1 month ago

(E)

Bitcoin Price Update - May 3, 2025

Current Price: $96,515 USD

24h Change: -1,365.00 USD

Bitcoin dipped after peaking at $97,892, hitting a low of $96,181 in the past 24 hours. The market shows a bearish trend as we head into the weekend.

Stay alert, traders! #bitcoin #CryptoUpdate #BTC #cryptonews #Bitfinex #cryptomarket

Current Price: $96,515 USD

24h Change: -1,365.00 USD

Bitcoin dipped after peaking at $97,892, hitting a low of $96,181 in the past 24 hours. The market shows a bearish trend as we head into the weekend.

Stay alert, traders! #bitcoin #CryptoUpdate #BTC #cryptonews #Bitfinex #cryptomarket

1 month ago

🚨 JUST IN: The SEC has extended its deadline to decide on the Franklin XRP Fund spot ETF. A decision is now due by June 17, 2025 .

This delay keeps the crypto community on edge as investors await regulatory clarity on what could be a major milestone for XRP and the broader market. What’s your take—bullish or bearish on the outcome? 💭

#xrp #cryptonews #ETF #SEC #FranklinTempleton #bitcoin #crypto

This delay keeps the crypto community on edge as investors await regulatory clarity on what could be a major milestone for XRP and the broader market. What’s your take—bullish or bearish on the outcome? 💭

#xrp #cryptonews #ETF #SEC #FranklinTempleton #bitcoin #crypto

2 months ago

According to CryptoQuant analyst Maartunn, around 8,000 bitcoins that had been inactive for five to seven years were recently transferred in a single transaction. This movement, valued at $674 million, has heightened bearish sentiment within the #cryptocurrency market.

#bitcoin

#bitcoin

3 months ago

#ETHBreaks2k

💥Ethereum Surpasses $2,000! Will ETH Reach $2,500 or Fall to $1,950? 💥

◼️Ethereum's price has surged over 7% today, allowing the leading altcoin by market capitalization to reclaim the significant $2,000 threshold. This resurgence has brought a wave of relief to the altcoin market, which has experienced a notable uptick in recent hours.

🔸▪️Despite this positive momentum, traders remain cautious about Ethereum's short-term outlook, as the risk of a bearish pullback appears to be increasing. Many are asking, “Is now the right time to sell your Ethereum?”

💥Ethereum Surpasses $2,000! Will ETH Reach $2,500 or Fall to $1,950? 💥

◼️Ethereum's price has surged over 7% today, allowing the leading altcoin by market capitalization to reclaim the significant $2,000 threshold. This resurgence has brought a wave of relief to the altcoin market, which has experienced a notable uptick in recent hours.

🔸▪️Despite this positive momentum, traders remain cautious about Ethereum's short-term outlook, as the risk of a bearish pullback appears to be increasing. Many are asking, “Is now the right time to sell your Ethereum?”

3 months ago

🚨 BREAKING: The European Central Bank 🇪🇺 Plans to Launch a CBDC by October 2025! 💶🔗

The digital euro is coming—what does this mean for privacy, banking, and crypto adoption in Europe? 👀

Bullish or bearish for the future of decentralized finance? 🤔

#CBDC #DecentralizedFinance #defi

The digital euro is coming—what does this mean for privacy, banking, and crypto adoption in Europe? 👀

Bullish or bearish for the future of decentralized finance? 🤔

#CBDC #DecentralizedFinance #defi

3 months ago

Fear And Greed Index Study.

Currently, FGI Is At 24(Fear).

In The Last 90 Days, the Market Has Faced a Downslope Towards Fear From The December all-time high After The Trump #Optimisim .

Since The Last #bullrun , Recently On Feb 27 FGI Recorded Lowest At 20.

Once We Will Go Below 20 (Extreme Fear) In Coming Days.

Expect March to be a Bearish Month.⏳

#WhiteHouse #Cryptosummit

Currently, FGI Is At 24(Fear).

In The Last 90 Days, the Market Has Faced a Downslope Towards Fear From The December all-time high After The Trump #Optimisim .

Since The Last #bullrun , Recently On Feb 27 FGI Recorded Lowest At 20.

Once We Will Go Below 20 (Extreme Fear) In Coming Days.

Expect March to be a Bearish Month.⏳

#WhiteHouse #Cryptosummit

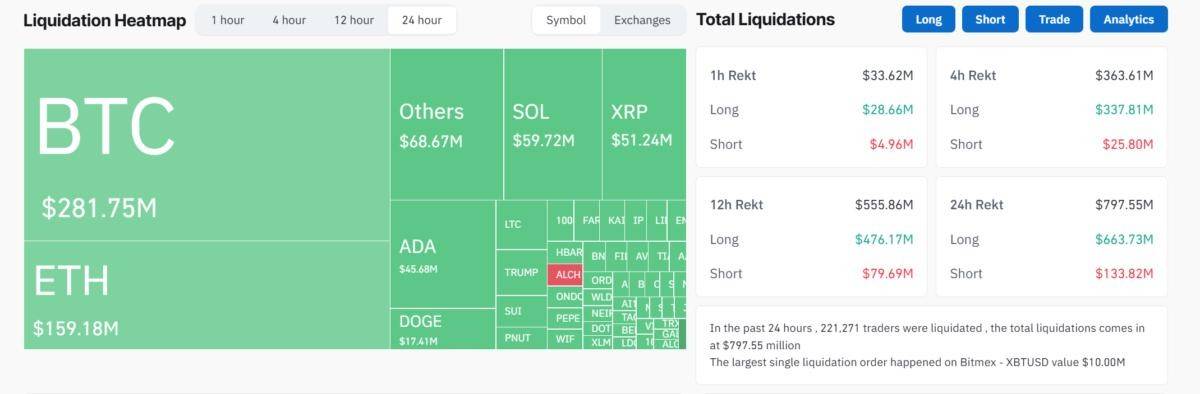

3 months ago

Bitcoin's weekend gains vanished as the Federal Reserve warned of a potential recession.

