27 mins. ago

30 mins. ago

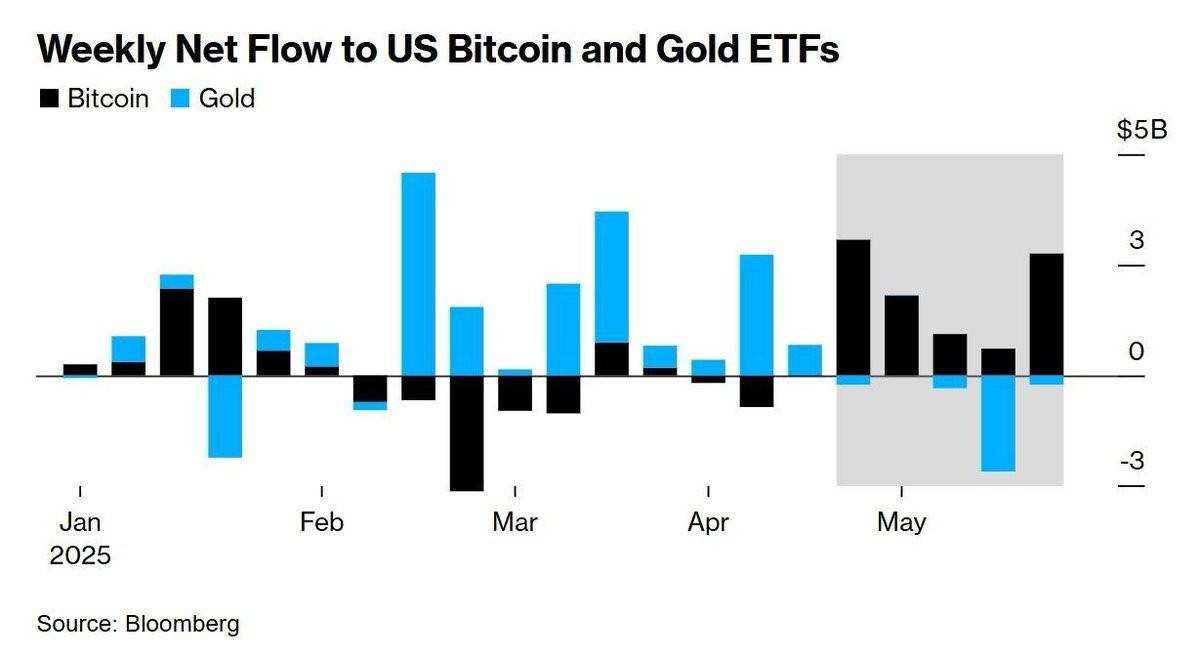

📊 UPDATE: US Bitcoin ETFs saw $9B in inflows over 5 weeks, while gold ETFs lost over $2.8B in outflows.

