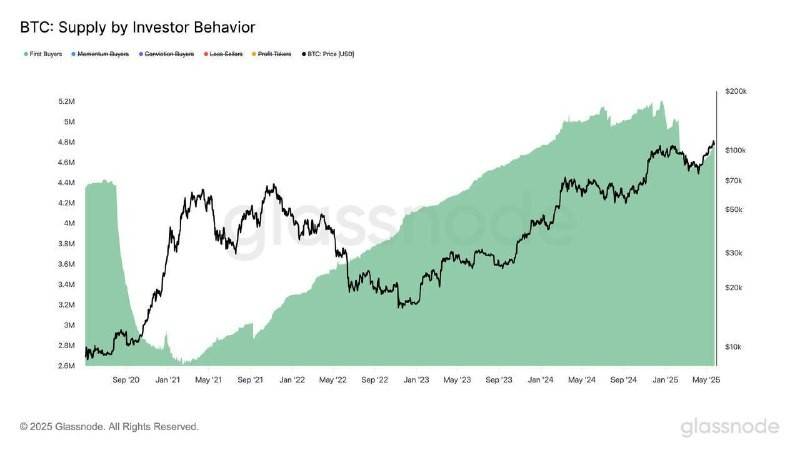

New Buyers’ Entry: Key Driver of Bitcoin’s Continued Uptrend

Sustained bullish trends in the Bitcoin market require the influx of new demand. Data analysis shows significant spikes in the number of first-time Bitcoin buyers (First Buyers) during the periods of July to December 2024 and March to May 2025.

These two periods directly coincided with phases of price growth. The notable increase in new buyers indicates fresh capital entering the Bitcoin ecosystem, strengthening the market structure and supporting the continuation of upward trends.

Sustained bullish trends in the Bitcoin market require the influx of new demand. Data analysis shows significant spikes in the number of first-time Bitcoin buyers (First Buyers) during the periods of July to December 2024 and March to May 2025.

These two periods directly coincided with phases of price growth. The notable increase in new buyers indicates fresh capital entering the Bitcoin ecosystem, strengthening the market structure and supporting the continuation of upward trends.

2 days ago

🟠Challenges Ahead for Bitcoin in Reaching a New All-Time High

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

Despite #bitcoin nearing its all-time high, market data suggests that selling pressure from investors and sluggish growth could hinder the breakout.

Analysts emphasize that holding the support level at $106,265 is crucial to maintaining bullish momentum. While indicators such as rising miner reserves and a Puell Multiple below 2 suggest continued upside potential, short-term holders remain a key source of downward pressure.

A recent study by Bitfinex highlights the $95,000 level as a critical pivot for determining the market’s direction.

