2 days ago

2 days ago

On August 15, 2010, Bitcoin broke.

A bug in Block 74638 created 184 billion BTC out of thin air. That’s not a typo. Two outputs of 92 billion BTC each slipped through because the code didn’t check for integer overflow. The system just accepted it. Bitcoin’s sacred 21 million? Completely ignored.

This wasn’t a theoretical flaw. It actually happened. And it proved something most people still don’t understand.

Bitcoin’s scarcity is not protected by code. It’s protected by people.

The only reason #bitcoin didn’t die that day is because someone noticed. A fix was pushed. A patched client was released. Nodes upgraded. Within five hours, the invalid block was erased from consensus. Bitcoin’s monetary policy was rescued, not by the protocol, but by the humans running it.

That’s the truth behind the “trustless” narrative. Code did not save Bitcoin. The community did.

Scarcity was never a guarantee. It was a fight. And it still is.

A bug in Block 74638 created 184 billion BTC out of thin air. That’s not a typo. Two outputs of 92 billion BTC each slipped through because the code didn’t check for integer overflow. The system just accepted it. Bitcoin’s sacred 21 million? Completely ignored.

This wasn’t a theoretical flaw. It actually happened. And it proved something most people still don’t understand.

Bitcoin’s scarcity is not protected by code. It’s protected by people.

The only reason #bitcoin didn’t die that day is because someone noticed. A fix was pushed. A patched client was released. Nodes upgraded. Within five hours, the invalid block was erased from consensus. Bitcoin’s monetary policy was rescued, not by the protocol, but by the humans running it.

That’s the truth behind the “trustless” narrative. Code did not save Bitcoin. The community did.

Scarcity was never a guarantee. It was a fight. And it still is.

12 days ago

North Korea has become the world's third-largest government holder of Bitcoin, following a massive cryptocurrency heist. Here's the detailed breakdown:

North Korea achieved this position through a massive cryptocurrency theft. On February 21, hackers affiliated with North Korea's Lazarus Group infiltrated Bybit, one of the largest cryptocurrency exchanges, stealing approximately $1.46 billion in Ethereum.

A significant portion of these stolen funds was subsequently converted into Bitcoin, boosting North Korea's total holdings to 13,562 BTC

#bitcoin #cryptocurrency #Heist #northkorea

North Korea achieved this position through a massive cryptocurrency theft. On February 21, hackers affiliated with North Korea's Lazarus Group infiltrated Bybit, one of the largest cryptocurrency exchanges, stealing approximately $1.46 billion in Ethereum.

A significant portion of these stolen funds was subsequently converted into Bitcoin, boosting North Korea's total holdings to 13,562 BTC