1 day ago

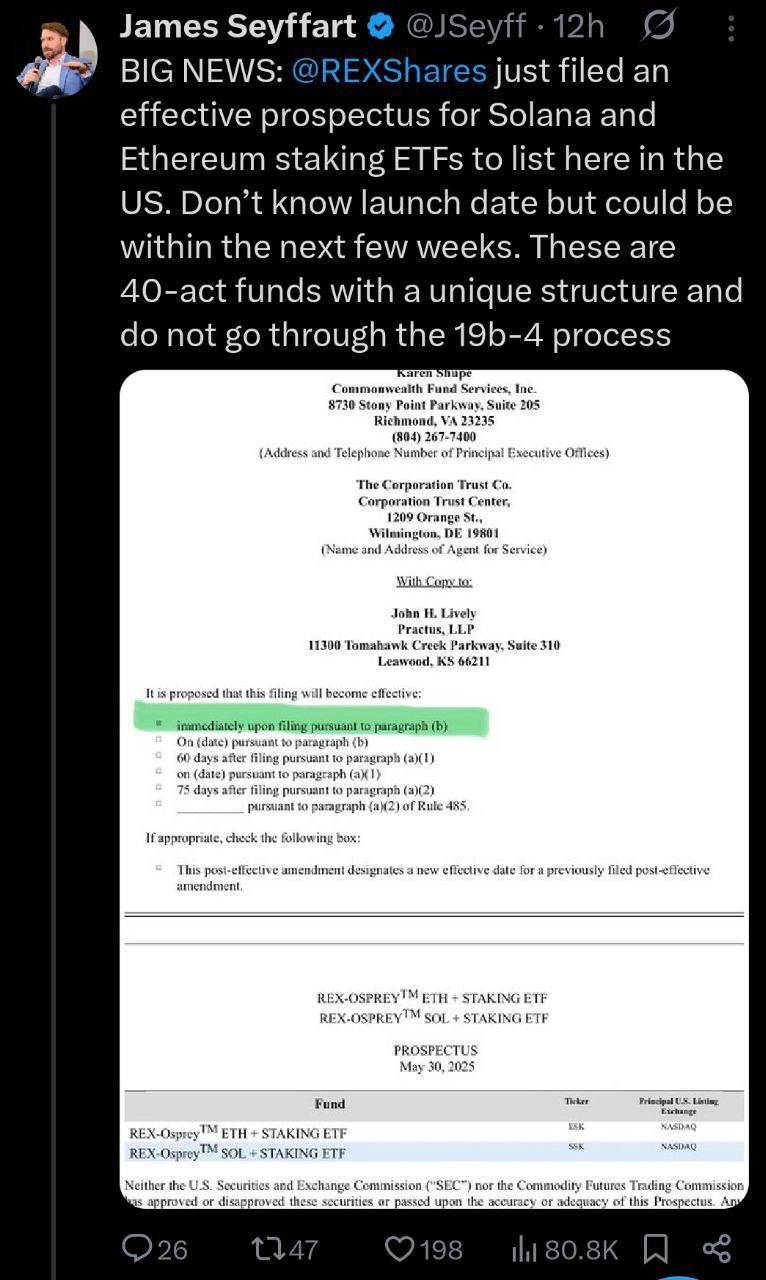

🚨 BIG NEWS FOR CRYPTO INVESTORS! 🚨

According to Bloomberg's ETF analyst, Ethereum and Solana staking ETFs could get approved as early as June!

If this happens, it could be a MAJOR step toward mainstream adoption and a game-changer for the crypto market.

Let’s see what June has in store… 📈💎

#cryptonews #ethereum #solana #ETF #CryptoTwitter #Web3 #Investing #Blockchain

According to Bloomberg's ETF analyst, Ethereum and Solana staking ETFs could get approved as early as June!

If this happens, it could be a MAJOR step toward mainstream adoption and a game-changer for the crypto market.

Let’s see what June has in store… 📈💎

#cryptonews #ethereum #solana #ETF #CryptoTwitter #Web3 #Investing #Blockchain

2 days ago

(E)

ETF FLOWS: Around 5.84K $BTC were sold and 26,69K $ETH were bought on May 30.

BTC ETFs saw $616.10M in net outflows.

ETH ETFs saw $70.20M in net inflows.

BTC ETFs saw $616.10M in net outflows.

ETH ETFs saw $70.20M in net inflows.

3 days ago

🚨 Big Moves by BlackRock! 🚨

On May 29, BlackRock's spot ETFs made significant purchases, snapping up 1,160 $BTC and a hefty 18,800 $ETH! 📈💰

This shows continued confidence in both Bitcoin and Ethereum from the world’s largest asset manager.

#blackrock #bitcoin #ethereum #cryptonews

On May 29, BlackRock's spot ETFs made significant purchases, snapping up 1,160 $BTC and a hefty 18,800 $ETH! 📈💰

This shows continued confidence in both Bitcoin and Ethereum from the world’s largest asset manager.

#blackrock #bitcoin #ethereum #cryptonews

3 days ago

🚨 ETF Flow Alert! 🚨

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

17 days ago

🚨 BREAKING: According to recent reports, BlackRock has indeed made a significant Ethereum purchase, acquiring 4,542 ETH valued at approximately $8.4 million.