2 days ago

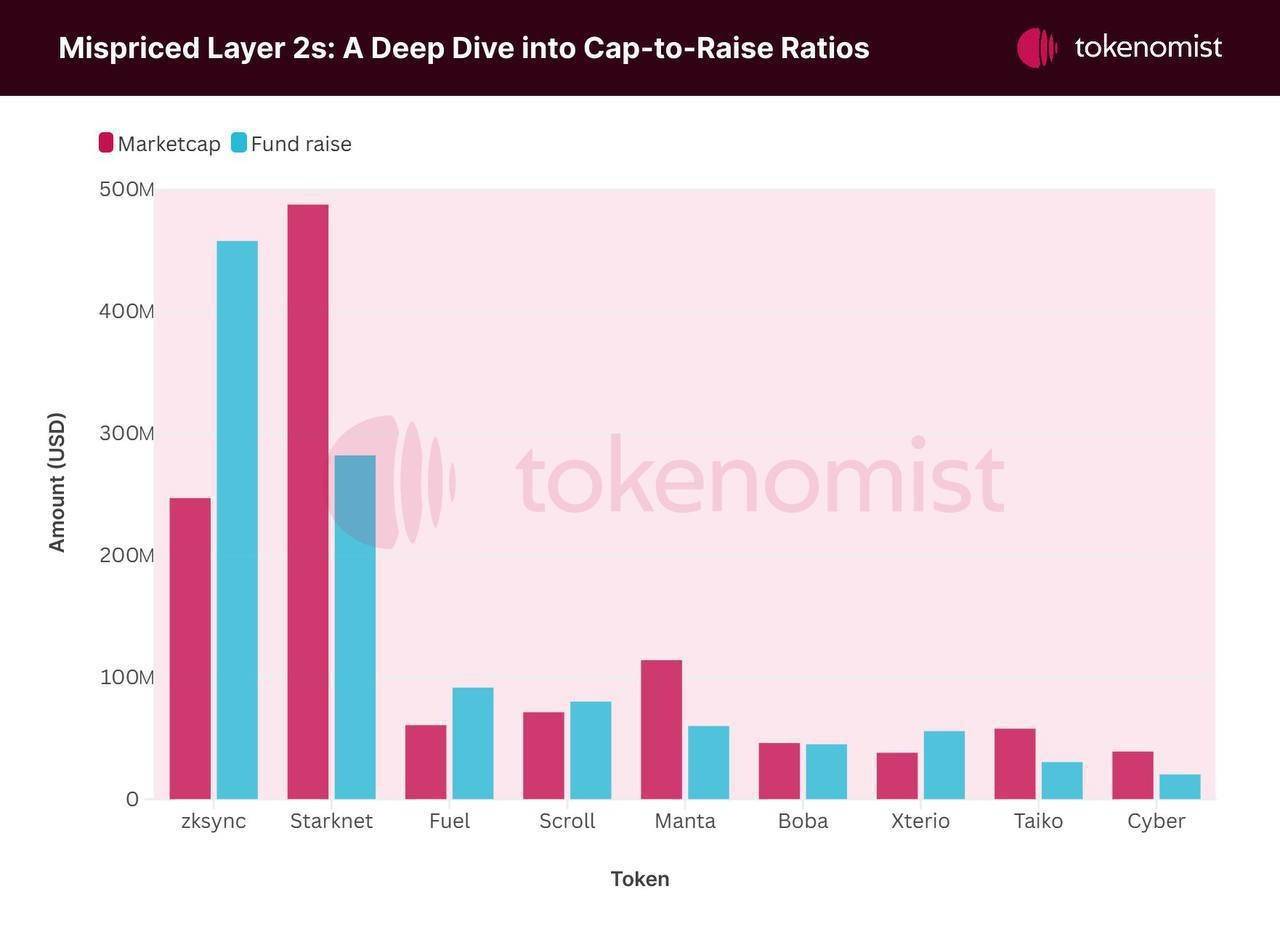

Market Cap Below Funding: The Strange Case of L2 Projects

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

Some prominent Layer 2 (L2) projects, despite raising substantial capital, are currently trading at market caps lower than their total funding, raising questions about their valuation.

The zkSync project, having raised approximately $450 million, currently has a market cap of only about $260 million. Similarly, Starknet, with over $250 million in funding, is trading at a market cap below $500 million. This significant gap between raised capital and market cap may indicate investor uncertainty regarding tokenomics, market adoption, or project performance.

3 days ago

Webus International Limited, a leading Chinese AI company, has announced a major strategic move in the world of digital finance. The company is set to raise up to $300 million through a new financing plan aimed at establishing an XRP Strategic Reserve.

This initiative underscores Webus’s commitment to advancing global payment solutions, leveraging the speed, scalability, and cost-efficiency of the XRP Ledger. By building a dedicated reserve of XRP — a digital asset designed for fast cross-border transactions — Webus is positioning itself at the forefront of the evolving fintech landscape.

This initiative underscores Webus’s commitment to advancing global payment solutions, leveraging the speed, scalability, and cost-efficiency of the XRP Ledger. By building a dedicated reserve of XRP — a digital asset designed for fast cross-border transactions — Webus is positioning itself at the forefront of the evolving fintech landscape.

3 days ago

Bitcoin dominance dropping can often signal a shift in the market. When Bitcoin's share of the total crypto market cap decreases, it frequently means capital is flowing into altcoins, potentially setting the stage for some exciting gains.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

Recent insights suggest that Bitcoin's dominance has indeed been on a decline, with some analysts pointing out that it recently dipped and is showing signs of a reversal from its peak. Historically, such trends have sometimes preceded what many call an "altseason," where altcoins see significant surges. For instance, posts on X and market analyses indicate a growing sentiment that a drop in #bitcoin dominance below key levels like 61.94% or even 60.24% could confirm an altcoin rally. Additionally, reports suggest that if Bitcoin consolidates or moves sideways without crashing, it could build confidence for altcoins to shine.

