12 days ago

(E)

Bitcoin Network Hashrate Rises Amid Price Decline

The graph below illustrates the remarkable volatility in Bitcoin's computational power, with hash rate fluctuating between 753 and 886 million TH/s throughout March. Despite this volatility, miners have maintained strong network participation, with the current hash rate reaching 811 EH/s

Mining Economics Analysis:

Our calculations reveal the significant financial pressures miners are facing:

1. Revenue per TH/s dropped from $0.0519 to $0.0467 (-10%) following the price decline.

2. Network-wide daily power costs exceed $33.7 billion

3. Despite these costs, miners maintain operations, suggesting confidence in future returns.

#bitcoin #bitcoinHashrate

The graph below illustrates the remarkable volatility in Bitcoin's computational power, with hash rate fluctuating between 753 and 886 million TH/s throughout March. Despite this volatility, miners have maintained strong network participation, with the current hash rate reaching 811 EH/s

Mining Economics Analysis:

Our calculations reveal the significant financial pressures miners are facing:

1. Revenue per TH/s dropped from $0.0519 to $0.0467 (-10%) following the price decline.

2. Network-wide daily power costs exceed $33.7 billion

3. Despite these costs, miners maintain operations, suggesting confidence in future returns.

#bitcoin #bitcoinHashrate

12 days ago

⚡️Digital Asset Funds Experience Significant Outflows Amid Global Uncertainty

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

14 days ago

20 days ago

(E)