#bitcoin #cryptocurrency #Heist #northkorea

12 days ago

13 days ago

Here's how I would invest 10,000$ 👇

- 40% $BTC

- 30% $ETH

- 15% L1's

- 10% DEXes

- 5% in high risk #memecoins #altcoins

How would you split your portfolio? 🤔

- 40% $BTC

- 30% $ETH

- 15% L1's

- 10% DEXes

- 5% in high risk #memecoins #altcoins

How would you split your portfolio? 🤔

13 days ago

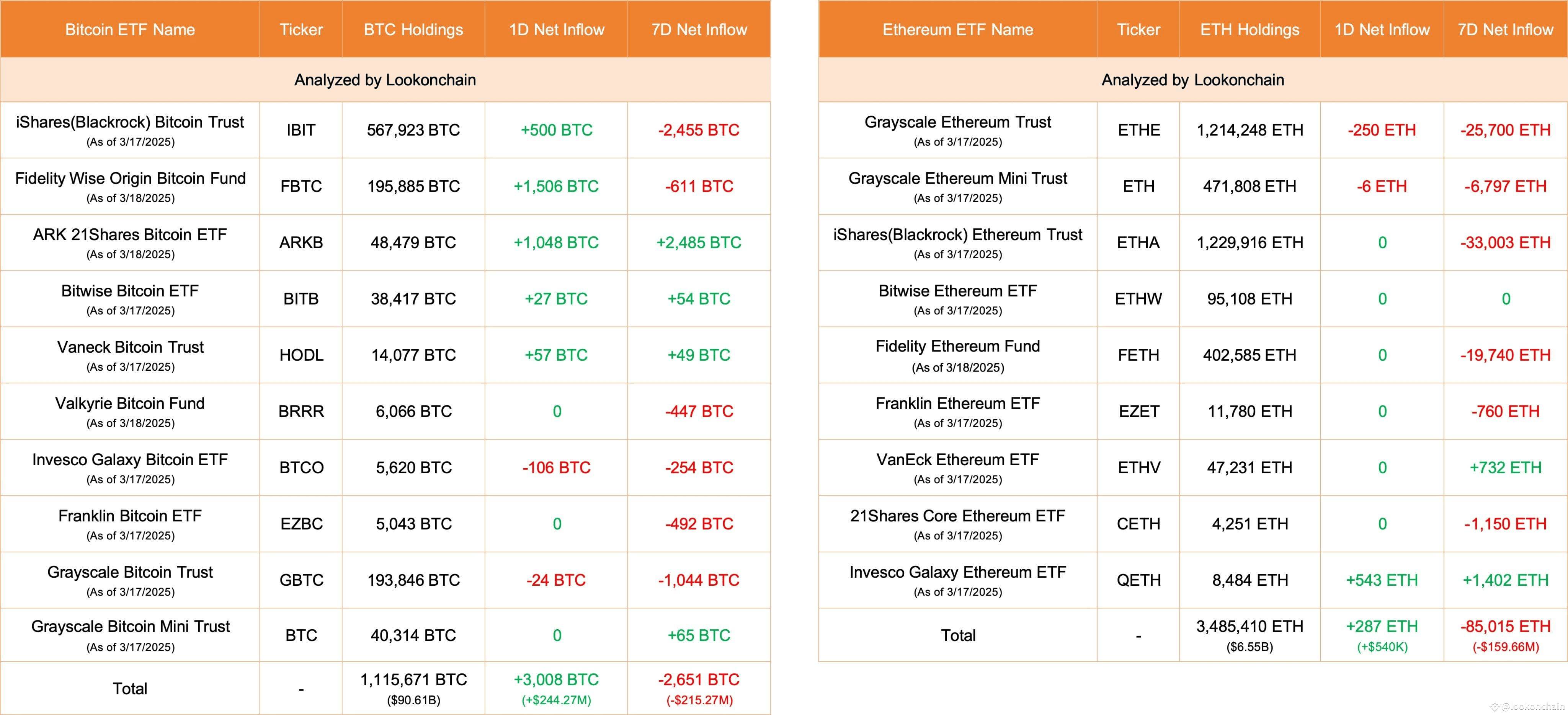

#bitcoin ETFs

NetFlow: +3,008 $BTC(+$244.27M)🟢

#fidelity inflows 1,506 $BTC($122.32M) and currently holds 195,885 $BTC($15.91B).

#ethereum ETFs

NetFlow: +287 $ETH(+$540K)🟢

#InvescoGalaxy inflows 543 $ETH($1.02M) and currently holds 8,484 $ETH($15.93M).

NetFlow: +3,008 $BTC(+$244.27M)🟢

#fidelity inflows 1,506 $BTC($122.32M) and currently holds 195,885 $BTC($15.91B).

#ethereum ETFs

NetFlow: +287 $ETH(+$540K)🟢

#InvescoGalaxy inflows 543 $ETH($1.02M) and currently holds 8,484 $ETH($15.93M).

14 days ago

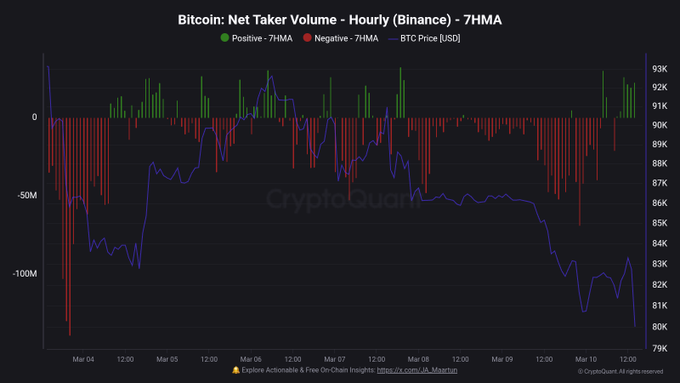

Bitcoin Hovers Near $83K As Whales and Miners Cash Out – Will BTC Drop to $75K?

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

14 days ago

📉 Standard Chartered has reduced its year-end price target for Ether (ETH) from $10,000 to $4,000. Currently, ETH is trading at around $1,903.