That said, it's worth keeping a balanced perspective. Some analysts caution that while dominance is dropping, a full-blown altseason isn't guaranteed yet due to macroeconomic uncertainties and varying liquidity. Bitcoin's dominance might plateau or recover if market volatility spikes, as it often acts as a safer haven during unstable times.

Keep a close eye on market indicators like trading volumes for altcoins and Bitcoin's price behavior. If dominance continues to fall and liquidity increases, your optimism for altcoins exploding could very well play out.

4 days ago

DeFi Development Corp. Embraces Liquid Staking to Expand Solana Holdings.

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

DeFi Development Corp., a Nasdaq-listed firm, has adopted liquid staking token (LST) technology to enhance its treasury management and validator operations.

The company owns 609,190 SOL (Solana tokens) as of May 15, worth approximately $105.8 million based on current market prices.

The company plans to allocate a portion of its SOL holdings into dfdvSOL, an LST built on the staking infrastructure of Sanctum.

Liquid staking tokens allow investors to retain asset liquidity while staking their tokens.

This move makes DeFi Development Corp. the first publicly traded company to own LSTs on Solana.

Parker White, the company's CIO and COO, highlighted that the adoption of dfdvSOL helps drive stake to the company's validators and increase SOL holdings.

The company, previously known as Janover, rebranded after former Kraken executives acquired a majority stake in April.

It closed a $24 million private placement earlier this month to fund general corporate purposes and Solana accumulation.

DeFi Development's stock dropped 16.95% on the Nasdaq, closing at $22.19 on Wednesday.

Solana's price traded down 0.7% in the past 24 hours, currently valued at $173.4, with a market capitalization of $90.3 billion, ranking as the sixth-largest cryptocurrency.

#sol #solana

4 days ago

🎉 Big news in the world of freedom tech!

Rumble.com just added a Bitcoin emoji to its chat. 💸

It might be a small symbol… but it’s a huge step toward decentralized communication and financial freedom. 🚀

#bitcoin #FreedomTech #Rumble #CryptoInChat #Decentralization #BitcoinEmoji

Rumble.com just added a Bitcoin emoji to its chat. 💸

It might be a small symbol… but it’s a huge step toward decentralized communication and financial freedom. 🚀

#bitcoin #FreedomTech #Rumble #CryptoInChat #Decentralization #BitcoinEmoji

5 days ago

(E)

Bitget Launches SyrupUSDC: The 20% APY Stablecoin Solution.

#Bitget Wallet has introduced SyrupUSDC, an innovative yield-bearing stablecoin that combines automatic value appreciation with bonus token rewards web3.bitget.com. This unique financial instrument represents a significant advancement in stablecoin technology, offering users up to 20% APY through a sophisticated reward structure.

Backed by real-world assets via Maple Finance.

Reward Structure:

SyrupUSDC offers a dual-reward system web3.bitget.com:

-Base APY: 10% annual yield

-Bonus APY: Additional 10% through SYRUP token airdrops

For example, depositing 100 USDC could grow to approximately 120 USDC over time, broken down as follows:

-Base rewards increase the SyrupUSDC value to ~110 USDC

-SYRUP token airdrops add equivalent value of ~10 USDC

(via: https://www.bitget.com/new...

#Bitget Wallet has introduced SyrupUSDC, an innovative yield-bearing stablecoin that combines automatic value appreciation with bonus token rewards web3.bitget.com. This unique financial instrument represents a significant advancement in stablecoin technology, offering users up to 20% APY through a sophisticated reward structure.

Backed by real-world assets via Maple Finance.

Reward Structure:

SyrupUSDC offers a dual-reward system web3.bitget.com:

-Base APY: 10% annual yield

-Bonus APY: Additional 10% through SYRUP token airdrops

For example, depositing 100 USDC could grow to approximately 120 USDC over time, broken down as follows:

-Base rewards increase the SyrupUSDC value to ~110 USDC

-SYRUP token airdrops add equivalent value of ~10 USDC

(via: https://www.bitget.com/new...