🚨 Bitcoin Liquidation Alert: Massive Short Squeeze Incoming

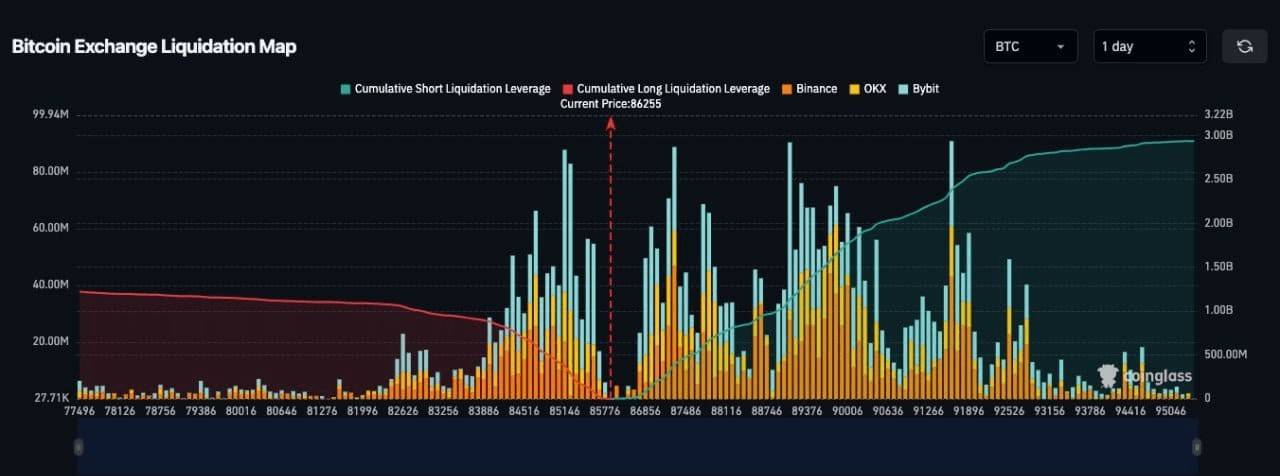

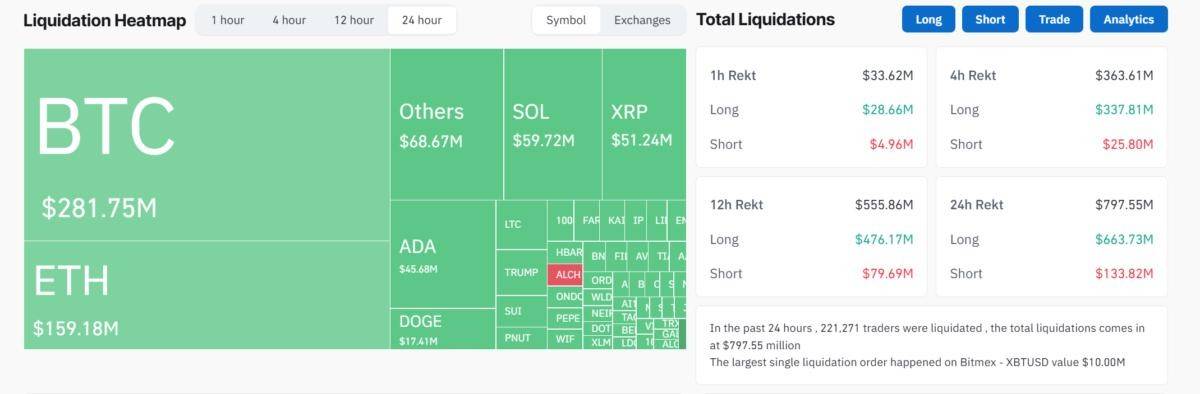

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

Bitcoin's liquidation map reveals a staggering $3 billion in short liquidations set to trigger at $95,000, potentially fueling an explosive rally. The current price sits at $86,255, with cumulative short liquidation leverage (green) increasing steadily. If $BTC continues its upward trajectory, an intense short squeeze could be on the horizon, forcing liquidations and accelerating price movement past key resistance zones.

The chart shows high liquidation clusters between $85,000 and $90,000, indicating a significant liquidity pocket that could be exploited by market movers. With Binance, OKX, and Bybit contributing to heavy liquidation volumes, traders should prepare for heightened volatility. If BTC surpasses $90,000, an aggressive move toward $95,000+ seems likely as leveraged shorts get wiped out, leading to a potential parabolic extension.

#bitcoin #BitcoinLiquidation #Liquidation #BTC

26 days ago

Bitcoin's weekend gains vanished as the Federal Reserve warned of a potential recession.

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

27 days ago

(E)

CryptoPunk #4464 : The Million-Dollar Ape NFT Saga Continues

CryptoPunk #4464 significant sales involving Ethereum, including one exceeding $2 million. This rare NFT, one of only 24 ape-themed CryptoPunks in the 10,000-piece collection, has a notable transaction history. On July 12, 2022, it sold for 2,500 ETH, which at the time equated to approximately $2.615 million USD, marking it as one of the largest NFT sales in that 30-day period. More recently, on March 1, 2025, posts on X reported that CryptoPunk #4464 sold again, this time for 1,011 ETH, valued around $2.18 million USD based on the Ethereum price at that moment.

These sales highlight the enduring value and volatility of high-profile NFTs like CryptoPunk #4464 , even amidst fluctuating crypto market conditions.

The variance in ETH and USD values between these transactions reflects the dynamic nature of cryptocurrency pricing, with the 2022 sale fetching a higher ETH amount but a similar USD value due to differences in Ethereum's market rate over time.

https://www.nftdropscalend...

#CryptoPunk4464 #NFTMillionDollarSale #EthereumNFT #CryptoArt #NFTCollectors #ApeNFT #CryptoPunkSale #DigitalAssets #NFTMarket #BlockchainArt

CryptoPunk #4464 significant sales involving Ethereum, including one exceeding $2 million. This rare NFT, one of only 24 ape-themed CryptoPunks in the 10,000-piece collection, has a notable transaction history. On July 12, 2022, it sold for 2,500 ETH, which at the time equated to approximately $2.615 million USD, marking it as one of the largest NFT sales in that 30-day period. More recently, on March 1, 2025, posts on X reported that CryptoPunk #4464 sold again, this time for 1,011 ETH, valued around $2.18 million USD based on the Ethereum price at that moment.

These sales highlight the enduring value and volatility of high-profile NFTs like CryptoPunk #4464 , even amidst fluctuating crypto market conditions.

The variance in ETH and USD values between these transactions reflects the dynamic nature of cryptocurrency pricing, with the 2022 sale fetching a higher ETH amount but a similar USD value due to differences in Ethereum's market rate over time.

https://www.nftdropscalend...

#CryptoPunk4464 #NFTMillionDollarSale #EthereumNFT #CryptoArt #NFTCollectors #ApeNFT #CryptoPunkSale #DigitalAssets #NFTMarket #BlockchainArt

28 days ago

Swiss National Bank Rejects #bitcoin Reserves Proposal

According to CoinDesk, Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of incorporating bitcoin into Switzerland's central bank reserves. Schlegel highlighted concerns over the cryptocurrency's volatility, liquidity, and security as primary reasons for this decision. In an interview with the Tamedia group, he emphasized that the instability of #cryptocurrencies makes them unsuitable for preserving long-term value.

