10 days ago

ETF FLOWS – June 2 Update:

📉 Bitcoin (BTC):

Around 2,530 $BTC were sold, leading to $267.5M in net outflows across BTC ETFs.

📈 Ethereum (ETH):

Over 30,810 $ETH were bought, bringing in $78.2M in net inflows for ETH ETFs.

What’s driving the divergence? Let’s break it down👇

#crypto #ETF #bitcoin #ethereum #MarketUpdate

📉 Bitcoin (BTC):

Around 2,530 $BTC were sold, leading to $267.5M in net outflows across BTC ETFs.

📈 Ethereum (ETH):

Over 30,810 $ETH were bought, bringing in $78.2M in net inflows for ETH ETFs.

What’s driving the divergence? Let’s break it down👇

#crypto #ETF #bitcoin #ethereum #MarketUpdate

11 days ago

11 days ago

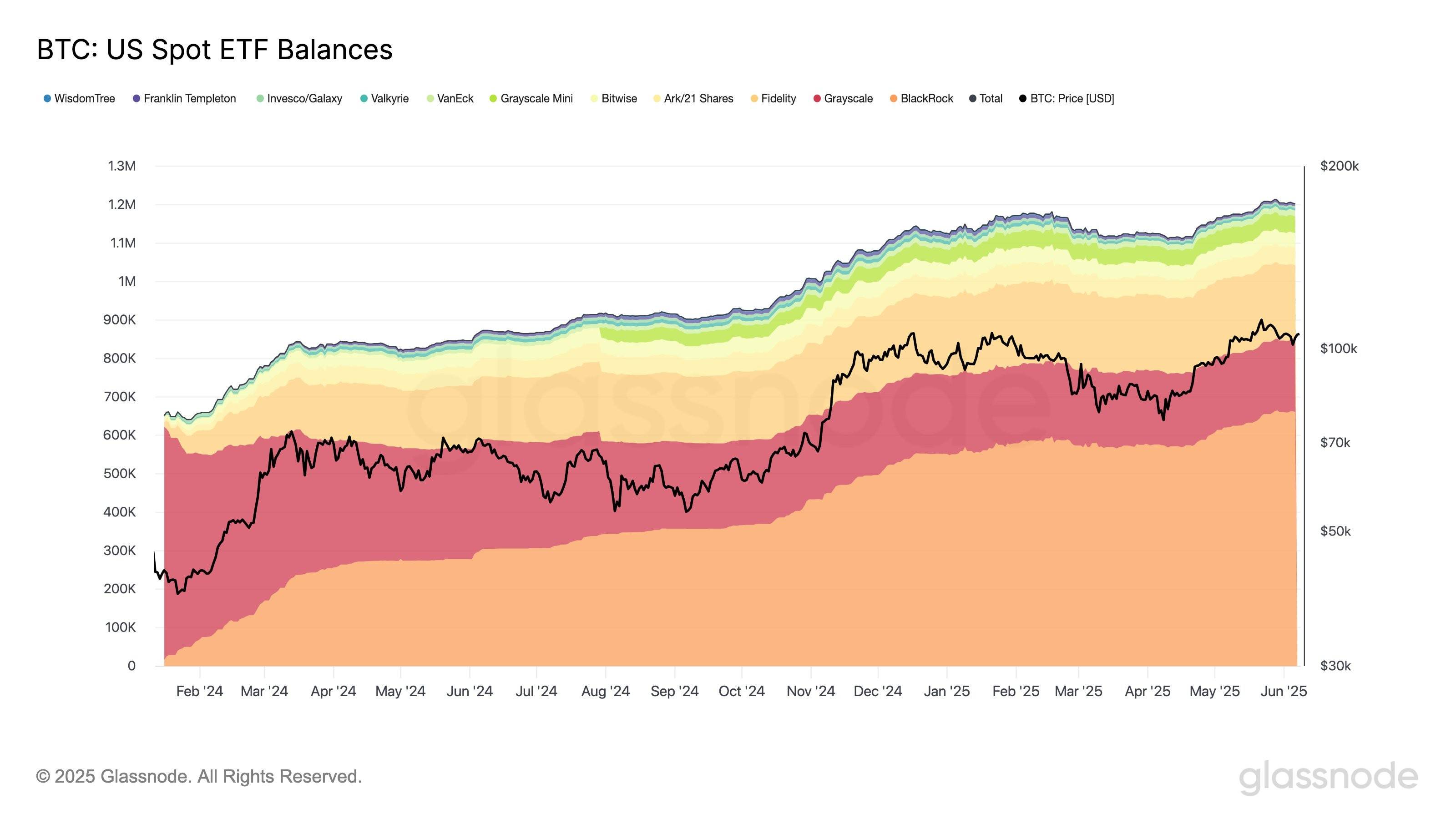