6 days ago

🚨 BREAKING: Trump Media Group Plans to Raise $3 Billion to Invest in Crypto! 🚀

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

This kind of institutional backing could be a major catalyst for the entire market. If executed, this move signals growing mainstream adoption and confidence in digital assets.

#crypto #bitcoin #ethereum #MarketUpdate #BULLISH #TrumpMedia #DigitalAssets #Investing #Blockchain

6 days ago

HUGE NEWS FOR CRYPTO! 🔥

Pakistan is taking a MASSIVE step into the future — allocating 2,000 megawatts of electricity specifically for Bitcoin mining! 🧠💡

This is more than just energy — it’s a powerful signal that crypto is here to stay. 🚀

#bitcoin #cryptonews #Bitcoinmining #Pakistan #FutureOfEnergy #BlockchainRevolution 💡🔋

Pakistan is taking a MASSIVE step into the future — allocating 2,000 megawatts of electricity specifically for Bitcoin mining! 🧠💡

This is more than just energy — it’s a powerful signal that crypto is here to stay. 🚀

#bitcoin #cryptonews #Bitcoinmining #Pakistan #FutureOfEnergy #BlockchainRevolution 💡🔋

6 days ago

XRP May Experience a Decline Due to Concerns About Market Peaks

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

Recent on-chain analysis indicates that XRP, despite its remarkable rally of over 385% since late 2024, may be nearing a market peak. Over 70% of #xrp 's realized market capitalization has been accumulated between late 2024 and early 2025, suggesting that many investors purchased at higher price points. This trend, noted by Glassnode, resembles previous market tops where newer investors, sensitive to price shifts, often initiate significant sell-offs during market corrections.

Historical data reveals that similar conditions in late 2017 and 2021 resulted in substantial declines in XRP's value, raising concerns about a potential local top forming in January 2025.

XRP's network activity has also seen a significant decline. After reaching record levels in March 2025, the number of active addresses has plummeted by over 90%, returning to pre-breakout levels.

16 days ago

🚀 Tether Launches Decentralized AI Platform QVAC 🚀

Tether, the company behind USDT, is shaking up the AI landscape with **QVAC**—a decentralized platform that prioritizes **privacy** and **autonomy** by running AI applications **directly on users' devices** instead of relying on the cloud. 🌐

💡 Key Features:

✔ No reliance on centralized servers

✔ Enhanced privacy—data stays with users

✔ AI-powered tools like real-time transcription & media translation

✔ Crypto integration—AI agents can transact using #bitcoin & #USDT

With its new **Wallet Development Kit**, Tether is enabling AI-driven payments, further expanding its footprint beyond stablecoins.

📢 What do you think? Is decentralization the future of AI?

#AI #Blockchain #Tether #PrivacyFirst #CryptoPayments #Web3 #bitcoin #USDT

Tether, the company behind USDT, is shaking up the AI landscape with **QVAC**—a decentralized platform that prioritizes **privacy** and **autonomy** by running AI applications **directly on users' devices** instead of relying on the cloud. 🌐

💡 Key Features:

✔ No reliance on centralized servers

✔ Enhanced privacy—data stays with users

✔ AI-powered tools like real-time transcription & media translation

✔ Crypto integration—AI agents can transact using #bitcoin & #USDT

With its new **Wallet Development Kit**, Tether is enabling AI-driven payments, further expanding its footprint beyond stablecoins.

📢 What do you think? Is decentralization the future of AI?

#AI #Blockchain #Tether #PrivacyFirst #CryptoPayments #Web3 #bitcoin #USDT

17 days ago

(E)

🚀 Altcoin Season on the Horizon as Bitcoin Nears All-Time High? 🚀

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

As #bitcoin inches closer to its all-time high—now trading near $104,000* —the crypto community is buzzing with talk of an Altcoin Season .