Schlegel further explained that the central bank's reserves must remain highly liquid to be readily available for monetary policy interventions. He also pointed out the inherent security risks associated with software-based assets, noting that software can be prone to bugs and vulnerabilities. These remarks come amid a broader discussion in Switzerland regarding the potential inclusion of Bitcoin in the SNB's reserves.

A recent initiative, spearheaded by entrepreneur Yves Bennaim, is advocating for a constitutional amendment that would require the SNB to hold bitcoin alongside gold in its reserves. This initiative, launched in December, aims to gather 100,000 signatures within 18 months to prompt a nationwide vote on the matter. While the proposal does not specify the exact bitcoin allocations, it suggests that the reserves should be built from the bank's earnings.

Despite the increasing acceptance of cryptocurrencies in Switzerland, with several Swiss banks offering cryptocurrency-related services, Schlegel remains skeptical.

According to CoinDesk, Swiss National Bank (SNB) President Martin Schlegel has dismissed the idea of incorporating bitcoin into Switzerland's central bank reserves. Schlegel highlighted concerns over the cryptocurrency's volatility, liquidity, and security as primary reasons for this decision. In an interview with the Tamedia group, he emphasized that the instability of #cryptocurrencies makes them unsuitable for preserving long-term value.

Schlegel further explained that the central bank's reserves must remain highly liquid to be readily available for monetary policy interventions. He also pointed out the inherent security risks associated with software-based assets, noting that software can be prone to bugs and vulnerabilities. These remarks come amid a broader discussion in Switzerland regarding the potential inclusion of Bitcoin in the SNB's reserves.

A recent initiative, spearheaded by entrepreneur Yves Bennaim, is advocating for a constitutional amendment that would require the SNB to hold bitcoin alongside gold in its reserves. This initiative, launched in December, aims to gather 100,000 signatures within 18 months to prompt a nationwide vote on the matter. While the proposal does not specify the exact bitcoin allocations, it suggests that the reserves should be built from the bank's earnings.

Despite the increasing acceptance of cryptocurrencies in Switzerland, with several Swiss banks offering cryptocurrency-related services, Schlegel remains skeptical.

1 month ago

The hardest part of holding #bitcoin isn't dealing with volatility.

It's the boring times.

We all know people like this. They FOMO in when the price is surging, hold during a retrace, and eventually get bored by the sideways price.

This is the pain I often speak of.

It's the boring times.

We all know people like this. They FOMO in when the price is surging, hold during a retrace, and eventually get bored by the sideways price.

This is the pain I often speak of.

6 months ago

🎰 An unforgettable adventure awaits you in the game Royal Fruits 5 Hold’n’Link from NetGame! 💰💰💰

🌟 A classic fruit slot with modern elements, it offers an RTP of 96.1% and high volatility, meaning big wins. 👍👍👍

Life hacks to increase your chances of winning:

📉 Monitor your bets - start small and gradually increase your bet.

⏳ Play for a long time - the longer you play, the higher the chance of activating the Hold’n’Link function. 🎁🎁🎁

🎁 Use free spins - this will allow you to increase your balance without additional investments. Use free spins - this will allow you to increase your balance without additional investments.

🍀 Don’t miss your chance to try your luck in Royal Fruits 5 Hold’n’Link and win a big jackpot! 💯💥

🎉 We wish you big wins and bright emotions! 🔥

https://bit.ly/4f2OPkc

🌟 A classic fruit slot with modern elements, it offers an RTP of 96.1% and high volatility, meaning big wins. 👍👍👍

Life hacks to increase your chances of winning:

📉 Monitor your bets - start small and gradually increase your bet.

⏳ Play for a long time - the longer you play, the higher the chance of activating the Hold’n’Link function. 🎁🎁🎁

🎁 Use free spins - this will allow you to increase your balance without additional investments. Use free spins - this will allow you to increase your balance without additional investments.

🍀 Don’t miss your chance to try your luck in Royal Fruits 5 Hold’n’Link and win a big jackpot! 💯💥

🎉 We wish you big wins and bright emotions! 🔥

https://bit.ly/4f2OPkc

8 months ago

The Rise of Cryptocurrencies: A Financial Revolution in Progress

Cryptocurrencies, digital assets based on blockchain technology, are revolutionizing the financial world. Bitcoin, created in 2009 by the mysterious Satoshi Nakamoto, paved the way for a multitude of other cryptocurrencies like Ethereum, Ripple, and Litecoin. Their promise? Decentralized, transparent, and secure finance.