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

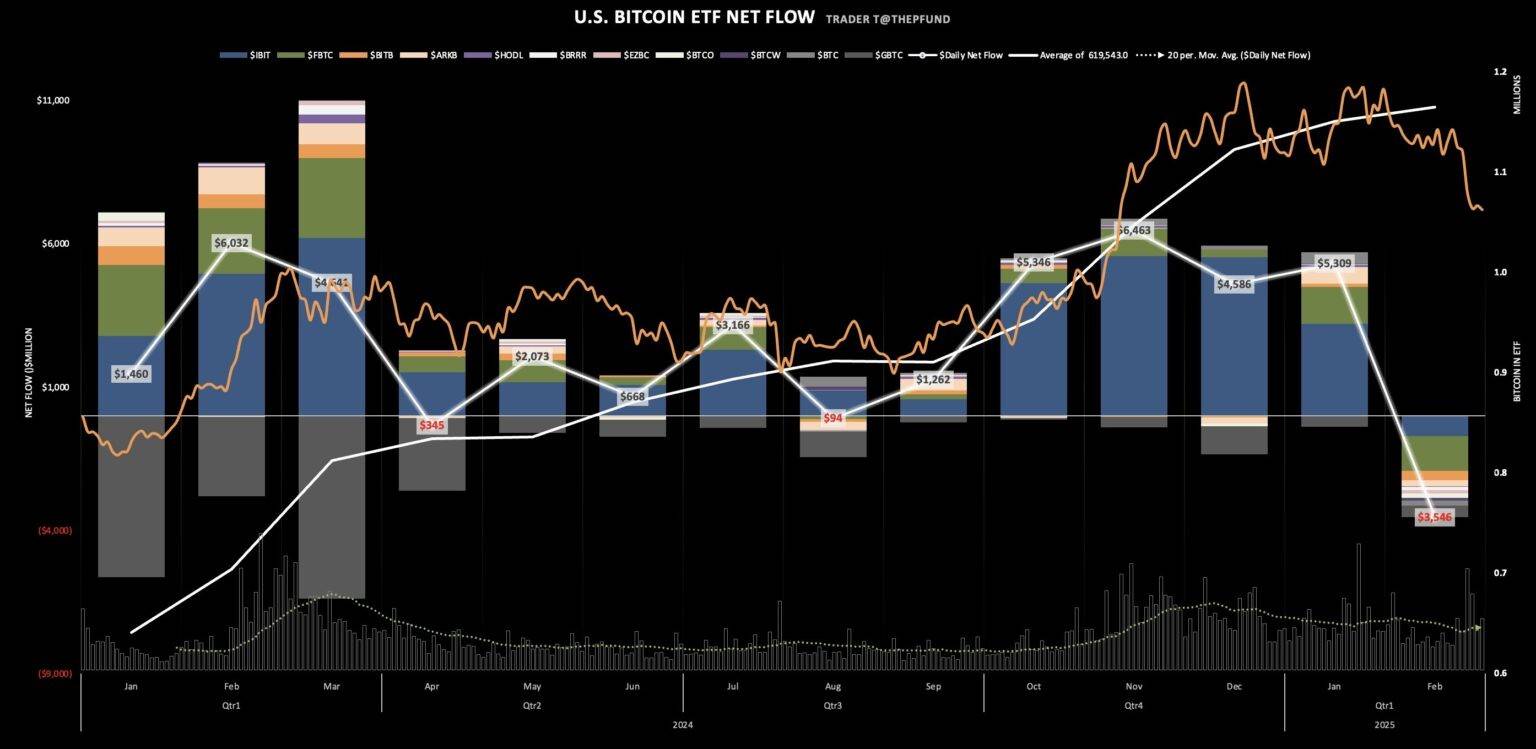

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

3 months ago

Bitcoin ETFs lost $3.5 billion in a week as the Fed adopted a bearish outlook on U.S. GDP.

As investors observe these developments, there is increasing curiosity about whether Bitcoin ETFs will recover in March. Given the volatile nature of the market and the ongoing geopolitical tensions, the outlook for Bitcoin and related ETFs remains uncertain.

#bitcoin #bitcoinetf

As investors observe these developments, there is increasing curiosity about whether Bitcoin ETFs will recover in March. Given the volatile nature of the market and the ongoing geopolitical tensions, the outlook for Bitcoin and related ETFs remains uncertain.

#bitcoin #bitcoinetf

4 months ago

Sponsored by

Administrator

12 months ago