Cryptocurrency analyst nobrainflip recently pointed to four key indicators suggesting we may be at the start of a major altcoin rally:

✅ BTC nearing ATH

✅ Retail investor interest at historic lows

✅ ETH/BTC breaks 3-year downtrend

✅ Altcoin Season Index rebounds from deep lows

"Now is the clearest bull setup in my seven years in crypto," he noted. "Each of these factors has individually triggered altseasons in the past. Now they’re all aligning."

What’s Behind the Shift?

Despite BTC’s strong performance, retail attention remains unusually low—suggesting this rally could be driven by institutional inflows rather than hype-driven retail FOMO.

Meanwhile, the ETH/BTC ratio breaking out suggests growing risk appetite , often a precursor to broader altcoin strength.

The rebound in the Altcoin Season Index adds fuel to the fire, signaling that capital may finally be rotating into alts.

📈 Stay sharp, stay informed, and always manage risk.

#crypto #bitcoin #AltcoinSeason #BTC #ETH #ethereum #CryptoTwitter #MarketAnalysis #trading #Investing #Web3 #Blockchain

17 days ago

🚀 Cardano ETF Approval Anticipation? Surge in Network Activity!

With growing buzz around the potential approval of a #Cardano (#ADA) ETF, network activity is spiking! Could this be a major catalyst for the future of Cardano? 📈

👉 Read more: https://www.eblockmedia.co...

#cryptonews #Blockchain #ETF #CardanoCommunity #ADA

With growing buzz around the potential approval of a #Cardano (#ADA) ETF, network activity is spiking! Could this be a major catalyst for the future of Cardano? 📈

👉 Read more: https://www.eblockmedia.co...

#cryptonews #Blockchain #ETF #CardanoCommunity #ADA

17 days ago

Tether's Blacklisting Delays Lead to $78 Million USDT Transfers

Blockchain compliance firm AMLBot has released a report highlighting delays in Tether's blacklisting process since 2017. These delays have allowed over $78 million in USDT to be transferred before the freeze could take effect. The issue arises from Tether's multi-signature contract mechanism on Ethereum and Tron, which requires two multi-signature transaction confirmations, resulting in an average delay of 44 minutes. During this window, attackers can monitor blacklist submission transactions in real-time and swiftly move assets to evade freezing measures. The report indicates that approximately 170 Tron addresses exploited this delay, with each address transferring nearly $290,000 on average before being officially blacklisted. This incident has raised concerns about the efficiency of Tether's compliance enforcement.

#ETH #USDT

Blockchain compliance firm AMLBot has released a report highlighting delays in Tether's blacklisting process since 2017. These delays have allowed over $78 million in USDT to be transferred before the freeze could take effect. The issue arises from Tether's multi-signature contract mechanism on Ethereum and Tron, which requires two multi-signature transaction confirmations, resulting in an average delay of 44 minutes. During this window, attackers can monitor blacklist submission transactions in real-time and swiftly move assets to evade freezing measures. The report indicates that approximately 170 Tron addresses exploited this delay, with each address transferring nearly $290,000 on average before being officially blacklisted. This incident has raised concerns about the efficiency of Tether's compliance enforcement.

#ETH #USDT

27 days ago

🚀 Big news for Dogecoin enthusiasts! 🚀 Nasdaq has filed with the SEC to list the 21Shares Dogecoin ETF. 📈

21Shares has partnered with the House of Doge to track DOGE's performance using the CF DOGE-Dollar US Settlement Price Index. 💰 Coinbase Custody Trust will hold the fund’s tokens as the official custodian. 🔒

This ETF aims to provide a straightforward way to invest in Dogecoin without using leverage or derivatives. 🚫 Meanwhile, the SEC is still reviewing Bitwise’s spot DOGE ETF application, with a decision expected by June 15. 🤔

#dogecoin #DOGE #ETF #crypto #21Shares #Nasdaq

Read more here https://www.coindesk.com/m...

21Shares has partnered with the House of Doge to track DOGE's performance using the CF DOGE-Dollar US Settlement Price Index. 💰 Coinbase Custody Trust will hold the fund’s tokens as the official custodian. 🔒

This ETF aims to provide a straightforward way to invest in Dogecoin without using leverage or derivatives. 🚫 Meanwhile, the SEC is still reviewing Bitwise’s spot DOGE ETF application, with a decision expected by June 15. 🤔

#dogecoin #DOGE #ETF #crypto #21Shares #Nasdaq

Read more here https://www.coindesk.com/m...