🔍 The bank notes that ETH's market dominance is declining and that Coinbase's Base platform has reduced ETH's market value by $50 billion.

📈 A recovery in ETH's price is expected, but the rise of BTC could affect all digital assets.

#ETH #ethereum #DigitalAssets

🔍 The bank notes that ETH's market dominance is declining and that Coinbase's Base platform has reduced ETH's market value by $50 billion.

📈 A recovery in ETH's price is expected, but the rise of BTC could affect all digital assets.

#ETH #ethereum #DigitalAssets

15 days ago

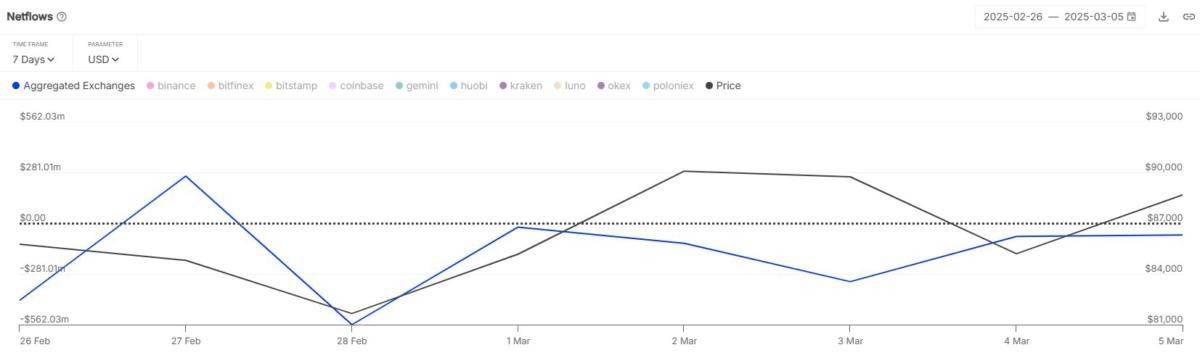

⚡️Digital Asset Funds Experience Significant Outflows Amid Global Uncertainty

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

15 days ago

Cryptocurrency Market Experiences $178 Million in Liquidations

Recent data from Coinglass indicates that the cryptocurrency market experienced liquidations totaling $178 million in the past 24 hours. Of this total, long positions accounted for $126 million, while short positions amounted to $51.63 million. Specifically, Bitcoin (BTC) had liquidations of $36.22 million, and Ethereum (ETH) saw $33.48 million in liquidations.

#cryptocurrency #ethereum #bitcoin #Coinglass #liquidations

Recent data from Coinglass indicates that the cryptocurrency market experienced liquidations totaling $178 million in the past 24 hours. Of this total, long positions accounted for $126 million, while short positions amounted to $51.63 million. Specifically, Bitcoin (BTC) had liquidations of $36.22 million, and Ethereum (ETH) saw $33.48 million in liquidations.

#cryptocurrency #ethereum #bitcoin #Coinglass #liquidations

16 days ago

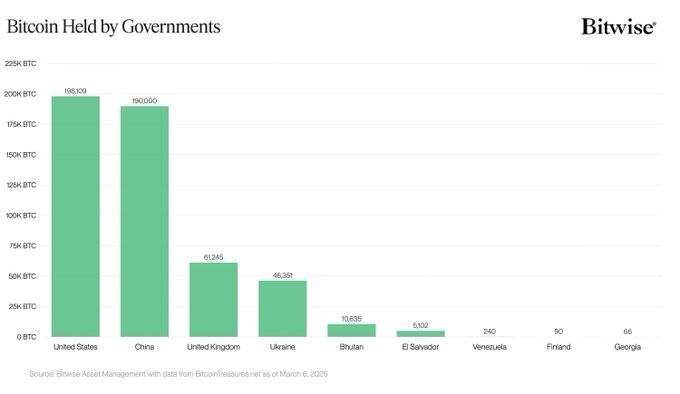

🔥 INSIGHT: The US holds the largest government Bitcoin reserves with 198,109 BTC, closely followed by China, which has 190,000 BTC.

Will more states be joining the Bitcoin race soon? 👀

#bitcoin #US #bitcoinreserve #china

Will more states be joining the Bitcoin race soon? 👀

#bitcoin #US #bitcoinreserve #china

17 days ago

$BTC

Short Liquidation Alert!

A massive $53,823 short liquidation just hit at $84,362.5! This shows sellers are getting liquidated, and bulls are stepping in with power. If #bitcoin holds above $84,000, we could see a big upward push soon.

