1 month ago

🚨 Russia Moves to Criminalize Illegal Crypto Mining 🚨

Russia's financial watchdog is pushing for criminal charges against illegal cryptocurrency mining, linking it to money laundering risks.

A draft law—prepared with the Ministry of Finance and Central Bank—has already gained backing from key policy groups like the Civic Chamber.

🗣️ Deputy Director German Neglyad: "Crypto must not become a tool for illegal finance."

Also weighing in, Federation Council's Nikolai Zhuravlev stressed the importance of proactive legislation to protect the financial system. Meanwhile, Osman Kabaloev of the MoF confirmed plans to introduce both administrative fines and criminal liability to crack down on abuse of low-cost energy for mining and illicit fund transfers.

🔍 The message is clear: crypto innovation must go hand-in-hand with regulation.

#cryptonews #Russia #MoneyLaundering #Regulation #Blockchain #Policy #mining #finance

Russia's financial watchdog is pushing for criminal charges against illegal cryptocurrency mining, linking it to money laundering risks.

A draft law—prepared with the Ministry of Finance and Central Bank—has already gained backing from key policy groups like the Civic Chamber.

🗣️ Deputy Director German Neglyad: "Crypto must not become a tool for illegal finance."

Also weighing in, Federation Council's Nikolai Zhuravlev stressed the importance of proactive legislation to protect the financial system. Meanwhile, Osman Kabaloev of the MoF confirmed plans to introduce both administrative fines and criminal liability to crack down on abuse of low-cost energy for mining and illicit fund transfers.

🔍 The message is clear: crypto innovation must go hand-in-hand with regulation.

#cryptonews #Russia #MoneyLaundering #Regulation #Blockchain #Policy #mining #finance

2 months ago

🇺🇸 JUST IN: The Federal Reserve has withdrawn its guidance for banks on crypto-asset and dollar token activities.

This may open the door for more bank involvement in both stablecoins and broader crypto services.

This may open the door for more bank involvement in both stablecoins and broader crypto services.

2 months ago

Riot Platforms has secured a $100 million credit facility from Coinbase Credit, a subsidiary of Coinbase Global, Inc. The credit facility, Riot's first bitcoin-backed facility, will provide the company with non-dilutive funding at an attractive financing cost.

Key Points:

Purpose: Riot intends to use the proceeds from the credit facility for strategic initiatives and general corporate purposes.

Terms: The loan has a variable annual interest rate of at least 7.75%, calculated as the greater of 3.25% or the federal funds rate upper bound, plus 4.5%. It will mature 364 days after the effective date, with a possible one-year extension subject to Coinbase's consent.

Collateral: The loan is secured by a portion of Riot's total bitcoin holdings. As of April 2025, Riot held 19,223 BTC, valued at approximately $1.8 billion.

Strategic Importance: The credit facility is a key part of Riot's efforts to diversify funding sources, support operations, and pursue strategic growth initiatives, with a focus on long-term stockholder value creation.

Market Reaction: Following the announcement, shares of Riot Platforms (RIOT) rose more than 8% on April 23, amid a broad rally for Bitcoin miners and the overall stock market.

Key Points:

Purpose: Riot intends to use the proceeds from the credit facility for strategic initiatives and general corporate purposes.

Terms: The loan has a variable annual interest rate of at least 7.75%, calculated as the greater of 3.25% or the federal funds rate upper bound, plus 4.5%. It will mature 364 days after the effective date, with a possible one-year extension subject to Coinbase's consent.

Collateral: The loan is secured by a portion of Riot's total bitcoin holdings. As of April 2025, Riot held 19,223 BTC, valued at approximately $1.8 billion.

Strategic Importance: The credit facility is a key part of Riot's efforts to diversify funding sources, support operations, and pursue strategic growth initiatives, with a focus on long-term stockholder value creation.

Market Reaction: Following the announcement, shares of Riot Platforms (RIOT) rose more than 8% on April 23, amid a broad rally for Bitcoin miners and the overall stock market.

2 months ago

BREAKING: The SEC and Feds just dropped the hammer on a $200M crypto scheme — because apparently, “get rich quick” wasn’t meant to be this literal.