DOGE News: Nasdaq Seeks SEC Approval to List 21Shares’ Dogecoin ETF

Coinbase Custody Trust will hold the fund’s tokens and serve as the official custodian for the ETF.

https://www.coindesk.com/markets/2025/04/30/nasdaq-seeks-sec-approval-to-list-21shares-dogecoin-etf

1 month ago

🔐 BREAKING: U.S. Court Rules OFAC’s Sanctions on Tornado Cash Were Illegal

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

The U.S. District Court for the Western District of Texas has issued a final ruling in the long-standing legal battle over Tornado Cash, declaring that the Treasury Department’s Office of Foreign Assets Control (OFAC) acted unlawfully by sanctioning the privacy protocol.

In a win for privacy advocates and decentralized technology, the court has permanently prohibited OFAC from imposing sanctions on the Tornado Cash protocol itself — ending a two-year legal dispute.

📜 While OFAC removed Tornado Cash from its sanctions list earlier this year, the court noted its attempt to reserve the right to re-sanction in the future. Judge Robert Pitman ruled that such actions must comply with the precedent set by the Fifth Circuit Court of Appeals.

⚖️ Plaintiffs’ attorneys accused OFAC of trying to sidestep judicial review through procedural maneuvers — a move the court clearly rejected.

⚠️ Important note: This ruling applies only to the protocol, not to individuals. Developers Roman Storm and Roman Semenov remain under criminal indictment by the U.S. Department of Justice and are still listed on OFAC sanctions.

A landmark decision with major implications for crypto regulation, decentralization, and digital rights.

#crypto #tornadocash #OFAC #PrivacyRights #BlockchainLaw #Web3 #CryptoRegulation #LegalVictory

1 month ago

🚨 BREAKING NEWS! 🚨

The Government of Sierra Leone now officially accepts #bitcoin for citizenship applications! 🇸🇱✨

A historic move toward a crypto-powered future! 🌍💥

#BitcoinAdoption #cryptonews #SierraLeone #BlockchainRevolution

The Government of Sierra Leone now officially accepts #bitcoin for citizenship applications! 🇸🇱✨

A historic move toward a crypto-powered future! 🌍💥

#BitcoinAdoption #cryptonews #SierraLeone #BlockchainRevolution

1 month ago

Paul Atkins Sworn In as New SEC Chairman

Mr. Paul Atkins was officially sworn in yesterday as the new Chairman of the U.S. Securities and Exchange Commission (SEC). He previously served as a member of the Commission from 2002 to 2008.

His confirmation by the Senate passed with a 52-44 vote, signaling a major shift in regulatory policy. During his previous tenure, Atkins was known for advocating reduced regulations and supporting financial innovation, particularly in the cryptocurrency space.

Given his prior connections to the crypto industry and his favor for lighter regulations, it is expected that under his leadership, the SEC will adopt a more crypto-friendly approach toward digital assets.

Mr. Paul Atkins was officially sworn in yesterday as the new Chairman of the U.S. Securities and Exchange Commission (SEC). He previously served as a member of the Commission from 2002 to 2008.

His confirmation by the Senate passed with a 52-44 vote, signaling a major shift in regulatory policy. During his previous tenure, Atkins was known for advocating reduced regulations and supporting financial innovation, particularly in the cryptocurrency space.

Given his prior connections to the crypto industry and his favor for lighter regulations, it is expected that under his leadership, the SEC will adopt a more crypto-friendly approach toward digital assets.

1 month ago

The crypto seas just trembled—a $6.6 BILLION Bitcoin whale has stirred after years of dormancy. When these leviathans move, they don’t just make ripples… they create tidal waves across the market.

But who is this whale? Why now? And what could this mean for Bitcoin's next move? Let’s dive into this breaking development that has every trader, analyst, and HODLer watching closely.

🧠 The Awakening: 94,500 BTC Moved After 5+ Years

On-chain analysts confirmed a jaw-dropping transaction: a wallet containing 94,500 BTC—worth roughly $6.6 billion—moved funds for the first time since 2019. That’s pre-pandemic Bitcoin, bought at a fraction of today’s price.