What’s Next?

Buy Zone: $83,800 - $84,300

Entry: $84,000

Target 1: $85,800

Target 2: $87,500

Stop Loss: $83,200

Trade smart! Always manage your risk. This is not financial advice. Do your own research before making any moves.

Short Liquidation Alert!

A massive $53,823 short liquidation just hit at $84,362.5! This shows sellers are getting liquidated, and bulls are stepping in with power. If #bitcoin holds above $84,000, we could see a big upward push soon.

What’s Next?

Buy Zone: $83,800 - $84,300

Entry: $84,000

Target 1: $85,800

Target 2: $87,500

Stop Loss: $83,200

Trade smart! Always manage your risk. This is not financial advice. Do your own research before making any moves.

17 days ago

Cannot confirm that the market is shifting to a downtrend

According to the assessment of CryptoQuant CEO - Ki Young Ju

Bitcoin: Apparent Demand (30-day sum) can be understood as the displayed demand for Bitcoin over a 30-day period calculated based on changes in the supply of active $BTC.

This is an indicator measuring the amount of BTC moving in the market over the past 30 days.

- If this indicator is positive → Demand is high.

- If this indicator is negative → Many BTC are inactive, indicating weaker demand.

Ki Young Ju believes that "Demand for #bitcoin is stabilizing, but it cannot be confirmed that the market is shifting to a downtrend."

According to the assessment of CryptoQuant CEO - Ki Young Ju

Bitcoin: Apparent Demand (30-day sum) can be understood as the displayed demand for Bitcoin over a 30-day period calculated based on changes in the supply of active $BTC.

This is an indicator measuring the amount of BTC moving in the market over the past 30 days.

- If this indicator is positive → Demand is high.

- If this indicator is negative → Many BTC are inactive, indicating weaker demand.

Ki Young Ju believes that "Demand for #bitcoin is stabilizing, but it cannot be confirmed that the market is shifting to a downtrend."

17 days ago

21 days ago

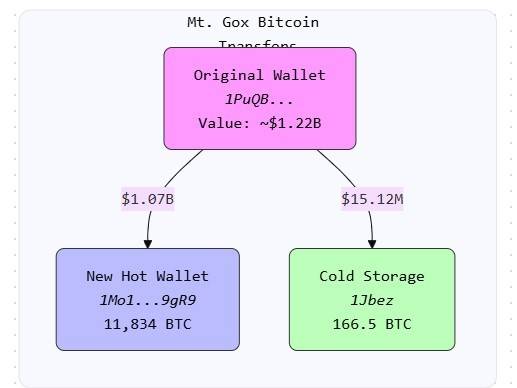

Mt. Gox Transfers 11,502 BTC

Arkham has detected that Mt. Gox transferred 11,502 BTC to an unknown new address approximately 30 minutes ago. The transaction is valued at around $905 million and may be related to ongoing repayment plans.

A significant Bitcoin transfer occurred on March 5, 2025, when Mt. Gox moved substantial amounts of cryptocurrency to new addresses. Here's what happened:

Transaction Details-

- Primary Transfer: 11,834 BTC ($1.07 billion) moved to address 1Mo1...9gR9

- Secondary Transfer: 166.5 BTC ($15.12 million) moved to cold storage wallet 1Jbez

- Transaction Time: Approximately 3:17 UTC

- Source Wallet: 1PuQBjpPfAuANa3KM4HBdfF98BC7wnWhTb

Arkham has detected that Mt. Gox transferred 11,502 BTC to an unknown new address approximately 30 minutes ago. The transaction is valued at around $905 million and may be related to ongoing repayment plans.

A significant Bitcoin transfer occurred on March 5, 2025, when Mt. Gox moved substantial amounts of cryptocurrency to new addresses. Here's what happened:

Transaction Details-

- Primary Transfer: 11,834 BTC ($1.07 billion) moved to address 1Mo1...9gR9

- Secondary Transfer: 166.5 BTC ($15.12 million) moved to cold storage wallet 1Jbez

- Transaction Time: Approximately 3:17 UTC

- Source Wallet: 1PuQBjpPfAuANa3KM4HBdfF98BC7wnWhTb

21 days ago

Emirates NBD Bank in Dubai has just launched cryptocurrency trading!

Users can now buy, hold & sell BTC, ETH, SOL, XRP & ADA. 🚀

Source: https://www.bloomberg.com/...