BlackRock's move aligns with broader institutional interest in Ethereum-based financial products. The Chicago Board Options Exchange (Cboe) has recently submitted a request to the SEC seeking permission for staking features within Ethereum spot ETFs

The world’s largest asset manager is doubling down on crypto — what does that tell YOU? 🧠💸.

This isn’t just a trend… it’s a massive shift in the financial landscape. 🚀

#crypto #ethereum #Blockchain #finance #bitcoin #Web3 #Investing #MarketUpdate

BlackRock's move aligns with broader institutional interest in Ethereum-based financial products. The Chicago Board Options Exchange (Cboe) has recently submitted a request to the SEC seeking permission for staking features within Ethereum spot ETFs

The world’s largest asset manager is doubling down on crypto — what does that tell YOU? 🧠💸.

This isn’t just a trend… it’s a massive shift in the financial landscape. 🚀

#crypto #ethereum #Blockchain #finance #bitcoin #Web3 #Investing #MarketUpdate

1 month ago

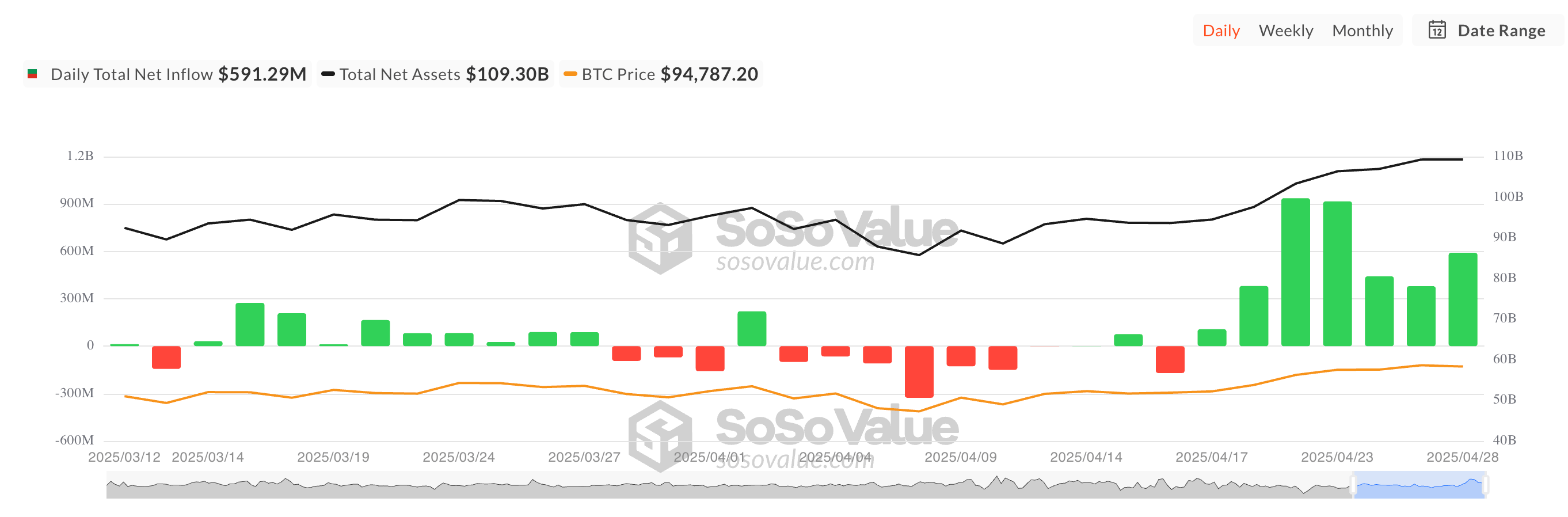

🚀 Bitcoin ETF Chart Pack Alert – Just dropped today on Bloomberg.