The main appeal of cryptocurrencies lies in their independence from traditional financial institutions. They offer an alternative to centralized banking systems, enabling fast and low-cost transactions without intermediaries. Additionally, the blockchain technology underlying them ensures transaction integrity and traceability.

However, investing in cryptocurrencies is not without risks. Their extreme volatility can lead to spectacular gains but also severe losses. Therefore, it is crucial to thoroughly research and diversify investments.

Despite these challenges, the adoption of cryptocurrencies continues to grow. Major companies like Tesla and PayPal now accept Bitcoin payments, and countries like El Salvador have even adopted it as legal tender. This trend reflects a growing recognition of the value and potential of cryptocurrencies.

In conclusion, cryptocurrencies represent a significant innovation that could redefine our financial system. For investors and technology enthusiasts, they offer unprecedented opportunities, provided they approach this field with caution and discernment. #crypto #Blockchain #bitcoin #DecentralizedFinance

Cryptocurrencies, digital assets based on blockchain technology, are revolutionizing the financial world. Bitcoin, created in 2009 by the mysterious Satoshi Nakamoto, paved the way for a multitude of other cryptocurrencies like Ethereum, Ripple, and Litecoin. Their promise? Decentralized, transparent, and secure finance.

The main appeal of cryptocurrencies lies in their independence from traditional financial institutions. They offer an alternative to centralized banking systems, enabling fast and low-cost transactions without intermediaries. Additionally, the blockchain technology underlying them ensures transaction integrity and traceability.

However, investing in cryptocurrencies is not without risks. Their extreme volatility can lead to spectacular gains but also severe losses. Therefore, it is crucial to thoroughly research and diversify investments.

Despite these challenges, the adoption of cryptocurrencies continues to grow. Major companies like Tesla and PayPal now accept Bitcoin payments, and countries like El Salvador have even adopted it as legal tender. This trend reflects a growing recognition of the value and potential of cryptocurrencies.

In conclusion, cryptocurrencies represent a significant innovation that could redefine our financial system. For investors and technology enthusiasts, they offer unprecedented opportunities, provided they approach this field with caution and discernment. #crypto #Blockchain #bitcoin #DecentralizedFinance

Subscribe to Unlock

For 1$ / Monthly

9 months ago

AI and Crypto: A Revolution in Progress

Artificial intelligence (AI) and cryptocurrency are two of the most disruptive innovations of the 21st century, shaping the future of finance and society.

AI transforms various sectors, particularly finance, by enabling real-time analysis of vast data. Traders use AI to predict market movements and optimize strategies, identifying trends that humans might miss.

Cryptocurrencies offer a decentralized alternative to traditional banking, allowing fast, secure transactions without intermediaries. Blockchain technology ensures transparency and traceability, making fraud nearly impossible.

The integration of AI in crypto opens new possibilities. AI models can analyze millions of transactions to detect fraud, while intelligent trading bots execute trades at incredible speeds, maximizing investor returns.

However, challenges remain. The volatility of cryptocurrencies can affect AI model effectiveness, and evolving regulations may impact AI’s role in this space.

Despite these hurdles, the future looks bright. As technology advances, we can expect greater adoption of AI in the crypto sector, creating a world where transactions are fast, secure, and guided by intelligent decisions.

The alliance between AI and cryptocurrency could redefine finance and enhance security, offering exciting opportunities ahead.

Artificial intelligence (AI) and cryptocurrency are two of the most disruptive innovations of the 21st century, shaping the future of finance and society.

AI transforms various sectors, particularly finance, by enabling real-time analysis of vast data. Traders use AI to predict market movements and optimize strategies, identifying trends that humans might miss.

Cryptocurrencies offer a decentralized alternative to traditional banking, allowing fast, secure transactions without intermediaries. Blockchain technology ensures transparency and traceability, making fraud nearly impossible.

The integration of AI in crypto opens new possibilities. AI models can analyze millions of transactions to detect fraud, while intelligent trading bots execute trades at incredible speeds, maximizing investor returns.

However, challenges remain. The volatility of cryptocurrencies can affect AI model effectiveness, and evolving regulations may impact AI’s role in this space.

Despite these hurdles, the future looks bright. As technology advances, we can expect greater adoption of AI in the crypto sector, creating a world where transactions are fast, secure, and guided by intelligent decisions.

The alliance between AI and cryptocurrency could redefine finance and enhance security, offering exciting opportunities ahead.

Subscribe to Unlock

For 1$ / Monthly

Sponsored by

Administrator

9 months ago