This isn't your average whale.

This is a legacy address, possibly tied to early miners, institutions, or even an exchange cold wallet. But the timing and scale are what's making jaws drop.

Whether it's reallocation, institutional movement, or prep for ETF flows, one thing’s clear: the giants of crypto are waking up... and they’re not swimming quietly.

#BitcoinWhales #BTCAlert #CryptoNewss #cryptomarket #BTCVolatility

But who is this whale? Why now? And what could this mean for Bitcoin's next move? Let’s dive into this breaking development that has every trader, analyst, and HODLer watching closely.

🧠 The Awakening: 94,500 BTC Moved After 5+ Years

On-chain analysts confirmed a jaw-dropping transaction: a wallet containing 94,500 BTC—worth roughly $6.6 billion—moved funds for the first time since 2019. That’s pre-pandemic Bitcoin, bought at a fraction of today’s price.

This isn't your average whale.

This is a legacy address, possibly tied to early miners, institutions, or even an exchange cold wallet. But the timing and scale are what's making jaws drop.

Whether it's reallocation, institutional movement, or prep for ETF flows, one thing’s clear: the giants of crypto are waking up... and they’re not swimming quietly.

#BitcoinWhales #BTCAlert #CryptoNewss #cryptomarket #BTCVolatility

2 months ago

DWF Labs has announced a notable $25 million investment in World Liberty Financial (WLFI), a decentralized finance protocol with ties to the Trump family. This investment is seen as a significant step into the U.S. market for DWF Labs, which plans to open an office in New York City to foster relationships with regulators and financial institutions. The investment, which highlights DWF's confidence in the U.S. as a growing region for institutional crypto adoption, comes amidst existing political controversies surrounding WLFI.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

Notably, there are growing concerns about the potential for financial misconduct associated with this investment. Allegations have surfaced regarding the governance and revenue distribution of WLFI, indicating that a substantial portion of its earnings may directly benefit Trump's family. Furthermore, DWF Labs itself has faced prior accusations of market manipulation, which contributes to the skepticism regarding the legitimacy of this partnership.

As DWF Labs integrates into the U.S. crypto landscape, it aims to leverage its position to provide liquidity for WLFI’s upcoming stablecoin, USD1, but the circumstances surrounding this investment warrant careful scrutiny from the crypto community and regulatory bodies alike.

2 months ago

Mantra has issued a statement regarding the unexpected significant drop in the price of its OM token. The statement clarifies that the Mantra team has not engaged in any selling activities. The funds of the Mantra mainnet OM team and advisory team remain 100% locked, while the ERC-20 tokens are publicly circulating and not under team control. Currently, 77.5 million OM tokens are in circulation, with over 200,000 mainnet OM wallets.

The initial forced liquidation sales exerted downward pressure on the price, triggering automatic liquidation events on exchanges for leveraged positions using OM as collateral. This led to further liquidation and collateral seizure, adding additional downward pressure. Some major OM traders were liquidated by centralized exchanges.

Mantra plans to release details of an OM Token support plan, which will include a token buyback and supply destruction strategy. Mantra CEO John Patrick Mullin has publicly committed to destroying the tokens allocated to his team.

https://www.mantrachain.io...

The initial forced liquidation sales exerted downward pressure on the price, triggering automatic liquidation events on exchanges for leveraged positions using OM as collateral. This led to further liquidation and collateral seizure, adding additional downward pressure. Some major OM traders were liquidated by centralized exchanges.

Mantra plans to release details of an OM Token support plan, which will include a token buyback and supply destruction strategy. Mantra CEO John Patrick Mullin has publicly committed to destroying the tokens allocated to his team.

https://www.mantrachain.io...

2 months ago

🔥 TODAY: Michael Saylor from Strategy shared a Bitcoin tracker, which typically indicates an upcoming Bitcoin purchase.

The company purchased nearly $2 billion worth of Bitcoin in its last transaction. How much do you think it will acquire this time?

The company purchased nearly $2 billion worth of Bitcoin in its last transaction. How much do you think it will acquire this time?