The momentum continues: Bitcoin ETFs have pulled in nearly $4 billion over 8 consecutive days of inflows. 🚨

Here’s a look at how the cumulative flows have evolved over time – the adoption train isn’t slowing down. ⏳📈

#bitcoin #ETF #CryptoInvesting #MarketUpdate #Bloomberg

The momentum continues: Bitcoin ETFs have pulled in nearly $4 billion over 8 consecutive days of inflows. 🚨

Here’s a look at how the cumulative flows have evolved over time – the adoption train isn’t slowing down. ⏳📈

#bitcoin #ETF #CryptoInvesting #MarketUpdate #Bloomberg

1 month ago

🚨 BIG Bitcoin Move Alert! 🚨

Yesterday alone, ETFs bought 6,310 BTC .

Over the last 6 trading days? A whopping ~40,000 BTC !

The institutional appetite for Bitcoin is accelerating — this is no dip. This is demand like we've never seen before. 💸🔥

#bitcoin #CryptoUpdate #ETF #OnChainData #BTC #InstitutionalInvesting

Yesterday alone, ETFs bought 6,310 BTC .

Over the last 6 trading days? A whopping ~40,000 BTC !

The institutional appetite for Bitcoin is accelerating — this is no dip. This is demand like we've never seen before. 💸🔥

#bitcoin #CryptoUpdate #ETF #OnChainData #BTC #InstitutionalInvesting

1 month ago

NEW: South Korea's People Power Party has promised to approve spot Bitcoin ETFs if victorious.

The June 3 election outcome, with opposition leader Lee Jae-myung currently ahead in polls, could determine the future of these proposed reforms.

The June 3 election outcome, with opposition leader Lee Jae-myung currently ahead in polls, could determine the future of these proposed reforms.

1 month ago

🌐 Over the past 5 trading days:

🔹 Bitcoin ETFs attracted $3B in inflows

🔻 Gold ETFs saw $1B in outflows

= A $4B divergence signaling a shift in investor sentiment.

Analysts note: Bitcoin is increasingly seen as the go-to hedge amid rising Treasury yields and falling demand for traditional assets like gold. 👑🔥

#bitcoin #crypto #ETF #Investing #gold #Markets

🔹 Bitcoin ETFs attracted $3B in inflows

🔻 Gold ETFs saw $1B in outflows

= A $4B divergence signaling a shift in investor sentiment.

Analysts note: Bitcoin is increasingly seen as the go-to hedge amid rising Treasury yields and falling demand for traditional assets like gold. 👑🔥