#Dubai #NBDBank #cryptocurrency #trading #BTC #UAE

Users can now buy, hold & sell BTC, ETH, SOL, XRP & ADA. 🚀

Source: https://www.bloomberg.com/...

#Dubai #NBDBank #cryptocurrency #trading #BTC #UAE

21 days ago

🚨 INTERESTING!

Bitcoin ($BTC) is currently declining in value, but more buyers are starting to accumulate.

#bitcoin

Bitcoin ($BTC) is currently declining in value, but more buyers are starting to accumulate.

#bitcoin

22 days ago

(E)

🚨BREAKING: Banking Giant BBVA to Enable #bitcoin Buying and Selling Directly in Consumer Apps

Key Features

- Trading of both Bitcoin (BTC) and Ethereum (ETH)

- Services integrated directly into BBVA's mobile banking app

- Full custody management using BBVA's proprietary cryptographic key system

- No third-party involvement in asset storage

THIS IS HUGE! 🔥🔥

https://www.reuters.com/te...

#BBVA

Key Features

- Trading of both Bitcoin (BTC) and Ethereum (ETH)

- Services integrated directly into BBVA's mobile banking app

- Full custody management using BBVA's proprietary cryptographic key system

- No third-party involvement in asset storage

THIS IS HUGE! 🔥🔥

https://www.reuters.com/te...

#BBVA

22 days ago

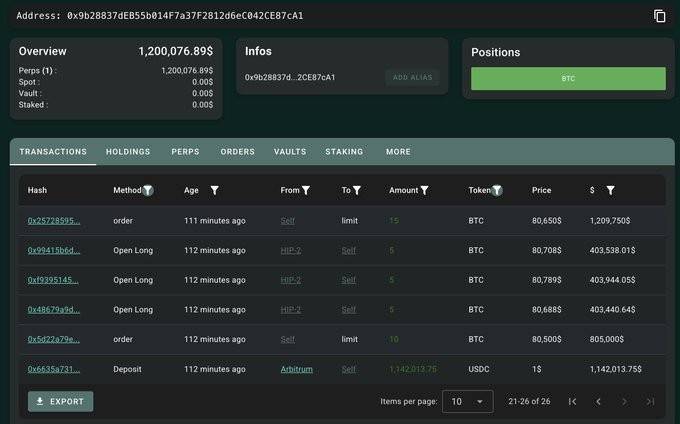

As $BTC's price declines, some whales are buying the dip and going long.

- Wallet 0x9b28...7cA1 deposited 1.14M $USDC into #Hyperliquid to long $BTC with 20x leverage.

- Wallet 0x8Bff...CDC3 spent $4M to set 100 limit orders to long $BTC at $76,000 - $79,000.

https://hypurrscan.io/addr...

https://hypurrscan.io/addr...

#bitcoin #BTC #whales

- Wallet 0x9b28...7cA1 deposited 1.14M $USDC into #Hyperliquid to long $BTC with 20x leverage.

- Wallet 0x8Bff...CDC3 spent $4M to set 100 limit orders to long $BTC at $76,000 - $79,000.

https://hypurrscan.io/addr...

https://hypurrscan.io/addr...

#bitcoin #BTC #whales

22 days ago

(E)

🚨 BREAKING NEWS 🚨 : Michael Saylor pushes $81tn Bitcoin master plan to White House to ‘own the future’

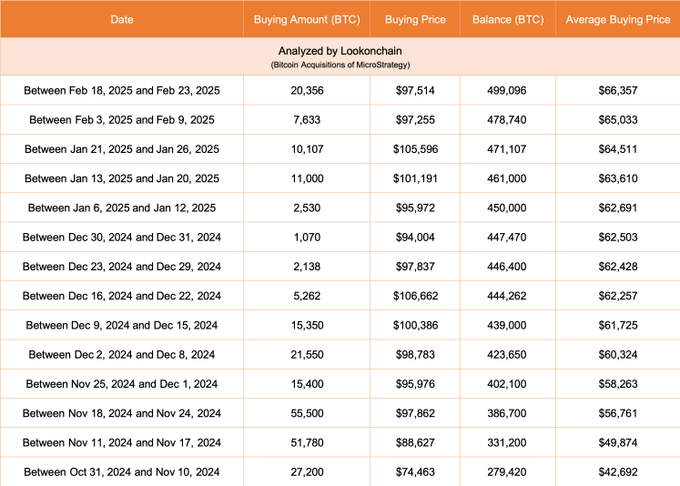

Michael Saylor, founder of MicroStrategy, has presented an ambitious plan for the U.S. government to strategically acquire between 5% and 25% of the total Bitcoin supply by 2035.