When your favorite influencer says “HODL,” but the Feds say “HOLD UP!”

Crypto bros be like: “It’s not a scam, it’s decentralized innovation.”

Meanwhile, the SEC: “Tell it to the judge, Satoshi.”

Read the full story here: https://cointelegraph.com/...

When your favorite influencer says “HODL,” but the Feds say “HOLD UP!”

Crypto bros be like: “It’s not a scam, it’s decentralized innovation.”

Meanwhile, the SEC: “Tell it to the judge, Satoshi.”

Read the full story here: https://cointelegraph.com/...

2 months ago

🇺🇸 NEW: Gold briefly hit a record $3,500/oz after Trump slammed Fed Chair Powell, fueling investor demand for safe-haven assets.

2 months ago

🚨 "Last chance to buy Bitcoin before $100K?" 💰

Arthur Hayes, BitMEX co-founder, says the window to buy BTC cheap might be closing fast! ⏳ With macro trends shifting and money printing back on the table, he believes Bitcoin is poised for a major move.

💸 As the Fed signals rate cuts, liquidity is flowing—and crypto could be the biggest winner.

📈 $BTC to $100,000? Hayes thinks it's not if, but when.

🧠 Are you ready... or still waiting?

#bitcoin #crypto #BTC #ArthurHayes #BitcoinTo100K #cryptonews #buythedip #HODL

Arthur Hayes, BitMEX co-founder, says the window to buy BTC cheap might be closing fast! ⏳ With macro trends shifting and money printing back on the table, he believes Bitcoin is poised for a major move.

💸 As the Fed signals rate cuts, liquidity is flowing—and crypto could be the biggest winner.

📈 $BTC to $100,000? Hayes thinks it's not if, but when.

🧠 Are you ready... or still waiting?

#bitcoin #crypto #BTC #ArthurHayes #BitcoinTo100K #cryptonews #buythedip #HODL

2 months ago

🚨 BREAKING: FEDERAL RESERVE CHAIR SAYS #bitcoin & CRYPTO ARE "BECOMING MAINSTREAM" 💥

He also expressed SUPPORT for a clear LEGAL FRAMEWORK ✅

This is BIG. The ripple effect will be felt globally 🌍🔥

#cryptonews #BitcoinAdoption #CryptoRegulation #MainstreamCrypto

He also expressed SUPPORT for a clear LEGAL FRAMEWORK ✅

This is BIG. The ripple effect will be felt globally 🌍🔥

#cryptonews #BitcoinAdoption #CryptoRegulation #MainstreamCrypto

2 months ago

📅 Big Week Ahead in Markets & Policy! 🇺🇸💼

Here’s what to watch:

🔹 Monday:

- President Donald Trump is expected to reveal more details on semiconductor tariffs—a hot topic for tech & trade watchers. 💻📉

🔹 Tuesday: A Fed-heavy day!

- Patrick Harker (2026 FOMC voter, Philly Fed) talks Fed roles.

- Raphael Bostic (2027 FOMC voter, Atlanta Fed) weighs in on monetary policy. 🏛️💬

🔹 Thursday:

- Fed Chair Jerome Powell takes the stage at the Chicago Economic Club. 👔📢

- Weekly jobless claims data (week ending Apr 12) drops—key labor market signal. 📊

🔹 Friday:

- 📍 NYSE will be closed for the day—plan your trades accordingly! 🛑📈

Stay tuned for a week full of market-moving moments!

#FinanceNews #FOMC #FederalReserve #Markets #Trump #Semiconductors #JeromePowell #NYSE #EconomicUpdates

Here’s what to watch:

🔹 Monday:

- President Donald Trump is expected to reveal more details on semiconductor tariffs—a hot topic for tech & trade watchers. 💻📉

🔹 Tuesday: A Fed-heavy day!

- Patrick Harker (2026 FOMC voter, Philly Fed) talks Fed roles.

- Raphael Bostic (2027 FOMC voter, Atlanta Fed) weighs in on monetary policy. 🏛️💬

🔹 Thursday:

- Fed Chair Jerome Powell takes the stage at the Chicago Economic Club. 👔📢

- Weekly jobless claims data (week ending Apr 12) drops—key labor market signal. 📊

🔹 Friday:

- 📍 NYSE will be closed for the day—plan your trades accordingly! 🛑📈

Stay tuned for a week full of market-moving moments!