#bitcoin #crypto #ETF #Investing #gold #Markets

1 month ago

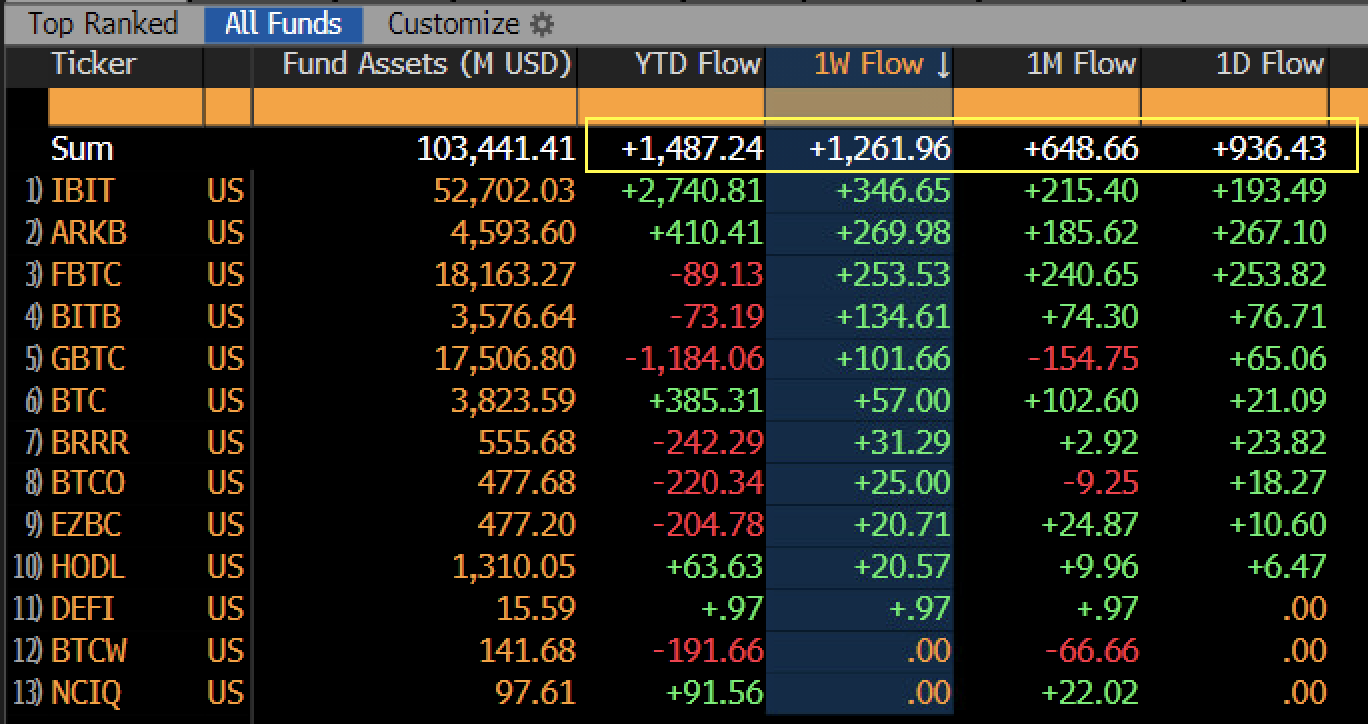

🚨 Bitcoin ETFs are heating up! 🚀

Over $1.26B in net inflows this past week alone — and guess who’s leading the pack?

🏆 IBIT crushes it with +$346.65M in weekly flows

🔥 ARKB & FBTC follow with +$269.98M & +$253.53M

📉 Meanwhile, GBTC continues its outflow streak: -$1.18B YTD 😬

Total BTC ETF assets now over $103B. Institutions aren’t just watching — they’re BUYING. 📈

#bitcoin #ETF #CryptoFunds #BTC #InstitutionalAdoption #IBIT #ARKB #FBTC #BloombergData #CryptoFlows

Over $1.26B in net inflows this past week alone — and guess who’s leading the pack?

🏆 IBIT crushes it with +$346.65M in weekly flows

🔥 ARKB & FBTC follow with +$269.98M & +$253.53M

📉 Meanwhile, GBTC continues its outflow streak: -$1.18B YTD 😬

Total BTC ETF assets now over $103B. Institutions aren’t just watching — they’re BUYING. 📈

#bitcoin #ETF #CryptoFunds #BTC #InstitutionalAdoption #IBIT #ARKB #FBTC #BloombergData #CryptoFlows

1 month ago

⚡️Update: U.S. spot bitcoin ETFs saw $936 million in net inflows, which is the largest since Jan. 17.

1 month ago

⚡️ BULLISH: US-listed Bitcoin ETFs reached $381 million on April 21.

That’s the largest single-day inflows since January.

That’s the largest single-day inflows since January.