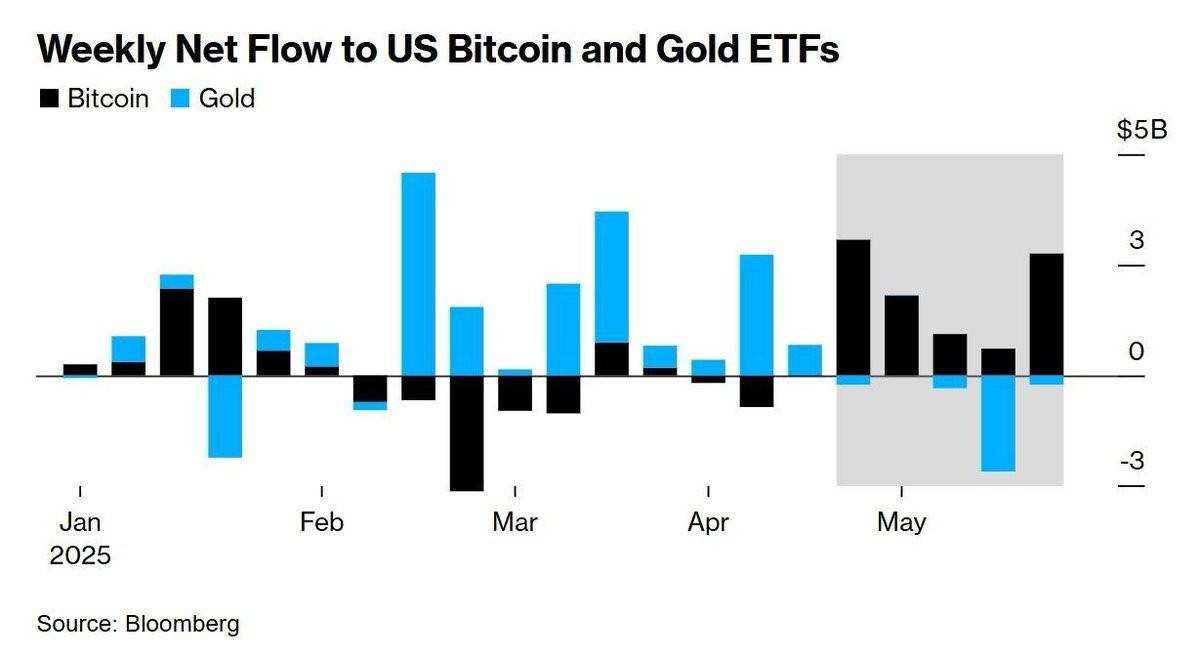

📊 UPDATE: US Bitcoin ETFs saw $9B in inflows over 5 weeks, while gold ETFs lost over $2.8B in outflows.

13 days ago

(E)

ETF FLOWS: Around 5.84K $BTC were sold and 26,69K $ETH were bought on May 30.

BTC ETFs saw $616.10M in net outflows.

ETH ETFs saw $70.20M in net inflows.

BTC ETFs saw $616.10M in net outflows.

ETH ETFs saw $70.20M in net inflows.

14 days ago

🚨 ETF Flow Alert! 🚨

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

Major moves in the crypto market on May 29! 📊💸

🔴 Bitcoin ETFs: Around 3,220 $BTC sold, resulting in $346.8M in net outflows.

🟢 Ethereum ETFs: A whopping 34,290 $ETH bought, with $91.9M in net inflows.