#FinanceNews #FOMC #FederalReserve #Markets #Trump #Semiconductors #JeromePowell #NYSE #EconomicUpdates

2 months ago

MASSIVE WEEK AHEAD

📅 April 1 – ISM Manufacturing Data

📅 April 2 – Major Tariffs Announcement

📅 April 3 – Initial Jobless Claims Report

📅 April 4 – Fed Chair Powell Speaks @ SABEW Conference

📅 April 4 – U.S. Unemployment Data Release

With economic indicators in focus, traders are on high alert.

If the data leans bullish, could we see the next big market rally?

📅 April 1 – ISM Manufacturing Data

📅 April 2 – Major Tariffs Announcement

📅 April 3 – Initial Jobless Claims Report

📅 April 4 – Fed Chair Powell Speaks @ SABEW Conference

📅 April 4 – U.S. Unemployment Data Release

With economic indicators in focus, traders are on high alert.

If the data leans bullish, could we see the next big market rally?

3 months ago

Bitcoin is following US stocks more than trading on its own.

FED interest rate decision and fomc is due on Wednesday. This can potentially move the markets more.

#bitcoin

FED interest rate decision and fomc is due on Wednesday. This can potentially move the markets more.

#bitcoin

3 months ago

BREAKING: White House Rejects Cryptocurrency Transaction Tax Proposal

David Sacks, the White House crypto and AI czar, has rejected the idea of taxing every cryptocurrency transaction to strengthen the U.S. strategic Bitcoin reserve and digital asset holdings.

On a recent episode of the All In podcast, host Jason Calacanis proposed a 0.01% tax on each crypto transaction, to be paid in the asset being transferred, purchased, or sold.

Sacks expressed doubts, pointing out that taxes often begin small but tend to grow over time. He cited the U.S. income tax, which started with a limited scope but later expanded to affect far more people.

Sacks voiced concerns about the potential strain of new taxes, even if they’re initially presented as minor. Crypto investors also criticized the idea, especially the prospect of taxing transfers between wallets owned by the same person.

The White House Crypto Summit held recently didn’t delve into specific tax proposals, though the Trump administration has signaled interest in broad federal tax reform.

President Donald Trump has floated the idea of abolishing the federal income tax, favoring tariffs on imported goods as a revenue source instead. He highlighted the 19th century, when tariffs alone funded the U.S. government, as a time of notable economic success. U.S. Commerce Secretary Howard Lutnick backed this plan, proposing to replace the Internal Revenue Service (IRS) with an 'External Revenue Service.'

#cryptocurrency #Tax #Cryptotax #WhiteHouse #bitcoinreserve

David Sacks, the White House crypto and AI czar, has rejected the idea of taxing every cryptocurrency transaction to strengthen the U.S. strategic Bitcoin reserve and digital asset holdings.

On a recent episode of the All In podcast, host Jason Calacanis proposed a 0.01% tax on each crypto transaction, to be paid in the asset being transferred, purchased, or sold.

Sacks expressed doubts, pointing out that taxes often begin small but tend to grow over time. He cited the U.S. income tax, which started with a limited scope but later expanded to affect far more people.

Sacks voiced concerns about the potential strain of new taxes, even if they’re initially presented as minor. Crypto investors also criticized the idea, especially the prospect of taxing transfers between wallets owned by the same person.

The White House Crypto Summit held recently didn’t delve into specific tax proposals, though the Trump administration has signaled interest in broad federal tax reform.

President Donald Trump has floated the idea of abolishing the federal income tax, favoring tariffs on imported goods as a revenue source instead. He highlighted the 19th century, when tariffs alone funded the U.S. government, as a time of notable economic success. U.S. Commerce Secretary Howard Lutnick backed this plan, proposing to replace the Internal Revenue Service (IRS) with an 'External Revenue Service.'

