1 month ago

Jim Cramer says: "a recession in the next 6 months due to tariffs is very likely, i would say there is a 90% chance"

2 months ago

🚨 BREAKING: BlackRock CEO Larry Fink issues a stark warning — "the economy is weakening" 📉

He predicts markets could tumble another 20%, sparking fresh recession fears. But it’s not all doom and gloom — Fink also sees a long-term buying opportunity for those who stay the course. 🧠💼

📊 Volatility ahead… Are you buying the dip or sitting this one out?

💬👇 #MarketNews #RecessionFears #LarryFink #blackrock #Investing #StockMarket

He predicts markets could tumble another 20%, sparking fresh recession fears. But it’s not all doom and gloom — Fink also sees a long-term buying opportunity for those who stay the course. 🧠💼

📊 Volatility ahead… Are you buying the dip or sitting this one out?

💬👇 #MarketNews #RecessionFears #LarryFink #blackrock #Investing #StockMarket

3 months ago

(E)

🔥 NEW: BlackRock's Bold Prediction: Recession Could Drive Bitcoin's Next Bull Run

#bitcoin #blackrock #DigitalAssets

#bitcoin #blackrock #DigitalAssets

3 months ago

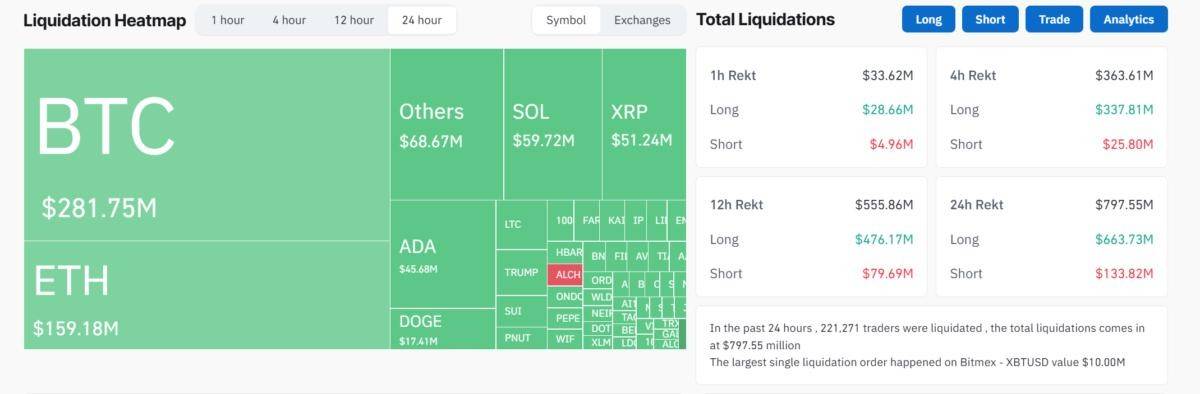

Bitcoin's weekend gains vanished as the Federal Reserve warned of a potential recession.

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

Sponsored by

Administrator

11 months ago