Looks like investors are rotating into $ETH while $BTC sees some selling pressure. What’s your take on this shift? 🤔 Let’s discuss! 👇

#bitcoin #ethereum #ETFFlows #cryptomarket

2 months ago

🌐 Over the past 5 trading days:

🔹 Bitcoin ETFs attracted $3B in inflows

🔻 Gold ETFs saw $1B in outflows

= A $4B divergence signaling a shift in investor sentiment.

Analysts note: Bitcoin is increasingly seen as the go-to hedge amid rising Treasury yields and falling demand for traditional assets like gold. 👑🔥

#bitcoin #crypto #ETF #Investing #gold #Markets

🔹 Bitcoin ETFs attracted $3B in inflows

🔻 Gold ETFs saw $1B in outflows

= A $4B divergence signaling a shift in investor sentiment.

Analysts note: Bitcoin is increasingly seen as the go-to hedge amid rising Treasury yields and falling demand for traditional assets like gold. 👑🔥

#bitcoin #crypto #ETF #Investing #gold #Markets

2 months ago

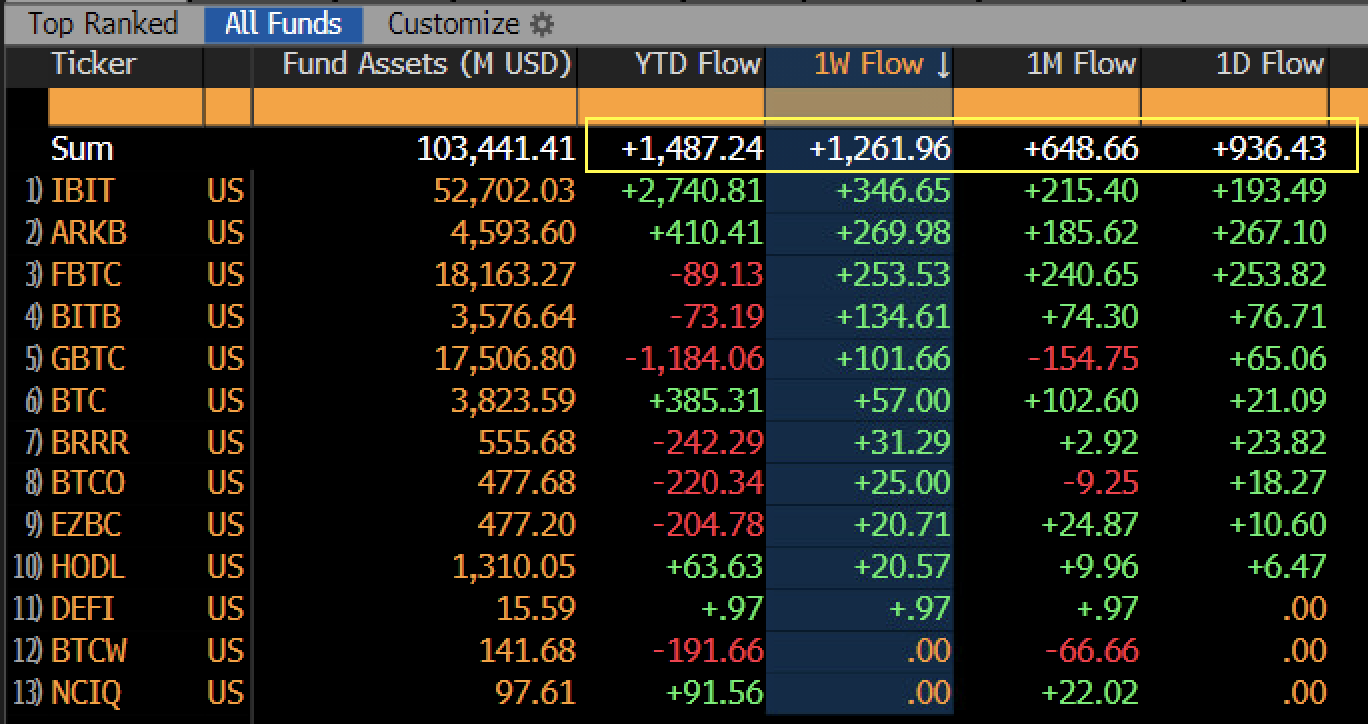

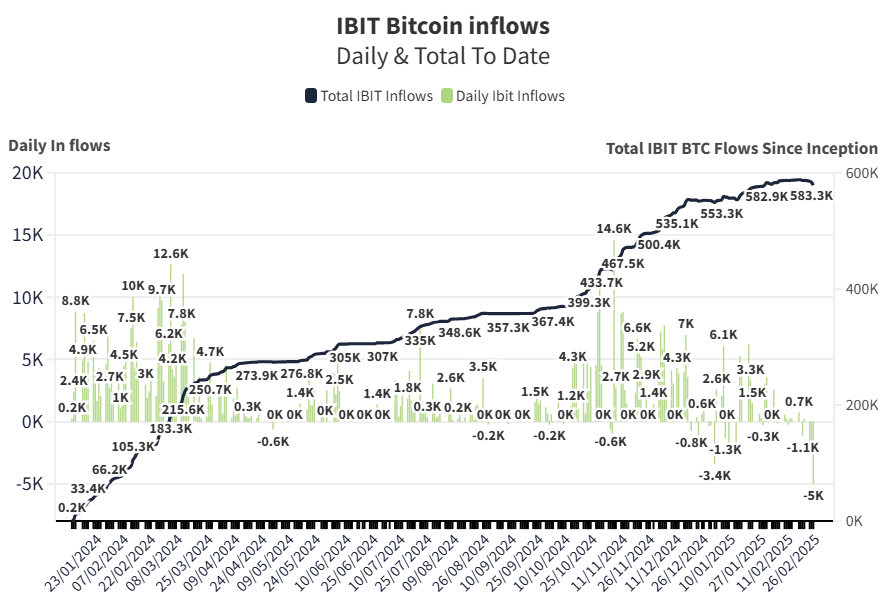

🚨 Bitcoin ETFs are heating up! 🚀

Over $1.26B in net inflows this past week alone — and guess who’s leading the pack?

🏆 IBIT crushes it with +$346.65M in weekly flows

🔥 ARKB & FBTC follow with +$269.98M & +$253.53M