1 month ago

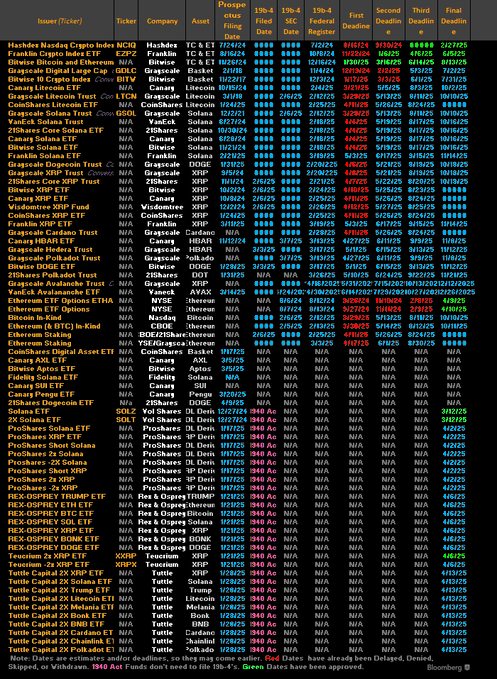

🚨 There are now *72 crypto-related ETFs* sitting with the SEC, just waiting for approval to list — or to list options. We're talking *everything* from XRP, Litecoin, and Solana to Penguins, Doge, and even 2x Melania 👀

Yeah… it’s gonna be a *wild* year. Buckle up. 🚀🔥 #CryptoETFs #SEC #Crypto2025 #bitcoin #altcoins

Yeah… it’s gonna be a *wild* year. Buckle up. 🚀🔥 #CryptoETFs #SEC #Crypto2025 #bitcoin #altcoins

1 month ago

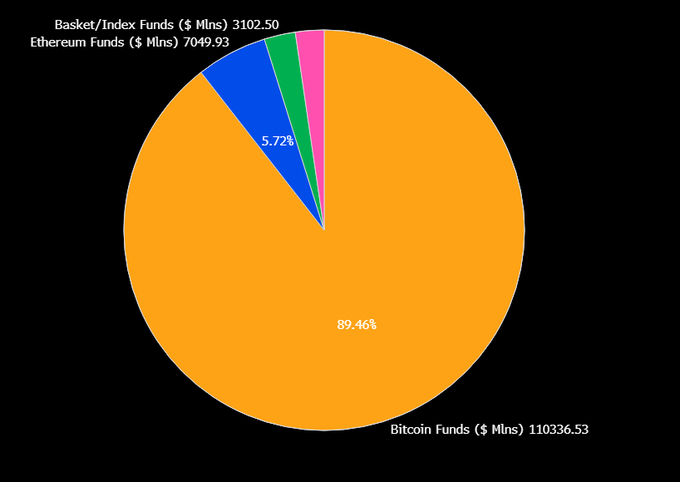

🚨 No Second Best? 🚨

Bitcoin ETFs now hold a massive 90% of all crypto fund assets worldwide. 💰🌍

Yes, altcoin & meme coin ETFs are on the way in 2025 — but let’s be real: they’ll barely make a dent.

🟧 Bitcoin is the king, and it’s likely to keep a dominant 80–85% share for the long haul.

#bitcoin #crypto #BTCdominance #CryptoInvesting #ETF

Bitcoin ETFs now hold a massive 90% of all crypto fund assets worldwide. 💰🌍

Yes, altcoin & meme coin ETFs are on the way in 2025 — but let’s be real: they’ll barely make a dent.

🟧 Bitcoin is the king, and it’s likely to keep a dominant 80–85% share for the long haul.

#bitcoin #crypto #BTCdominance #CryptoInvesting #ETF

2 months ago

📊 Ethereum ETF Update – April 17 📊

According to SoSoValue, all 9 Ethereum Spot ETFs recorded zero net inflows or outflows yesterday — holding steady with no change throughout the day.

🔹 Total Net Asset Value: $5.269 Billion

🔹 Net Asset Ratio: 2.76% (compared to ETH's market cap)

🔹 Cumulative Net Inflows (All-time): $2.244 Billion

Steady day for ETH ETFs — eyes on the next move. 👀💼

According to SoSoValue, all 9 Ethereum Spot ETFs recorded zero net inflows or outflows yesterday — holding steady with no change throughout the day.