2 months ago

(E)

Optimistic Ethereum, now primarily referred to as Optimism or OP Mainnet, is a layer-2 scaling solution for Ethereum focused on improving transaction speed and reducing costs while maintaining security through optimistic rollups.

Here's the latest based on recent activity:

Superchain Expansion: Optimism is pushing its "Superchain" vision, a network of interoperable layer-2 blockchains built on the open-source OP Stack. Recent posts highlight integrations like Unichain, with incentives starting April 15, 2025, and Soneium's growth strengthening the ecosystem.

Retro Funding: Optimism continues its Retroactive Public Goods Funding (RetroPGF), rewarding developers and projects that contribute to Ethereum’s ecosystem. A recent call for applications for the next round closes April 27, 2025, emphasizing fair rewards based on impact, not marketing. Over 2 million OP tokens were allocated this month for dev tooling and onchain builders.

Performance and Governance: The OP token governs the Optimism Collective, a decentralized system driving ecosystem growth. As of early 2025, OP’s price is around $0.65-$0.69 USD, with a market cap of about $1.14 billion. Q4 2024 saw an 11.3% increase in total value locked (TVL) to $756.1 million, though price performance remained flat, causing a dip in market cap rank.

Open-Source Commitment: Optimism is doubling down on open-sourcing its tech, with 131 GitHub repositories and contributions like the OP Stack powering chains like OP Mainnet and Base. This aligns with their mission to scale Ethereum collaboratively.

https://x.com/optimism

https:

Here's the latest based on recent activity:

Superchain Expansion: Optimism is pushing its "Superchain" vision, a network of interoperable layer-2 blockchains built on the open-source OP Stack. Recent posts highlight integrations like Unichain, with incentives starting April 15, 2025, and Soneium's growth strengthening the ecosystem.

Retro Funding: Optimism continues its Retroactive Public Goods Funding (RetroPGF), rewarding developers and projects that contribute to Ethereum’s ecosystem. A recent call for applications for the next round closes April 27, 2025, emphasizing fair rewards based on impact, not marketing. Over 2 million OP tokens were allocated this month for dev tooling and onchain builders.

Performance and Governance: The OP token governs the Optimism Collective, a decentralized system driving ecosystem growth. As of early 2025, OP’s price is around $0.65-$0.69 USD, with a market cap of about $1.14 billion. Q4 2024 saw an 11.3% increase in total value locked (TVL) to $756.1 million, though price performance remained flat, causing a dip in market cap rank.

Open-Source Commitment: Optimism is doubling down on open-sourcing its tech, with 131 GitHub repositories and contributions like the OP Stack powering chains like OP Mainnet and Base. This aligns with their mission to scale Ethereum collaboratively.

https://x.com/optimism

https:

2 months ago

From Pensions to Crypto: The Bold New Frontier of Retirement Investing

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

Pension funds are increasingly exploring investments in cryptocurrencies, particularly Bitcoin, as part of their diversification and growth strategies. This trend is evident across several countries:

United States: The Michigan State Retirement Fund invested approximately $6.6 million in the ARK 21Shares Bitcoin ETF in July 2024. Similarly, the State of Wisconsin Investment Board holds significant positions in the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Jersey City's pension fund is also considering similar allocations.

Japan: The Government Pension Investment Fund (GPIF), the world's largest pension fund, is exploring Bitcoin as a potential diversification tool. In March 2024, GPIF initiated a five-year research plan to assess innovative investment strategies, including cryptocurrencies.

Norway: The Norwegian Government Pension Fund has invested indirectly in #cryptocurrencies by holding shares in companies like MicroStrategy, MARA (formerly Marathon Digital), Coinbase, and Block Inc., which have Bitcoin on their balance sheets. Analysts estimate that the Norwegian fund indirectly owns over 2,440 BTC.

Australia: In May 2024, AMP, one of Australia's largest pension funds, invested $27 million in Bitcoin, marking it as the first major Australian pension fund to adopt digital assets. This investment represents a modest 0.05% of AMP's $57 billion assets under management.

#crypto #pension #Fund

2 months ago

LATEST: Pakistan is looking to allocate surplus electricity to Bitcoin mining and AI data centers, according to its head of crypto council Bilal bin Saqib.

Sponsored by

Administrator

11 months ago