📉 Meanwhile, GBTC continues its outflow streak: -$1.18B YTD 😬

Total BTC ETF assets now over $103B. Institutions aren’t just watching — they’re BUYING. 📈

#bitcoin #ETF #CryptoFunds #BTC #InstitutionalAdoption #IBIT #ARKB #FBTC #BloombergData #CryptoFlows

Over $1.26B in net inflows this past week alone — and guess who’s leading the pack?

🏆 IBIT crushes it with +$346.65M in weekly flows

🔥 ARKB & FBTC follow with +$269.98M & +$253.53M

📉 Meanwhile, GBTC continues its outflow streak: -$1.18B YTD 😬

Total BTC ETF assets now over $103B. Institutions aren’t just watching — they’re BUYING. 📈

#bitcoin #ETF #CryptoFunds #BTC #InstitutionalAdoption #IBIT #ARKB #FBTC #BloombergData #CryptoFlows

2 months ago

📊 Ethereum ETF Update – April 17 📊

According to SoSoValue, all 9 Ethereum Spot ETFs recorded zero net inflows or outflows yesterday — holding steady with no change throughout the day.

🔹 Total Net Asset Value: $5.269 Billion

🔹 Net Asset Ratio: 2.76% (compared to ETH's market cap)

🔹 Cumulative Net Inflows (All-time): $2.244 Billion

Steady day for ETH ETFs — eyes on the next move. 👀💼

According to SoSoValue, all 9 Ethereum Spot ETFs recorded zero net inflows or outflows yesterday — holding steady with no change throughout the day.