His proposal, introduced at a White House summit on March 7, 2025, envisions that such acquisitions could lead to significant economic benefits, generating up to $81 trillion for the U.S. Treasury by 2045.

Saylor advocates a policy of never selling the acquired Bitcoin, asserting that it could serve as a national asset to bolster economic stability and counter national debt.

Saylor's plan, which he outlines in a document titled “A Digital Assets Strategy to Dominate the 21st Century Global Economy,” emphasizes systematic and programmatic purchases to establish the United States as the largest holder of Bitcoin globally, with up to 5.25 million BTC.

His initiative aligns with President Trump's recent executive order creating a Strategic Bitcoin Reserve, although the immediate purchase strategy has not yet been fleshed out.

https://assets.contentstac...

#Saylor #Trump #bitcoin #WhiteHouse

Michael Saylor, founder of MicroStrategy, has presented an ambitious plan for the U.S. government to strategically acquire between 5% and 25% of the total Bitcoin supply by 2035.

His proposal, introduced at a White House summit on March 7, 2025, envisions that such acquisitions could lead to significant economic benefits, generating up to $81 trillion for the U.S. Treasury by 2045.

Saylor advocates a policy of never selling the acquired Bitcoin, asserting that it could serve as a national asset to bolster economic stability and counter national debt.

Saylor's plan, which he outlines in a document titled “A Digital Assets Strategy to Dominate the 21st Century Global Economy,” emphasizes systematic and programmatic purchases to establish the United States as the largest holder of Bitcoin globally, with up to 5.25 million BTC.

His initiative aligns with President Trump's recent executive order creating a Strategic Bitcoin Reserve, although the immediate purchase strategy has not yet been fleshed out.

https://assets.contentstac...

#Saylor #Trump #bitcoin #WhiteHouse

23 days ago

(E)

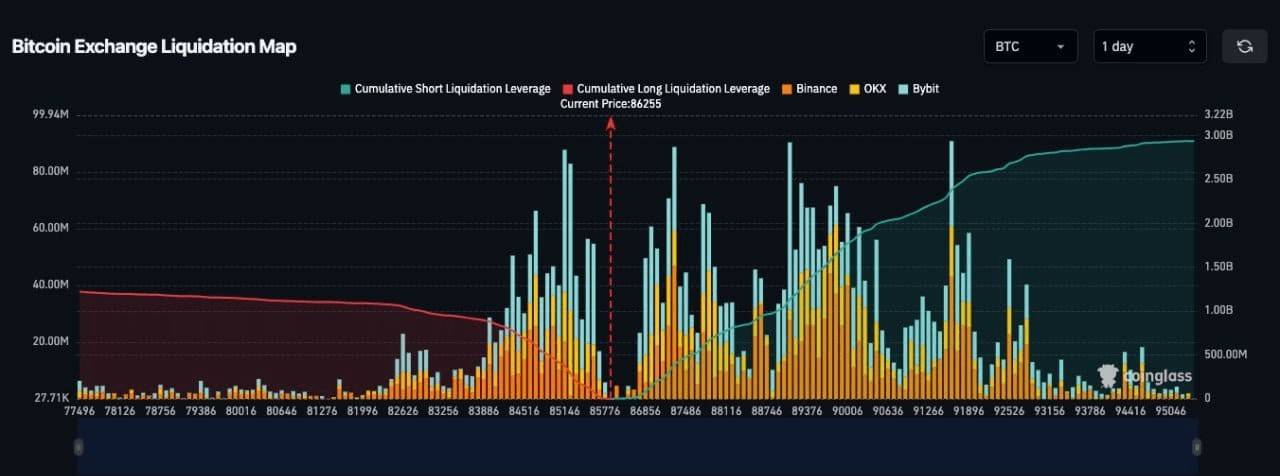

🚨 Bitcoin Liquidation Alert: Massive Short Squeeze Incoming

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

26 days ago

Mt. Gox moves 11,834 BTC ($1 billion worth of #bitcoin ) to unmarked address

https://intel.arkm.com/exp...

https://intel.arkm.com/exp...

Sponsored by

Administrator

9 months ago