#cryptocurrency #Tax #Cryptotax #WhiteHouse #bitcoinreserve

3 months ago

HISTORY: 10 years ago today, the US government sold 50,000 #bitcoin for $270 each

A $4.4 BILLION mistake 💀

https://finance.yahoo.com/...

https://www.yahoo.com/news...

A $4.4 BILLION mistake 💀

https://finance.yahoo.com/...

https://www.yahoo.com/news...

Feds auction $13.5M worth of Silk Road bitcoins

U.S. Marshals auctioned about $13.5 million worth of bitcoins forfeited by convicted Silk Road owner Ross Ulbricht on Thursday.

https://finance.yahoo.com/news/feds-auction-13-5m-worth-153622407.html

3 months ago

Crypto Fraudster's Ex-Partner Guilty

Iris Ramaya Au, the former partner of #cryptocurrency fraudster Adam Iza, known as the "Godfather," has pleaded guilty to federal tax charges. She admitted to failing to report over $2.6 million in illicit gains acquired through Iza's criminal activities.

Au's guilty plea includes acknowledging that she provided false information on her tax return regarding these earnings from 2020 to 2023.

As a result of her actions, she faces a potential sentence of up to three years in federal prison. This development follows Iza's own guilty plea to multiple charges, including conspiracy, wire fraud, and tax evasion, where he is expected to face a significantly longer sentence of up to 35 years in prison.

#crypto #Fraud #cryptocurrencyfraudster #cryptocurrency #cryptoscam

Iris Ramaya Au, the former partner of #cryptocurrency fraudster Adam Iza, known as the "Godfather," has pleaded guilty to federal tax charges. She admitted to failing to report over $2.6 million in illicit gains acquired through Iza's criminal activities.

Au's guilty plea includes acknowledging that she provided false information on her tax return regarding these earnings from 2020 to 2023.

As a result of her actions, she faces a potential sentence of up to three years in federal prison. This development follows Iza's own guilty plea to multiple charges, including conspiracy, wire fraud, and tax evasion, where he is expected to face a significantly longer sentence of up to 35 years in prison.

#crypto #Fraud #cryptocurrencyfraudster #cryptocurrency #cryptoscam

3 months ago

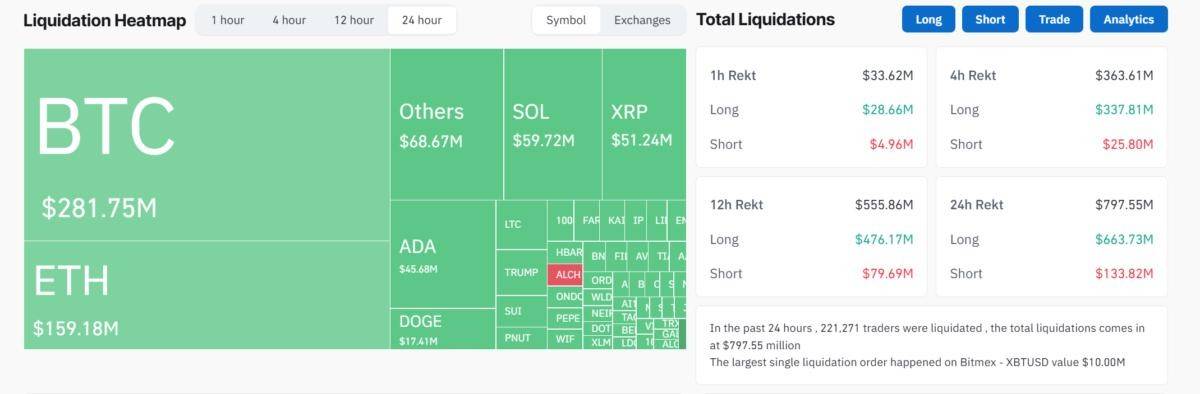

Bitcoin's weekend gains vanished as the Federal Reserve warned of a potential recession.