🔹 Total Net Asset Value: $5.269 Billion

🔹 Net Asset Ratio: 2.76% (compared to ETH's market cap)

🔹 Cumulative Net Inflows (All-time): $2.244 Billion

Steady day for ETH ETFs — eyes on the next move. 👀💼

2 months ago

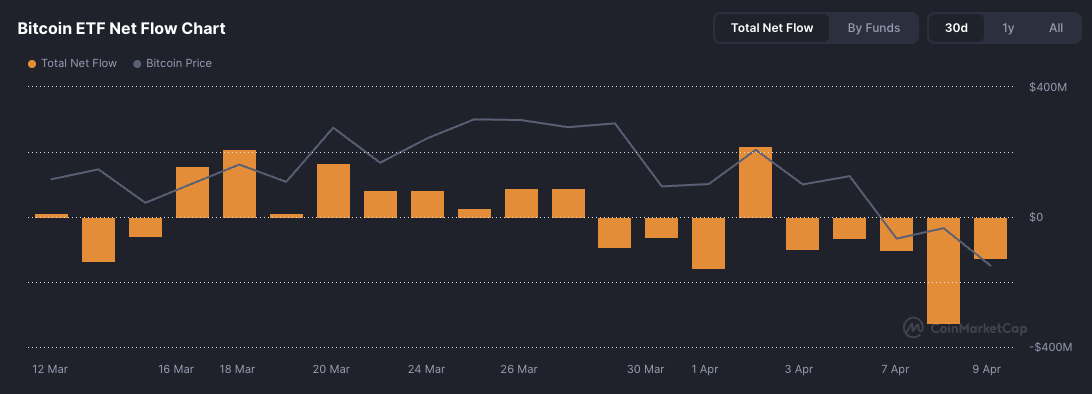

📉 Spot Bitcoin ETFs have seen $556.5 million in outflows since the start of the week.

Are investors taking profits or bracing for more volatility? 👀💸

#bitcoin #cryptonews #ETFs #BTC #cryptomarket

Are investors taking profits or bracing for more volatility? 👀💸

#bitcoin #cryptonews #ETFs #BTC #cryptomarket

2 months ago

Bitcoin Withdrawals Surge Amid Market Uncertainty.

This resulted in a net outflow exceeding $220 million, suggesting that investors might still be accumulating more #bitcoin at lower prices.

This resulted in a net outflow exceeding $220 million, suggesting that investors might still be accumulating more #bitcoin at lower prices.

3 months ago

Bitcoin Hovers Near $83K As Whales and Miners Cash Out – Will BTC Drop to $75K?

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

A dormant whale booked an $85M profit, and miners cashed out $27M, increasing selling pressure on Bitcoin.

U.S. spot Bitcoin ETFs have recorded five consecutive weeks of outflows, raising concerns over institutional support.

#bitcoin #BTC #whales #Miners #ETF #Cryptocrash

3 months ago

⚡️Digital Asset Funds Experience Significant Outflows Amid Global Uncertainty

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

investors are increasingly withdrawing from digital assets as these investments face declining popularity due to rising geopolitical and economic uncertainties. Last week alone, global digital asset funds saw a loss of $1.7 billion, as reported by CoinShares. This brings the total outflow over the past five weeks to $6.4 billion. In the United States, bitcoin (BTC) exchange-traded funds (ETFs) have experienced the longest streak of weekly outflows since their debut in January 2024, with investors pulling out more than $5.4 billion during this period.

U.S. President Donald Trump has expressed support for cryptocurrencies, notably through the order to establish a Bitcoin Strategic Reserve. However, this support has not been sufficient to alleviate concerns stemming from tariff-induced trade tensions and monetary policy challenges. Despite the presidential backing, the digital asset market continues to face significant pressure.

Bitcoin has seen a substantial decline, dropping over 21% in the last three months to approximately $83,000. The broader CoinDesk 20 Index (CD20) has also suffered, losing around 34.6% of its value during the same timeframe. These figures highlight the ongoing volatility and uncertainty within the digital asset sector, as investors remain cautious amid the current global economic landscape.

#bitcoin #Trump #Outflows #ETF #BTC #bitcoinreserve

3 months ago

Bitcoin's weekend gains vanished as the Federal Reserve warned of a potential recession.

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

Bitcoin Drops 10% As Recession Seems Near

The price of Bitcoin has shown extreme volatility over the past few days. Last week, the Crypto Fear and Greed Index hit its lowest level since 2022, and Bitcoin looked very bearish due to several key factors.