🔹 Total Net Asset Value: $5.269 Billion

🔹 Net Asset Ratio: 2.76% (compared to ETH's market cap)

🔹 Cumulative Net Inflows (All-time): $2.244 Billion

Steady day for ETH ETFs — eyes on the next move. 👀💼

2 months ago

🚨 Big news from Hong Kong! 🚨

Hong Kong's first virtual asset ETFs — including the Bosera Ether ETF (03009) and its USD counter (09009) — have officially received the green light to participate in staking activities starting April 25! 🔥

Bosera International's Chairman & CEO, Lian Shaodong, shared that the company will continue to harness its strengths in investment and fintech to bridge traditional finance with Web 3.0 — aiming to deepen the connection between on-chain and off-chain ecosystems while diversifying market products. 🌐💹

Web3 is evolving fast — and Hong Kong is right at the front! 🚀

Source : https://www.prnewswire.com...

#Web3 #CryptoETF #staking #ethereum #HongKong #Bosera #VirtualAssets #fintech #BlockchainNews #CryptoInnovation

Hong Kong's first virtual asset ETFs — including the Bosera Ether ETF (03009) and its USD counter (09009) — have officially received the green light to participate in staking activities starting April 25! 🔥

Bosera International's Chairman & CEO, Lian Shaodong, shared that the company will continue to harness its strengths in investment and fintech to bridge traditional finance with Web 3.0 — aiming to deepen the connection between on-chain and off-chain ecosystems while diversifying market products. 🌐💹

Web3 is evolving fast — and Hong Kong is right at the front! 🚀

Source : https://www.prnewswire.com...

#Web3 #CryptoETF #staking #ethereum #HongKong #Bosera #VirtualAssets #fintech #BlockchainNews #CryptoInnovation

2 months ago

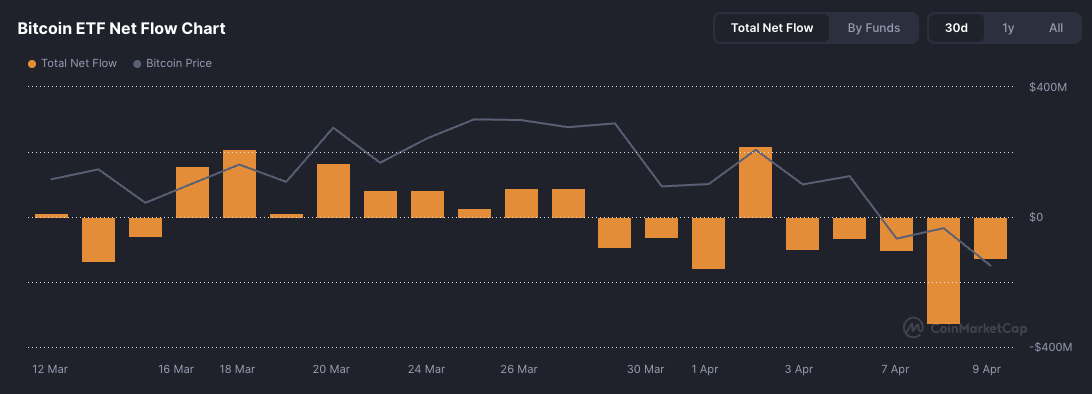

📉 Spot Bitcoin ETFs have seen $556.5 million in outflows since the start of the week.

Are investors taking profits or bracing for more volatility? 👀💸

#bitcoin #cryptonews #ETFs #BTC #cryptomarket

Are investors taking profits or bracing for more volatility? 👀💸

#bitcoin #cryptonews #ETFs #BTC #cryptomarket

2 months ago

(E)

🔁 Bitcoin's Evolution: From Digital Gold to Economic Backbone 💥

Bitcoin isn't just a buzzword anymore — it's a movement that reshaped finance. From humble beginnings to becoming a cornerstone of modern economies, here's how it all unfolded:

📜 2009–2012: The Genesis Era

➡️ A decentralized idea was born. Mostly a niche experiment among cypherpunks and tech enthusiasts.

🏆 2013–2017: The Digital Gold Era

➡️ Seen as a store of value. The “digital gold” narrative took off. Hodlers were born.

🌪️ 2017–2021: Financial Disruption Era

➡️ Bitcoin challenged traditional finance. DeFi emerged. Mainstream media took notice.