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

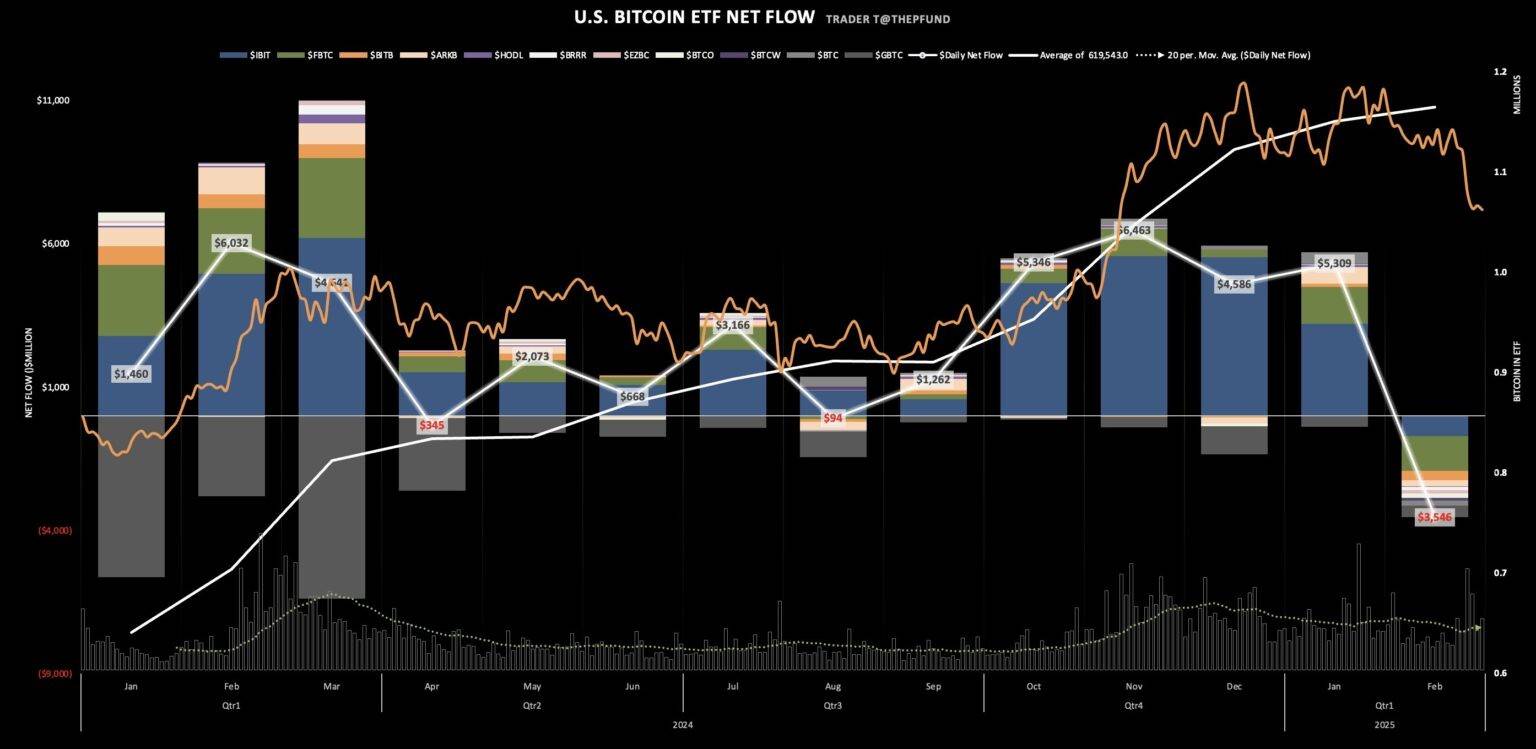

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

3 months ago

Bitcoin ETFs lost $3.5 billion in a week as the Fed adopted a bearish outlook on U.S. GDP.

As investors observe these developments, there is increasing curiosity about whether Bitcoin ETFs will recover in March. Given the volatile nature of the market and the ongoing geopolitical tensions, the outlook for Bitcoin and related ETFs remains uncertain.

#bitcoin #bitcoinetf

As investors observe these developments, there is increasing curiosity about whether Bitcoin ETFs will recover in March. Given the volatile nature of the market and the ongoing geopolitical tensions, the outlook for Bitcoin and related ETFs remains uncertain.

#bitcoin #bitcoinetf

Sponsored by

Administrator

12 months ago