Yesterday, Trump announced a crypto reserve that caused token prices to pump. However, that forward momentum has completely vanished today.

There are a few reasons that Bitcoin is looking so bearish right now. Essentially, Trump’s announcement may have only slapped a bandage on a very serious wound.

Last week, Bitcoin ETFs had their worst week ever, with $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, it has become even more pessimistic.

The Fed is now predicting that the US GDP will shrink 2.8% by the end of Q1 2025. From an economic perspective, this is apocalyptic compared to its predictions four weeks ago, which showed 3.9% growth.

Another important factor contributing to Bitcoin’s volatility is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main cause, and that’s probably true.

However, the crypto market crashed when Trump recently announced 25% tariffs on the EU, joining ones on Canada, Mexico, and China.

If the US economy enters a recession, however, the downsides of that integration will fully reveal themselves.

#bitcoin #CryptoReserve #crypto #Trump #recession #USGDP #FED #bearish #Cryptocrash

3 months ago

Ethereum Spot ETF Experiences Significant Net Outflow of $41.82 Million.

On the same day, the Grayscale #ethereum Trust ETF (ETHE) saw a single-day net outflow of $11.66 million, bringing its historical net outflow to $4.075 billion. Meanwhile, the #Grayscale Ethereum Mini Trust ETF reported no net #outflow , maintaining a historical total net inflow of $605 million. As of the latest update, the total net asset value of Ethereum spot ETFs stands at $8.063 billion, with an ETF net asset ratio of 3.02% relative to Ethereum's total market capitalization. The historical cumulative net #inflow has reached $2.819 billion.

On the same day, the Grayscale #ethereum Trust ETF (ETHE) saw a single-day net outflow of $11.66 million, bringing its historical net outflow to $4.075 billion. Meanwhile, the #Grayscale Ethereum Mini Trust ETF reported no net #outflow , maintaining a historical total net inflow of $605 million. As of the latest update, the total net asset value of Ethereum spot ETFs stands at $8.063 billion, with an ETF net asset ratio of 3.02% relative to Ethereum's total market capitalization. The historical cumulative net #inflow has reached $2.819 billion.

4 months ago

4 months ago

🚨Blackrock Sells 1865 Bitcoin - IBIT's Second largest outflow since launch

🚨Fidelity Sells 3920 Bitcoin - Largest sell-off since ETFs launched

#bitcoin #BTC #sell #bearmarket #blackrock #fidelity #ETF

🚨Fidelity Sells 3920 Bitcoin - Largest sell-off since ETFs launched

#bitcoin #BTC #sell #bearmarket #blackrock #fidelity #ETF

7 months ago

AiETF Token Homepage

AiETF is an innovative cryptocurrency token designed to correlate with ETF inflows and outflows, providing a secure and scalable investment opportunity.

https://aietftoken.com/ref...

AiETF is an innovative cryptocurrency token designed to correlate with ETF inflows and outflows, providing a secure and scalable investment opportunity.

https://aietftoken.com/ref...

11 months ago

According to a report by asset manager ARK Invest released on July 18, Bitcoin became oversold in June after the German government initiated a multibillion-dollar sell-off of 50,000 BTC. These bitcoins were seized in a 2020 police sting against Movie2k, a streaming platform for pirated content.

The sell-off caused Bitcoin prices to drop from highs above $70,000 in early June to below $55,000 during a brief dip in July.

"Based on short-term holder realized profits/losses and miner outflows, Bitcoin appears oversold," the report states, which covers data through June 30 and includes more recent figures. "Current levels of miner outflows suggest that miners are capitulating, which could signal a bullish reversal."

The sell-off caused Bitcoin prices to drop from highs above $70,000 in early June to below $55,000 during a brief dip in July.

"Based on short-term holder realized profits/losses and miner outflows, Bitcoin appears oversold," the report states, which covers data through June 30 and includes more recent figures. "Current levels of miner outflows suggest that miners are capitulating, which could signal a bullish reversal."

Sponsored by

Administrator

12 months ago