🏦 2022–Present: Institutional Adoption Era

➡️ Big money arrived. ETFs approved. Banks and governments can’t ignore it anymore.

🔗 From a whitepaper to Wall Street — Bitcoin's journey is far from over.

#bitcoin #crypto #BTC #Blockchain #FinancialRevolution #digitalgold #CryptoHistory

Bitcoin isn't just a buzzword anymore — it's a movement that reshaped finance. From humble beginnings to becoming a cornerstone of modern economies, here's how it all unfolded:

📜 2009–2012: The Genesis Era

➡️ A decentralized idea was born. Mostly a niche experiment among cypherpunks and tech enthusiasts.

🏆 2013–2017: The Digital Gold Era

➡️ Seen as a store of value. The “digital gold” narrative took off. Hodlers were born.

🌪️ 2017–2021: Financial Disruption Era

➡️ Bitcoin challenged traditional finance. DeFi emerged. Mainstream media took notice.

🏦 2022–Present: Institutional Adoption Era

➡️ Big money arrived. ETFs approved. Banks and governments can’t ignore it anymore.

🔗 From a whitepaper to Wall Street — Bitcoin's journey is far from over.

#bitcoin #crypto #BTC #Blockchain #FinancialRevolution #digitalgold #CryptoHistory

2 months ago

Banks Poised to Reenter Digital Asset Market in 2025

This development marks a strategic shift after years of cautious involvement in the cryptocurrency space.

Current Market Context:

1. Total cryptocurrency market capitalization exceeds $3.7 trillion

2. Bitcoin constitutes over half of the total cryptocurrency market value.

3. Spot Bitcoin ETFs have seen remarkable growth, with BlackRock's iShares Bitcoin Trust reaching $50 billion in assets under management in just 227 trading days

#banks #DigitalAssets #cryptocurrency #bitcoin #blackrock

This development marks a strategic shift after years of cautious involvement in the cryptocurrency space.

Current Market Context:

1. Total cryptocurrency market capitalization exceeds $3.7 trillion

2. Bitcoin constitutes over half of the total cryptocurrency market value.

3. Spot Bitcoin ETFs have seen remarkable growth, with BlackRock's iShares Bitcoin Trust reaching $50 billion in assets under management in just 227 trading days

#banks #DigitalAssets #cryptocurrency #bitcoin #blackrock

2 months ago

Solana Futures ETFs Launched, Paving the Way for Spot Approval

Two groundbreaking Solana futures ETFs are launching in the United States on March 20, marking a significant milestone in cryptocurrency market development cryptoslate.com. This launch follows the successful introduction of Solana futures on the Chicago Mercantile Exchange (CME) and sets the stage for potential spot ETF approval later this year.

#solana #ETF #cryptocurrency

Two groundbreaking Solana futures ETFs are launching in the United States on March 20, marking a significant milestone in cryptocurrency market development cryptoslate.com. This launch follows the successful introduction of Solana futures on the Chicago Mercantile Exchange (CME) and sets the stage for potential spot ETF approval later this year.

#solana #ETF #cryptocurrency

3 months ago

#bitcoin ETFs

NetFlow: +3,008 $BTC(+$244.27M)🟢

#fidelity inflows 1,506 $BTC($122.32M) and currently holds 195,885 $BTC($15.91B).

#ethereum ETFs

NetFlow: +287 $ETH(+$540K)🟢

#InvescoGalaxy inflows 543 $ETH($1.02M) and currently holds 8,484 $ETH($15.93M).

NetFlow: +3,008 $BTC(+$244.27M)🟢

#fidelity inflows 1,506 $BTC($122.32M) and currently holds 195,885 $BTC($15.91B).

#ethereum ETFs

NetFlow: +287 $ETH(+$540K)🟢

#InvescoGalaxy inflows 543 $ETH($1.02M) and currently holds 8,484 $ETH($15.93M).

3 months ago

Bitcoin Hovers Near $83K As Whales and Miners Cash Out – Will BTC Drop to $75K?

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

Sponsored by

Administrator

11 months ago